The Fed Rate Cut Won't Help

by: Kirk Spano

Summary

- There is a lot of focus on a potential interest rate cut, but it is of limited value to the economy and equity markets.

- Ending quantitative easing (QT) in September is of far more consequence and could fuel a rally in the U.S. and emerging markets.

- Until we enact smart fiscal policy, the economy is going to muddle along for a long time as asset bubbles develop.

- Buy a late summer correction, but be ready to sell on any negative economic developments in 2020.

- Ending quantitative easing (QT) in September is of far more consequence and could fuel a rally in the U.S. and emerging markets.

- Until we enact smart fiscal policy, the economy is going to muddle along for a long time as asset bubbles develop.

- Buy a late summer correction, but be ready to sell on any negative economic developments in 2020.

The world is focused on what the Federal Reserve will do this week with interest rates. Will they cut?

If so, how much? A quarter point? A half point? It's so deliciously breathless. And it probably doesn't matter much.

The Three Stooges: LIRP, ZIRP and NIRP

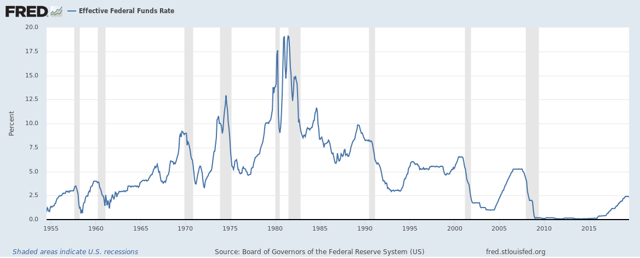

Seriously, whether it is low interest rate policy, zero interest rate policy or negative interest rate policy, none of these were ever meant to be forever policies. Unless of course, you ask Ben Bernanke, who said he didn't expect to see normal rates again in his lifetime. For the record, Bernanke was only 60 when he said this at quarter million dollar lunches (quarter million being the fee he got) he held for big shots a few years ago.

Historically, the Fed's benchmark interest rate has been a shade under 4%. It apparently hit an 11-year peak at 2.42% this past April.

.

So, while the U.S. avoided Japanese and European style negative interest rates, cousin NIRP, we can't get back to normal either. Low interest rate policy is the new normal it seems. The academics decree it. The politicians are too political to make the necessary changes to fix it - and it is broken. A visit from ZIRP is not out of the question given the dysfunction.

So, the result is that the fed funds rate is about to head back down in order to avoid a recession next year. But will it help much? I don't think so.

Folks Keep Forgetting About "Slow Growth Forever"

By now I thought that understanding and acceptance of the "slow growth forever" global economy would have happened. Apparently not. Let's give it the once through.

Demographics drive the economy. It always has, it always will.

When more younger people become middle class, the economy grows, nationally and globally. The American baby boom is the poster child for such economic expansions. But, what happened in several emerging markets, particularly China, in recent decades was just as big.

The financial obligations of aging demographics, mostly unfunded, are a major headwind to economic growth going forward. This is hitting the four largest economies. In order of severity: Japan, Europe, China and the U.S where we have the millennials to offset much of the coming Boomer Bust pain.

The Fed wrote a good paper about this back in 2016:

The problems of demographics on GDP growth are not unknown, just un-dealt-with.

Massive global debt is stifling borrowing and business development. Monetary policy, quantitative easing (QE) in particular, has offset that for now. But we are seeing the limits of easy money and the snap-back effects of the wealth inequality it creates.

Technology is also disinflationary due to the efficiencies and productivity it creates. While we are not to the "universal basic income" phase of civilization yet, we are likely to see 20% to 40% of jobs displaced by the middle of the century. If we allow it to happen, that could cause a massive depression. So far, we haven't shown any willingness to turn off the funnels to the 1%, so we might see a depression.

For more on "slow growth forever" see this article on Seeking Alpha:

Why Is Monetary Policy Losing Effectiveness

The simple answer is that by removing the hurdle rate for investing, asset bubbles form while standard of living is still not improving much for working people. At some point, the value of investments have to come back in line with what real incomes can afford.

I will throw out an anecdotal observation here. I have been looking at real estate in several cities the past year. I make pretty good money. I'm a 2-percenter. But, the amount I'd have to commit to most real estate doesn't make any sense. Why would I spend 40% of my income on a couple-thousand-square-foot home? A sensible middle class home. I'm not talking waterfront or mountain views.

Commercial real estate is even worse. Properties are bid up so high, I can't imagine that most folks could make a business work in those spaces given what the rents need to be to pay the owner's loans and taxes. I'll be writing about this more in depth in a few articles on REITs soon. The short of it, there are a lot of REITs that are going to drop 30% or more soon. One of my analysts, Dividend Sleuth, just pecked out this piece: 9 REIT Takeaways.

Stanley Druckenmiller talked about the dangers of removing the hurdle rate for investment at the Economics Club of NY:

So, lower rates are losing effectiveness and raising risks.

Quantitative Tightening Ending Is Almost QE

In September, the Fed will end quantitative tightening (QT). I discussed that the Fed should have done this a long time ago in this editor's pick: The Fed Is Making 2 Huge Mistakes

In that article, I argued that the Fed should stop raising interest rates and also not increase quantitative tightening. The would appear to be a discrepancy to what I said in the last section.

There's no contradiction.

Without QT, we could have let interest rates rise more towards normal. But, folks have some fetish with needing to reduce the Fed balance sheet. So, we have been removing $50 billion from the economy for nearly a year now.

During that period, assets have been choppy and had a significant correction. Now, with earnings likely have peaked for this cycle, we have to watch out for a rise in unemployment, especially with the trade war.

What good is $50 billion more in the economy if companies are going to tighten their belts?

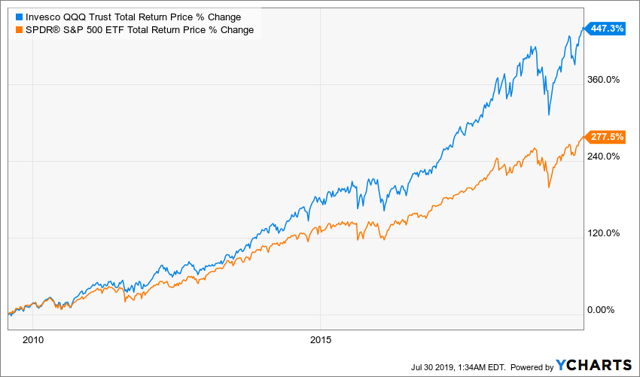

That money will simply flow into secondary investment markets, i.e. the S&P 500 (SPY) and Nasdaq (QQQ).

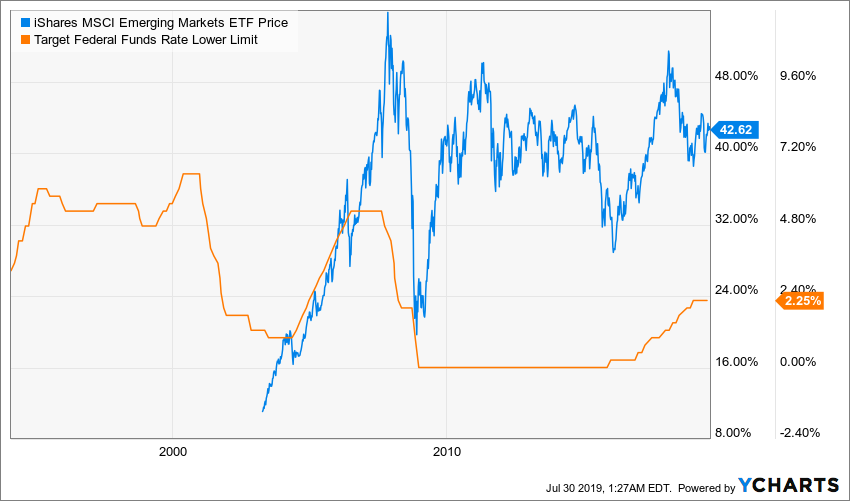

Emerging markets also are likely to see a rebound. Coupled with more QE in Europe, another $50 billion into the financial system is likely to end up overseas. This is what was happened after the financial crisis bailouts and again from 2016-2018. See the short time lag and then symmetry of the fed funds rate to the iShares MSCI Emerging Markets ETF (EEM):

Portfolio Management Now And Soon

Right now, as I discussed in a recent asset allocation article, I am heavy in cash as I expect volatility to jump after the Fed and China trade announcements. Also, earnings are showing all the telltale signs of having peaked. The Shiller PE ratio suddenly starts to gain importance.

That said, with the end of QT in September, I can see a big rally in the fourth quarter. The added money - actually, not subtracted money that has the impact of added money - to the financial system can drive asset prices up substantially, à la QE. So, I will be a buyer of QQQ on any summer correction.

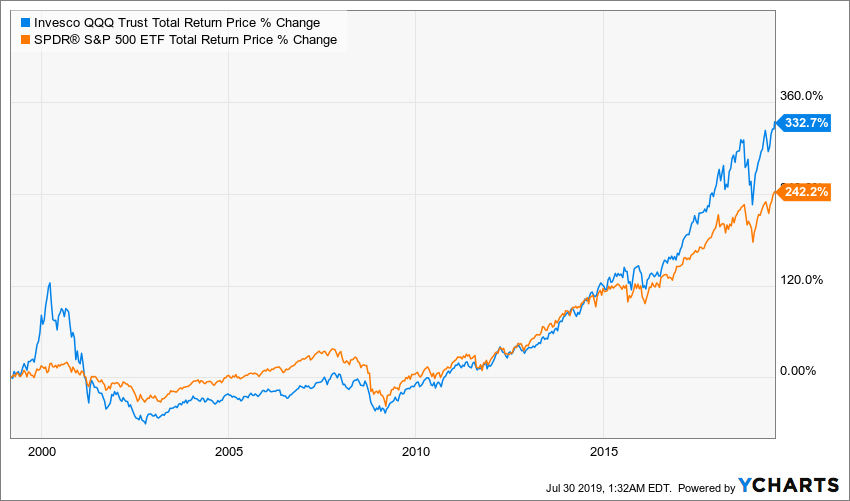

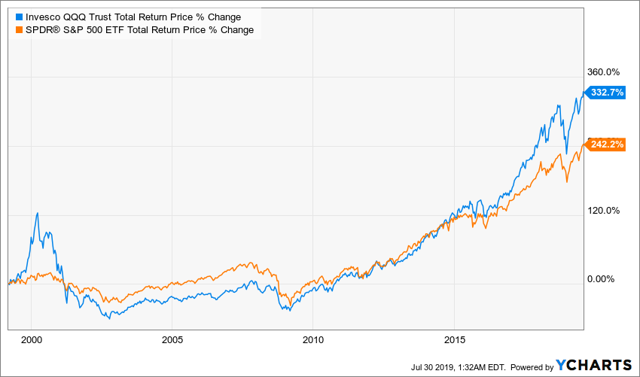

Why QQQ over SPY? The secular trends are with the tech, biotech and consumer heavy QQQ.

Here's the visual:

Portfolio Management Now And Soon

Right now, as I discussed in a recent asset allocation article, I am heavy in cash as I expect volatility to jump after the Fed and China trade announcements. Also, earnings are showing all the telltale signs of having peaked. The Shiller PE ratio suddenly starts to gain importance.

That said, with the end of QT in September, I can see a big rally in the fourth quarter. The added money - actually, not subtracted money that has the impact of added money - to the financial system can drive asset prices up substantially, à la QE. So, I will be a buyer of QQQ on any summer correction.

Why QQQ over SPY? The secular trends are with the tech, biotech and consumer heavy QQQ. Here's the visual:

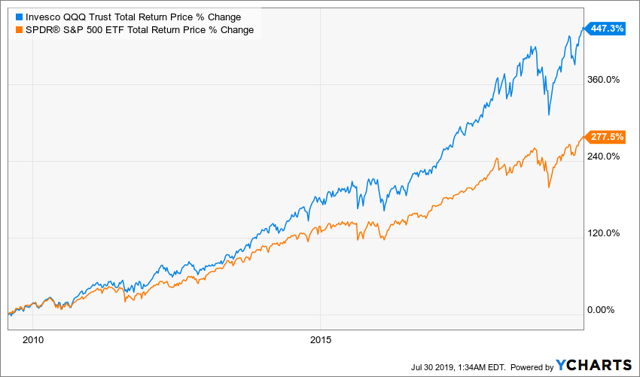

That chart includes the dot-com bust. Here's what the last decade looks like:

What to watch out for in 2020 is any slowing of the global economy. If companies are forced to start laying people off, that will resonate through the equity markets with force.

There's nothing worse for equities than people losing their jobs and cashing in retirement plans to pay for living expenses before retirement.

Build a Margin of Safety into your investing process in this changing and sometimes dangerous world. Benefit from insights and research by Kirk Spano, Dividend Sleuth and David Zanoni.

What to watch out for in 2020 is any slowing of the global economy. If companies are forced to start laying people off, that will resonate through the equity markets with force.

There's nothing worse for equities than people losing their jobs and cashing in retirement plans to pay for living expenses before retirement.

Build a Margin of Safety into your investing process in this changing and sometimes dangerous world. Benefit from insights and research by Kirk Spano, Dividend Sleuth and David Zanoni.

For up to date focus lists, buy prices and ongoing asset allocation modeling, join our growing group of mindful investors.

0 comments:

Publicar un comentario