by: David Alton Clark

Summary

- I have been in business for 40 years and in the market for a majority of that time. I thought I had seen it all. I was wrong.

- When contemplating the recent extraordinary 30% rally off the low, the wildly popular Michael Jordan documentary special, “The Last Dance,” immediately came to mind.

- I submit this "Last Dance" may be your "Last Chance" to take profits before the market's rapacious repartee is revealed as harsh realities sink in.

- In the following piece I provide my thoughts on the current state of affairs, where markets may be headed, and my investing game plan going forward.

Executive Summary

- When contemplating the recent extraordinary 30% rally off the low, the wildly popular Michael Jordan documentary special, “The Last Dance,” immediately came to mind.

- I submit this "Last Dance" may be your "Last Chance" to take profits before the market's rapacious repartee is revealed as harsh realities sink in.

- In the following piece I provide my thoughts on the current state of affairs, where markets may be headed, and my investing game plan going forward.

Executive Summary

The title of the piece pays homage to ESPN's wildly popular documentary on Michael Jordan, “The Last Dance.”

The documentary’s title represents Jordan’s final season as a Chicago Bull and the team’s effort to secure a sixth NBA Championship.

The series title came top of mind as I contemplated the recent extraordinary 30% rally off the low in the face of such economic destruction, albeit self imposed. The schism between the market and the economy has never been greater, according to my calculations.

Therefore, this may be your last chance to take profits on position held throughout the crash.

Either my assessment of the potential for economic recovery is vastly incorrect or the market is incredibly overpriced. I submit it’s the latter.

Now, it’s not all bad news. There's a chance we won’t be relegated to a depression. Yet, the odds of that outcome fade with each passing day.

In the following piece I lay out my thoughts on the current state of affairs and my investment strategy to navigate the coming carnage. Let’s begin.

Challenges

Extreme Overvaluation

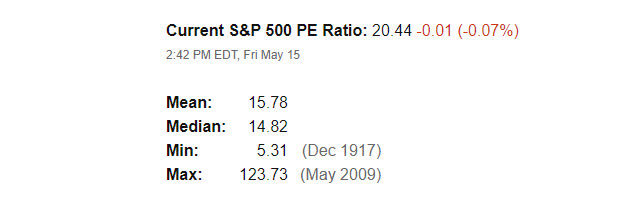

The forward price-earnings ratio has swollen to over 20.

The S&P 500 forward P/E ratio hasn’t been this high since 2002.

What’s more, I see earnings as decelerating in the coming months which may make things even more overvalued.

This is precisely what happened in 2009 when the P/E ratio rose to 123.73 as the selloff ensued.

Even a return to some semblance of normalcy of 14.82 would require a 20% move. The fact of the matter is the market is definitely overvalued at present. Now, can they get even more overvalued? Of course, but the odds are against it.

Shackled Reopening

.

Even when the economy is allowed to reopen, it will be purposely shackled to only 25%-50% due to continuing social distancing standards. Furthermore, while some states already have begun to reopen, others have extended the shutdowns even further into the future. L.A. County has said they may not reopen “non-essential" businesses unit July.

“Los Angeles County’s stay-at-home orders will “with all certainty” be extended for the next three months, county Public Health Director Barbara Ferrer acknowledged during a Board of Supervisors meeting Tuesday.”

This would be devastating to the economy. Nevertheless, reopening may lead to a second wave of the outbreak, which is our next challenge.

The second wave

.

Epidemiologists and public health officials have warned that a second wave of COVID-19 infections may occur if the social distancing standards and “stay at home” orders are lifted too soon. In fact, Dr. Fauci, head of the National Institute of Allergy and Infectious Diseases, stated in Senate testimony recently he’s worried some states are loosening social distancing restrictions even as their COVID-19 cases continue to rise.

“What I’ve expressed then and again is my concern that if some areas, cities, states, what have you, jump over those various checkpoints and prematurely open up without having the capability of being able to respond effectively and efficiently, my concern is that we will start to see little spikes that might turn into outbreaks.”

What’s more, a potential second COVID-19 wave will coincide with the peak of the 2020-21 U.S. influenza season. This may trigger a flood of hospital patients in need of respiratory support.

Unfortunately it seems these issues are being determined along party lines rather than according to the science.

Political power struggle

The reopening of the states is definitely taking on a political bent.

It seems as though red states are reopening at a fast pace while blue states are extending the social distancing standards and lock downs.

A number of protests have sprung up around the country demanding the reopening of the U.S. economy even as cases of COVID-19 continue to grow. Protesters in Florida, North Carolina, Virginia, Michigan, Minnesota, Maryland, New Hampshire, Idaho, Texas and California gathered outside their respective state legislatures to demand the reopening of the economy.

President Trump seems to support these events by stating we can’t let the cure become worse than the disease. It has put many small business owners between a rock and a hard place.

China trade tribulation

As the facts are revealing regarding the way China handled the beginning of the outbreak, a backlash has begun. Rumblings of a renewed cold war with China have resonated through the airways. Just as

I'm writing this the market dropped on news the Trump Administration moved to block shipments of semiconductors to Huawei Technologies from global chipmakers.

“The U.S. Commerce Department said it was amending an export rule to “strategically target Huawei’s acquisition of semiconductors that are the direct product of certain U.S. software and technology. The rule change is a blow to Huawei, as well as to Taiwan’s TSMC, a major producer of chips for Huawei’s Silicon unit as well as mobile phone rivals Apple and Qualcomm.”

A source close to the Chinese government told the Global Times China is prepared to retaliate.

“China is ready to take a series of countermeasures against a US plan to block shipments of semiconductors to Chinese telecom firm Huawei, including putting US companies on an "unreliable entity list," launching investigations and imposing restrictions on US companies such as Apple and suspending the purchase of Boeing airplanes.”

The bottom line is much of the recent upside in the market prior to the outbreak was based on phase one of the China trade deal being signed. These developments would seem to be a huge step backward in regards to trade.

Even so, I feel cooler heads will prevail on this issue.

Vaccine vagary

.

There are several pharmaceutical companies racing to create a viable vaccine. Some are stating they may have something to present even before the year is out. I don’t put much faith in this. In the past it has taken several years to produce a working vaccine.

I know we have had many incredible technological advances as of late, yet it still seems like unrealistic expectations to me. The reason I see this as a major factor is I don’t see people fully engaging in the economy until they feel safe.

I don’t see that happening until we have a proven vaccine and are able to deliver it at scale.

Party like its 1999

.

The recent rally been fueled in part by a rash of newly minted investors. A record number of new accounts have been established at major online brokers such as Charles Schwab, TD Ameritrade, Etrade, and Robinhood. Citi chief U.S. equity strategist Tobias Levkovich stated:

“The new accounts may represent “new investors who sense a generational-buying moment but do not have much background in the equity space.”

I can tell you by anecdotal experience this is definitely the case. I have many younger friends who have all called me asking about how to get involved in the stock market. Further, several of them feel 10 feet tall and bullet proof as they have only been involved during the recent run up over the last few weeks.

In each of the last two major crashes of 2000 and 2008 this is exactly what I saw happening just prior to the major downside move in the markets. I forced myself to always remember this sign and take heed if it were to occur again.

Now, that doesn’t mean the market is going to fall off a cliff tomorrow, yet it's one more box checked in my book.

So what am I doing?

For all these reasons I'm still in a wait and see mode with regard to my nest egg. In early February just after President Trump halted travel from China I sold out of my all my positions with the exception of AT&T (T) and advised my subscribers to do the same earlier.

This is not attempting to time the market. It is a risk management strategy I have developed over the years.

Whenever I feel uncertainty is at an all-time high and visibility at an all-time low, I raised cash and take a wait and see approach. At this point in my investing career I have enough money to live comfortably for the rest of my life.

I convert from capital appreciation to capital preservation mode. I use 10% of the equity portion of my portfolio to trade the volatile market long and short. This being my third time around I have managed to do quite well and have actually made much more money than I would have collected in dividends over the past few months.

That’s my strategy. I'm not saying it would work for everyone or recommending it. I'm just letting you know what I'm doing.

Once things become more clear regarding the reopening of the economy and the outbreak has diminished I will redeploy my cash hoard.

I'm not worried about missing out on the beginning of the rally. I see that as increasing my margin of safety and reducing risk.

The Wrap Up

I advise against making any big bets until the outbreak is contained and we have a better idea of how the reopening will shake out.

There's a massive amount of Fed stimulus in the system already which seems to have staved off a financial meltdown for now. Nonetheless, Chair Powell just stated the Congress must act in order for economic conditions to improve.

There's a massive amount of Fed stimulus in the system already which seems to have staved off a financial meltdown for now. Nonetheless, Chair Powell just stated the Congress must act in order for economic conditions to improve.

Furthermore, conditions aren’t as favorable as they appear at present. A significant amount of market bifurcation currently exists.

We are definitely investing in a time of the haves and have nots according to pre and post pandemic paradigms.

There are now two categories of stocks - B.C. and A.D. Those stocks that were winners in the B.C. (Before COVID-19) era and those that are now winners in the A.D. (After Disease) era.

We are definitely investing in a time of the haves and have nots according to pre and post pandemic paradigms.

There are now two categories of stocks - B.C. and A.D. Those stocks that were winners in the B.C. (Before COVID-19) era and those that are now winners in the A.D. (After Disease) era.

Moreover, many of the potential winners and losers have not been sorted out yet. So I advise proceeding with caution. We will eventually have a vaccine and the pandemic will fade into memory.

The American spirit cannot be broken. Yet, no one can know how long it may take.

0 comments:

Publicar un comentario