How Coke Is Shaking Things Up — and Why Its Stock Is a Buy

By Andrew Bary

Coca-Cola stock has bubbled up and down over the past five years, from $42.96 (12/31/15) to $50.68 (10/22/20). Photograph by Sarah Anne Ward; Food Styling by Ed Gabriels for Halley Resources

Coca-Cola stock has bubbled up and down over the past five years, from $42.96 (12/31/15) to $50.68 (10/22/20). Photograph by Sarah Anne Ward; Food Styling by Ed Gabriels for Halley ResourcesLong before people started talking about globalization, Coca-Cola was living it. Coke is in more than 200 countries and for many decades has had a global reach like no other consumer company. And when the world starts to get back to normal in 2021, the soda giant will be poised to rebound along with it.

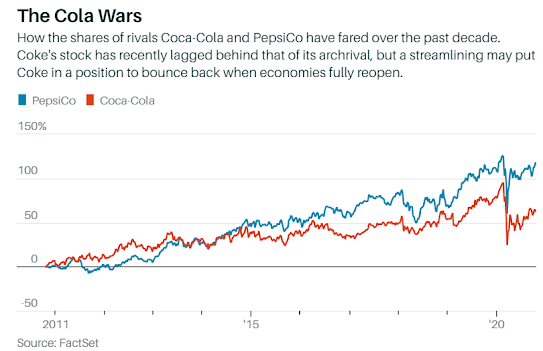

As a postpandemic “reopening” play, however, shares of Coca-Cola (ticker: KO) seem to be underappreciated. The stock has lagged behind PepsiCo (PEP) and Procter & Gamble (PG) this year.

It shouldn’t. More than those consumer peers, Coke benefits from rising living standards in the developing world. And Coke provides exposure to a weaker dollar because the company generates about 75% of its profits outside the U.S.

Investors are also overlooking a great operational turnaround story. Under its dynamic CEO of the past three years, James Quincey, Coke has largely sold off its company-owned bottling operations to franchisees, resulting in a capital-light business model with strong free-cash-flow generation.

“The beverage industry is a growth industry, and we are the market share leader not just in soft drinks, but also in other major categories, and we are gaining share,” Quincey tells Barron’s.

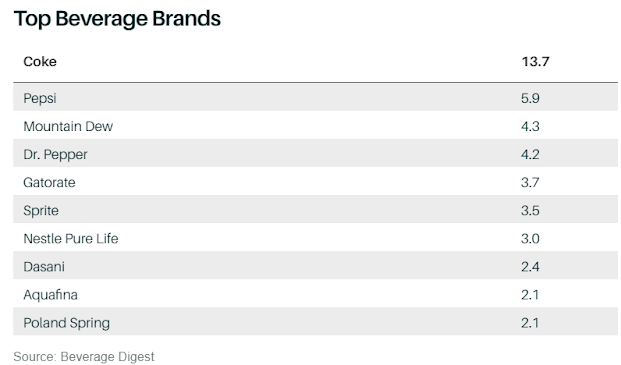

Still the Real Thing

Coca-Cola faces many challenges, but it remains the market leader in the U.S. beveragemarket.

The pandemic and its restrictions have hurt Coke, which gets about half of its sales from restaurants, cafeterias, stadiums, and other places and events outside the home. Quincey is optimistic, however.

“I believe the away-from-home [market] will come back if one is worried about the short term,” he says. “We are social animals. We love to mix and mingle and love to have experiences. That will come back, and Coke is pre-eminently positioned to benefit from the recovery from the pandemic, given the long-term positive trends in the beverage industry and our position as the leader.”

The CEO wants Coke to be bolder and better attuned to innovative beverages, including energy drinks and coffee-linked products, and more aggressive in culling “zombie” brands—as it recently did with Tab, the diet soda introduced in 1963—while continuing to expand its core soft-drink franchise.

The Covid-19 crisis has heightened Coke’s focus on these issues, with the company weighing the elimination of half of its 500 brands worldwide.

“Coke is a great recovery play going into 2021,” says Lauren Lieberman, an analyst at Barclays. “Coke is using this period to accelerate operational and strategic change that should allow the company to come out more profitable and with faster growth than before Covid.” She has an Overweight rating and $59 price target on the shares.

The stock, at around $50, is off 8% in 2020, and carries a bond-like yield of 3.2%, nearly double that of the S&P 500 index.

The annual dividend of $1.64 a share looks safe, despite a high payout of earnings. The dividend has been raised for 58 consecutive years, and is likely to increase in coming years, adding to the appeal of the stock.

Morgan Stanley recently identified Coke as a “mispriced” reopening stock. The company’s “long-term top-line growth outlook is above peers’, with strong pricing power and favorable strategy tweaks under Coke’s relatively new CEO, including increased innovation and a cultural shift toward a total beverage company,” wrote Morgan Stanley’s beverage analyst Dara Mohsenian.

Still, the shares aren’t cheap, trading for about 24 times projected 2021 earning of $2.09 a share. Coke critics call it a no-growth “growth” stock, given that earnings have been stuck around $2 a share for the past decade.

Yet profits could be set to finally break out. Credit Suisse analyst Kaumil Gajrawala sees $2.70 in 2023 earnings—15 cents above the consensus— and thinks that the stock could hit $70 then. The analyst has an Outperform rating on Coke, with a $57 price target. “The business was fundamentally restructured and showing momentum pre-Covid, and while the improvement has been delayed, it has not been derailed,” Gajrawala says.

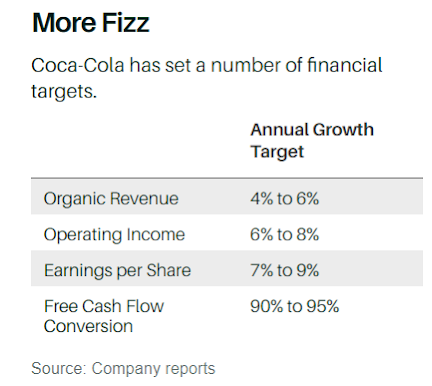

Coke targets 7% to 9% annual growth in earnings per share, and Gajrawala thinks the company can beat that goal coming out of 2021.

A strong dollar has dampened Coke’s profits; currency translations are expected to have a high-single digit impact on 2020 earnings after an eight-percentage point hit last year. But should the dollar weaken, few large companies would be bigger beneficiaries than Coke.

The soft-drink titan had strong years in 2018 and 2019, during which its organic revenues rose 5% and 6%, respectively. Reflecting pre-Covid optimism about Quincey and his strategy, Coke shares peaked at $60 in February.

CEO James Quincey wants Coca-Cola to be bolder with beverage innovations. Coca-Cola With Coffee and a hard seltzer are coming next year. /Melissa Golden/Redux

The progress halted in mid-March. Second-quarter organic revenue fell 26%, while earnings per share dropped 33%, to 42 cents a share.

“We started to win share in a growing industry, and that’s what you saw in 2018 and 2019,” CEO Quincey says. “And that’s what I think we can see growing forward and that will allow us to break out of the famous $2 a share in EPS”—he pauses—“infamous $2 a share in EPS.”

The company saw an improvement in the third quarter as adjusted earnings fell 2%, to 55 cents a share, from the year-earlier level, nine cents better than the consensus estimate, while volume slid 4%, compared with a 16% drop in the second quarter. The results, released on Thursday, cheered investors. Coke shares rose 2%, and several analysts raised their price targets.

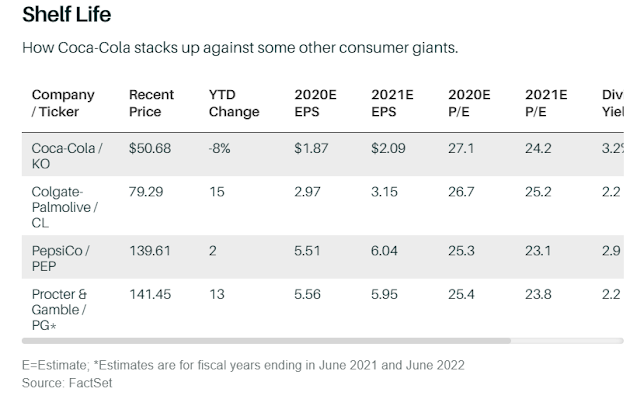

Shelf Life

How Coca-Cola stacks up against some other consumer giants.

Tempering the optimism was Quincey’s comment that the Atlanta-based company’s critical away-from-home business “showed signs of stalling” in September, amid greater Covid-19 restrictions in several markets.

Away-from-home volume was down in the midteens in the third quarter, against 50% in April. Coke also offered little guidance on 2021, other than to state that it aims to “recover faster than the broader economic recovery.”

Quincey has warned that the recovery could be jagged. The surge in Covid-19 cases in Europe—an important market for Coke—and the U.S. could slow the company’s recovery. As those cases have climbed, Coke’s stock has stagnated.

Still, he says, the third-quarter results show how “we clearly adapted to the situation we face with the pandemic and how the crisis has altered the landscape of how we sell and where consumers can drink our products.” And he adds, “More importantly, we’ve been trying not just to adapt but also to improve the business through the crisis, so that we can be even stronger and more capable of growth post the crisis.”

The longer-term challenge is the company’s reliance on carbonated soft drinks, which account for almost 70% of its global beverage volume.

Consumers increasingly favor a wider variety of drinks and are focusing more on health. Coke hasn’t been a great innovator, either, coming late to trends like flavored seltzer and energy drinks. It does own a 20% stake in Monster Beverage (MNST) worth $9 billion, and its bottlers distribute Monster Energy drinks.

Coke is trying to catch up, making room for newer drinks like AHA seltzer and Coca-Cola Energy. In the U.S. next year, it plans to roll out Coca-Cola With Coffee and Topo Chico Hard Seltzer, an alcoholic seltzer.

The company has succeeded with Coca-Cola Zero Sugar, a no-calorie diet drink that tastes more like regular Coke than Diet Coke.

Coke Zero Sugar has had double-digit volume growth in recent years, but it remains a third the size of Diet Coke in the U.S., according to Beverage Digest.

The Claus that refreshes: A local Coca-Cola salesman dressed as Santa Claus distributes gifts to an orphanage in Bacolod, in the Philippines, in 1999. Emerging markets like the Philippines are key to Coke’s growth./ Marcial Angelo/AFP/Getty Images

“Full sugar may be challenged, but low- and no-sugar is growing, and Coke Zero Sugar is a case in point,” says Lieberman of Barclays.

The company is trying to get in shape for a rebound. In August, Coke said that 4,000 employees would be offered enhanced severance packages in a program projected to cost $350 million to $550 million.

And Quincey is restructuring Coke’s global operations to help facilitate new-product introductions in its four regions—North America; Latin America; Asia Pacific; and Europe, the Middle East, and Africa—and improve cooperation. That has paid off with the successful introduction of a North American brand, Fuze Tea, in Europe, Lieberman says.

“The Coca-Cola brand and red-can Coke are held up as sacred things in the company,” says Duane Stanford, the editor of Beverage Digest. “What Quincey has said is that it’s OK to experiment with Coke with coffee and Coke Energy and extend the brand.

He has said, ‘We can preserve the legacy of Coke and modernize it.’ It’s hard to overestimate the importance of that.”

The Cola Wars

Many investors favor rival PepsiCo’s powerhouse snack-food business, Frito-Lay, over Coca-Cola’s beverage empire. Frito-Lay generates over half of its parent’s profits.

Coke, PepsiCo, and Procter & Gamble all have similar valuations—low- to mid-20s multiples of projected 2021 earnings. A Covid-19 play, P&G has gotten a lift this year as heavy demand has led to shortages of some of its leading products, including Bounty paper towels and Charmin toilet paper.

Soda might prove more durable than critics believe, however. “The carbonated soft drink business has been a relatively reliable way to generate low- to mid-single digit sales growth,” says Brett Cooper, an analyst at Consumer Edge Research, who rates Coke Overweight, with a $58 price target.

The company doesn’t have many fans among institutional investors. Coke’s profit gains are too anemic for most big growth-stock investors, who prefer faster-growing internet “staples,” such as Amazon.com (AMZN), Facebook (FB), and Google parent Alphabet (GOOGL). And the beverage maker’s valuation makes it too pricey for many value investors.

Jason Subotky, a portfolio manager at Yacktman Asset Management, and a holder of Coke shares, sees it differently: “In an environment where rates have gone down and price/earnings multiples have gone up, one of the things you prize most are consistent and predictable businesses. Coke is one of the best-positioned companies in a world of disruption, given its market presence worldwide. Who is going to dislocate Coke?”

Consumers drink two billion servings of Coke products daily, bought at 30 million retail outlets and supplied through 225 bottling partners around the world.

Subotky says Coke’s “ability to expand the consumption of beverages and achieve reasonable volume growth and some pricing continues to be there. The currency challenge has been severe, and that might go from being a headwind to tailwind.” He views Coke as the stock market equivalent of a triple-A bond, given its 3%-plus yield and relatively stable business.

Coke’s debt carries rock-bottom yields, with the company’s 10-year paper around 1.4% and its 30-year obligations at 2.5%, less than a percentage point above risk-free U.S. Treasuries.

Warren Buffett’s Berkshire Hathaway owns a stake in Coca-Cola that’s worth $20 billion. / Daniel Acker/Bloomberg

Coke’s most famous booster is Warren Buffett, whose Berkshire Hathaway (BRK.B) has owned a large stake since the late 1980s. That holding of 400 million shares, now worth $20 billion, hasn’t changed in more than 20 years. It represents 9% of the shares outstanding, making Berkshire Coke’s largest investor.

Buffett, Berkshire’s CEO, made a well-timed purchase; Coke stock rose about tenfold in the decade after he acquired his holding.

But the shares haven’t appreciated much since 1998. Coke’s stock market ranking has fallen to 29th from eighth since 1998, and its current market capitalization of $218 billion is below Salesforce.com’s (CRM) $227 billion.

Buffett declined to comment to Barron’s, but he told CNBC two years ago that “if you look at the return on tangible assets, you’ve got a very good business,” while acknowledging that “it doesn’t look as good as it did five or 10 years ago.” He attributed that to reduced brand loyalty linked to a growing willingness among consumers to try different products.

A numbers maven, Buffett pointed out that Coke sells 100 ounces of beverages annually for each of the seven billion people on the planet.

He’s a big consumer, drinking several Cokes a day. Buffett even has a Coke soda fountain in his Omaha office. He joked earlier this year in a Yahoo! interview that all of those Cokes may have helped him stave off Covid-19.

A potential new worry for Coca-Cola is the rise of socially responsible and environmental, social, and corporate governance, or ESG, investing. Coke’s high-sugar drinks, critics say, contribute to the global obesity problem. Then there is the environmental impact of all the waste from the 120 billion plastic bottles used to package its products each year.

Jeff Ubben, a leading activist investor who is now a socially conscious one, said recently that Coke could be hurt by the plastic-waste issue.

“The externalities of the core business are now starting to be reflected in the stock price,” Ubben said at a Reuters conference on ESG investing. In June, he retired from ValueAct Capital to start Inclusive Capital Partners.

Coke says that its overall recycling rate is 60%, with plastic bottles at about 55%. It aims to get to 100% by 2030. Just 10% of its plastic containers are from recycled material.

It’s harder to finesse the obesity issue. Coke gets a high percentage of sales from sugary drinks.

In response, Quincey points to the growth of no-sugar brands like Coke Zero sugar, reformulations of existing brands to lower sugar, and an emphasis on smaller packaging sizes.

“We have a clear strategy to be part of the solution,” he says.

Coke says that 45% of its brands are “low” or “no” sugar, which it defines as about 17 grams or less per 12-ounce can. A 12-ounce can of regular Coke has 39 grams of sugar and 140 calories.

But just 29% of its sales volume comes from low- or no-sugar drinks.

Smaller packages, like the popular 7.5 ounce cans of Coke with 90 calories each, are what the company calls a more permissible “treat.” The smaller cans also generate about double the profits to the Coke system.

Few big consumer companies have been hit harder by the pandemic than Coca-Cola. Yet, as people start heading back to restaurants, stadiums, arenas, and concerts and other events in an increasingly Covid-19-vaccinated world—perhaps as early as next year—the beverage giant’s out-of-home exposure could be a positive catalyst for its shares. With good news on Covid vaccines, the move into Coke shares could even start later this year.

In the interim, investors can enjoy a 3%-plus yield—and a Coke beverage. As the company’s ads say, “Together Tastes Better.”

0 comments:

Publicar un comentario