Gold Attains Escape Velocity

Paul Wong, CFA, Market Strategist

The precious metals complex set off fireworks in July as gold bullion reached all-time highs.

Silver bullion and gold mining equities broke through significant long-term resistance levels to further improve their bullish standing.

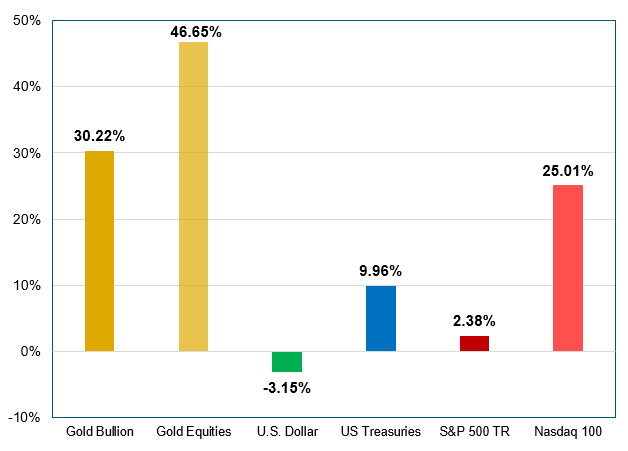

Year to date, the precious metals complex continues to outperform as gold has attained "escape velocity," i.e., it has gravitationally moved away from other asset classes.*

Gold bullion(1) was up 30.22% YTD through July 31, 2020, and 39.76% YOY. At the same time, gold mining equities (SGDM)(2) gained 47.70% YTD, and 61.54% YOY as of July 31. This compares to 2.38% YTD and 11.96% YOY returns for the S&P 500 TR Index.(6) Silver posted outsized gains in July and is up 36.62% YTD and 49.95% YOY as of July 31.

July Was Gold's Biggest Monthly Gain Since 2012

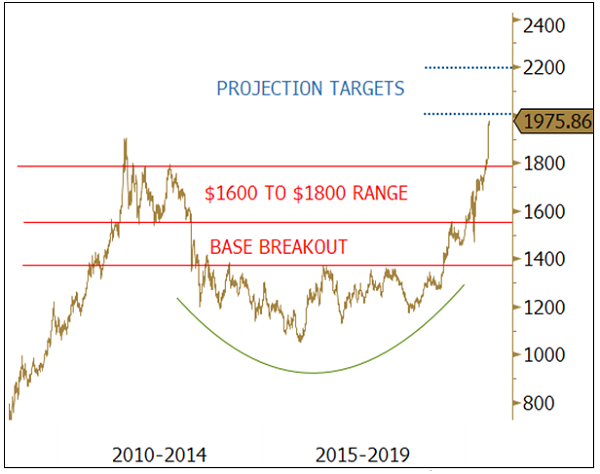

Gold bullion rose $195 per ounce, or 10.9%, in July to close at $1,976, an all-time high and the most significant monthly move for gold since 2012. The previous all-time high was $1,921 made nine years ago on September 6, 2011.

Gold has now reached all-time highs in every major currency, and conversely, every currency is at an all-time low in gold terms. Gold started its July move as the U.S. 10-YR Treasury real yield decline accelerated, and was capped off by the plunging U.S. dollar (USD).

Figure 1. Gold Delivers Outsized Returns YTD 2020

Source: Bloomberg. Data as of 7/31/2020. Gold is measured by GOLDS Comdty; Gold Equities are measured by GDX; the U.S. Dollar is measured by DXY Curncy; U.S. Treasuries are measured by the Bloomberg Barclays US Treasury Total Return Unhedged USD (LUATTRUU Index); the S&P 500 TR is measured by the SPX; and the Nasdaq 100 is measured by the QQQ ETF. Past performance is no guarantee of future results.

Yields Continue to Head Lower with Fed Support

In recent commentaries, we highlighted that real yields would see a pronounced decline once it became clear that nominal yields would be held constant. A combination of QE (quantitative easing), forward guidance and the market beginning to price in a semblance of yield-curve control (YCC) was anchoring nominal yields.

As the recovery took hold, breakeven yields began to rise, reflecting the prospect of recovery.

With nominal yields flat, real yields by default began to collapse. U.S. 10-YR real yields have now fallen below 2012 all-time lows and are likely to head lower (currently at -1.03%).

Gold bullion reaches as all-time high, and the stage has been set for gold to climb even higher.

However, the dynamic in this cycle is different from 2012. Negative real yields are now a Federal Reserve (Fed) objective and have all the firepower of the Fed behind them.

This "higher growth outlook equals higher gold prices" causation will be the opposite of the experience of the past decade (which was marked by the 2011-2019 gold bear cycle).

In a post-COVID-19 pandemic environment, rising growth expectations will mean lower negative rates. This negative yield policy is one of the primary tools the Fed will use to debase the growing U.S. debt burden.

Down the road, if economic conditions worsen or do not improve, we can envision Fed policy moving from capped nominal yields to capped real yields with obvious bullish consequences for gold.

The stage has been set for gold to continue to climb higher. We see increased fiscal spending ahead, extremely accommodative monetary policy in place for years and a challenging economy recovery (as stated by the Fed).

Until this changes, gold will continue to benefit. We believe that gold's latest price surge is likely the result of investors moving towards our long-held view as gold as a store of monetary value and a unique asset class with diversification qualities.

In recent commentaries, we have argued that gold has developed into an asset class with both long duration and short duration qualities, and an asset with positive convexity features. July's price action confirms our view.

Figure 2. Gold Projection Targets $2,000 to $2,200

Source: Bloomberg. Data as of 7/31/2020.

U.S. Dollar Weakness Likely to Persist

The other Fed policy objective would be to keep the USD from strengthening in an uncontrolled manner; even better, would be a steady path to lower levels. Before the COVID-19 outbreak, we were beginning to see the USD peak.

But the pandemic induced a financial system crisis in March 2020 that saw the USD surge as a

flight-to-safety flow took hold and, with it, rising USD funding stress. March was a wake-up call that an overly strong USD is a threat to the global growth outlook, given its ability to shutdown liquidity.

The Fed was well aware of the danger of a USD funding crisis. Of all the credit and swap facilities the Fed launched during the crisis, the USD repo and swap lines were one of the most successful and widely tapped.

Since then, U.S. interest rates are now at the lower bound and likely trapped there, there is no yield advantage, USD safe-haven flows have reversed and any currency volatility would make a carry trade difficult.

The USD weakness is also reflecting the resurgence of COVID-19 cases across the U.S. As more states pause or rollback re-openings (now about 75% of the population), a full and sustainable economic recovery is at risk of either being delayed or becoming less likely.

The weaker and further out the U.S. economic recovery, the more fiscal stimulus will be needed and the longer extreme monetary policies are likely to continue.

The risk is that U.S. unemployment will reset at a much higher structural level, and consumer spending will remain in a state of prolonged weakness.

As the Fed acknowledges, a sustainable U.S. economic recovery requires that the virus be brought under control. To date, there have been few signs that a federal, all-out coherent effort at containment and eradication is forthcoming.

On the present course, the U.S. economic recovery is likely to lag other developed economies that have already flattened their COVID-19 curves.

Other Factors Contributing to USD Softness

The Euro began its rebound earlier in the month as the EU (European Union) appeared to be finally getting its act together on the fiscal front after several decades. The EU's USD $2.8 trillion economic recovery plan includes fiscal burden sharing, the first sign of budgetary unity in a significant way.

The fiscal stimulus for the EU will be at 44% of GDP, roughly the same as the U.S. Another point is the EU is more tied to China trade than the U.S. The data from China continues to show surprising strength, though it remains supply-side weighted.

On the domestic causes of the weak USD, there is an expected heavy U.S. Treasury issuances to finance future fiscal stimulus, dysfunctional and divisive U.S. politics, continuing civil unrest, potentially even higher spending under a Biden agenda and the growing twin deficits.

On the non-domestic causes of a weak USD, more sovereigns are diversifying away from the USD, driven by the concern of further weaponization of the USD, the U.S. financial system and trade (i.e., sanctions, tariffs and other arbitrary penalties).

In its July FOMC (Federal Open Market Committee) meeting, the Fed announced an extension of the central bank dollar repo and swap lines to March 2021. This guarantee of ample USD supply will likely keep a lid on a runaway USD, reducing a right tail risk repeat of the March USD driven funding squeeze and liquidity stress. The safe-haven flight will continue to fade further with the extension of USD swaps and repo lines.

At the shorter end of the real yield curve, there is further room for deeper negative short-term yields. The short end of the real interest rate curve will have a more direct impact on further USD weakness. The introduction of YCC will also have a significant effect on the shorter end of the curve, and if introduced, we would likely see another leg of USD weakness.

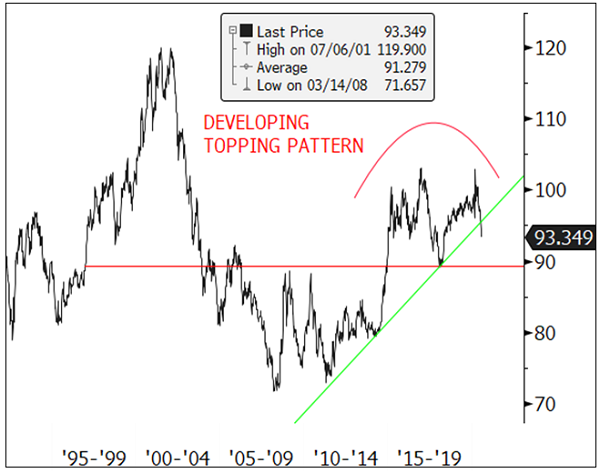

DXY (U.S. Dollar Index) has triggered an intermediate top on the charts and is developing a significant long-term topping pattern in the form of a potential double top (Figure 3). None of the arguments for a weaker USD is short term in nature; we expect USD weakness will be long term in nature.

Figure 3. DXY Large Long-Term Topping Pattern Developing, Intermediate Top in Place

Source: Bloomberg. Data as of 7/31/2020.

Silver Breaks Out as it Plays Catch-Up to Gold

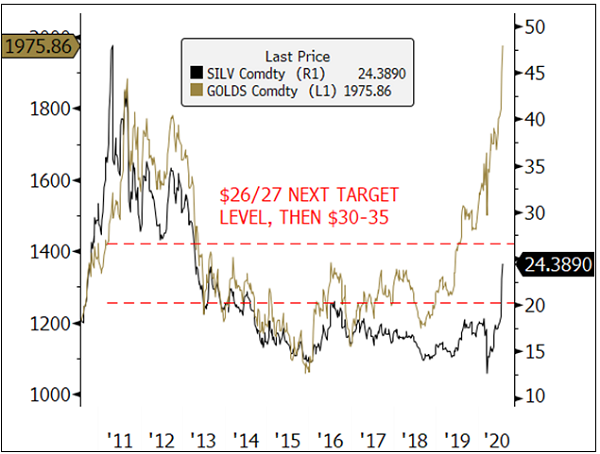

Spot silver surged $6.18 an ounce, or 33.95%, in July to close the month at $24.39, a seven-year high. Silver decidedly broke through the prior formidable resistance of $21/$22 with relative ease.

The next resistance level of $26/$27 remains, but given the momentum, accumulation and further potential buying in futures, we expect this level will be surpassed soon to open the $30-$35 trade range.

Silver is acting both as a store of value and leverage to economic growth...Spot silver surged 33.95% in July to close the month at $24.39, a seven-year high.

Most notable was the explosion in options volume in iShares Silver Trust (SLV), the largest silver ETF. Total open interest had climbed steadily to record levels. Options volume, however, has increased nine times its average daily volume, indicating that buying interest has now widened considerably, likely by larger investors that were not involved in silver earlier.

We view the $21/$22 breakout level on silver as analogous to the $1,350/$1,375 breakout level on gold bullion, and the $26/$27 level on silver as the rough equivalent to $1,600 gold (see Figure 4). Silver continues to have plenty of scope for a catch-up trade to gold bullion.

Figure 4. More Upside Ahead for Silver

Source: Bloomberg. Data as of 7/31/2020.

Silver ETF Flows Reach Record Highs

The fundamental picture for silver continues to improve. As governments look to bolster economic growth, we already see fiscal stimulus directed at intensive silver areas such as solar energy and 5G networks (fifth generation technology standard for cellular networks).

But the most significant surge in demand is from investor flows into silver-backed ETFs. Silver held in ETFs has increased 272 million ounces or 44.7% YTD, reaching a new record high of 878 million ounces of silver. YTD, the 272 million ounces added to ETF holdings, represents about 27% of 2019 total demand numbers.

As with the recent price surge in gold, investor interest in silver is focused primarily on the metal's value as a store of monetary value. Investor demand for gold and silver is highly correlated to U.S. M2 money supply.(7) Where gold buying (using Total Known Gold ETF Holdings from Bloomberg) has a 91% R-square (8) with M2 over the past five years, silver has a still very high R-square of 79%.

Silver also has an industrial component, and its correlation to copper (a proxy for cyclical growth) is quite high at a 57% R-square. By comparison, gold has almost no correlation to copper, as reflected by a 5% R-square.

Currently, silver is acting both as a store of value and leverage to economic growth, a very unusual but highly valuable quality in this current market environment. This latter point may help explain the surge in SLV option activity.

Gold Mining Equities: Multi-Year Breakout to Higher Levels

Gold mining equities had a decisive breakout in July. GDX had a stellar July, increasing 17% to close at $42.94, an eight-year high.

The $40 mark was a critical resistance level that defined the technical breakdown back in 2013.

The $40 resistance on GDX was the chart equivalent of $1,600 on gold bullion.

The break of $40 on GDX was a critical marker for the next bullish phase higher, which now targets the $50 - $55 range. YTD 2020, the average gold price so far is $1,678, or +20.5% higher than the 2019 average price of $1,393. As a reminder of the significant operating leverage for gold miners, using an AISC (All-in Sustaining Cost) of $1,000/oz, operating margins would be $678/oz using 2020 YTD pricing versus $393/oz for 2019, or 72.5% higher.

With five more months to go in 2020, the average realized gold price for 2020 would be significantly higher than $1,678.

Consensus price decks used for earnings estimates remain considerably below the current futures prices. Using Bloomberg data, consensus analysts' price decks are almost $100/oz below the combined realized and futures price curve for 2020.

Next year for 2021, the gap is even wider at $239/oz (futures curve versus consensus price deck). In terms of the following factors that the market is currently rewarding: sales growth, momentum, earnings surprises and target revision, we would expect gold mining equities to rank among the better performing categories merely by having the consensus price deck move up towards current pricing levels.

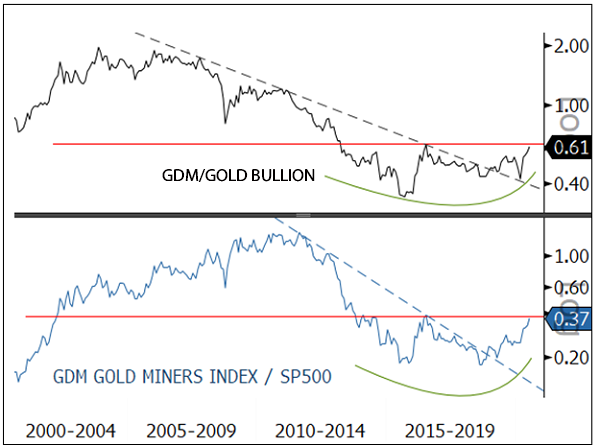

Year over year, GDX has increased 62.04%, and we see further upside. With GDX breaking above $40, gold equities are entering the next bullish phase — acceptance of the bull market (Figure 5a). The very long-term trends are now showing gold equities on the verge of breaking relative to gold bullion and relative to even the S&P 500 Index (Figure 5b).

In the prior cycle, gold equities outperformed the S&P 500 sevenfold over ten years, a surprising fact for many new participants perhaps, and possibly forgotten by many older ones.

Figure 5a. Gold Mining Equities Breaking Out to Next Price Target Range of $50-$55

Source: Bloomberg. GDX data as of 7/31/2020.

Figure 5b. Gold Mining Equities Relative to Gold Bullion and S&P 500: On the Verge of Major Breakout from Multi-Year Bases

Source: Bloomberg. Data as of 7/31/2020.

Economic Outlook?

Cloudy with a Chance of W, Wavy and Other Oddly Shaped Recoveries

Q2 U.S. gross domestic product (GDP) figures were released last week and, as expected, was horrific. Q2 GDP was down 32.9% on an annualized basis (-9.5% for the quarter), the worst number in living memory.

The COVID pandemic-induced sudden stop and now gradual and uneven re-opening of economies will create some abnormal and contradictory economic data points for a while yet.

The U.S. economic outlook remains mixed but has slipped recently as the number of COVID cases continues to escalate. With more than 75% of the population in states that are re-instituting lockdowns or delayed re-openings, recovery momentum will likely slow.

At the time of this writing, Phase 4 of the virus relief stimulus bill is currently stalled between Senate Republicans and House Democrats.

A sustainable V-shaped recovery scenario is highly questionable, given that 32 million Americans are claiming some form of unemployment insurance. Much of that imagined V-shaped recovery was likely due to the individual stimulus checks that have just run out.

No Country Has Been Untouched by COVID

The lasting damage from COVID will likely become more evident in the second half of 2020, once the shock and awe of the monetary and fiscal stimulus have settled. Growing job losses, classified as permanent, and increased bankruptcies are likely to indicate structural changes making their way through the U.S. economy.

Given that other countries continue to struggle with a second wave of COVID infections as well, a complete recovery is a challenging long-term task. Virtually no country has been untouched.

Every developed economy has initiated massive monetary and fiscal stimulus programs that have resulted in debt exploding to levels not seen in several decades or ever.

This coming fall, expected Treasury issuance will be faster than QE buying, potentially increasing yields. Yield-curve control remains a possibility as the Fed will need to contain interest rates by monetizing all fiscal stimulus programs. The economy will continue to require very accommodative financial conditions for years.

With monetary policy already at zero interest rates, and QE at massive levels, implementing yield-curve control may become necessary. The increased fiscal stimulus outlook is also timely as YCC is most effective when coordinated with fiscal stimulus.

The Precious Metals Bull Market Should Continue to Strengthen

Gold has staged a breakout in a spectacular manner driven by plunging real yields, and now with the USD topping out. Deep negative real yields and a falling USD are potent drivers for gold. All these factors are related, and all are likely to continue.

The current fiscal relief bill will have a $1 trillion floor, and more future relief spending is expected and sizeable fiscal stimulus programs will continue. Extreme accommodative monetary policy is here to stay indefinitely, even if conditions improve.

The USD has just started a major down leg. All the arguments we have made for being bullish on precious metals over the past year remain in place and have only accelerated or magnified.

We continue to predict that gold will remain in a multi-year bull market.

*Escape velocity is the minimum velocity that a moving body (such as a rocket) must have to escape from the gravitational field of a celestial body (such as the earth) and move outward into space.

1 Gold bullion is measured by the Bloomberg GOLDS Comdty Index.

2 Sprott Gold Miners Exchange Traded Fund (NYSE Arca: SGDM) seeks investment results that correspond (before fees and expenses) generally to the performance of its underlying index, the Solactive Gold Miners Custom Factors Index (Index Ticker: SOLGMCFT). The Index aims to track the performance of larger-sized gold companies whose stocks are listed on Canadian and major U.S. exchanges.

3 VanEck Vectors® Gold Miners ETF (GDX®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry.

4 The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies.

5 Commodity Futures Trading Commission's (CFTC) Gold Non-Commercial Net Positions weekly report reflects the difference between the total volume of long and short gold positions existing in the market and opened by non-commercial (speculative) traders. The report only includes U.S. futures markets (Chicago and New York Exchanges). The indicator is a net volume of long gold positions in the United States.

6 The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies.

7 M2 is a measure of the money supply that includes cash, checking deposits, and easily convertible near money. M2 is a broader measure of the money supply that M1, which just include cash and checking deposits (Source: Investopedia).

8 R-squared values range from 0 to 1 and are commonly stated as percentages from 0% to 100%. An R-squared of 100% means that all movements of a security (or another dependent variable) are completely explained by movements in the index (or the independent variable(s) you are interested in) (Source: Investopedia).

Paul Wong

Paul has held several roles at Sprott, including Senior Portfolio Manager. He has more than 30 years of investment experience, specializing in investment analysis for natural resources investments. He is a trained geologist and CFA holder.

0 comments:

Publicar un comentario