The lockdowns are necessary to get the disease under control — but they must be brief

Martin Wolf

© James Ferguson

A journey of a thousand miles begins with a single step. The journey through this pandemic is going to be long and hard. We cannot know where it will end, although it is hard not to speculate.

What we must do instead is focus on the steps right ahead if we are to avoid falling off our narrow path into mass deaths on one side, or economic devastation on the other. If we do not avoid these calamities in the near future, we risk chaos ahead.

Even if we do manage to do so, we will not return to the normality we took for granted until recently. For that, we must at least wait for a cure or vaccine. The economic and social damage will last even longer.

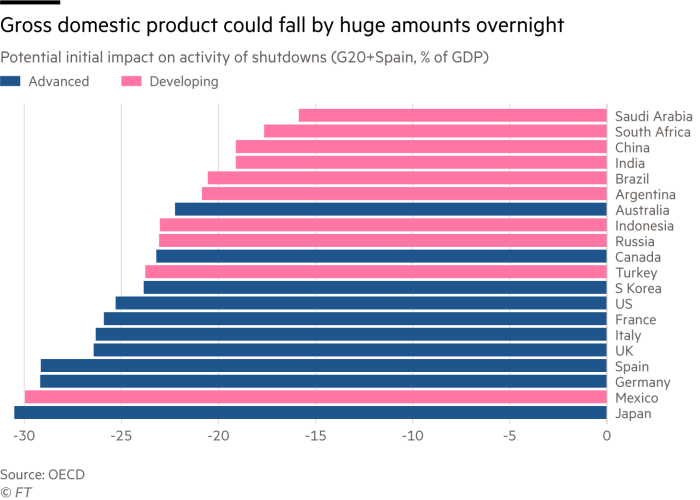

Analysis by the OECD illuminates the economic disruption ahead. This is no ordinary recession or even depression, caused by a collapse in demand. Economic activity is being switched off, partly because people fear contact and partly because governments have told them to stay at home.

The immediate impact of these actions could be a reduction in gross domestic product in the Group of Seven leading high-income countries of between 20 and 30 per cent. Every month that large parts of our economies stay closed, annual growth might fall by 2 percentage points.

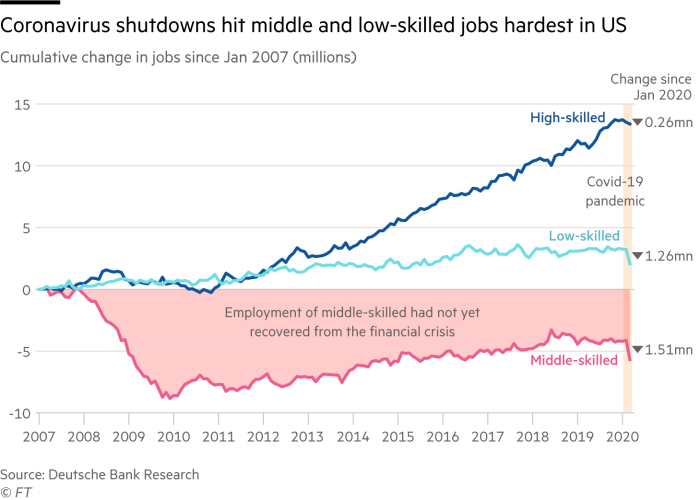

Moreover, the costs are unequally shared. Unskilled workers suffer worst from loss of jobs.

People and businesses able to work online, stay working. Those that cannot do so, do not. The costs are not evenly shared globally, either.

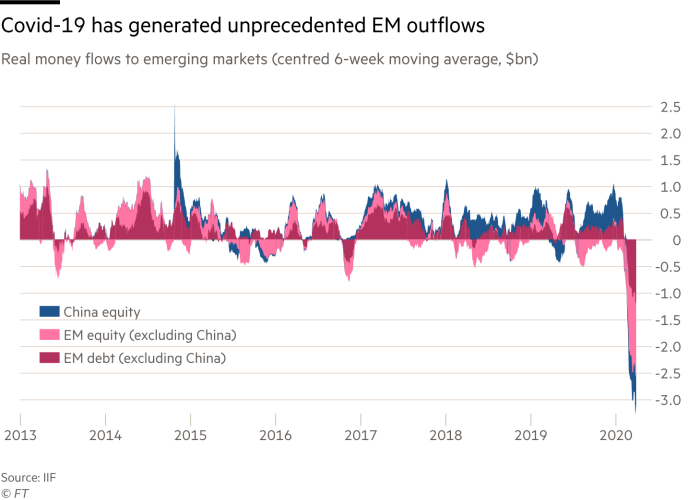

Many emerging and developing countries are being hit by collapsing external demand, falling commodity prices and unprecedented capital flight, while also having to manage the pandemic with highly inadequate health systems.

Lockdowns are especially brutal in countries with limited or no welfare states and vast numbers of people who subsist on their daily earnings from a fragile informal economy.

It is right to ask whether such economic carnage can be justified.

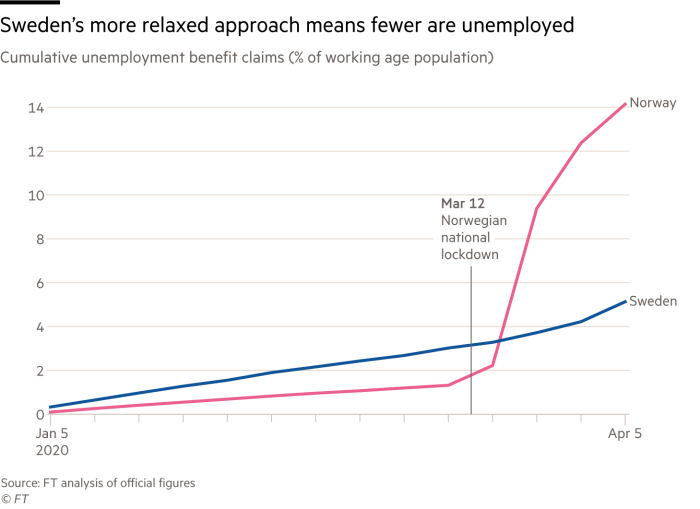

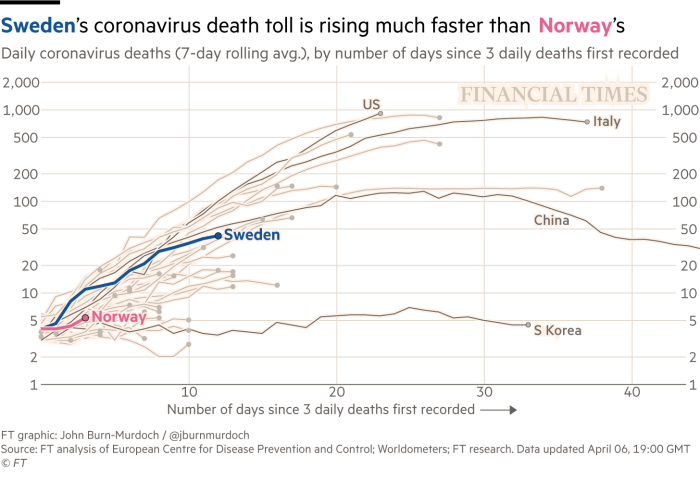

Among high-income countries, Sweden has taken the least restrictive approach.

A comparison with Norway makes the trade-off clear: unemployment has risen in Sweden, too, but by far less than in its neighbour; yet the number of deaths is also higher in Sweden.

We should be grateful for the Swedish experiment.

We can learn from it, one way or the other.

My view, however, in line with that of health experts and leading economists, is that the lockdowns are necessary to save health systems from collapse and get the disease under control.

But they have to be brief. It is impossible to keep people locked up indefinitely, without huge personal suffering and social and economic damage.

This is obviously true where governments are unable to offer the costly social protection measures feasible in high-income countries.

Lockdowns must be a short breathing space before we move to what a group of German experts calls a “risk-adapted strategy”.

During the lockdowns, governments must do whatever is needed to avoid having to employ such heavy-handed interventions again. They do not have much time to do so: a few months, no more. Otherwise, they may have no choice but to imitate Sweden.

Making the lockdowns pay, to allow us to live without them, is the essential first step. The second step is minimising economic damage. Here the focus must be on today, not on the high public debt and other burdens of the future. Sufficient unto the day is the evil thereof.

As in war, one must survive the present if there is to be a future worth having.

In considering what is to be done to manage the devastating economic impact, beyond reopening economies as swiftly as it is reasonably safe to do so, there are three essential considerations.

First, protect the weak, both within countries and among them. A disease threatens all. How one responds is a measure of our ethical standards. It is essential to ensure basic economic security for everybody if they are unable to work.

A temporary universal basic income is one obvious option. Similarly and crucially, ways must be found to support vulnerable economies.

There are many radical possibilities. One is a huge new issuance of the IMF’s Special Drawing Rights, with donation by high-income countries of their share into a trust for the benefit of the most vulnerable developing countries.

Also crucial will be a halt to debt-service payments for the duration of the crisis.

Second, do no harm. The deepest wound would come from destroying the trading system completely. That would make it vastly more difficult to restore global prosperity after the crisis is over.

Third, abandon outworn shibboleths. Already governments have given up old fiscal rules, and rightly so. Central banks must also do whatever it takes.

This means monetary financing of governments. Central banks pretend that what they are doing is reversible and so is not monetary financing. If that helps them act, that is fine, even if it is probably untrue. In the eurozone, they talk much of eurobonds.

But the support that matters will have to come from the European Central Bank. There is no alternative. Nobody should care. There are ways to manage the consequences.

Even “helicopter money” might well be fully justifiable in such a deep crisis.

More painful choices than these arise. An emergency like this will be used by would-be tyrants to strengthen their grip. At the same time, some freedoms will have to be given up, temporarily.

Managing such painful trade-offs depends on high levels of trust and trustworthiness, hardly salient characteristics of today’s democracies. But the test is now.

Governments that fail to confront these challenges risk collapse. Political systems that produce such governments risk losing their legitimacy.

We have to get these next steps right. Everything depends on our doing so.

0 comments:

Publicar un comentario