An Orgy of Speculation

Jared Dillian

I may not be good for much, but I am good for detecting a peak of speculative activity.

As of the end of last week, we were there.

Let me give you some data points.

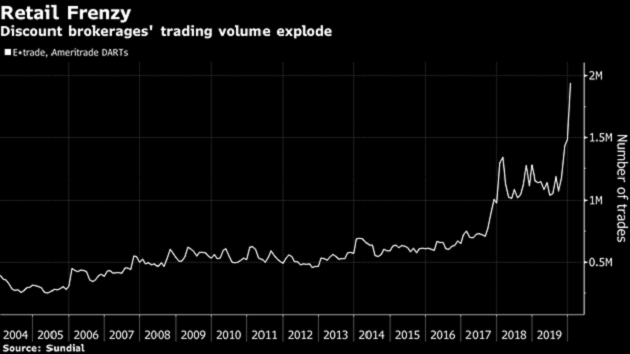

Look what happens when you cut retail trading commissions to zero:

Source: @Garth_Friesen

Of course, just the fact that Morgan Stanley is buying E*TRADE, a discount brokerage (that offers trades with zero commissions) was probably a sign of the top.

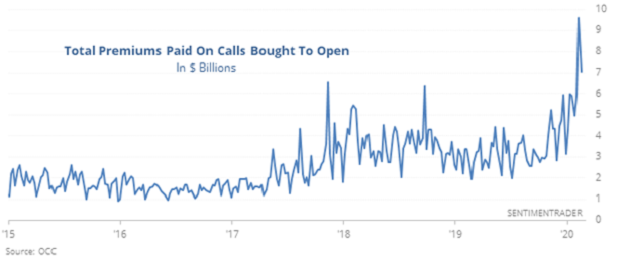

Next, we have a group of folks on Reddit who were coordinating manipulating stock prices higher through naked call buying. They did it with TSLA, and they’re doing it with MSFT and a bunch of smaller stocks. It’s incredible.

Of course, naked call buying was at an all-time high, according to Jason Goepfert at SentimenTrader.

Source: SentimenTrader

This is highly unusual.

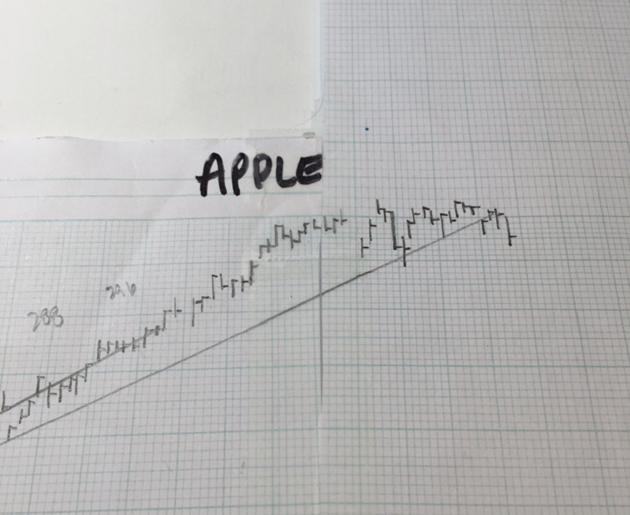

AAPL was rolling over, according to Helene Meisler and her hand-drawn charts:

Source: @hmeisler

Of course, there is no more powerful contrary indicator than an Economist cover:

I mean, the timing on this just does not get any better.

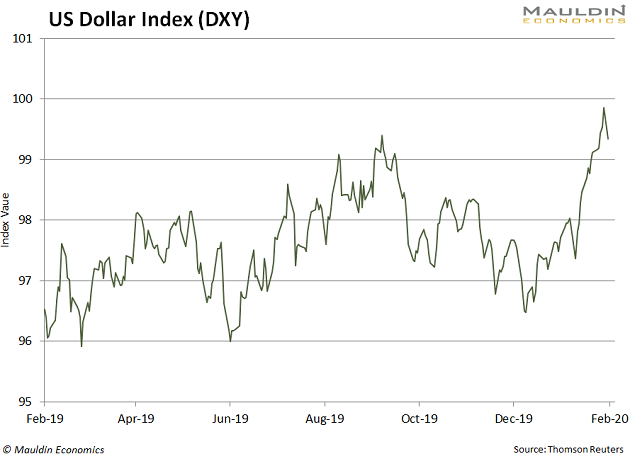

The dollar has had a heck of a run:

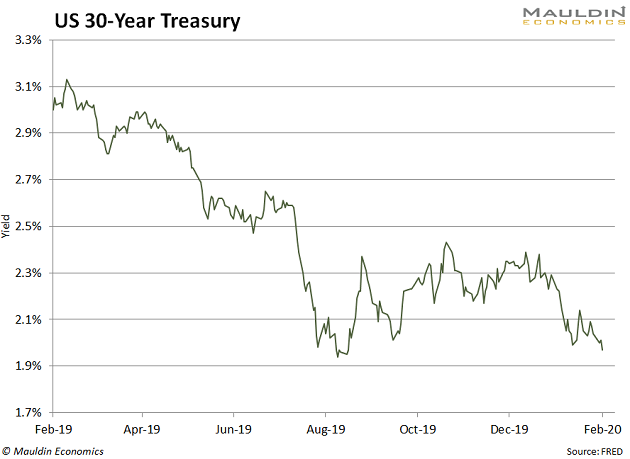

While worryingly, bond yields are making all-time lows:

And gold is making fresh highs, things you don’t usually see at the top:

Meanwhile, we’re headed into an election where someone who is really bad for the economy and the stock market has a real chance at becoming president. I have spent the last 4 weeks arguing with my older subscribers, who believe there is no chance that Bernie will become president. I assure you that the chance is not zero.

So that’s where we are.

Again, if you have an 80/20 portfolio here (or a 100/0 portfolio), your exposure to equities is TOO HIGH. It should be much lower. But then I would be repeating myself, because I say that all the time.

Who knows: maybe you were lucky enough to de-risk on the highs.

I have not spent much time talking about stocks in the last few years because the stock market has made little sense, mostly because of the presence of price-insensitive buying. Indexing, buybacks, and short volatility. Price-insensitive buying is still around—for the time being. I don’t know what gets it to stop, but nothing goes on forever.

This is where we are.

Where We’re Going

It’s been easy to see where the bond market is going. I’ve had plenty of pushback on that in the last 12 months, and here we are, talking about pegging the yield curve. Regardless of what the economy does, the push for easier monetary policy and lower interest rates is relentless—especially in an election year.

I still maintain that we have not yet made the business cycle obsolete. Extended bull markets lead to periods of overinvestment and malinvestment. This speculation and froth must be worked off. It’s possible that you can work off an overbought condition by going sideways, but probably not in this case.

Risky assets pretty much went vertical. People have been burned so many times calling a top, that nobody wants to call a top, which means that this is probably the best time to call a top.

I don’t talk about this a lot, because I am very much a set-it-and-forget-it type of investor. But there are a handful of times in your life, maybe just two or three, where you could be at a big inflection point in the market, and it’s worth adjusting the asset allocation a little bit.

Heresy, I know. I haven’t done the research on this, but I suspect that timely shifts in asset allocation can make a big difference in performance over the years. You don’t have to top-tick things, you just have to get it in the ballpark.

Yes, I am a pessimist. Yes, I tend to believe that the worst possible thing always happens. For sure, the worst possible thing this time would be pretty bad. A recession before the election, with Bernie Sanders getting elected as a result. I’m pretty sure nobody had that in their investment outlook at the end of last year.

And no, I’m not worried about the coronavirus. I mean, I am, but it’s a one-time hit to global GDP, not something we’re going to be dealing with on an ongoing basis. But in the interim, we’ve reached full panic mode on the coronavirus.

What’s happened over the last 10 years has pretty much been the best-case scenario. Isn’t it reasonable to expect that at some point we might get the worst-case scenario?

I’m bearish on stocks for the first time since 2017. Of course, things can always get more ridiculous, but I think we’re in the ballpark.

0 comments:

Publicar un comentario