We've Probably Seen The Worst

by: Calafia Beach Pundit

Summary

- As emotions cool, even as Covid-19 cases soar and deaths rise, we are beginning to see the light at the end of this tunnel.

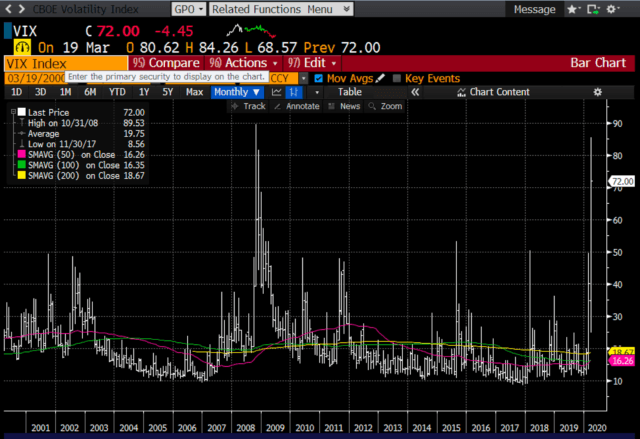

- The Vix index has reached a high that is just shy of the worst levels we saw at the height of the 2008 global financial crisis.

- The strength and weakness of the dollar tend strongly to coincide with the ups and down of commodity prices.

- The Vix index has reached a high that is just shy of the worst levels we saw at the height of the 2008 global financial crisis.

- The strength and weakness of the dollar tend strongly to coincide with the ups and down of commodity prices.

- My sense is that yesterday marked the extremes of panic, despair, capitulation, short-covering, and anguish.

As emotions cool, even as Covid-19 cases soar and deaths rise, we are beginning to see the light at the end of this tunnel. There are several drugs that are now available as therapeutics, thanks to Trump twisting the reluctant FDA's arm.

Trump knows, and everyone does also, that maximum pressure needs to be applied to the Saudis and the Russians to encourage them to end their mutually-destructive crude oil price war.

Even as Italian virus cases soar and mortality rates exceed what happened in China, the numbers in the rest of the world are becoming more realistic. High fatality rates appear to reliably coincide with colder climates, older and sicker populations (99% of the Italians who died from Covid-19 deaths had at least one other infirmity or illness!), populations with high rates of smoking, and populations with centralized healthcare systems.

Mortality rates in Germany, the US, Germany, Japan, France, the UK, Canada, Australia, Switzerland, So. Korea, and Singapore are much lower.

All mortality rates are most likely overstated in any case, since it appears that only about half of those infected with coronavirus show symptoms, and those are the only ones that tend to be tested.

If nothing else, the extreme measures already adopted by most of the U.S. and the rest of the world will almost certainly result in a slower progression of contagions in the weeks to come.

Testing kits - essential to effectively control the disease, but tragically lacking in most of the US until recently - are now being widely distributed.

I'm not saying this is the absolute bottom. The Vix index has probably hit its peak, but that doesn't guarantee that risk assets have hit their bottom.

The Vix peaked in October of 2008, but the stock market didn't hit bottom until early March '09.

Oil prices surged almost 25% today, but they remain extremely low.

The dollar continues to march higher, and that puts pressure on all commodity prices and most emerging market economies.

But the anguish that permeated everything yesterday seems to have faded to an important degree today.

On the margin, the news is no longer uniformly bad; there are pockets of relief and glimpses of improvement beginning to show up here and there.

Some relevant charts:

Chart #1

Chart #2

As Charts #1 and #2 show, the Vix index has reached a high that is just shy of the worst levels we saw at the height of the 2008 global financial crisis.

Back then, many thought that we were on the edge of the abyss, about to witness the collapse of the entire global financial system, coupled with a global depression.

Can a little tiny virus be worse than that?

Chart #1 shows that the market has effectively given up the gains it registered over the past three years.

Three years of record-setting profits, decent growth, rising prosperity, lower taxes, and record-low levels of unemployment - all for naught.

Chart #3

Chart #3 highlights the price action of the S&P 500 over the past six months.

It also shows (bottom bars) how trading volume has soared as prices have plunged.

Record levels of panic, record levels of trading, and plunging prices are the hallmarks of a panic-driven market, and they are also typical of bottoms.

Let's hope this is as bad as it gets.

Chart #4

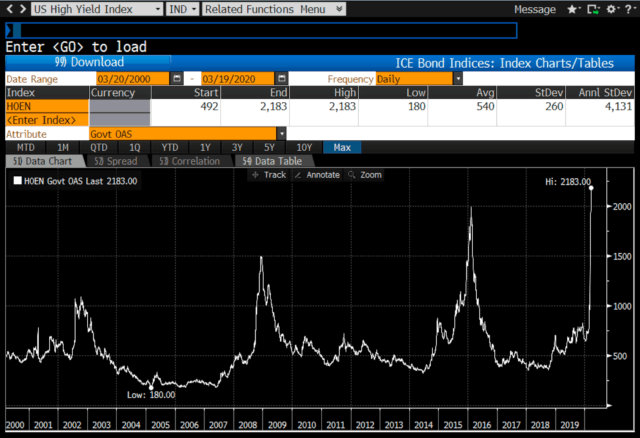

Chart #4 shows the spreads on high-yield, energy-sector bonds as of yesterday (March 18th).

We've never seen worse, and it is directly a function of the enormous decline in oil prices, which have created near-fatal conditions for most of the world's oil producers.

But thanks to a 24% gain in oil prices today, we've probably seen the high-water mark for energy sector credit spreads.

Importantly, Trump, today, announced that he is going to "apply pressure" to the Saudis and the Russians, in order to force them to cut their output.

Chart #5

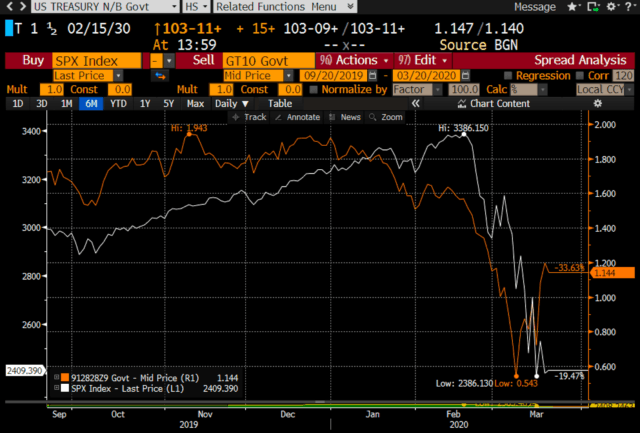

Chart #5 shows 10-yr Treasury yields (red line) and the level of the S&P 500 index (white line).

It looks very much like Treasury yields have been leading the stock market. If that is indeed the case, the big jump in yields over the past several days suggests the stock market is likely to experience some welcome relief in the days to come.

10-yr yields have traditionally been a good barometer of the market's degree of confidence in the outlook for the economy. Most commentators will probably attribute the rise in Treasury yields to the market's expectation of huge federal deficits being funded to pay for fiscal "stimulus" plans.

I have yet to see anyone of late come up with any fiscal plan that looks genuinely stimulative.

Sending checks to everyone does nothing to change incentives to work or to keep idle workers on the payroll.

I would get excited about a payroll tax holiday. In any event, it's just as likely that the market is reading the virus tea-leaves and concluding that the pandemic hype has been overblown.

Chart #6

Chart #6 shows the spread between 10-yr and 30-yr Treasuries.

Rising spreads are typical of economies that are growing and healthy.

I think this chart reinforces the argument that the market is beginning to look across the valley of despair, and anticipating better times ahead.

Chart #7

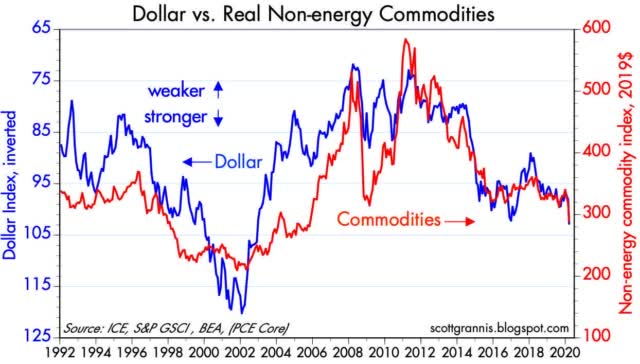

One troubling fact remains: the strong dollar. As Chart #8 shows, the strength and weakness of the dollar tend strongly to coincide with the ups and down of commodity prices.

The dollar is now at an 8-year high, and commodity prices are uniformly weak. (Note that the dollar is plotted using an inverted scale.)

That's bad news for emerging market economies, and it's even pulling down the price of gold - which is remarkable, given all the bad news that's out there.

For that matter, gold stands out among all commodities for its resistance to the strength of the dollar.

Gold investors should be wary.

0 comments:

Publicar un comentario