REMEMBER BREXIT? COVID-19 HAS JUST CHANGED THE STAKES / THE WALL STREET JOURNAL

Remember Brexit? Covid-19 Has Just Changed the Stakes

Domestic policy announcements may be more important than trade deals in the post-coronavirus world

By Jon Sindreu

Covid-19 has made investors forget about Brexit, with some justification. But it is worth watching an economy that could provide a test case for a world after peak globalization.

Britain left the bloc in January, but remains in the European Union’s single market and customs union until the end of the year. Earlier this week, British Prime Minister Boris Johnson and EU officials agreed not to extend this transition period, which means that any trade agreement for next year needs to be negotiated before Oct. 31.

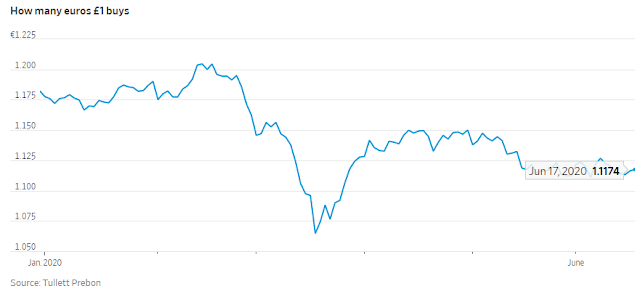

This deadline was tight even before the coronavirus pandemic. With little progress in video talks since, the risk of a “no deal” outcome has crept up. The pound, which is down 6% against the euro since the start of the year, may be in for a bumpy few months.

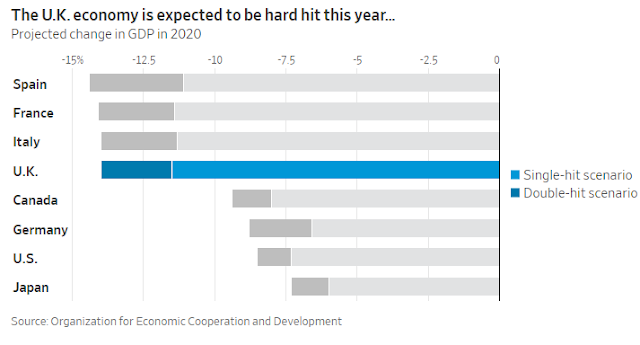

Meanwhile, Covid-19 could reduce U.K. economic output by as much as 14% this year, according to Organization for Economic Cooperation and Development estimates. Whether this makes the search for a deal that preserves existing ties more urgent—or gives the euroskeptic Mr. Johnson cover to pursue a more disruptive course—is debatable. The pandemic has depleted many of the supplies, notably of pharmaceuticals, that British companies had accumulated to cope with a no-deal scenario.

In any case, long-term investors don’t need to base U.K. allocation decisions on the type of deal achieved this year—not least because the best they can hope for is probably a bare-bones trade agreement. They should pay more attention instead to Britain’s domestic policies: Covid-19 has given governments more power to reshape their economies.

Fiscal policy is playing a huge role in containing the damage of the lockdowns. The U.K.’s fiscal package relative to its cyclically-adjusted output already far surpasses all its neighbors’ in size, UBSestimates show. The freedom to use this kind of financial muscle could also take on an outsize importance in the post-pandemic recovery, particularly at a time when more European governments are embracing the idea of supporting industrial champions.

The U.K. Treasury has long been reluctant to get involved in industrial strategy. But the times may be changing. It has drafted plans to save strategic firms, though for now this remains a short-term response.

The pandemic and the political backlash against globalization also may prompt more firms to bring supply chains closer to home. Pharma companies in particular have found themselves too dependent on Chinese ingredients during this crisis. A report by the University of Warwick found that being close to research and development spending—for which the U.K. is a hub—is one of the main reasons why some key industries decide to reshore production.

This trend may end up reducing the relative importance of Britain leaving the EU and increasing the power of U.K. policy to offset the problems caused by Brexit. For example, in the auto sector—often seen as having much to lose from a breakdown in trade relations—the transition to electric vehicles may require a lot more public funds, and the U.K. has the potential to deploy them. Despite Brexit, Japanese car maker Nissanlast month decided to retrench in Europe by closing its Spanish plant, not its British one.

The flip side, of course, is that British officials also have more leeway to fall short by stinting on recovery spending or making the wrong bets. Either way, domestic policy announcements, rather than trade deals, may be the news to watch in the post-coronavirus world.

0 comments:

Publicar un comentario