Inflation: A Revolution of Falling Expectations

By Paul Krugman

Macroeconomic policy in the United States has been subject to two great errors over the past half-century.

The odds are that you’ve only heard about the first, the way the Federal Reserve allowed inflation to become entrenched in the 1970s.

But the second — the way policymakers allowed the economy to operate far below capacity, needlessly sacrificing millions of potential jobs, for a decade following the financial crisis — was arguably even more severe.

The task facing today’s policymakers, which, given Joe Manchin — er, gridlock in Congress — effectively means the Fed, is to try to steer a course between Scylla and Charybdis, avoiding both past mistakes.

(Which mistake is Scylla, which Charybdis? I have no idea.)

The good news, which by and large hasn’t made headlines but is extremely important, is that recent data are showing encouraging signs the Fed may pull this off.

This news also, however, suggests that the Fed should steer a bit farther to the left than it may previously have been inclined to, and turn a deaf ear — stuff its ears with wax? — to demands it turn hard right rudder.

OK, enough with the classical metaphors.

Many people know the story of the 1970s.

The Fed repeatedly underestimated the risk of inflation and remained unwilling to follow anti-inflationary policies that might have caused a recession.

The result wasn’t merely that inflation got very high; high inflation went on so long that it became entrenched in public expectations.

At the peak in 1980, consumers surveyed by the University of Michigan didn’t just expect high inflation in the near future, they expected inflation at close to 10 percent to persist for the next five years.

And expectations of continuing high inflation were reflected in things like long-term wage contracts.

It took a severe recession and years of high unemployment to get inflation back down to an acceptable level, and that’s not an experience we want to repeat.

However, there’s another experience we don’t want to repeat: the long employment slump after the 2008 financial crisis.

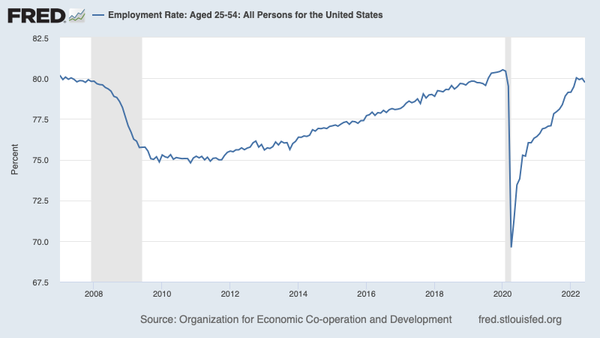

Here’s one commonly used labor market indicator, the percentage of prime-age adults with jobs:

Prime-age employment slumped in the aftermath of the crisis, which was understandable, but what’s really striking is how long it stayed depressed — almost to the end of the 2010s.

There was no good reason that far more Americans couldn’t have been employed during that period.

After all, inflation stayed low even when employment finally got back to pre-crisis levels.

So that long era of depressed employment was pure loss, representing vast waste: millions of workers who could have been employed but weren’t, hundreds of billions of dollars’ worth of goods and services America could have produced but didn’t.

True, getting America back to work would probably have required deficit spending; the Fed kept interest rates low for most of the period, but it clearly wasn’t enough.

Given the very low cost of servicing debt, though, it would have been worth it

Incidentally, for those readers — I know you’re out there — who insist that the Fed did a terrible thing by keeping interest rates low, are you saying that we should have had even fewer Americans working?

Really?

Anyway, when the pandemic recession struck, policymakers were anxious not to repeat the mistakes of the 2010s — and while they were gratifyingly successful in achieving a quick employment recovery, they overcompensated.

They (and I) were too ready to dismiss rising inflation as a temporary phenomenon, driven by pandemic disruptions and external shocks, like Putin’s invasion of Ukraine.

This might have been a defensible view provided inflation was largely confined to a few narrow sectors, but it has become much broader over time.

At this point there’s no real question that the U.S. economy has become seriously overheated, which calls for policies to cool it off — which is, in fact, what the Fed is doing.

But is the Fed moving fast enough? Or are we going to face a replay of the 1970s?

If there’s any truth to the standard analysis of what happened back then, the answer is that it depends on whether inflation is getting entrenched in expectations. But how do we measure expected inflation?

One answer is to look at what the financial markets — interest rates on inflation-indexed bonds, prices on swaps that investors use to protect themselves against inflation — are telling us.

Another is simply to ask people, as the Michigan survey has been doing for many years, and others — notably the New York Fed — have also been doing more recently.

Neither of these approaches is ideal. Bond traders don’t set wages and prices, and neither do consumers.

But they’re what we have, and we can hope that they’re an indication of what people who do set wages and prices are thinking.

Another question is: Expectations for inflation over what period?

You might consider it natural to ask what people expect for the year ahead.

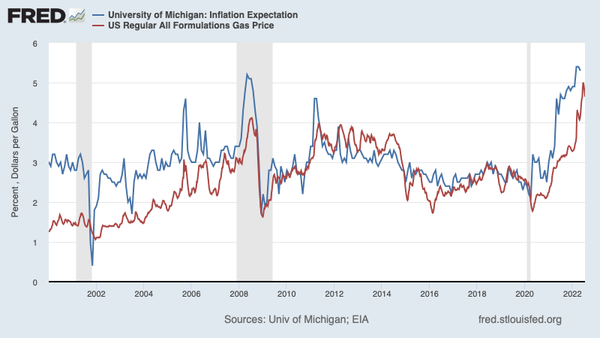

Unfortunately, we know from long experience that one-year inflation expectations basically reflect the price of gasoline, full stop:

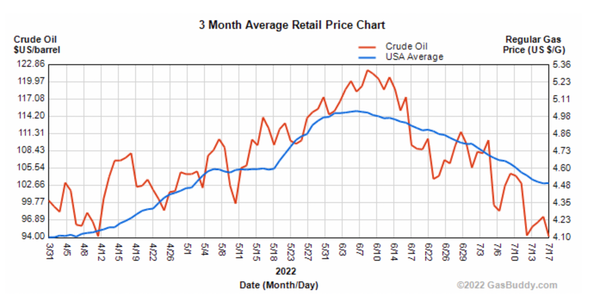

And given the decline in gas prices — which is likely to continue for a while, given falling prices of crude oil — one-year expectations, which have already plunged in the financial markets, are likely to fall a lot in surveys too:

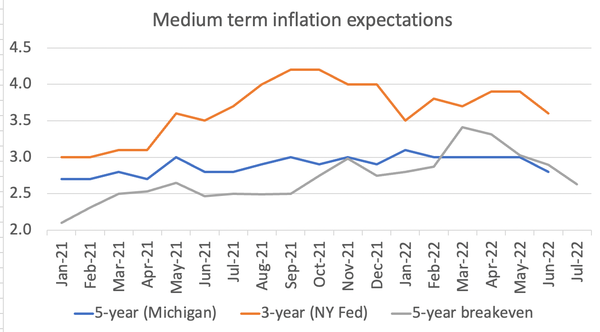

Better, then, to focus on medium-term expectations — which the Fed does.

By all accounts, the Fed was seriously rattled last month when a preliminary report from the Michigan survey showed a jump in five-year inflation expectations.

But as some of us warned at the time, this was quite likely a statistical blip, given the fact that other indicators weren’t telling the same story.

Sure enough, most of that inflation bump was revised away when the full data were released.

Now the latest Michigan numbers are out, and they show a significant decline in expected inflation. Once again, these are preliminary numbers, subject to revision.

But this time they go along with similar results from other sources, all of which point to a (mild) revolution of falling (inflation) expectations:

Note: The New York Fed number is above the Michigan number and the five-year breakeven, a measure derived from financial markets, because it asks for inflation over only three years — a number that has been high mainly because consumers expect a lot of inflation in the near future, not because they expect it to persist.

Expect to see that number fall next month, given declining gas prices.

What all of this suggests is that the balance of policy risks has shifted significantly.

There have always been two ways the Fed could get it wrong: (1) It might do too little to fight inflation, leading to a replay of the 1970s; or (2) It might do too much, sending us into a protracted, 2010s-style employment slump.

At this point, (1) looks considerably less likely than it did even a couple of months ago, while (2) correspondingly looks more likely.

Let’s hope the Fed is paying attention.

0 comments:

Publicar un comentario