The Case For A Melt-Up

by: The Heisenberg

Summary

- Another week of gains for US stocks raises familiar questions about whether a rally that has equities up an astounding 17% YTD can possibly run further.

- Although the story is familiar and the arguments largely unchanged, it's all worth recapping in detail precisely because the issues remain unresolved.

- " Where to from here?" has been an unanswerable, intractable question for weeks.

- Although the story is familiar and the arguments largely unchanged, it's all worth recapping in detail precisely because the issues remain unresolved.

- " Where to from here?" has been an unanswerable, intractable question for weeks.

Anyone with a penchant for skepticism had a leg up in 2018, when, for the first time in a long time, caution paid off.

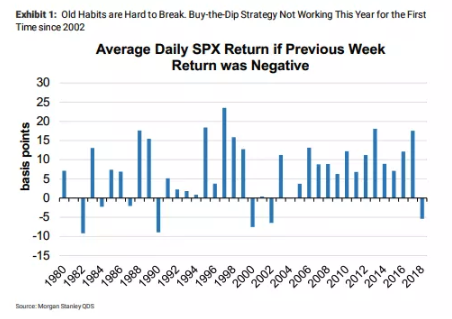

A simple "buy the dip" strategy failed for the first time in 16 years.

(Morgan Stanley)

(Morgan Stanley)

While the media has variously trotted out Morgan Stanley's Mike Wilson as the poster boy for "nailing it" (based on his prescient "rolling bear market" thesis), the only analyst I'm aware of who actually hit it right on the head last year wasn't an equities analyst at all. Rather, it was Deutsche Bank's derivatives strategist Aleksandar Kocic, who, in the course of documenting the Fed's efforts to re-strike the vaunted central bank "put", suggested the S&P (SPY) would eventually find itself sitting between 2,300 and 2,400.

Kocic's call wasn't the product of some deep-seated skepticism or propensity to dislike the longest bull market in recorded history. Rather, it was the natural outgrowth of his analysis of the Fed's transition to the role of convexity manager, versus convexity supplier, with the latter being the mode the Fed operated in for the entirety of the post-crisis years until the normalization push got going in earnest.

But, again, you needn't have been actually brilliant (like Kocic) to have looked smart last year.

You needed only have been cautious about a scenario that found the Fed pigeonholed into hawkishness and thus predisposed to pushing financial conditions inexorably tighter until something finally snapped.

As you may or may not be aware, SocGen has been somewhat skeptical of equities for a while, and as such, some of the bank's calls ended up looking smarter than those emanating from the street's more bullish strategists last year. It's fair to say their skepticism has carried over into 2019, although that characterization comes with the obvious caveat that there are bulls at every bank and not every piece of research they produce is designed to push a bearish outlook.

Earlier this month, for instance, the bank suggested investors should avoid the FOMO temptation. To wit, from an early April note:

Our analysis shows the balance of risks is still broadly titled to the downside for risk assets and we recommend investors gear their portfolio allocations for the tug-of-war between bad cyclical indicators and more policy loosening.

That underscores the tension in 2019. On one side is a global economy that's nowhere near out of the proverbial woods after last year's deceleration, and on the other side are central banks, determined to "reflate" (as it were).

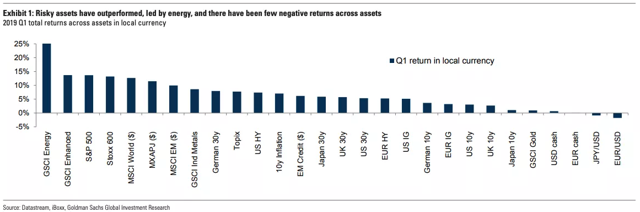

So far, the coordinated dovish pivot from policymakers (which continued apace this week with the Riksbank pushing out the next hike and the Bank of Japan enhancing their forward guidance) combined with recent signs of stabilization in the Chinese economy have prevailed over the economic malaise evidenced in Europe and Asia. As poorly as virtually every asset (save USD "cash") performed last year, 2019 has been equally indiscriminate on the upside, with virtually everything posting positive returns in Q1.

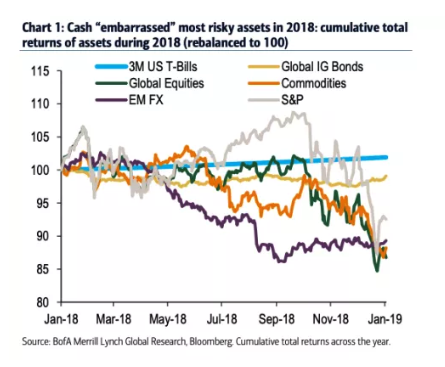

I doubt this is necessary, but just in case, here's how badly assets of all stripes were trounced last year by cash:

(BofAML)

And here's what Q1 brought in terms of cross-asset performance:

(Goldman)

It has not, generally speaking, been a pleasant experience for those who decided to sit things out on the assumption that Q4's drawdown was just the beginning of something worse.

If that's you (i.e., if you were too shell-shocked from December to risk hitching your wagon to the Fed's dovish pivot in January), you can at least take comfort in the fact that you're hardly alone.

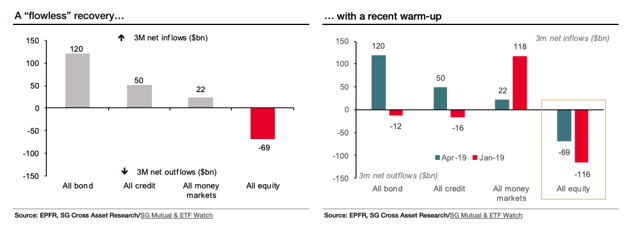

Q1 was variously described as a "flow-less" rally, lacking figurative and literal buy-in by key investor cohorts, whose assumed participation going forward is a key part of any bullish thesis.

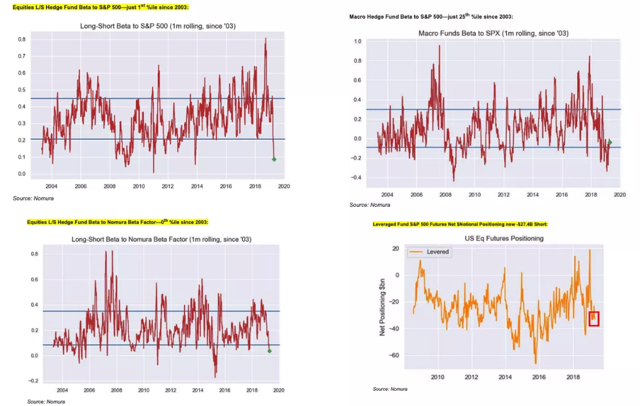

EPFR data shows $91 billion coming out of global equities funds and $120 billion flowing into global bond funds YTD. Here is a set of visuals from Nomura's Charlie McElligott which illustrate the extent to which exposure is low and positioning light.

(Nomura)

There's a sense in which asking whether some of the investor groups who haven't participated "should" get involved is an exercise in question-begging. Part and parcel of the bull thesis going forward is that left-behind cohorts will indeed be "forced" in (and you can take that figuratively in the sense of FOMO getting the best of fundamental/discretionary investors and literally in the sense that if volatility remains suppressed and markets remain "in-trend", systematic strategies will mechanically re-leverage).

But if the viability of the bull thesis relies on you (actually, several yous, plural) participating, then it's impossible to evaluate that thesis.

Well, with all of this in mind, SocGen is out with a brand new US equity strategy piece and the title is "A near-term melt-up to 3,000 is possible, but move fast".

Most of the points are familiar, but given all the "melt-up" talk engendered by the prospect of flows turning a corner and positioning finally inflecting, it's worth highlighting some of the key passages.

SocGen reiterates the notion that while an acute lack of liquidity (i.e., a dearth of market depth) can make the situation worse on the way down (as it did in Q4 and at various other intervals last year), it can also exaggerate upside moves following a rebound. I talked about this at length in a post here last week and one of the points I made was that buybacks hitting in a low-liquidity environment could very well help explain why the rebound in Q1 was so dramatic.

"The low liquidity feature of the S&P 500 futures market exacerbates bullish and bearish moves", SocGen writes, adding that if you ask the bank, "it may have [both] amplified the sell-off at end-2018, but also may have supported the rally in early 2019."

They go on to note the obvious, which is that scarce liquidity and buybacks will "continue to play an important role in US equities’ performance".

As far as the above-mentioned under-positioning and lackluster flows dynamics are concerned, SocGen underscores the glaring discrepancy between large outflows from equities and inflows to bonds. If you look at the chart in the right pane below, you can see that the situation for equities is perhaps starting to turn around.

(SocGen)

Additionally, managed money net positioning has recently moved back to (basically) neutral, suggesting folks are tentatively inclined to become at least marginally comfortable with the rally.

When it comes to what could go "right" from here, the story is always the same. Nearly every analyst you care to consult will tell you that it all depends, at least to a great degree, on whether the recent inflection in China's activity data proves sustainable.

And with that, comes a paradox.

I talked at length here on Monday about how good news on the economy has become "bad" news for Chinese equities because the better the data, the less likely Beijing is to deploy kitchen-sink-type stimulus. Subsequently, Reuters reported that Chinese officials are squarely on "pause" when it comes to RRR cuts and the PBoC's move to roll out of another round of targeted medium-term lending (on Wednesday) quite clearly indicates that a piecemeal approach is the default option going forward (as opposed to indiscriminate liquidity injections).

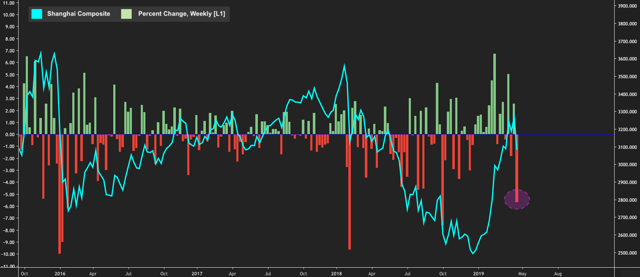

By Friday, it was a rout on the Mainland. This was the third-worst week for the Shanghai Composite going back to the doldrums of early 2016 and the proximate cause was the fear that better data means less stimulus.

With that in mind, consider the following from the same SocGen note:

Taking the previous two episodes of Chinese government stimulus, in 2012 and 2015, we calculate the change in US and World ex-US 12m forward EPS, several months before and after the U-turn in China’s credit impulse indicator. The results are striking – global earnings expectations tend to rebound after China stimulates its economy.

(SocGen)

As you can see, a turn in China's credit impulse is mission critical (if that's too strong, let's just say that in this case, correlation probably does equal causation) for forward global earnings.

The question, then, is what happens in the event China's economy merely "stabilizes" at a low level, leading to a scenario where Beijing takes a kind of wait-and-see approach, continuing to eschew kitchen-sink stimulus for targeted measures that don't pack the same kind of punch? If you're looking for hints as to what the answer to that question might be in risk assets, I would refer you to the chart of the Shanghai Composite above.

SocGen's take is constructive, though. "Even if we believe that the extent of Chinese policy easing will be much less than during previous years – to avoid another equity bubble and growth in shadow banking credit, it should be enough to stabilize earnings expectations", the bank writes.

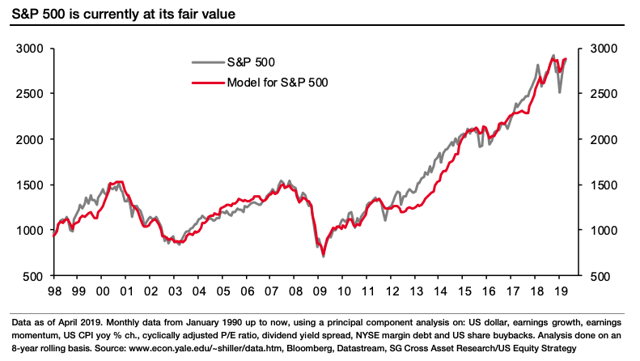

Between that benign take, buybacks, the prospect of flows and positioning starting to turn and an S&P that, to SocGen anyway, doesn't look particularly expensive, there's scope for things to run further from here. On the valuation bit, the following chart shows the bank's principal component analysis which uses the dollar, earnings growth, earnings momentum, CPI, CAPE, dividend yield spreads, EPS and buybacks to model the index:

The amusing thing about all of the above (and I don't mean "amusing" in a pejorative way), is that it feels like a lot of effort to go through to determine that the S&P might "melt-up" to 3,000. As of Friday's close, we're already at 2,940.

But the actual "target" isn't the point. Rather, the point is that the debates outlined above continue to define the market narrative. To the extent all of this is an effort to answer the question "Where to from here?" consider the issue largely unresolved.

0 comments:

Publicar un comentario