'Crazy Inverted Yield Curves' And The Danger Of Reflexivity

by: The Heisenberg

Summary

- On Friday morning, the University of Michigan's Richard Curtin said something profound about the reflexive nature of consumer sentiment and the Fed.

- His assessment, which accompanied the second-worst consumer sentiment reading of the Trump presidency, has a parallel in the bond market.

- If the Fed tightened us into a slowdown in Q4 2018, we're in danger of talking ourselves into one in Q3 2019.

- His assessment, which accompanied the second-worst consumer sentiment reading of the Trump presidency, has a parallel in the bond market.

- If the Fed tightened us into a slowdown in Q4 2018, we're in danger of talking ourselves into one in Q3 2019.

On Friday morning, Richard Curtin, director of the University of Michigan consumer survey, delivered a rather sobering message.

"The main takeaway for consumers from the first cut in interest rates in a decade was to increase apprehensions about a possible recession", Curtin said.

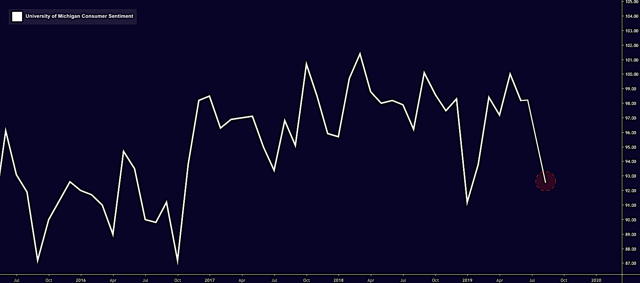

That assessment came alongside the second-worst consumer sentiment print of the Trump presidency.

The 92.1 preliminary print for August missed estimates by a mile and represented a sharp drop from 98.4 in July.

Curtin's brief take on how the US consumer interpreted the Fed's July rate cut was profound, even if he didn't mean for it be. In reality, the US consumer is doing fine. Retail sales rose 0.7% in July, more than doubling estimates and printing ahead of even the most optimistic forecast from 70 economists. It was the fifth consecutive monthly gain, and underscored the message from the second quarter GDP report, which featured a strong read on personal consumption.

Most Americans don't know that much about monetary policy and I'd be willing to bet that less than 2 out of ten voters can tell you what the yield curve even represents. That, in turn, means that left to their own devices, the vast majority of Americans wouldn't have the first clue about whether Fed policy is or isn't "too tight" and thereby constraining the US economy.

President Trump and his advisers (with an emphasis on Peter Navarro, who has made numerous appearances on television this week, each time calling for Fed rate cuts), have raised the Fed's public profile and made Jerome Powell a household name. What the preliminary read on consumer sentiment clearly shows is that Americans, suddenly attune to the situation, were spooked by the Fed's rate cut.

The worry is that if the consumer begins to take his/her cues from the Fed, as Curtin suggested on Friday, it will eventually undermine an otherwise healthy US economy. As the economy decelerates, the Trump administration would doubtlessly call for more rate cuts, potentially spooking Americans further, in a self-feeding loop.

There's a parallel with what's going on in the bond market. I've talked about this before, but it's obviously gone into hyperdrive in August.

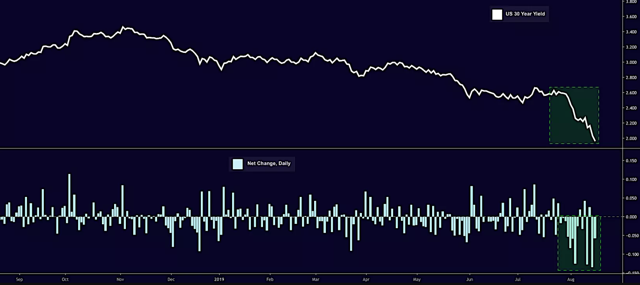

30-year yields in the US fell below 2% this week and, as mentioned previously, ultra futures tripped the extended hours circuit breaker on Wednesday, a testament to just how "crazy" (to quote one trader) the rally has been.

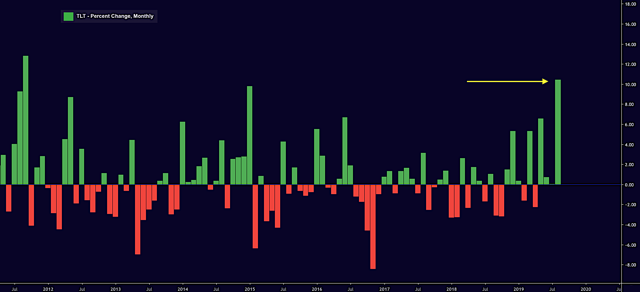

There are a variety of factors that help explain what can very fairly be described as one of the more incredible bond rallies in recent memory, but do bear in mind that some of what you're seeing is a self-fulfilling prophecy.

For instance, receiving flows have magnified things over the past several sessions. This is the same dynamic I discussed at length in these pages earlier this year, only to be dismissed by some readers as employing unnecessary "jargon".

Fast forward to August, and you can understand why I was so intent on making the point back in March. Bloomberg ran an entire article on this Friday called "Treasury Rally Gets Supercharged by Pension, Insurer Hedge Flows". Below, find a bit of additional color from the same BofA rates strategists cited by Bloomberg, which isn't available in their piece.

From an August 9 note:

While we’ve been highlighting the risk of a positioning squeeze in the belly, the long end is still underinvested in our view. As we’ve discussed recently, the strategic asset allocation flows (the duration and convexity grab) from liability driven investors may still have a long way to go. In the past, this flow often occurred in a higher rates environment as the funding gap closes. Today, the deteriorating growth outlook also provides incentive for long end demand as investors grab yields and hedge for tail events.

From an August 16 note:

Convexity-related receiving flows from both pensions, who are likely the most underfunded they have been since 2016, and the mortgage universe are likely to remain ongoing factors for long end spread tightening.

As Bloomberg reminds you, "these transactions have in turn helped drive down US Treasury yields even further [in a] feedback loop".

The lower long-end yields go, the more convinced market participants become that everyone else is panicking about the outlook for global growth. Those jitters beget still more demand for duration, which pushes yields even lower, and around we go. Hence the borderline ridiculous rally in bonds.

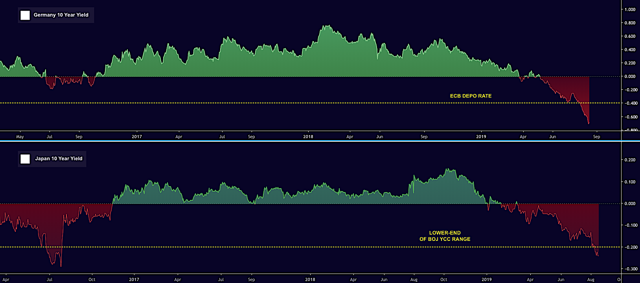

Of course, what's happening in the US bond market is influenced by dynamics abroad, where yields continue to plunge. 10-year yields in Germany approached -0.70% this week and JGB yields touched -0.255% on Friday before the Bank of Japan cut purchases in the five-to-10-year bucket in a bid to avoid a severe undershoot of the lower-end of the yield-curve-control band.

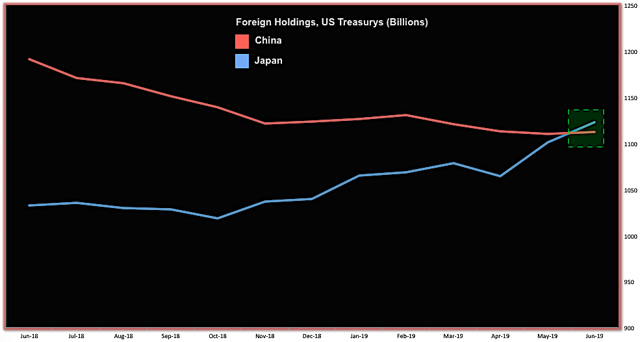

Term premium spillovers from overseas are pushing down long-end yields stateside, and it's not a coincidence that Japan surpassed China as America's biggest creditor for the first time since May 2017 in June, the latest TIC data, out Thursday afternoon, showed.

All of that is, in one way or another, being exacerbated by global growth concerns tied to trade tensions. The more acute things get, the more convinced the market becomes that central banks will be forced to act, and those expectations further fuel the fixed income rally. The total global stock of negative-yielding debt rose more than $1 trillion this week alone.

The problem in the US is that the Fed is staring at, among other things, five consecutive months of relatively robust retail sales, a still healthy labor market, two straight months of hotter-than-expected core CPI readings, firming wages, rebounding manufacturing gauges (besides MNI's noisy Chicago barometer, which looks awful) and a very decent second quarter GDP report.

That informs the FOMC's contention that the July rate cut should be seen as a "mid-cycle adjustment", a characterization which is preventing the short-end from rallying as quickly as it would if the Fed were committed to aggressively cutting rates.

Well, with incessant pressure on the long-end tied to all of the factors outlined above, you're left with a relentless, bullish flattener. Here's BofA again, and this is from a separate note from those mentioned above:

Domestic drivers include expectations for further downgrades of the neutral rate, cheapening of 2yT to OIS on stressed funding conditions, and a Fed that put itself squarely behind the curve by characterizing the July cut as a mid-cycle-tweak, effectively sterilizing the rate cut in the process. External drivers include the expectation of lower for long global yields. the downgrade of global growth expectations on the exacerbation of trade war rhetoric, and end-cycle allocations that tend to favor USD assets and are compounded in this cycle by scarcity of safe haven assets.

Coming full circle, this flattening feeds back into the original self-fulfilling prophecy mentioned here at the outset.

That is, the US consumer might not know that much about the yield curve, but, as mentioned elsewhere earlier this week, the 2s10s gets the front-page treatment on the business section of every major news outlet in the country. It is, frankly, the only curve that "matters" to the general public, even if market participants and the Fed prefer other tenors or different indicators of impending recession altogether.

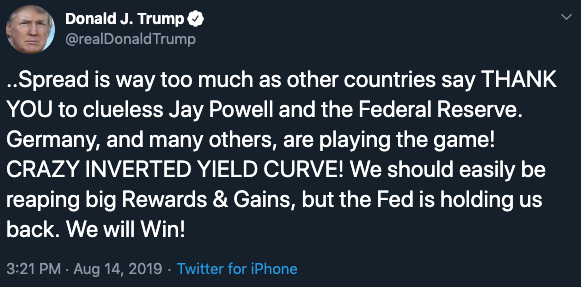

It would be damaging enough to consumer sentiment to have headlines about an "infallible" recession indicator plastered all over the front page of the nation's newspapers without having the one person in the world who absolutely shouldn't be amplifying the message, tweeting about it in the most alarmist fashion imaginable (and please do note that I couched that in apolitical terms - I'm saying it's damaging to sentiment, not that the President is necessarily "wrong"):

Not to put too fine a point on it, but that is precisely the kind of thing that contributes to the self-fulfilling prophecy described by the University of Michigan's Curtin in Friday's consumer sentiment report.

That is, the shrill rhetoric draws the public's attention to Fed policy and the bond market, with the effect of "increasing apprehensions about a possible recession", to quote Curtin.

The more apprehensive everyone gets, the faster all of the loops described above spin, which is why you're seeing what you're seeing in bonds.

In the fourth quarter of 2018, it was entirely fair to suggest that the Fed had tightened the US economy into a slowdown, as Nomura put it at the time.

In the third quarter of 2019, it's equally accurate to suggest that we're about to talk ourselves into another one.

Finally - and perhaps most importantly - don't let it be lost on you that the more extreme pricing gets in the bond market, the more difficult it is for the Fed to deliver a "dovish surprise". That, in turn, raises the odds that each successive rate cut will be ineffective at reducing the pressure in funding markets and in the curve, until eventually, we hit the zero lower bound having accomplished very little along the way.

0 comments:

Publicar un comentario