S&P 500: The Next Stock Market Crash May Have Just Started

by: Victor Dergunov

Summary

- The S&P 500/SPX had run up by nearly 50% since its mid-March lows.

- However, leadership became extremely thin in recent sessions as the "Big Five" and other large tech companies did much of the heavy lifting.

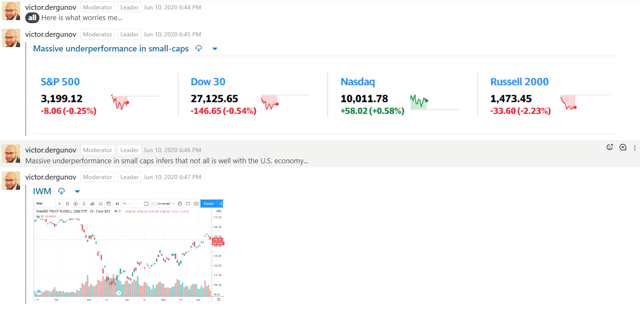

- We also noticed massive underperformance in the Russell 2000/small-cap index yesterday, which alarmed us quite a bit.

- I expect this "pullback" to continue.

- Target correction range is from 12%-20% from recent highs, or about 2,850-2,550 in SPX.

- However, leadership became extremely thin in recent sessions as the "Big Five" and other large tech companies did much of the heavy lifting.

- We also noticed massive underperformance in the Russell 2000/small-cap index yesterday, which alarmed us quite a bit.

- I expect this "pullback" to continue.

- Target correction range is from 12%-20% from recent highs, or about 2,850-2,550 in SPX.

Image Source - Is the next stock market crash just starting?

Image Source - Is the next stock market crash just starting?

The S&P 500/SPX (SP500) is down by around 80 points this morning, now testing the key support level at 3,100.

It looks like that the economic reality is not nearly as constructive as stock market optimism has been implying in recent weeks.

COVID-19 is not going away, and as mentioned in previous articles it's likely to continue to weigh on economic growth as well as on stock prices going forward.

The Second Wave

More than a dozen states are showing significant resurgences in Novel Coronavirus/CV cases.

Naturally, this will likely weigh on consumer confidence, employment, other data, and overall economic growth.

However, is this really the second wave of the CV? Not likely, as this is probably just the extension of the first wave due to premature "re-openings," relaxed attitudes, densely-populated protests, and other factors. When the second wave comes it will likely be in the fall, coupled with the cold and flu season.

Please keep in mind that this could lead to a certain level of pandemonium, as many people will not be aware whether they have the flu, a cold, or the Novel Coronavirus. There will also likely be uncertainty about the outcome of the election by then, another negative factor for markets overall.

Market Outlook

We've been cautious throughout this rally, as it was artificially induced by enormous Fed stimulus, and we saw an evident disconnect between the real economy and the stock market.

Furthermore, I never believed, and still do not believe, that the economy will return to "normal" any time soon.

In Q2 we chose to allocate a large portion of our portfolio to the gold, silver, mining/GSM sector, as well as to Bitcoin and other systemically important digital assets. The reasoning behind this was that these assets would outperform due to their inflation proof/resistant qualities. After all, the Fed is printing an unprecedented amount of money, so it makes sense to own assets that should benefit from the underlying phenomenon.

Having said that, we do own some stocks, but our non-GSM equities/ETF segment makes up only around 15% of our portfolio now. We've also been taking some profits on their way up in certain names.

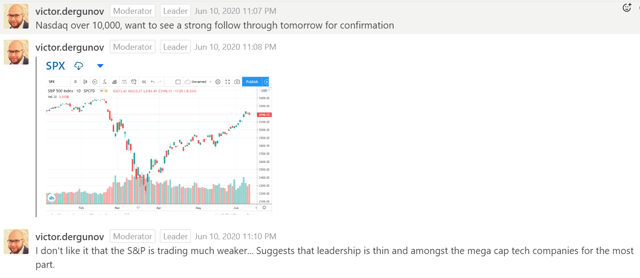

Not all was looking well yesterday

Source: Albright Investment Group

Source: Albright Investment Group

Yesterday, I mentioned that I did not like the way the SPX and markets in general were trading. We saw very thin leadership, primarily from the "Big 5" and other big tech names.

Most other sectors, especially the more cyclical ones did not trade well, closing near the lows of the session.

Another factor that troubled me notably, was the massive underperformance in the Russell 2000 small cap index.

We saw that the Russell 2000 was sending out a clear warning signal yesterday, as small caps are typically supposed to lead a recovery, because they essentially represent the state of the American domestic market.

So, What's Next?

We see that we had a massive rally of nearly 50% from the mid-March lows. Many of the stocks in our watch/buy list that we put out around the lows in March appreciated by 50%, 100%, 150% or even more in some cases. Now it's time for a pullback, possibly even a correction.

The best case scenario is that stocks bounce back from the current (roughly 3,100) level.

However, this is not likely in my view. We could see a pullback of around 7% from recent highs, which would bring the SPX down to roughly 3,000 support.

However, the selling may not stop there. The market could decline further to its next major area of support at around 2,850. This may be the likeliest scenario right now, and would represent a correction of around 12%.

Nevertheless, in a more severe case scenario, the market could fall all the way back down to the 2,550 point, roughly a 20% correction from recent highs.

0 comments:

Publicar un comentario