The waiting game: where are the world’s worst port delays?

From Shenzhen to Los Angeles, storms, Covid and labour shortages are causing disruption

Gill Plimmer and Harry Dempsey

The Kwai Chung container port in Hong Kong: the backlog off southern China is currently the world’s worst © Marc Fernandes/NurPhoto via Reuters

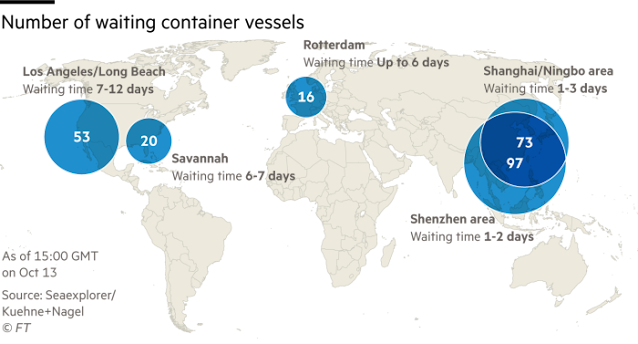

The Kwai Chung container port in Hong Kong: the backlog off southern China is currently the world’s worst © Marc Fernandes/NurPhoto via ReutersThe nearly 100 ships waiting on the horizon to berth at the Hong Kong and Shenzhen container ports are just the latest sign of the problems to have snarled global supply chains, pushed up consumer prices in Europe and the US, and led to shortages of goods ranging from Christmas toys to furniture.

The backlog off southern China is currently the world’s worst.

A typhoon closed the ports for two days this week — but although weather often disrupts shipping, this just added to the problems from previous jams since the pandemic began.

In August, a single Covid case paralysed a terminal for a fortnight in the major Chinese port of Ningbo, outside Shanghai.

Globally, there are now 584 container ships stuck outside ports, nearly double the number at the start of the year, according to real-time data from Kuehne+Nagel, one of the world’s largest freight forwarders.

“Supply chains have been hit from all angles and have broken down to an unprecedented level,” said Simon Heaney, an analyst at maritime consultancy Drewry.

“The problems are much more deep-seated than what you see at the ports.”

Increased demand for consumer products, Covid-induced disruption to container ship schedules and a shortage of port workers and truck drivers have all combined to extend waiting times at ports.

Adding to the problem is that when ships arrive at their destinations later than expected, cargo operations and turnround schedules are knocked out of sequence, causing a ripple effect of disruption on freight, truck and warehouse services.

The snarl-ups in supply chains are reflected in a surge in shipping costs: the average global price of shipping a 40 foot container is now close to $10,000, three times higher than at the start of 2021 and almost 10 times pre-pandemic levels, according to Freightos.

Detlef Trefzger, chief executive of Kuehne+Nagel, expects the congestion in sea freight will last at least until the beginning of Chinese new year in February and may get worse before then.

Others believe that the crisis could last longer — especially if weather is bad or there are more coronavirus outbreaks in China, given its zero-Covid policy.

“We’re getting into the winter period in the northern hemisphere that will bring a return to normal challenges — snow, wind and the closures of terminals.

Then we don’t know what will happen,” said Lars Mikael Jensen, head of global ocean network at Maersk.

“I can’t judge if we’re over the worst.”

In Europe, there are long waits for ships outside Hamburg and Antwerp.

Even when vessels do not have to wait for days at sea, there can still be huge disruptions — as at Rotterdam port in the Netherlands and at Felixstowe in the UK, where shortages of truck drivers or clogged inland waterways slowed the onward movement of cargo.

On Thursday, Felixstowe remained the hardest hit UK port, with two ships at anchor waiting for a berth.

Maersk, the biggest shipping company, has diverted some of its UK bound cargo to Europe, where it can be shifted to smaller vessels for transport to the UK.

Similar logistical problems have hit ports on the west coast of the US.

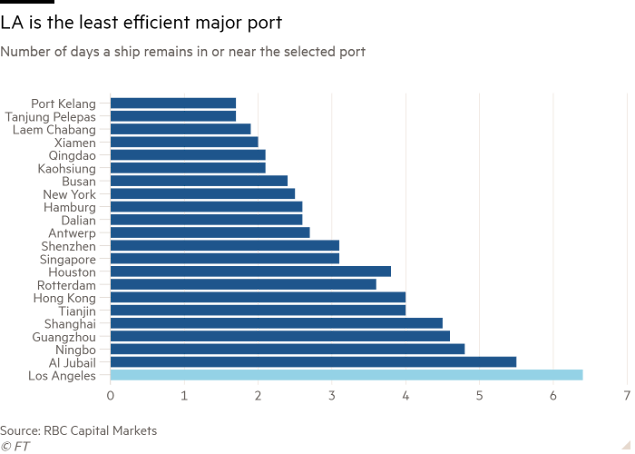

Although the number of ships waiting at sea has fallen from a record 76 in September to 57 now, shortages of port workers and truckers means it takes up to 12 days for ships to drop anchor and unload containers, delaying the delivery of everything from sneakers to tropical fruits and Lego.

That is why it takes three times longer compared with pre-pandemic times to clear vessels at Los Angeles and Long Beach.

By contrast at large Chinese ports, which work 24 hours a day, seven days a week, it only takes 20 per cent longer, according to IHS Markit’s port performance programme, an industry data set.

The problem is so severe that US president Joe Biden has been pushing rail freight companies, trucking groups and ports to increase their capacity.

Large businesses including Walmart and UPS have meanwhile pledged to step up their efforts to move goods.

Lars Jensen, a container shipping analyst at Vespucci Maritime, said that even when problems start to ease, port bottlenecks will still come in fits and starts everywhere as delayed vessels try to dock all at once.

“Nobody should expect this to be a gradual and smooth transition,” he said.

“You’re going to have these back and forth ripples that will take a while to get out of the system.”

0 comments:

Publicar un comentario