by: Victor Dergunov

Summary

- Despite trading close to all-time highs, cracks are starting to form beneath the surface of the U.S. economy.

- "Value" companies like McDonald's, Coca-Cola, Walmart, and many others are trading at P/E multiples of 22, 25, or higher.

- Despite the high multiples, many safe-haven sectors appear to have very little potential for earnings growth, and corporate profits may be peaking.

- Much of the economic data implies that a slowdown is occurring and a recession could strike sometime in 2020.

- The bear market could begin within the next 6-12 months, will likely cause multiples to contract substantially, and the S&P 500 could decline to around 1,800.

- "Value" companies like McDonald's, Coca-Cola, Walmart, and many others are trading at P/E multiples of 22, 25, or higher.

- Despite the high multiples, many safe-haven sectors appear to have very little potential for earnings growth, and corporate profits may be peaking.

- Much of the economic data implies that a slowdown is occurring and a recession could strike sometime in 2020.

- The bear market could begin within the next 6-12 months, will likely cause multiples to contract substantially, and the S&P 500 could decline to around 1,800.

S&P 500: The "New Normal"

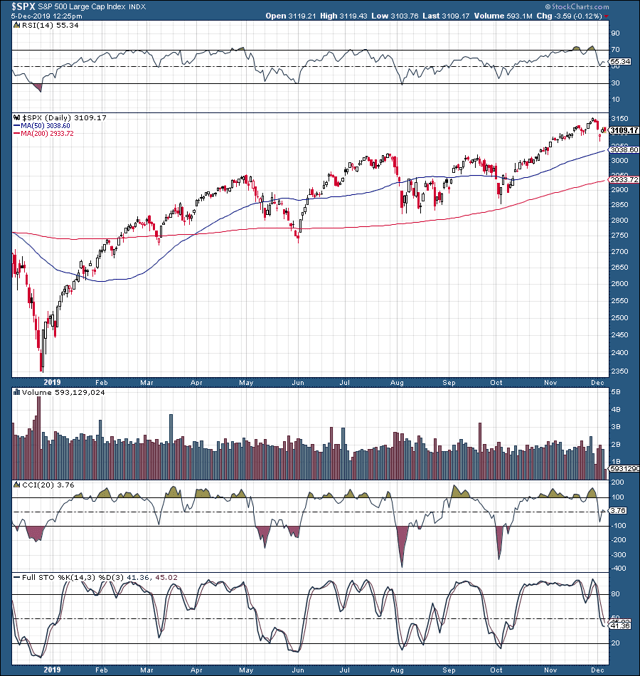

Despite clear cracks forming beneath the surface of the U.S. economy, the S&P 500/SPX (SP500) and other major stock market averages are trading near all-time highs.

Prior to the recent slight dip, the SPX had appreciated by an impressive 35% from its 2018 December bottom, gaining approximately 800 points, as it surged from around 2,350 to over 3,150 in under one year.

This is rather remarkable, given that the economy does not appear to be in substantially better shape than it was one year ago. In fact, mostly what has changed is that stock multiples have expanded and stock prices have increased.

In fact, after a closer look, we see that the stock market may be on the precipice of another significant correction, and a recession, coupled with a bear market in equities, could materialize sometime next year.

The New Normal

What's with McDonald's (NYSE:MCD) trading at 25 times earnings? It's the "new normal" people say.

The company missed its latest earnings report, is projected to have zero revenue growth this year, and is projected to show a decline in EPS YoY in 2019. 2020 consensus estimates are for under 3% revenue growth and about 8% EPS growth.

So, why is McDonald's trading at 25 times earnings?

Right, the new normal, incidentally, like the S&P 500, MCD also appreciated by more than 30% from peak to trough in its latest share price surge. But where are the results to justify such moves? Moreover, what is the probability that MCD and other companies will continue to outperform to justify continued multiple expansion?

The new normal to me sounds a lot like the famous last words of many investors that have said "it's different this time". Also, the new normal reminds me of a phrase Alan Greenspan used, "irrational exuberance" when referring to markets in the late 90s.

These are value companies, right?

McDonald's, Coca-Cola (NYSE:KO), Walmart (NYSE:WMT), Procter & Gamble (NYSE:PG), Johnson & Johnson (NYSE:JNJ), etc. (this list can go on and on). These are value companies, not high growth tech or biopharma names. Typically, throughout history under relatively normal market conditions, "value" names trade at around 10, 12, maybe 15 times earnings. 16-18 and higher I consider expensive, excluding extraordinary sets of circumstances. So, why are value companies like JNJ, MCD, WMT, PG and many others trading at P/E multiples of 22, 25, or even higher in some cases?

The new normal seems to be increased capital being rotated into what investors perceive as "safe-haven" value stocks that pay dividends and whose businesses are not likely to be greatly affected by an economic downturn or even a possible recession.

But what about their stock prices?

When the bear market arrives, many of the "value" names will get hit hard as well, and given how much some of these stocks have been bid up they may decline by 50% or more in some cases.

In a bear market, it is not only about whether a business will survive but it is about multiple adjustment and compression. P/E multiples of many value companies will likely revert to their historic means of 10-15 times earnings.

We know that McDonald's and Coca-Cola are probably not going out of business no matter how severe the next recession will be.

People will continue to consume their products recession or no recession, bear market or no bear market. However, what will get adjusted are their P/E ratios, especially if their earnings begin to decline.

In my view, during the next bear market, you can expect to see McDonald's trading at 12-15 times earnings. Moreover, by that time, EPS may be $7 a share and not $7.84.

This would put MCD's stock price at around $84-$105, a steep way down from today's price of $195. In fact, this would equate to a decline of right around 50%.

The point is that the probability of multiple compression seems very likely in future years, and not just concerning McDonald's, but many of the "value" names, the S&P 500, and stocks in general.

Let's look at some sector valuations, in general

- The Healthcare segment of the economy is trading at around 50 times last year's GAAP earnings and at about 46 times this year's projected P/E ratio.

- The Consumer staples segment trades at around 29 times trailing and 27 times this year's estimates.

- Real estate trades at 37 times trailing and at over 40 forward P/E.

- Materials are trading at about 22 times both trailing and forward.

- Industrials are at 23 times trailing and 20 times forward.

- Information technology is at 30 times trailing and 32 times forward.

- Utilities are at 27 times trailing and at around 20 times forward earnings.

- The Energy sector is trading at 17 times trailing but about 35 times this year's estimates.

- Financials are trading at about 13 times trailing and 12 times this year's estimates.

So, where is the value in this market?

It appears that some of the most defensive sectors are the most overbought ones right now. Real estate at 40 times this year's estimates is remarkably expensive, as is healthcare at 46 times this year's P/E projections. Consumer staples at 27-29 times earnings? Very expensive. Same thing with utilities trading at 27 times trailing P/E ratio.

These are defensive segments that typically trade at far lower multiples (10-15). Perhaps investors are bidding up stocks in these segments because they believe the underlying names will perform better in an economic downturn or a recession.

The problem with this assumption is that while their businesses may continue to function relatively well compared to more cyclical sectors of the economy, their P/E ratios will very likely contract substantially, cutting down stock prices significantly when a bear market occurs.

I expect many of these safe-haven names to readjust back to P/E ratios of 10-15, more in line with their historic averages when the repricing occurs. Essentially nothing outside of financials appears particularly cheap right now.

Furthermore, financials are relatively cheap for good reason, as many companies in this segment have very little to no revenue growth going forward. EPS will also likely get squeezed, especially as the Fed proceeds to lower rates in the future.

Finally, many financials are loaded with all types of debt, credit card, car loan, corporate, etc. and may have to face significant writedowns when the consumer begins to buckle.

Speaking Of The Consumer

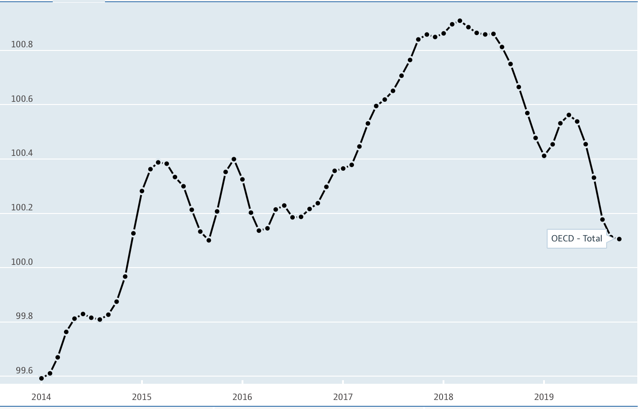

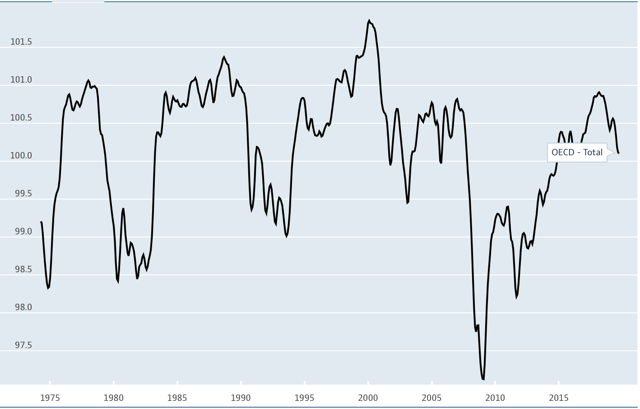

We can see that the consumer confidence index CCI likely peaked in early 2018 and is now at a multi-year low, possibly heading lower. Nevertheless, we do not see this weakness reflected in SPX valuations and in stock prices in general.

Source: OECD.org

Moreover, if we take a longer-term view of the index, we see that just about after every peak a recession occurred. We see the index topped out in the late 1980s before the early 1990s recession, around 1999, before the dotcom bust in 2000, in 2007, before the "great recession", and we likely saw a peak in 2018 before a recession that could strike sometime in 2020.

As Far As Other Data Is Concerned: Mixed At Best

CB consumer confidence also came in lower than expected for November, 125.5 vs. an expected 127. Manufacturing remains in recession, with the latest ISM manufacturing PMI coming in at 48.1 vs the expected 49.2.

Furthermore, the November PMI figures were even lower than October's 48.3. ISM non-manufacturing PMI also came in lower than expected, 53.9 vs. an expected 54.5. Finally, employment data, the latest ADP non-farm employment change came in at just 67K vs an expected 140K and well below last month's 121K.

In other words, the economic picture is getting worse once again, not better. In fact, many indicators like those I just mentioned and others are implying that a recession is likely approaching, and there is little reason to expect corporate earnings to move significantly higher or multiples to expand next year.

Peak Earnings Could Be Here Already

If we look at corporate earnings for the first three quarters of this year, they are actually lower than last year for the first three quarters. On average, last year's $1.85 trillion per quarter topped this year's $1.843 trillion average per the first 3 quarters.

With global growth slowing, economic indicators softening, and other detrimental factors hitting corporate profits, I would not be surprised to see YoY declines in U.S. corporate earnings this year as well as in 2020.

Source: TradingEconomics.com

Still, for some reason consensus estimates suggest that earnings will increase, and will increase substantially in the S&P 500 particularly. First, if we observe closely, we see that the S&P 500 is trading at about 24.5 times trailing earnings.

This is about 13.4% more expensive than where the SPX was at one year ago. Additionally, the forward estimate is for a P/E ratio of just 19. This implies that S&P 500 companies will have about 30% earnings growth in 2020 YoY. This seems remarkably optimistic in my view.

The Bottom Line: As The Recession Approaches

As the recession approaches, it is likely only a matter of time until the S&P 500 and stocks in general enter a bear market. Investors are bidding up value, "safe-haven" names as they attempt to rotate capital into less cyclical stocks and sectors of the economy. However, with many non-cyclical sectors trading at irregularly high P/E ratios, multiple compression will likely drive share prices substantially lower when the economic downturn arrives.

For instance, the mean P/E ratio for the S&P 500 is roughly 15.77, yet the SPX is currently trading at around 23 times earnings (24.5 times trailing) earnings. Thus, if we use the 23 times figure the SPX would need to correct by roughly 32% from current levels to get back down to its historic mean of 15.77. This would bring the SPX down to around the 2,100 level.

If we use the Shiller P/E ratio gauge, we see that the SPX is trading at around 30.27, where the mean is only 16.67. This implies that a decline of roughly 45% is possible in the S&P 500 to bring earnings multiples (Shiller P/E ratio) back down to their historic average. A 45% decline from current levels would bring the SPX down to around the 1,700 point.

Source: multpl.com

Therefore, I believe that the "new normal" is not going to be a long-lasting phenomenon and will dissipate in time much like "it is different this time", and the irrational exuberance periods did in their times.

I am looking for substantial multiple compression to start to occur in most sectors within the next 6-12 months, including and especially in the non-cyclicals that have been bid up to irrationally high levels.

Ultimately, I expect the S&P 500 can bottom out at around 1,800, right between the 1,700 and 2,100 figures quoted earlier.

0 comments:

Publicar un comentario