By Jacky Wong

After two accounting scandals in less than a week, the Chinese growth story will likely become a tougher sell on U.S. stock markets.

New York-listed Chinese tutoring company TAL Education said Tuesday that an employee had forged contracts to inflate sales. The news came just five days after Luckin Coffee, listed on Nasdaq, said much of its revenue last year was fabricated by some of its staff, which triggered an 83% collapse in the Chinese coffee chain’s share price.

The scale of the fraud at TAL, which was discovered in a routine internal audit, seems much smaller. Its “Light Class” segment, which provides live-streamed lessons to school kids and where the sales were made up, accounted for just 3% to 4% of its estimated revenue for the fiscal year through February. Its stock dropped 6.7% Wednesday.

The economic emergency stop prompted by the coronavirus pandemic probably has helped bring these incidents to light. The plunge in revenue and difficulties in getting funding may have made covering financial holes harder.

More scandals will likely surface as the downturn drags on, especially as the yearslong bull market made investors complacent about burning money to achieve unprofitable growth.

The scandals will also put the spotlight back on the longstanding corporate-governance problems of U.S.-listed Chinese companies. Their audits aren’t subject to U.S. inspections because China doesn’t allow it, and the legal recourse for investors could be limited.

Given how difficult and costly it is to conduct proper due diligence, investors may choose to keep their distance, especially from the smaller stocks.

Luckin Coffee said much of its revenue last year was fabricated by some of its staff.

Photo: jason lee/Reuters .

There were already calls for tighter scrutiny on U.S.-listed Chinese companies as geopolitical conflicts between the U.S. and China escalated. These latest scandals will only make those calls louder.

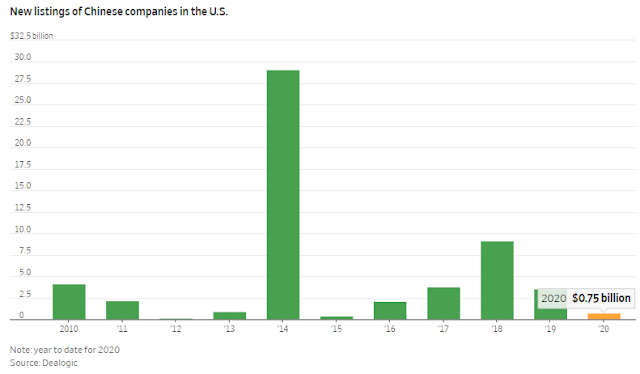

Initial public offerings for Chinese companies in the U.S. dwindled after a wave of frauds were exposed in 2011 and 2012, but they picked up again with Alibaba’s $25 billion float in 2014.

As U.S. investors become more skeptical, some bigger, better Chinese companies may seek to list their shares closer to home. Alibaba’s $13 billion listing in Hong Kong has been a great success, and its rival JD.com is considering a similar move. More may follow suit.

The fallout from the latest debacle among U.S.-listed Chinese companies could last a long time.

0 comments:

Publicar un comentario