Ditching debt would unleash financial instability in Washington but likely backfire on Beijing

Michael Mackenzie

China is the largest foreign holder of US Treasury debt with $1.1tn worth of holdings © FT montage; AP/AFP/Getty

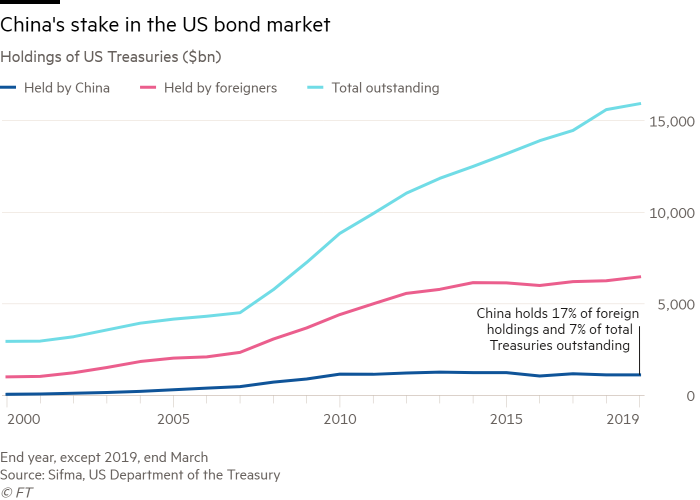

Occupying a prominent place in the bilateral trade and economic relationship between the US and China is the $16tn Treasury bond market. As the world’s two biggest economies escalate their rivalry, anxiety over whether China will abruptly use its $1.1tn holdings of US Treasuries as a trade war weapon is rippling through the bond market.

Rather like President Donald Trump’s numerous tweets extolling the benefits of tariffs for the US economy, the idea that China will undertake a major liquidation of its Treasury debt portfolio as a weapon does not stack up.

Liquidating its Treasury portfolio may appear a compelling threat on paper. China’s stake along with other foreign buyers, comprising 40 per cent of the market, has down the years helped contain US interest rates, enabling Washington to spend and push the federal deficit ever higher.

In practice, a draconian response from China runs the risk of unleashing a bout of financial instability that resonates globally. But the effect would be shortlived and wind up damaging China more than the US at a time when Beijing already faces the challenge of rebalancing a slowing and highly indebted economy.

That will not halt conjecture about China’s intentions. The latest official Treasury data released this week revealed further selling by the market’s largest foreign holder and during a time when a trade deal between Washington and Beijing appeared on track. While the drop in Treasury notes and bonds held by China in March was the largest in a year, half of the $20bn in sales was recycled back into short-dated bills.

This fits a pattern seen in recent years where China has been in maintenance mode with its Treasury portfolio as holdings peaked at $1.316tn in November 2013. China surpassed Japan as the largest foreign holder of Treasury debt in 2008, and has comfortably owned in excess of $1tn since 2010. Years of trade surpluses generated hefty foreign exchange reserves that peaked in 2014. In turn, this has helped manage the level of the renminbi, a currency that is weakening as the trade dispute intensifies.

Beijing is ready to sell Treasuries in order to moderate any decline in the currency given the often-stated desire for financial stability after a bruising 2015 devaluation of the renminbi. With more foreign investment funds buying mainland shares and bonds, a sudden drop in the currency would only impair China’s efforts to open up its markets to the rest of the world.

Supporting the renminbi in this way should not, however, be seen as an escalation by China towards actively liquidating its Treasury portfolio. Indeed, several factors limit Beijing from abruptly exiting the Treasury market.

There is a good reason why a chunk of China’s reserves sit in the world’s largest government bond market: it is deep, liquid and pays a positive yield. The two main rivals to Treasuries are Japanese government bonds and German Bunds. Both markets not only lack the depth and variety of Treasuries, they are also negative-yielding through to their respective 10-year benchmarks.

True, China’s central bank has been buying more gold lately, but as Marc Chandler at Bannockburn Global Forex points out, Beijing’s Treasury holdings are “worth around five years of gold production”.

Beyond trying to find an asset that can effectively replace US debt, there is the risk of China moving the Treasury market too sharply against it. Once any market senses a whale is selling, the cost of doing so rises sharply and China’s unsold holdings would devalue.

There are also reasonable grounds for thinking the bond market would recover from a temporary bout of indigestion that pushes yields sharply higher. In a $16tn market, China has some influence, but there are limits and for every seller there is a buyer.

This is particularly true given the current outlook flagged by the US bond market. Expectations for economic growth and inflation are the ultimate drivers of bonds. A two-year Treasury yield of 2.20 per cent sits below the Federal Reserve’s current overnight borrowing rate range. This late-cycle view of the US economy suggests Treasury prices will head higher over time. So it hardly makes sense for China to dump its holdings because it would only present a buying opportunity for others who hold a less reassuring macro view.

These are all aspects of Treasury trading that China understands. Despite the speculation over a dramatic exit trade, Beijing will stick to a long game. Treasury yields will trend lower as the economic cycle ebbs and the clamour among other investors for owning government bonds means China can exit near the top in price terms and smoothly pivot away from the US more broadly and focus on rebalancing its economy.

0 comments:

Publicar un comentario