Copper prices have risen in the past few months, but weakness in China’s construction sector could put an end to the rally

By Nataniel Taplin

China’s construction sector, the top source of global demand for copper, is losing steam. Photo: ruben sprich/Reuters

Things have been looking up for copper.

Prices for the red metal have risen about 4% since early September, after a dark and dreary stretch for it beginning in mid-2018.

Like many growth plays, copper has been buoyed by signs of warming relations between the U.S. and China, after a bruising trade conflict.

The latest headlines show even a limited deal between the two powers this winter is no sure thing.

But there are even more fundamental reasons to doubt the rally in copper—an important part of the investment case for mining stocks such as GlencorePLC or Freeport-McMoRan Inc. —has further to run.

That’s because Chinese construction, the top source of global demand, is losing steam after two strong years.

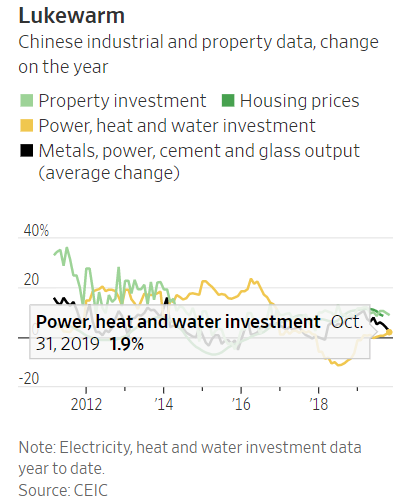

Monthly data Thursday showed property-investment growth, a good proxy for the construction of new homes, offices and other buildings, slowing to 8.8% on the year, down from 10.5% in both of the two months prior.

Growth in heavy industrial output and home prices has been slowing for months, and overall industrial growth also moderated in October.

Property investment is likely to droop further, along with industry and house prices, unless Beijing ramps up credit supply—which it has been unwilling to do.

There was some better news for metals in Thursday’s data: investment in power and utilities rose 1.9% in the first 10 months of 2019, compared with the same period a year earlier.

That beats the negative or near-zero growth of the last two years. Still, only far more substantial flows into the already overinvested power sector could offset the drag from property.

Last year, miner BHP estimated the construction sector accounted for 26% of China’s copper demand, versus 22% for power.

A trade deal would be marginally positive for copper.

But the real story for industrial metals is China’s construction cycle.

Investors should keep their attention focused there.

0 comments:

Publicar un comentario