Expedia Isn’t Ready for an Extended Stay

Its homestay business may be booming, but it isn’t the key to the online travel agent’s recovery

By Laura Forman

The coronavirus pandemic has hit various players in the travel sector hard. / PHOTO: MOHAMED ABD EL GHANY/REUTERS

Investors bidding up Expedia Group EXPE -0.10% might be mistaking it for Airbnb.

Back in July, Expedia Chief Executive Peter Kern called vacation rental specialist Vrbo the “strongest part” of his company’s story.

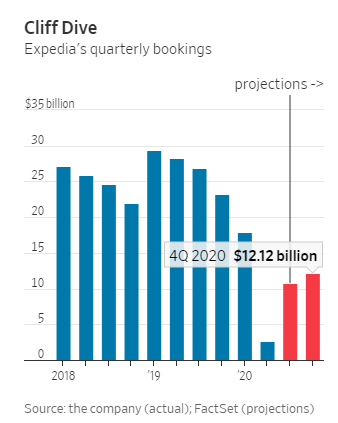

Although its buoyancy over the pandemic-riddled summer has no doubt helped the online travel agent recover from the depths of a historic travel lull, data show its surge—even if sustained—can’t right the ship for the whole company.

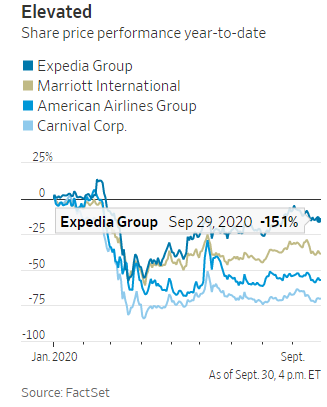

Despite bookings for its overall business falling 85% in the second half of March and April, Expedia shares are up 100% from their mid-March lows and are now down just under 15% year-over-year.

That is significantly better than shares of key players across various travel sectors, even though as a booking platform its success depends upon demand for the broader industry’s business.

Shares of Marriott International are down 38% year-over-year, for example, while American Airlines and Carnival are down 57% and 70%, respectively, over the same period.

The homestay sector has indeed benefited from travelers’ desire to forgo crowded hotels and airplanes. While analytics firm STR reports that revenue per available room across U.S. hotels was still down more than 48% year-over-year as of mid-September, data from Edison Trends suggests that homestay giant Airbnb’s business had returned to or exceeded pre-pandemic levels in some cases for August.

SimilarWeb data show Vrbo had about 40% more web traffic than the same time last year as recently as last week. A recent industry report by travel data site Skift and McKinsey & Co. posited that this year could represent an inflection point in the lodging industry “when vacation rentals became mainstream.”

It isn’t clear, however, that homestay’s hot moment is sustainable. An August survey of U.S. travelers from Raymond James showed that, while 41% were more likely to book at hotel alternatives like Airbnb and Vrbo over the next year because of Covid-19, 39% reported “no change” in where they would like to book, while 20% said they are less likely to book at hotel alternatives.

When asked back in July whether recent trends lead him to believe there is a more permanent secular trend toward alternative accommodations in the industry, Expedia’s Mr. Kern himself said he hadn’t seen “anything to suggest that people’s travel behavior will materially change.”

Yet Vrbo is still relatively small, both compared to its competition and to Expedia’s overall business. Airbnb has more than 3.5 times the number of global listings as Vrbo, for example. And while Expedia hasn’t broken out Vrbo’s performance since the fourth quarter of 2019, the homestay business accounted for just over 9% of the company’s overall revenue and generated under 5% of its overall adjusted earnings before interest, tax, depreciation and amortization in that period.

Inherent to Vrbo’s recent success has been an aversion to air travel, hotels, and the inability to take many cruises due to no-sail orders—all of the things Expedia’s broader performance depends upon most. Its “core OTA,” or online travel agency business, was 82% of its overall bookings in the fourth quarter of 2019, Vrbo’s was 10%.

And that core business could be lagging even when controlling for the pandemic. A survey published in September by RBC across U.S. and British internet users found that while Expedia had historically been the most popular destination for planning travel in the U.S., it now ranks third, behind Airbnb and Google.

Even after the pandemic eases, Expedia’s investors might find that the company’s elite status has lapsed.

0 comments:

Publicar un comentario