by: Trading Places Research

Summary

- It makes for a great headline, but the Fed is not the cause of this rally.

- Every dollar the Fed has pumped into the economy is spoken for, and it is not in equities.

- The truth is a lot more boring and scary than the conspiracy theory.

- Every dollar the Fed has pumped into the economy is spoken for, and it is not in equities.

- The truth is a lot more boring and scary than the conspiracy theory.

Arithmetic Versus Alchemy

I’ve been having the same discussion on Twitter, and here in Seeking Alpha comments for some time now.

I am repeatedly told that the Fed is pumping the stock market, and I should either just fall in line, or be outraged, or both.

Let’s look at what has happened since the March 11 Fed balance sheet.

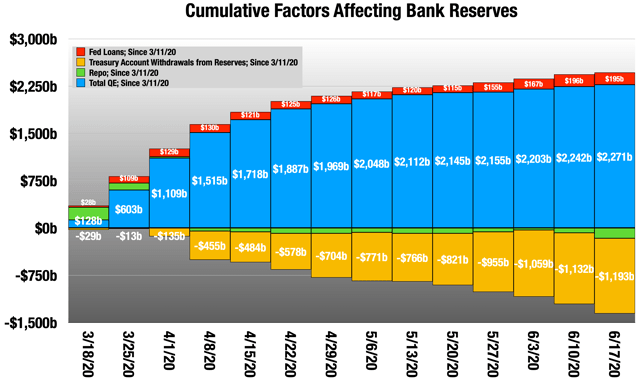

So far, since March 11, the Fed has pumped in $2.3 trillion to the economy in new dollars.

That is mostly QE (the blue column), with an additional $195 billion in loans (the facilities), offset by a reduction in repo of $163 billion.

Where is that $2.3 trillion?

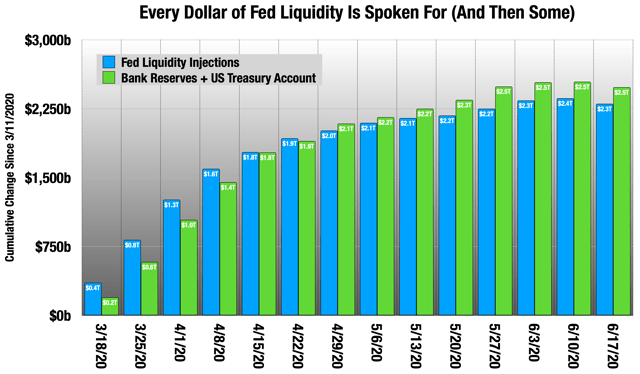

We know exactly where it is, because it is in only two places - bank reserves at the Fed, and the US Treasury’s checking account, also at the Fed.

Together, these have risen $2.5 trillion, $180 billion more than the Fed’s liquidity injections.

In addition to all the cash banks have taken from the Fed and held on to, they have also taken in an additional $180 billion in deposits that they are also holding on to.

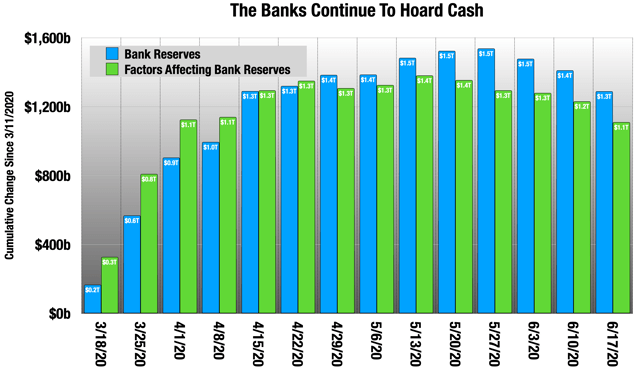

The banks are hoarding cash, not putting it to work.

The takeaway should not be “OMG, buy everything!”

It should be, “OMG, 3 months into this, the banks are still scared to put their money to work!”

QE1 and QE2

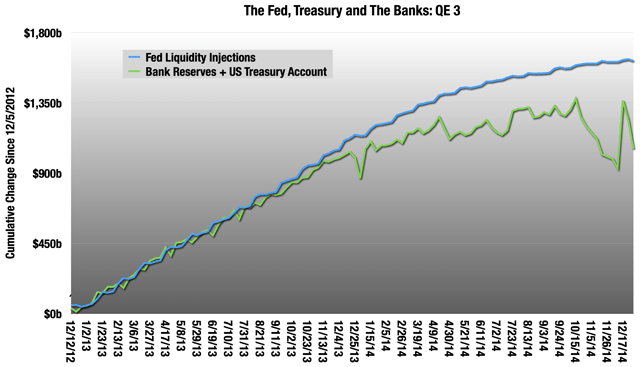

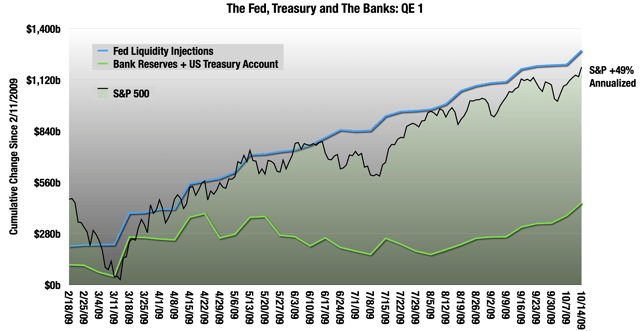

Let’s look at QE 1 and QE 2, which are instructive. QE 3 is much less helpful, because the sequester, a huge deflationary event, happened right in the middle of it and makes the whole chart run off course in 2014.

Keep in mind that this is all happening during one of the longest bull markets of all time, with a total return of 400% on the S&P 500 over 11 years, or 16% annualized.

QE 1 is what set up everyone’s expectations for how this goes.

The Fed piled in liquidity to the banks, mostly by taking their toxic MBSs off their hands, but also through outright Treasury purchases, for the first time at scale.

The banks turned around and left very little of that in reserves, and this was also before Treasury began running larger balances in 2015, so most of that found its way into the economy, and presumably some of that to equities.

In QE 1, bank reserves and the Treasury’s account did not rise by more than $300 billion until the end there. $850 billion was the difference between the two lines at the peak.

That money was being lent out in various ways, and some undoubtedly found its way into equities. This is the exact opposite of what is happening now.

In that period, the S&P was up 49% annualized, far better than the cycle average.

Keep in mind, that also includes a 19% drop at the beginning of QE 1.

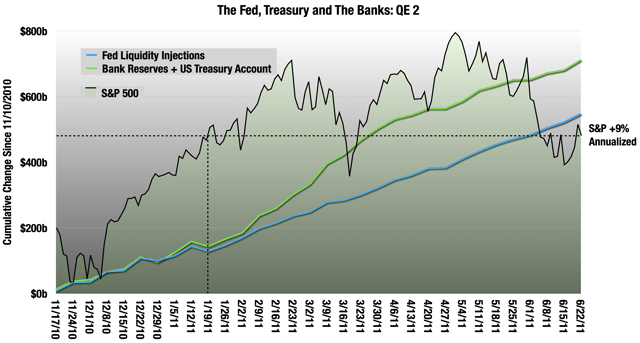

So that was everyone’s expectation coming into QE 2, but that worked out far differently:

What we see here is that a couple of months into QE 2, the banks began to hoard cash, as they are doing now.

What you will note is that by the time it ended, the S&P was only up 9% annualized, below the cycle average.

Also, all the gains were baked in by the time reserves started taking off (dotted lines).

Why This Is Scary, Not Exciting

The point of this giant QE is to keep the banks liquid and lending, while the Federal government is out there borrowing trillions.

Despite what Jerome Powell says, they are monetizing the debt, every last dime of it, and that’s a good thing.

The alternative is a credit freeze and a depression.

Inflation is the very last of our problems right now.

Quite clearly the banks are liquid, but just as clearly, they are not lending.

We see that reluctance in widening credit spreads, which indicate that banks think the cost of risk has risen.

Right now, the spreads for mortgage and corporate A-rated with their Treasury benchmarks are around 50 basis points higher than they were before the crisis.

These are typically very thin spreads around 100 basis points, so 50 basis points is a lot.

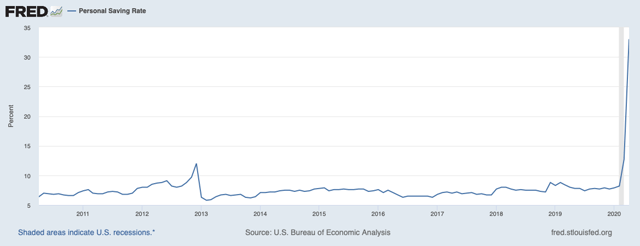

Moreover, they are not the only ones hoarding cash right now. In the first place, the Treasury certainly is.

But so are households:

That’s a 33% personal savings rate in April, by far the highest on record.

We will get the May number this week. It will likely be lower than 33%, but still the second highest on record.

Households paid off $85 billion in credit card debt in March and April.

Banks, corporations and people hoard cash for the same reason: they foresee bad things on the horizon, and want to make sure their balance sheets are in order.

The Fed’s Secondary Policy Consists Of Very Large Numbers In Press Releases

The Fed’s primary policy in all this is massive QE to keep the banks liquid.

But their secondary policy has been to put very large numbers into press releases.

This began even before QE, with repo.

By the end of March, the Fed could have had $4 trillion in outstanding repo, but only a small fraction of that was ever used.

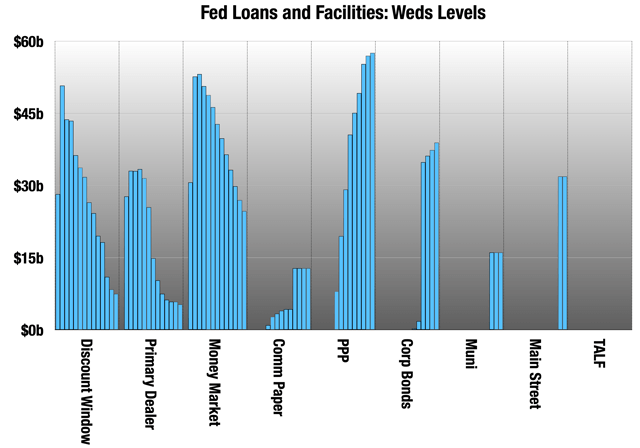

This continued with the facilities, which all remain far below their limits

The 3 early ones to the left are way below where they could have been, and have been coming down slowly for weeks now.

The commercial paper facility remains small. Corporate bonds remain at 5% of their potential size - only about 15% of the secondary facility and none of the primary facility had been used by last Wednesday.

It’s still early, but the Muni and Main Street facilities are very small. Even PPP hasn’t reached $60 billion yet. Talks just started up this week.

The point of this is twofold:

- Put very large numbers in press releases to impress upon people that the Fed will do what it takes to stave off the very worst - a massive wave of defaults, foreclosures, evictions and bankruptcies.

- But also, unlike many market participants, the Fed understands that we are in for the long haul here, and they may need to keep needing to hit up those facilities, maybe for a couple of years.

Fed's Powell says the Fed is not thinking about raising rates, that economy will need support for an extended period of time

Rosengren: Because of the continued community spread of the disease and the acceleration of new cases in many states, I expect the economic rebound in the 2nd half of the year to be less than was hoped for.

Kashkari says he would expect the unemployment rate to climb again if there is a second wave, thinks the real number today is around 20%

- Bloomberg Terminal headlines from the past week

Every few days, one of these headlines hits, where the people we are counting on to save us tell us that things are very bad, and we are in for a long haul.

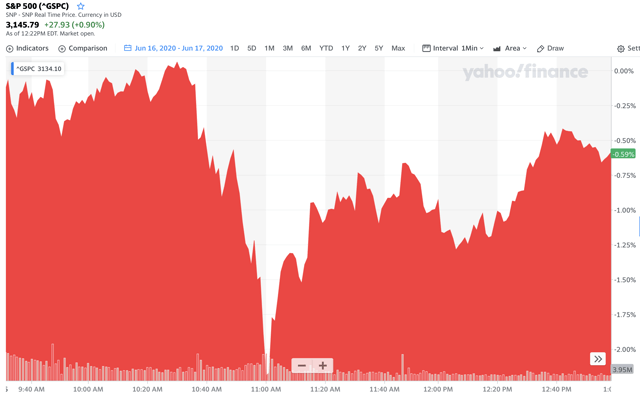

Here’s what the market did during Powell’s testimony:

The market listened to him for about half an hour, then lost focus.

It’s pretty much what happens every time Powell opens his mouth.

So listen to what they are telling you:

- COVID-19 is not done with us.

- Even without that, there is a very long road back.

- The Fed can only put a net over the worst of it.

What Is The Counter-Argument?

I don’t know the answer to that question. Every time I ask someone to explain to me exactly how the Fed is juicing the market right now, I get a lot of hand waving, oblique mentions of liquidity, and some pitiful stares at this poor, dumb sap who thinks that the Fed isn’t rigging the market.

The answer is always very short on math, because the math just isn’t there. We can account for every dime that the Fed has put into the economy since this began. Either the banks are hoarding it, or Treasury is.

So please, I invite anyone to explain to me, like I was a 5-year-old, what exactly is the mechanism that explains “the Fed is juicing the market," when we know exactly where all the Fed’s money is, and we know that it isn’t in the market.

One request: please bring math.

0 comments:

Publicar un comentario