Fearing The Fearless Stock Market

by: Michael A. Gayed, CFA

Summary

- A bullish technical break has happened in the S&P 500.

- Cheap commodities point to an expensive market.

- Near-term bullishness remains, but fragilities are building.

- Cheap commodities point to an expensive market.

- Near-term bullishness remains, but fragilities are building.

But we have to ask ourselves, what's the purpose of the stock market? It's supposed to be a source of capital for growing business. It's lost that purpose.

- Mark Cuban

As we start the Thanksgiving week, it is worth discussing that complacency is the norm at this point in the year - expect new highs to come.

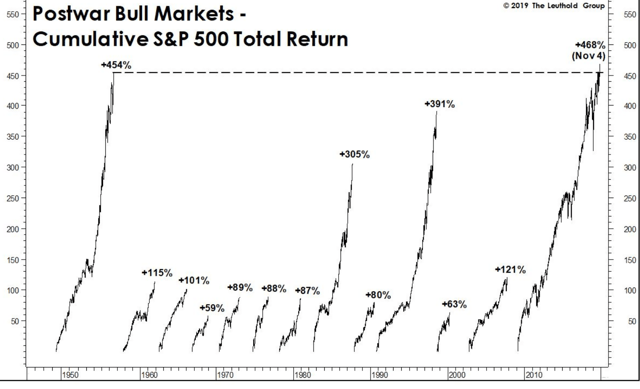

With no important economic releases scheduled this week and the market optimistic about the US-China trade deal, the S&P 500 looks poised to continue its march. The current bull run is nothing short of impressive - the cumulative S&P 500 total return exceeds all the previous bull markets after the second world war.

A comparison of the bull market run reveals longer consolidations in the current upside move than in the past.

It suggests a shake-up of weak hands on the move up and keeps the potential for even more gains alive.

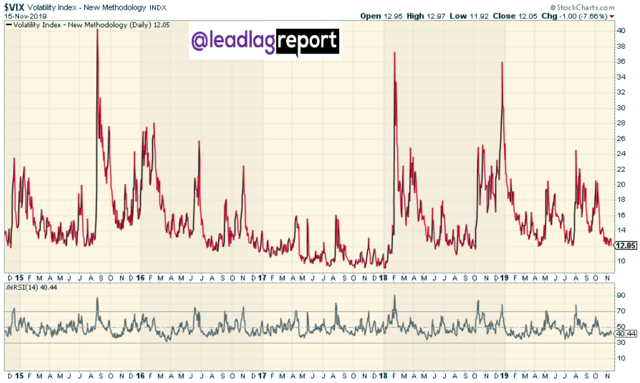

One of the last Lead-Lag Reports I wrote mentioned that even with huge uncertainties, the VIX continues to drop.

Are market participants too lax?

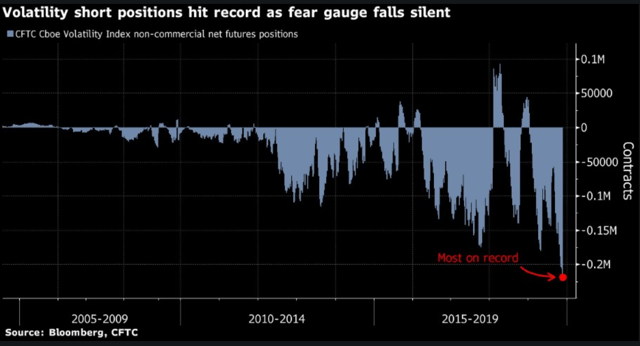

Net short speculative positions in futures linked to the VIX hit a fresh record low of more than 218,000 contracts - the fear gauge falls silent.

Alarming signals do exist.

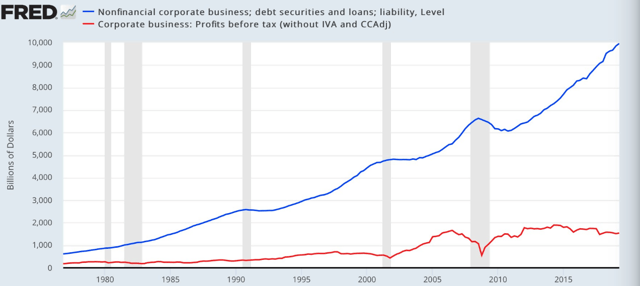

First, corporate debt keeps surging now at $10 trillion.

At the same time, the US national debt rose by 5.8% in the last year.

A healthy stock market and solid job creation drove tax revenues - a slowdown may complicate things moving forward.

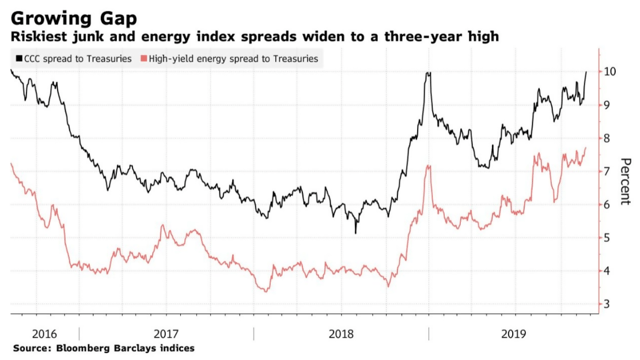

Second, a growing gap between the riskiest junk and energy index reached a three-year high - downgrades in the speculative-grade debt market outpace upgrades at an alarming rate.

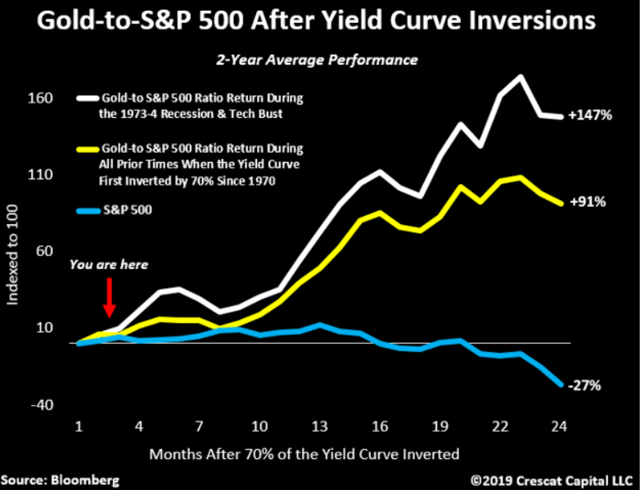

Third, gold to S&P 500 ratio after yield curve inversion points to weakness ahead - the two-year average performance following the inversion implies a stock market decline of almost 30%.

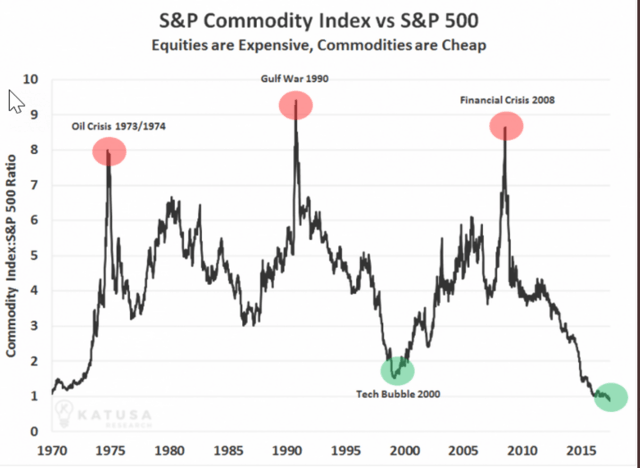

Finally, the S&P Commodity Index vs. the S&P 500 ratio tells us that commodities are cheap while stocks expensive.

This kind of chart makes even the most ardent bull a little uneasy.

Bulls have the record low VIX levels in their favor, while bears look at deteriorating conditions promising a decline. Is complacency justified under the current conditions?

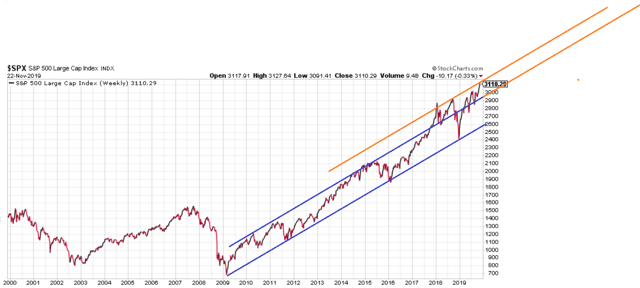

The technical picture is bullish. Not only that the recent bull market evolved in a perfect rising channel - it recently broke above the upper edge, a further bullish sign signaling a change in the bull trend's dynamics fueling further gains.

Bulls would want to see the price remaining in the orange channel. It's not unusual for price to change dynamics again - a further break of the upper channel implies even more pain for bears.

On the other hand, a bearish case makes sense only on a break below 2,400. At that point, the series of higher lows and higher highs get invalidated.

Like it or not, the path of least resistance (especially during the Thanksgiving week) points to further gains, fueling the hopes of a Santa rally. Unless negative surprises from the trade war front occur, bulls have all the reasons in the world to be fearless.

Your Biggest Mistakes Are Often Invisible.

Sometimes, the biggest risks in your portfolio are just sitting there, waiting to surprise you.

That's why paying attention to the right data and insights is so important.

A few quick tips from an investment manager isn't enough: you need to dive deep into the signals that shake the market and move your portfolio.

0 comments:

Publicar un comentario