by: James A. Kostohryz

Summary

- The next leg down in the current bear market cycle is soon at hand.

- The forthcoming economic and financial crisis will be more severe, by far, than any in US economic history since the Great Depression.

- During the next leg down in the ongoing bear market, the value of the S&P 500 index is likely to decline a minimum of 26% from Friday's closing level.

- Extremely severe declines, surpassing those experienced during the financial crisis of 2008-2009, are a distinct possibility.

My regular readers are aware that I have been warning of severe US and global recessions - and associated massive stock market declines – due to the fallout from the global COVID-19 pandemic crisis. After alerting my readers and subscribers well in advance about the initial bear market decline,

I later provided my readers and subscribers with a forecast of the stock market crash experienced during the week of March 16 - March 20. After alerting my subscribers between March 19 and all of last week about an impending bear market rally, I'm now again warning my readers and subscribers about a forthcoming second major leg in the current bear market cycle.

In this article I will explain why it's highly likely that, after the current bear market rally runs its course (likely within the next few days), US equities will reverse to the downside and initiate a second major leg down in the current bear market cycle, resulting in a collapse in the value of the S&P 500 index which extends far beneath recent lows established on Friday, March 20. In this article I will describe only one methodology which I have employed to arrive at this forecast.

The Method

The method I describe in this article is relatively simple. I provide a list of historical bear markets since 1929 and classify them by their severity. I then briefly review some of the economic crises and recessions associated with those bear markets and compare them in terms of severity to the current and forthcoming economic crisis and recession that's associated with the global COVID-19 outbreak.

It will briefly explain why the current and forthcoming economic crisis and recession is likely to be significantly more severe than any other economic crisis and/or recession since the Great Depression. In this context, I will show that it will be quite fortunate, indeed, if during the current bear market cycle, the S&P 500 index manages to establish a bottom somewhere in the range of 1876 to 1463.

Historical Bear Markets

I define a bear market as a decline in the value of the S&P 500 index lasting at least two months and involving a drawdown of 20.0% or more from peak to trough. Correspondingly, a bull market is defined as an increase in the value of the S&P 500 index lasting at least two months and involving a gain of 25% or more from trough to peak.

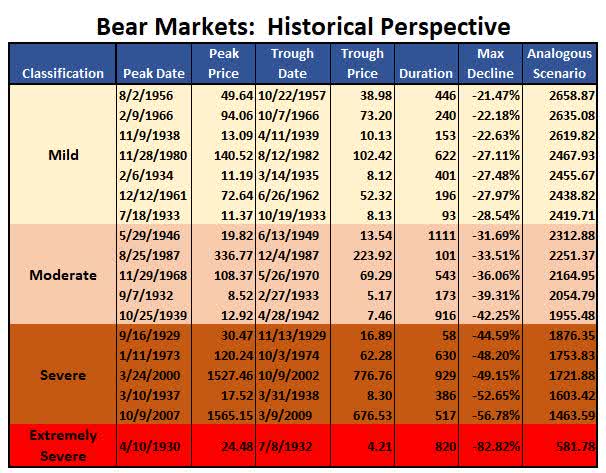

In the table below I provide a list of all historical bear markets since 1929. Furthermore, these historical bear markets have been classified by severity - Mild, Moderate, Severe, Extremely Severe.

Readers should take note of the figures on the right, under the column heading “Analogous Scenario.” This is the hypothetical trough value of the S&P 500 during the current bear market cycle that would correspond to the maximum draw-down of each of the individual historical bear markets that are reported in this list.

In What Range is The Current Bear Market Likely to Trough?

It will be noted by those familiar with economic history that the economic downturns associated with “mild” category of bear markets were relatively mild recessions – or in some cases were merely economic slowdowns. The “moderate” category of bear markets were generally associated with a moderate deterioration of general economic conditions.

The “severe” category of bear markets were associated with five of the most severe economic contractions in American economic history since 1929. Finally, the “extremely severe” category of bear markets thus far contains only one historical example (April 1930 – June 1932) – a bear market which was associated with an economic crisis of such severity that it has no rival among other crises in American economic history since 1929.

My current “optimistic case” is that the current bear market will ultimately be classified merely in the “moderate” category. In accordance with this particular analysis, this would imply a trough for the current bear market cycle in the range (S&P 500 index) of 2313 to 1955. For reasons I will proceed to explain later in this article, I believe that it's relatively unlikely that the S&P 500 will bottom out in this range during the current bear market cycle.

My current “base case” scenario (my working hypothesis) is that the current bear market will ultimately fall into the “severe” category. In this particular analysis, this would imply a trough for the current bear market cycle in the range (S&P 500 index) of 1876 to 1463.

As one contemplates the current and prospective economic crisis, it becomes quite clear that its degree of severity is significantly greater than that of the five economic crises and recessions that are associated with the bear markets classified under the “severe” category. Let us review a few important considerations in this regard.

1. Peak loss of output. It's now generally accepted by economists that US GDP will contract by an annualized rate of somewhere between 15% and 25% in the second quarter of 2020 (some economists have estimated that the contraction in 2Q 2020 could be as severe as -50%).

This would represent the greatest quarterly contraction in US economic history, by far.

2. Cumulative loss of output. Even though the US economy may resume quarterly sequential economic growth in the third quarter, the US economy will most likely remain in deep contraction mode on a year-over-year basis (i.e. relative to the same period in 2019) for all of 2020. This is due to the fact that social distancing will continue to be practiced (mandated and/or voluntary) – to a lesser or greater degree – for 12-18 months (or until a vaccine and/or cure for COVID-19 is widely available), thereby devastating large parts of the US economy during this time.

For example, restaurants, sporting events, air travel, concerts, conventions, shopping malls and tourism will be devastated (relative to 2019 levels) for as long as social distancing is being practiced. In this context, it can be estimated with confidence that the cumulative loss of output associated with the forthcoming recession, relative to the baseline level of output (in this case 2019), will be by far the most severe since the Great Depression. No other recession since 1929 comes even close.

3. Peak unemployment. Peak unemployment is likely to surpass 20% and could be substantially higher. This is a higher rate of peak unemployment than any US economic crisis since the Great Depression.

4. Cumulative loss of hours of production. The cumulative loss of productive labor associated with the forthcoming recession will surpass any such losses since the great depression. No other recession other than the Great Depression produced a loss of labor hours that is even close, by comparison.

5. Massive financial crisis. The forthcoming financial crisis will make the Financial Crisis of 2007-2009 look like child’s play. No financial crisis since the Great Depression will be remotely comparable to the one which will be experienced in the coming months and years. The financial crisis of 2007-2009 – which had been the most severe financial crisis since the Great Depression - was mainly caused by defaults in just one segment of the credit market, namely residential mortgages.

The forthcoming financial crisis will involve massive defaults on debt obligations from virtually every single industry in the US economy. Furthermore, massive defaults on commercial leases will have a devastating impact on the highly leveraged real estate sector and the financial entities that finance them.

In the course of the forthcoming financial crisis, the common equity shares of many banks and financial companies will become worthless, while virtually all common equity shareholders of financial companies that provide credit will be subject to massive dilution in forthcoming restructurings and recapitalizations.

6. Loss of wealth. The aggregate intrinsic value of common equity shares in the US economy will suffer a precipitous plunge. Many companies will face bankruptcy and the value of common equity shares for most of these companies will go to zero. And in the case of most companies that manage to escape bankruptcy, most common shareholders (public or private) will face drastic reduction in the intrinsic value of their shares due to a combination of increased debt (raised to cover losses) and shareholder dilution via recapitalizations.

Furthermore, valuation multiples based on earnings or other fundamental metrics will collapse due to the application of lower long-term growth rates and higher discount rates (i.e. higher risk premiums).

In sum, the severity of the current and forthcoming economic crisis and recession will be far greater than that of any since the Great Depression. Therefore, it's reasonable to infer that the bear market associated with the current and forthcoming economic crisis will be more severe than any bear market since the Great Depression.

In sum, the severity of the current and forthcoming economic crisis and recession will be far greater than that of any since the Great Depression. Therefore, it's reasonable to infer that the bear market associated with the current and forthcoming economic crisis will be more severe than any bear market since the Great Depression.

Certainly, on this basis, it will be quite fortunate if the current bear market cycle manages to establish a bottom somewhere in the range of the five major US equity market declines categorized as “severe” bear markets.

What About the Effects of Monetary And Fiscal Stimulus?

In response to the above thesis it could be argued that the analysis does not take into account the extent of government counter-cyclical monetary and fiscal stimulus to counter-act the crisis.

In my estimates, I certainly do take into account massive monetary and fiscal stimulus.

Although this subject cannot be thoroughly addressed in this article, I will briefly point out the following:

1. No silver bullet. Fiscal and monetary stimulus will in no way be able to fully compensate for loss of output and loss of income (business and personal) that will result from this crisis. Massive losses of output and income (both personal and business) will occur despite stimulus efforts.

2. False expectations on bailouts. Although many US industries will undoubtedly be “rescued,” it's unlikely that common equity shareholders of publicly held corporations will be fully “bailed out” – and some will not be bailed out at all. There's little political appetite in the US to provide bailouts for common equity shareholders of large corporations. The current bailout packages that have been approved by Congress are mainly designed to assist small- and medium-sized businesses.

Any forthcoming bailouts of large publicly-traded corporations (such as those that comprise the S&P 500) will most likely involve restructurings and/or recapitalizations in which the value of common shareholder equity will be either be completely wiped out or at least massively diluted. It's important that investors not confuse bailouts of small- and medium-sized businesses with bailouts of publicly held corporations that trade on the stock market.

Furthermore, it's important that investors understand the difference between “bailing” out a company as a going concern (thereby preserving employment and production) and bailing out common equity shareholders. It's likely that the former will occur, but the latter is likely to occur to a much lesser extent.

3. There's no free lunch. The massive increase in public and private debt plus the monetary debasement associated with the current and forthcoming bailouts and rescue packages (and their monetary financing) will be unprecedented – and this will have massive economic costs which will greatly impair US economic growth going forward.

Long-term earnings growth will be impaired and risk premiums used to discount future earnings will increase. Therefore, this crisis will result in a long-term loss of economic value and/or wealth. As a consequence of this, there will be a massive decline in the valuations of US equity shares going forward.

In sum, even though government fiscal and monetary stimulus will certainly ameliorate some of the loss of common equity shareholder value that will occur as a result of the current and forthcoming economic crisis, the likely loss of aggregate common equity shareholder value is very likely to be enormous. Indeed, the aggregate loss of intrinsic shareholder value (not just market value) is likely to be far greater than that experienced in any crisis since the Great Depression.

Risk of Another Depression?

There's a rapidly-increasing risk that the situation could devolve into something more similar to a scenario similar to the “Extremely Severe” bear market that was associated with the Great Depression. In studying the stock market declines associated with the Great Depression, you will note that the peak-to-trough stock market decline associated with the Great Depression passed through two major price cycles prior to reaching the ultimate trough.

The first bear market cycle phase began in September of 1929, accelerated with the Crash of October 1929 and finally established a trough in December of 1929. Please note that, up until that point, the bear market associated with the October 1929 Crash was "merely" classified as "severe."

Indeed, starting in December of 1929, a substantial bull market developed, as investors at that time expected the crisis to be short-lived. However, by April of 1930, it became clear that the economic and financial crisis would become prolonged and a second - and much more terrible - bear market phase began which resulted in a US equity market decline of more than -80%.

This second bear market phase associated with the Great Depression occurred between April of 1930 and June of 1932.

The first bear market cycle phase began in September of 1929, accelerated with the Crash of October 1929 and finally established a trough in December of 1929. Please note that, up until that point, the bear market associated with the October 1929 Crash was "merely" classified as "severe."

Indeed, starting in December of 1929, a substantial bull market developed, as investors at that time expected the crisis to be short-lived. However, by April of 1930, it became clear that the economic and financial crisis would become prolonged and a second - and much more terrible - bear market phase began which resulted in a US equity market decline of more than -80%.

This second bear market phase associated with the Great Depression occurred between April of 1930 and June of 1932.

My Current Base Case Scenario Forecast

My current expectation is that the US equity market will establish an intermediate trough sometime in the next two months which will be situated in the “severe” range. This situation would be analogous to the first major leg (September 1929 to April 1930) of the massive stock market declines associated with the Great Depression.

However, (keeping the Great Depression analogy in mind) if effective epidemiological, economic and financial solutions cannot be devised and implemented by August of 2020 (or market participants expect that solutions will not be forthcoming), I expect the current bear market to transition into the “extremely severe” category (as occurred after April of 1930).

A transition into the “severe” category would imply that the US Equity market declines associated with the COVID-19 economic crisis would ultimately be significantly more severe than those of the 2007-2009 bear market (the most severe of the bear markets classified in the “severe” category). In such a scenario, I would expect the S&P 500 to ultimately reach a trough below 1000.

However, my “base case” currently assumes that effective epidemiological, economic and financial solutions can be put in place by August 2020. In this scenario, I would expect the current bear market cycle may trough in the “severe” range - i.e. between 1876 and 1464. This implies a minimum decline of 26% relative to Friday’s closing value on the S&P 500 index. However, it should be noted that, for reasons described above, this scenario can arguably be considered to be somewhat optimistic.

Finally, it should be noted that this method of analysis this is just one of several scenario analyses which I have performed. However, all other methodologies yield similar results. For example, scenario analyses based on valuation metrics yield similar results.

Conclusion

Investors urgently need to implement a portfolio strategy which is designed to effectively deal with the forthcoming economic crisis and the associated severe or extremely severe bear market. Investors stuck in old and irrelevant patterns of thinking - i.e. investors that do not understand the severity of the forthcoming economic and financial crisis and that "this time is different" - will be severely punished and will suffer tremendous losses of wealth and income.

Wise investors must devise their portfolio strategy plan quickly and decisively, because the second leg of the current bear market is soon at hand.

0 comments:

Publicar un comentario