Edwards, Druckenmiller And A Pair Of Simple Points

by: The Heisenberg

If you're looking for a reason to doubt the pro-cyclical rotation story, SocGen's Albert Edwards is happy to oblige.

And while there are plenty of reasons to be skeptical about the prospect of the reflation narrative getting serious traction in 2020, there are also good reasons to be constructive.

Here is a relatively quick take which stands as a rare nod from me to the merits of brevity and conciseness.

And while there are plenty of reasons to be skeptical about the prospect of the reflation narrative getting serious traction in 2020, there are also good reasons to be constructive.

Here is a relatively quick take which stands as a rare nod from me to the merits of brevity and conciseness.

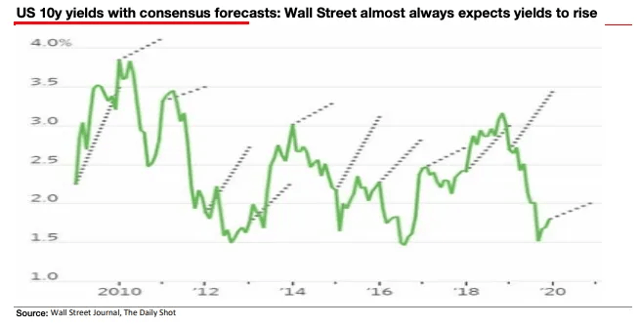

If you're looking for reasons to doubt the pro-cyclical rotation narrative that's part and parcel of many year-ahead market outlooks, you might take a look at how misguided consensus has been over the past decade when it comes to forecasting bond yields.

"At this time of the year sellside strategists will always wheel out their year-ahead forecasts [and] these will without fail predict a rise in both equity markets and bond yields," SocGen's incorrigible, yet exceedingly affable, bear wrote, in a Tuesday note.

As I put it elsewhere earlier this week, the upside bias on equity targets could be in part a reflection of the fact that, over time, stocks tend to rise, but the bond yield forecasts are less forgivable.

"It is bond strategists that really leave me perplexed, in that – in the teeth of a relentless bull market raging since 1982 – they still consistently forecast a year-ahead rise in yields against the trend," Edwards wrote.

If you follow Albert, you can probably guess that he doesn't see it as particularly likely that the reflation narrative is going to get fresh legs, leading to a breakeven-led rise in yields next year.

SocGen's house view, in fact, is for 10-year US yields to sit around 1.20% in Q4 of 2020.

Here's a helpful snapshot of sellside forecasts:

Goldman's relatively lofty 2.25% call is an extension of their above-consensus view on the US economy.

The bank expects growth to clock in at 2.3% in 2020, much higher than the 1.8% consensus expects.

You'll also note that the forecasts aren't as optimistic as they have been in previous years.

Although SocGen's house call is something of an outlier, even Goldman's upbeat take (and when I say "upbeat," I'm of course referencing the fact that when you project higher yields into the new year, you're usually projecting decent economic outcomes) is only 40bps or so above where yields were on Thursday.

In the bottom pane, you can see reflation optimism reflected in the steepest 2s10s since 2018.

That optimism is obviously reflected in record high stock prices too.

A handful of readers have recently echoed some of Albert's skepticism about whether and to what extent this optimism is warranted.

After all, Sino-US relations are still extremely fraught and we saw this week just how tenuous the Brexit situation still is (the pound totally erased its post-election rally when Boris Johnson raised the specter of a crash-out scenario again).

Rather than subject my audience here to another lengthy diatribe (my last post for this platform was nearly 3,000 words, and it seems like I may have hit the point of diminishing returns around halfway through it), I thought I'd offer two quick counterpoints.

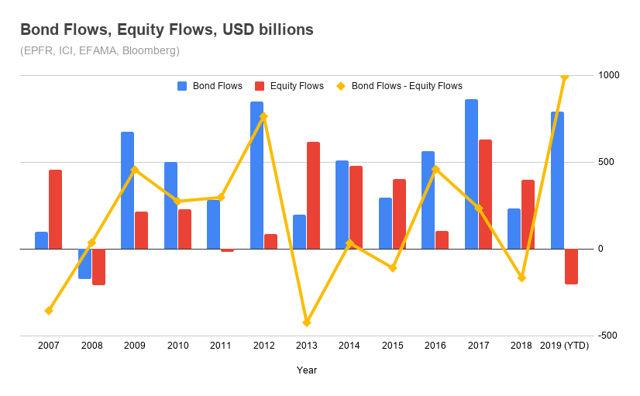

The first is the notion that investors will be inclined to rotate out of bonds and back into stocks in 2020.

As you may or may not be aware, the disparity between equity flows (which were negative) and bond flows (which were massively positive) in 2019 is vast.

Have a look:

Assuming the economic outlook stabilizes (which kind of begs the question, but you get the idea), one might very fairly suggest that the extreme flow divergence this year will at least partially reverse.

That goes double when you consider how low yields are (i.e., bonds are less attractive both from a yield and capital appreciation perspective).

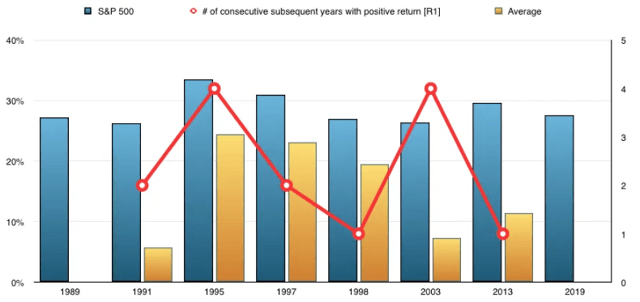

The second is an appeal to history.

As I explained elsewhere on Wednesday, this admittedly superficial take is a bit convoluted due to the close proximity of blockbuster years in the 90s, but the visual below shows years since 1989 when the S&P has risen 25% or more, plotted with the subsequent number of consecutive years with gains and the average performance over those years.

Simply put, "objects in motion tend to stay in motion."

But perhaps the best reason to remain constructive on risk assets is that the combination of easy monetary policy and fiscal stimulus makes being bearish rather unpalatable, at least in the near- to medium-term.

If you don't believe me, just ask arguably the greatest investor to ever live.

"Well, you have very low unemployment here, you have fiscal stimulus in Japan, you have fiscal stimulus and a lot of confidence coming to Britain, we’re running a trillion-dollar deficit at full employment, apparently we’re going to have some kind of green stimulus in Europe and we have negative real rates everywhere and negative absolute rates a lot of places," Stanely Druckenmiller told Bloomberg this week, in an interview.

"With that kind of unprecedented stimulus relative to the circumstances, it’s hard to have anything other than a constructive view on markets, risk and the economy in the intermediate term," he went on to say. "So, that’s what I have."

Nothing further.

0 comments:

Publicar un comentario