Earnings season could be a wake-up call to investors when it begins next week

By Justin Lahart

Apple, hobbled by its flagging iPhone business, is expected to report a 16% decline in net income for the latest quarter. Photo: Kirsty O'Connor/Zuma Press

Second-quarter earnings reports are going to be weak. Investors should be prepared for that, but many of them aren’t.

Earnings season kicks off next week, with a number of big companies in the S&P 500 slated to release results. Given the litany of problems they recently have faced, the news won’t be good.

Economic weakness abroad has cut into business at many multinational companies, while the strength of the dollar—which was up 6% against other currencies in the second quarter from a year earlier on a trade-weighted basis—will further damp profits generated overseas. Costs for labor and other inputs are running higher at a time when companies are struggling to raise prices, putting the squeeze on profit margins. Trade tensions have been hampering business investment, weighing on sales of technology firms and other makers of capital equipment.

Then there is a slew of company-specific issues. The grounding of the 737 MAX has hit Boeing ’s business for example, and analysts polled by FactSet estimate its net income fell by nearly half, or about $1 billion, in the second quarter from a year earlier. That amounts to about 0.3% of overall S&P 500 earnings. Apple ,hobbled by its flagging iPhone business, is expected to report a 16% decline in net income. That is more modest than Boeing’s expected drop, but because Apple’s starting level of earnings is so much higher it will have a more pronounced effect on S&P profits.

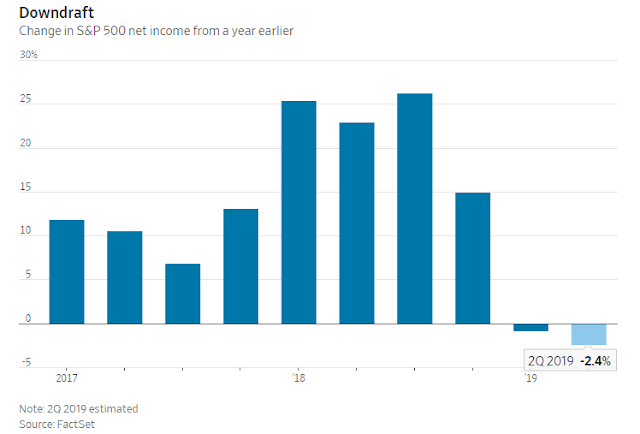

Overall, analysts expect earnings per share at companies in the S&P 500 to log a decline of 0.3%, according to Refinitiv. It would look worse if companies hadn’t been buying back stock, reducing their share count. Net income for the S&P 500 is expected to post a 2.4% decline.

Chances are earnings won’t be quite as bad as analysts say; by the time earnings season rolls around, they usually have set the bar low enough for many companies to easily clear. That said, at the start of the year, analysts thought second-quarter earnings per share would be up by 6.5%, and that isn’t going to be a mark that companies achieve. Moreover, an unusually large number of companies already have issued warnings that their results will fall short.

Yet even as the earnings picture has deteriorated, stocks have been pushing higher in a rally that has sent them into record territory. Much of that is due to enthusiasm over the increasing likelihood that the Federal Reserve will cut rates later this month. As a result, many investors may have lost sight of the earnings headwinds many companies face—even though some of those headwinds count as reasons for the Fed to loosen.

When results start coming out, investors could be in for a jolt.

0 comments:

Publicar un comentario