The extradition bill that sparked the protests wasn’t the underlying cause of the protests, and its withdrawal isn’t guaranteed to end them

By Mike Bird

Students in Hong Kong boycotted the first day of classes Monday. Photo: Kin Cheung/Associated Press

Hong Kong Chief ExecutiveCarrie Lam ’s unpopular extradition bill is a symptom of the city’s political problem, not a cause. Investors are in for a shock if protesters aren’t satisfied with its long-awaited withdrawal.

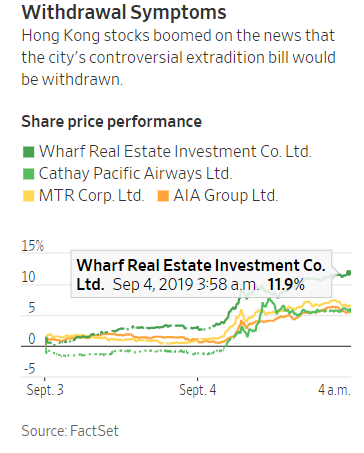

Mrs. Lam has finally resolved to retire the bill that has sparked months of protests in the special administrative region of China. Stocks surged in response to the news, with the Hang Seng Index up nearly 4%, led by property developers. Wharf Real Estate Investment 1997 12.11%▲ rose nearly 12%.

Hong Kong’s financial markets now seem priced for mild disruption, at worst—even amid the clearest signs yet that the political crisis is spilling over into the local economy.

A survey of private businesses published Wednesday suggested that the beginnings of a serious recession were under way in August. The IHS Markit Hong Kong PMI survey came in at 40.8, far below the neutral 50 level. The result is consistent with a roughly 4% to 4.5% contraction in gross domestic product. Purchasing activity was at its lowest level in the 21-year history of the series.

Even before Wednesday’s rally, Hong Kong’s markets weren’t priced for anything like a 4% drop in GDP. The FTSE Local Hong Kong, which comprises stocks that make at least 70% of their sales in the city, has yet to even reach a one-year low.

The 12-month forward price-to-book ratio for Hong Kong’s mammoth real-estate developers is 0.68, barely below the 0.72 average the sector has recorded since 2012. Property prices aren’t showing signs of stress, with values in July within a fraction of their historical highs.

The PMI series requires caution, having sent exaggerated signals before. Notably, the series logged its worst reading during the 2003 SARS epidemic. GDP ended up falling by 0.6% in the second quarter of that year, compared with the same quarter of 2002—nothing like the crash the PMI number suggested.

But the miserable economic sentiment should make investors more cautious, particularly since there is no guarantee Mrs. Lam’s climbdown will resolve the crisis.

The withdrawal of the bill is no longer the sole demand of the protesters, nor perhaps even their primary focus. It is one of five demands that also include the withdrawal of the “riot” designation given to the June 12 protest, an independent commission into police handling of the protests and universal suffrage. Every additional weekend of disruption, escalation and the souring of trust in public institutions has made the situation more difficult to repair.

Of course, Mrs. Lam doesn’t need to convince the protesters she has given them everything they want. Dimming their enthusiasm to the point where the city can function on a day-to-day basis would be enough to revive the local economy.

Investors are behaving as if she has already done that. Their relief may prove premature.

0 comments:

Publicar un comentario