Gold's Path To $5,000: The 'New Economic Reality'

by: Victor Dergunov

Summary

- GLD/Gold has appreciated by around 30% since the Fed flipped on its monetary policy late last year.

- You can expect a brief short-term correction, but this should be another extraordinary long-term buying opportunity.

- It's not just Fed easing, as there is an essential "race to the bottom" amongst major central banks around the world.

- The Fed is likely only getting started with its easing cycle and the monetary base should expand substantially over the next 3-5 years.

- Gold has a direct correlation with the U.S.'s monetary base, and as the "new normal economic environment" becomes evident, gold should go much higher.

Gold's Path to $5,000: The "New Economic Reality"

SPDR Gold Shares (GLD)/Gold has appreciated by about 30% since my "Don't Panic: This Is a Golden Long-Term Buying Opportunity" article I wrote on August 16, 2018. This was a time when the Fed was tightening and gold hit a short-term bottom at around $1,175 following a vicious sell-off.

Gold 1-Year Chart

In this article, I called out the Fed on its tightening program, mentioning that the economy was unable to sustain higher rates, and the Fed would need to reverse policy and, eventually, introduce new rounds of QE to support markets and the slowing economy.

Here we are, roughly 1-year later, the Fed is now cutting instead of tightening, is putting an end to its QT program, is likely to continue to bring rates down close to zero (or zero, possibly negative), and should eventually introduce new rounds of QE.

Therefore, my thesis has not changed. Moreover, the recent rally, while very impressive is likely only the beginning of a long-term bull market in gold that should take gold/GLD prices much higher over the next several years.

GLD: Great Way to Build Exposure to Gold

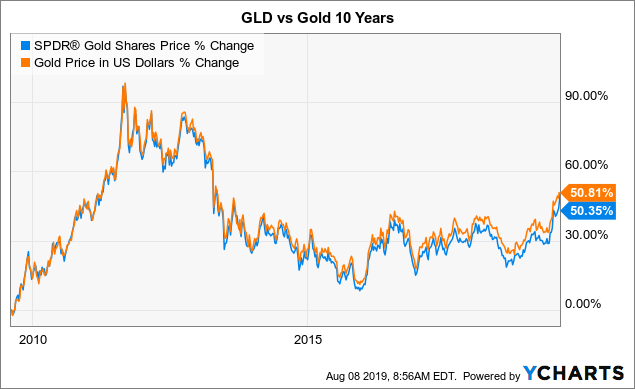

GLD is the largest physically-backed (reportedly) gold exchange-traded fund in the world, with roughly $40 billion worth of net assets. It offers market participants an efficient way to access the gold market, as it mimics the price of gold almost identically.

In addition, the ETF is an attractive alternative to trading gold futures, as it can be traded much like a stock on the NYSE Arca exchange, instead of dealing with alternative exchanges and trading requirements pertaining to futures contracts.

Furthermore, it is an appealing alternative to trading physical gold, as investors get exposure to the same price action as the metal but can buy and sell gold with great fluidity of an ETF using GLD.

Data by YCharts

Data by YCharts

Since the ETF mimics the price of gold almost identically, I will refer to GLD and gold interchangeably throughout this article.

A Closer Look at the Recent Move Higher

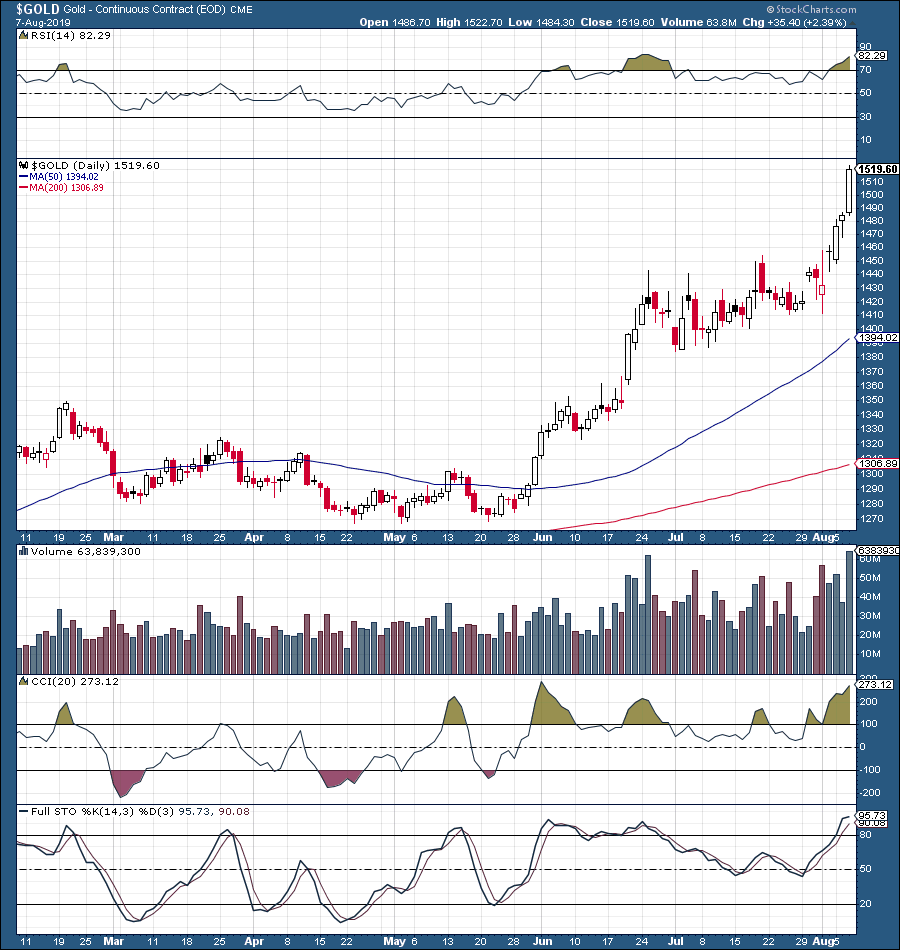

Gold has skyrocketed by nearly 20% over the past 2.5 months. Now, this is due to several factors, the main one being the Fed and its recent embankment on a new easing cycle. However, I must say, the recent move looks excessive, and gold is now substantially overbought on a short-term basis.

Gold 6-Month Chart

This does not mean that the rally is over. Nevertheless, a correction seems very likely. In fact, gold is already starting to correct and is trading slightly below $1,500 at the time of writing this article.

Gold Price 5-Day Chart

Now, gold could consolidate around the $1,480-1,500 level and proceed higher or gold could possibly correct to around the $1,440-1,450 level. This would represent a textbook 5% correction and would very likely create an incredibly lucrative long-term buying opportunity.

I do not expect gold to fall below $1,440 in this easing economic environment, and in my view, gold may never fall below this level again.

It's Mostly About the Fed

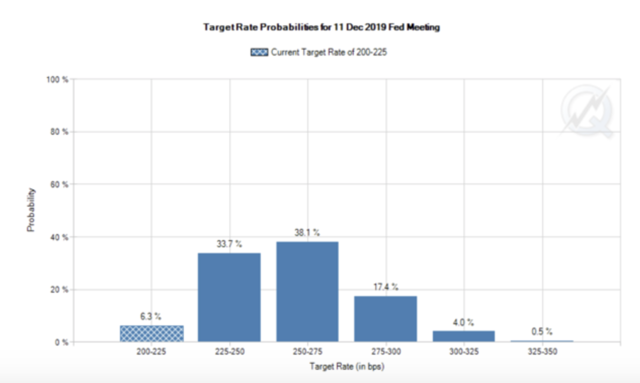

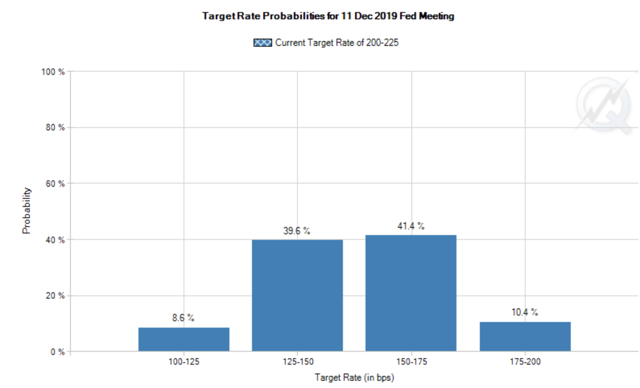

It would typically be all about the Fed as the Fed has pulled a complete 180 on monetary policy over the past year. Last year, it was tightening, and even as late as mid-December, the consensus was that the benchmark rate would be between 2.5% and 3% by December of this year. However, if we look at probabilities now, the benchmark rate will likely be around 1.25-1.75% by this December.

Then (August 16, 2018):

Source: CMEGroup.com

And Now (August 8, 2019):

Moreover, I believe the Fed will continue to cut the funds rate until it reaches zero (possibly go negative), like Japan for instance, and will very likely introduce fresh rounds of QE.

Why will the Fed do all this?

The Fed "officially" has a dual mandate, to promote maximum employment, and ensure price stability (keep inflation at around 2%). However, the Fed appears to have a few other mandates as well. These appear to be to support the U.S. economy, prop up equity markets, and attempt to delay the recession by any means necessary.

Thus, the Fed is essentially prepared to use multiple tools at its disposals to keep the U.S. economy from falling into a recession. Naturally, this will require extremely low rates and probably a lot of QE. Everything the Fed is likely to do over the next several years is extremely bullish for gold.

Also, it is not just the Fed. Central banks all around the world are easing, and by easing, I mean" printing" enormous amounts of fiat currencies. Look at the recent move in China to essentially devalue the yuan.

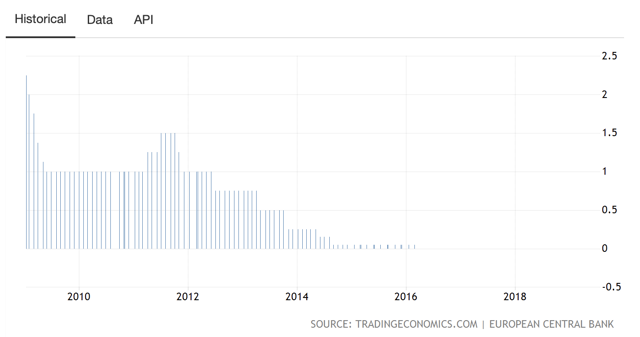

The ECB has implemented QE in the past and has held their benchmark rate at zero since 2016. So, I see no reason why the ECB will not implement additional QE as the global slowdown continues.

ECB Benchmark Rate 10-Year Chart

Source: TradingEconomics.com

These are just a few examples, but the fact is that major central banks around the world are doing several things. They are trying to weaken their currencies to "improve economic activity", make their exports cheaper in foreign markets, bring down bond/treasury rates, etc.

This is essentially a race to the bottom, where central banks are "creating" enormous amounts of currencies while there is only so much gold in the world. This is extremely bullish for gold and GLD, gold/silver/miners GSMs in general.

Gold's Direct Correlation with U.S. Monetary Base

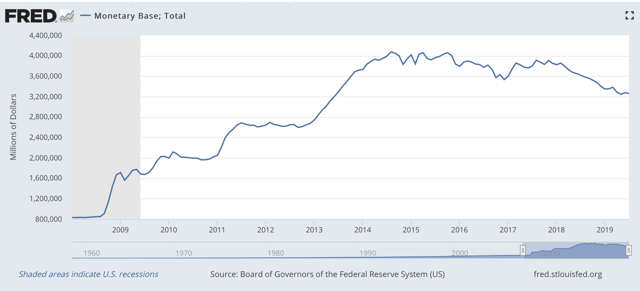

In my 2019 February 22nd article "Gold: The Big Picture", I outlined in detail gold's direct correlation with the U.S.'s expanding monetary base. In the article, I discussed how gold has appreciated by about 3,760% since 1970, while the U.S.'s monetary base had expanded by roughly 4,300 in the same time frame.

Now gold is up by around 4,200% since 1970, as the monetary base is getting set to expand again, but this time not only in the U.S. but around the globe. Here is what happened the last time the Fed expanded the monetary base with zero rates and QE following the 2008 recession.

Also, a factor to notice is that since the monetary base has decreased to about $3.2 trillion due to recent Fed tightening and QT, gold is now starting to outperform on a historic basis, up by 4,200% (using the recent high of around $1,520) vs. the monetary base's 4,000% in the same time frame.

I believe this trend of gold outperformance could and will continue as the world becomes flooded with more dollars, euros, yens, yuans, etc.

Source: St. Louis Fed

From 2008 to 2015, the monetary base surged from around $800 billion to roughly $4 trillion, an increase of about 400% or 5-fold. Gold prices lagged percentage wise because market participants were led to believe that this would be a temporary measure and that the Fed would eventually normalize rates and decrease the monetary base through QT.

However, we recently learned that the U.S. economy cannot withstand higher rates and QT.

That is probably predominantly why the economy began to slow down substantially late last year and the stock market (S&P 500) crashed by 20%.

Thus, it is now clear that for the U.S. economy to expand (or to at least not to go into a recession), lower rates are required. Furthermore, more QE will very likely be required as well to keep growth alive, and probably even more QE will be needed to eventually pull the U.S. economy out of the upcoming recession.

Therefore, the monetary base is likely to increase substantially over the next several years.

Instead of $4 trillion, the U.S.'s monetary base may balloon to $8 trillion or more over the next 5 years.

Perhaps more importantly, market participants may begin to understand that these monetary expansions are not simply temporary measures, but are the "new normal".

Hence, gold prices have a lot of catching up to do. While the U.S.'s monetary base has more than quadrupled over the last 10 years (up by about 307%), gold prices have only risen by about 88% in the same time frame. This was again because many market participants believed the Fed would ultimately normalize rates and contract the monetary base substantially.

However, as the new economic reality sets in; meaning that instead of contracting the monetary base, the Fed is about to expand it again and could continue to expand it substantially for an indefinite period of time, gold is likely to go much higher to keep up with its historic correlation and the ever-expanding money supply.

The "Easing" is Just Getting Started

Let's presume that over the next 3-5 years, the Fed continues its easing policy to first attempt to delay the recession, and then to stimulate economic growth following the recession.

This would mean that the monetary base could expand by 10-fold from 2008 to around 2022-2025. So, if gold continues its historic correlation with the expanding money supply it can only go much higher.

The $64,000 question: How much higher?

Well, since the monetary base can expand by 10-fold from 2008 to 2022-2025, then why couldn't gold? Gold was trading at around $800 in 2008, so it is entirely plausible that gold could also expand by around 10-fold and reach a price of roughly $8,000 by 2025.

However, even if we take a much more conservative approach and say gold increases in value by around 5-fold, we arrive at a price of $4,000. In this scenario, percentage wise, the U.S.'s monetary base and the price of gold would both appreciate by around 10,500% from their levels in 1970. Gold from roughly $37 to $4,000, and the U.S.'s monetary base from around $75 billion to $8 trillion.

However, due to gold's recent outperformance and the likelihood of this trend continuing due to the immense fiat production around the globe (not just in the U.S.), a $5,000 price target on gold within the next 5 years seems more plausible in my view.

The Bottom Line: Buy Gold, GLD, and GSMs, in General

The Fed, along with other major central banks, around the world are in a race to the bottom to devalue their currencies. They are doing this to make exports cheaper, stimulate economic activity, prop up asset prices, attempt to delay recessions, bring bond and interest rates down, etc.

There is only so much gold in the world to go around, yet the money that the Fed and other central banks can print is essentially limitless. Also, we see that normalizing rates, raising the benchmark rate in the U.S. to 4-5%, and deflating the monetary base are fantasies. The U.S. economy, much like many other developed economies cannot continue to expand or to even function properly under such conditions.

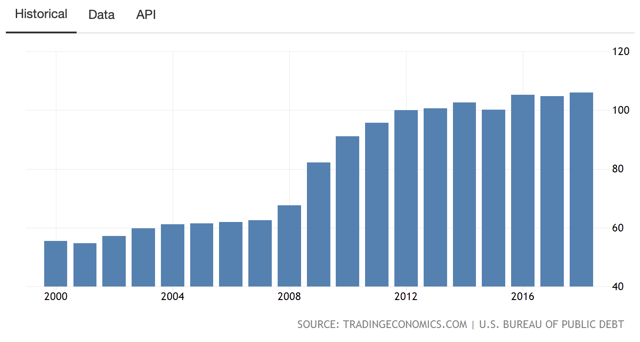

The "new normal" is for the monetary base to continue to expand indefinitely. This is largely due to the enormous amounts of government debt developed nations have accumulated over past decades. You can read in detail about America's debt problem in my "America's Impending Debt Crisis" article.

I won't go into too much detail about it now, but basically America's national debt, at over 106% of GDP is going to lead to a "new normal" of extremely low or negative interest rates, and a much weaker dollar. This is a perfect environment for gold and GSMs, in general, to thrive in.

U.S. Debt to GDP Ratio 20-Year Chart

Ultimately, to sustain this new normal economic environment the Fed will need to keep most key rates at zero or negative and will need to implement QE so it can expand the monetary base to devalue our national debt. Naturally, this will reflect very poorly on the USD.

Therefore, gold at $5,000 in 3-5 years seems plausible, and it is likely to continue to go higher after that. Naturally, there will be corrections along the way but I believe we are in the beginning stages of a multi-year bull market in GLD/gold.

$5,000 in gold would equate to roughly $466 in GLD, about a 233% gain from current levels.

0 comments:

Publicar un comentario