Fed Weighs Proposals for Eventual Reduction in Bond Holdings

Shrinking the central bank’s $8.76 trillion asset portfolio offers another tool to tighten policy at a time of high inflation

By Nick Timiraos

Fed officials set the stage at last month’s meeting for a series of interest-rate increases that could begin in March./ PHOTO: SAMUEL CORUM/BLOOMBERG NEWS

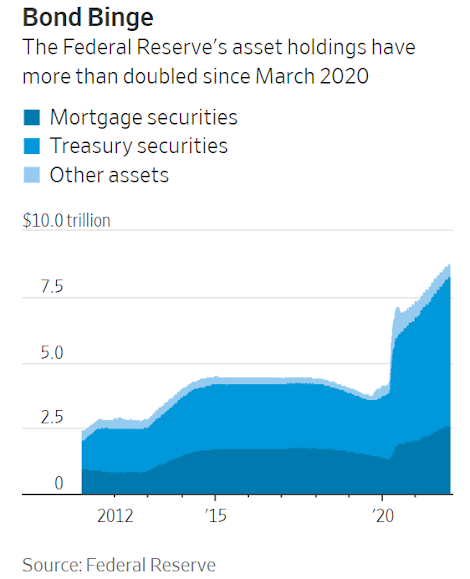

Fed officials set the stage at last month’s meeting for a series of interest-rate increases that could begin in March./ PHOTO: SAMUEL CORUM/BLOOMBERG NEWSFederal Reserve officials are beginning to map out how and when they could shrink their $8.76 trillion portfolio of Treasury and mortgage securities, which more than doubled amid efforts to stabilize the economy over the past two years.

At their policy meeting last month, officials agreed to wind down their bond-purchase stimulus program more quickly amid growing concerns about high inflation, setting it on track to end in March.

Officials began discussing at that meeting what should happen to the bondholdings after that point, and some are pushing to start shrinking them sooner and faster than they did after an earlier asset-purchase program.

Markets would see that as a form of tightening monetary policy because it would signal the central bank’s desire to deliberately slow the economy.

The Fed launched the current program in March and April 2020 when it bought nearly $1.5 trillion in Treasurys to stabilize the market for U.S. government debt.

The coronavirus pandemic had set off a dash for dollars that threatened to trigger a global financial crisis.

Shortly afterward, the Fed committed to buying at least $120 billion a month in Treasury and mortgage securities to provide additional stimulus to the economy.

The central bank began reducing the pace of those purchases this past November.

The bond-buying programs stimulate the economy by holding down long-term interest rates, encouraging consumers and businesses to borrow and spend.

In theory, doing so should also spur financial markets by driving investors into stocks, corporate bonds and other assets.

Once the Fed stops buying assets, it could keep the holdings steady by reinvesting the proceeds of maturing securities into new ones, which should have an economically neutral effect.

Alternatively, the Fed could allow its holdings to shrink by allowing bonds to mature, or run off.

Fed Chairman Jerome Powell said last month that he and his colleagues hadn’t made any decisions on the matter and were likely to continue their discussion at their Jan. 25-26 meeting.

But he hinted that the central bank wasn’t preparing to follow the path taken between 2014 and 2019.

Back then, the Fed kept the bondholdings steady for three years and then gradually began shrinking the portfolio, sometimes called a “balance sheet.”

When the Fed began this process in late 2017, the economy was weaker than it is now: Inflation was below the Fed’s 2% target, and the unemployment rate was higher.

“The economy is so much stronger now, so much closer to full employment,” Mr. Powell said at a Dec. 15 news conference.

“This is just a different situation, and those differences should inform the decisions we make about the balance sheet at this time.”

Mr. Powell pointedly stopped short of saying the Fed would follow the course it took last decade, a shift from comments he made in July 2021.

Last summer, he told lawmakers that the 2017-19 episode provided a “reasonable starting place—to think that we might hold the balance sheet constant for some time and then perhaps allow it to shrink.”

Fed officials set the stage at last month’s meeting for a series of interest-rate increases that could begin in March, completing a major policy pivot amid worries about the potential for high inflation to persist.

Most market participants polled by the New York Fed in an October survey expected the Fed to start shrinking its holdings no sooner than 2024.

Shrinking the portfolio faster or sooner could come as a surprise to some investors.

Fed governor Christopher Waller, who last month described inflation as “alarmingly high,” said that shrinking the asset portfolio faster would offer one way to tighten policy without requiring even more aggressive interest-rate increases.

“I don’t see any reason to delay balance sheet adjustment,” he said during a moderated discussion on Dec. 17.

“If we start doing some balance-sheet runoff by summer, that’ll take some pressure off.

You don’t have to raise rates quite as much.”

Mr. Waller said the Fed should aim to shrink its holdings to around 20% of gross domestic product, down from 35% today.

St. Louis Fed President James Bullard also advocated in November for the Fed to shrink holdings after it stops purchasing securities “or shortly thereafter.”

The Federal Reserve says it will accelerate the wind-down of its bond-buying program, the biggest step the central bank has taken in reversing its pandemic-era stimulus.

One way for Fed officials to clarify their portfolio planning would be to issue a new statement of policy “normalization” principles, as they did when they were nearly finished with their asset-purchase stimulus program in 2014.

In addition to choosing when to start shrinking the portfolio, officials have to decide how to do so.

In October 2017, the Fed began allowing a small amount of holdings—$10 billion—to run off every quarter, with the amounts increasing by $10 billion every quarter through 2018.

A related question centers on the composition of assets.

Holding long-term Treasury securities, in theory, provides more stimulus than holding short-term securities.

In May 2019, Fed officials were divided over how to structure their portfolio.

One group favored maintaining a portfolio of Treasury bills, notes and bonds in proportions that reflected the outstanding Treasury market.

This approach would have a neutral effect on financial conditions.

Another camp preferred weighting their holdings toward Treasury bills and other shorter-maturity holdings, which would allow the Fed to dial up stimulus in a downturn by quickly shifting back to longer-dated holdings.

The Fed’s balance sheet today consists of many more shorter-term Treasury securities than it did in the previous decade.

If officials didn’t limit the potential runoff, the holdings would shrink relatively quickly—by about $3 trillion over two years.

The Fed paused its balance-sheet runoff in 2019 and began to increase its holdings later in the year amid concerns the central bank had drained too many bank deposits, known as reserves, from the financial system.

Going forward, the problem may be lessened because the Fed last year devised a new facility that allows banks to more readily exchange government assets for Fed reserves.

0 comments:

Publicar un comentario