By Mike Bird

The opening up of China’s stock market to the global financial system is a mixed blessing for Chinese companies—and the international investors now giving them more money than ever.

On Wednesday, index giant MSCI Inc. MSCI -0.65% completed a planned increase in the weight of the country’s domestic stocks—A-shares—in the flagship MSCI Emerging Markets Index.

The change raises the weighting of A-shares to 20% of a full market share, meaning they now make up 4% of the EM Index, up from 0.7% in February.

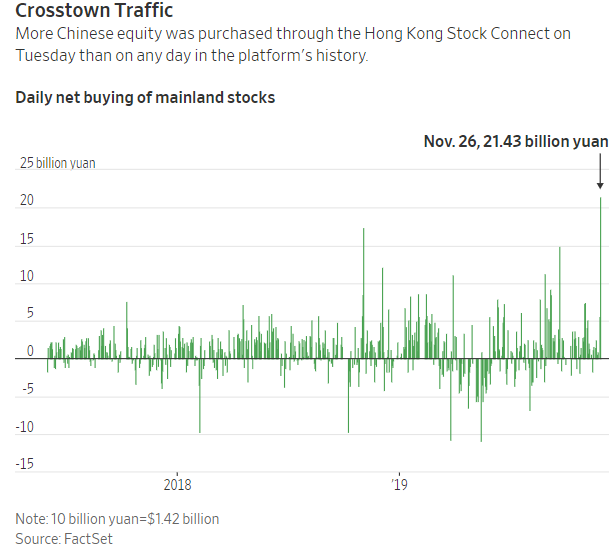

The Hong Kong Stock Connect, which allows foreign investors to buy select mainland shares, saw its busiest day on record on Tuesday as money managers aligned their funds with the new benchmark.

The Chinese government has wanted to be better represented in global benchmarks for years, but may find its status comes with unwanted baggage.

One of the valuable things about Chinese markets—even amid the chronic speculative activity, lack of transparency and tangled debt dynamics—is the relative autonomy the country enjoys to steer its own financial cycle.

Its ability to tweak financial conditions independently means its government bonds, for example, offer returns that are less correlated to those from other major markets.

The Chinese economy’s sheer heft is part of what allows it to exercise some control over its business cycle, but so is its relatively closed financial system.

The walled garden of capital controls, which constrains the ebb and flow of investment into and out of China, allows the government to maintain something of an economic microclimate.

Other emerging markets are less fortunate. Instead of setting their own monetary conditions, they are tugged along by global risk appetite among investors and the U.S. Federal Reserve’s policy decisions.

One of the valuable things about Chinese markets is the relative autonomy the country enjoys to steer its own financial cycle. PHOTO: ALY SONG/REUTERS

The mere designation of a country as an emerging market in benchmark indexes can make disparate bourses—tagged with the label because they meet some investability standards, but fewer than those of their developed-market peers—behave more like one another, with foreign capital flooding and fleeing them at the same time.

If China were more open to foreign capital flows, it would find itself more exposed to financial forces beyond its control. Indeed, the parts of the economy perhaps most open to outside investment—listed equities available for purchase through the Stock Connect platforms—have begun to respond more to decisions on economic policy made in Washington.

According to a paper by Chang Ma, assistant professor of finance at Fudan University, and two co-authors, Chinese companies accessible through the Connect enjoy lower financing costs and higher returns. Their investment spending was found to be sensitive to an unexpected tightening of American monetary policy, compared with both their competitors, and themselves prior to the existence of the Connect.

MSCI’s decision to include China is broadly a victory for the country’s stock market. But flows through the Connect have already become more volatile this year, with brief drawdowns recorded. More access and attention from the rest of the world could come with negative consequences, too.

After years of lobbying to become an emerging market, China may find it gets a little more than it wished for.

0 comments:

Publicar un comentario