I'm Buying Gold And Silver, But Not For The Reason You Think

by: Lyn Alden Schwartzer

Summary

- I'm accumulating gold, silver, and gold/silver stocks to maintain a 5-7% portfolio allocation to precious metals.

- I consider gold to be fairly valued or mildly undervalued at the current time. Not necessarily deeply undervalued like some argue, but a good long-term risk/reward opportunity.

- Streaming/royalty companies are my preferred choice.

- Silver and platinum are historically undervalued.

- I consider gold to be fairly valued or mildly undervalued at the current time. Not necessarily deeply undervalued like some argue, but a good long-term risk/reward opportunity.

- Streaming/royalty companies are my preferred choice.

- Silver and platinum are historically undervalued.

- Precious metals are a useful asset class within a diversified portfolio.

Gold is a store of wealth that protects against currency weakness, while gold stocks are investments (albeit historically not well-managed as a group). Silver and platinum are hybrids in the sense that they have a lot of industrial applications but can also serve as stores of wealth.

However, precious metals are a controversial subject. Many people invest in them heavily and have a strong attachment to them, while others consider them unsuitable for inclusion in any respectable portfolio.

I'm a moderate in this sense; I have no strong feelings either way but invest in precious metals when the price is right and the winds are in their favor. They're a defensive asset class that can provide good returns when appropriately priced and during times of turmoil.

In particular, I have a simple framework for determining roughly what I'm willing to pay for gold, which can then be extrapolated to other precious metals. I don't try to time or trade gold over the short term; I merely assess whether it's reasonably priced and worth holding for the long term.

Asset Price Inflation

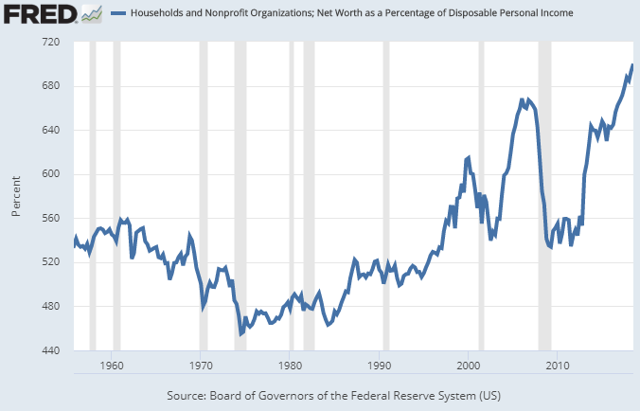

As I have shown in a couple articles, net worth relative to income is at record levels in the United States, which some people refer to as the "Everything Bubble":

Chart Source: St. Louis Federal Reserve

Chart Source: St. Louis Federal Reserve

The combination of low interest rates and money-printing has inflated asset prices, even though it hasn't inflated consumer prices for everyday goods. Stocks, real estate, bonds, and gold have all been propped upto high levels in part by very easy monetary policy.

The broad money supply per capita of the U.S. has grown a lot more quickly than the consumer price index over the past 20 years. Due to the slowing velocity of that money and other factors, it hasn't translated into higher prices on everyday goods, but it has translated into higher prices of financial assets.

The U.S. economy is nearly ten years into what is likely to soon become the longest economic expansion in the United States. However, many late-cycle elements have built up, including record corporate debt-to-GDP, a flat yield curve, potentially peaking house sales and vehicle sales, and a central bank that is trying to gradually tighten monetary policy and finding it challenging to do. Most recession indicators aren't flashing red for the next two quarters, but many of them are flashing yellow for a slowdown over the next two years.

On top of that cyclical aspect, the U.S. has major structural deficits, including a very high fiscal deficit as a percentage of GDP compared to what it was during other bull markets, a steadily increasing federal debt as a percentage of GDP, a permanent trade deficit, a weaker middle class than most other developed countries based on median net worth, underfunded pension systems, and underfunded future liabilities for Medicare and Social Security. During the next recession or the one thereafter, there are 4 economic bubbles in particular that I'm concerned about unfolding.

Many investors who are bearish on the economy believe that gold (GLD) is the answer to these problems; that gold (especially physical gold but potentially also gold stocks and gold ETFs) can protect investors from unusually high asset valuations. They argue that everything is in a bubble, including stocks, bonds, and real estate, and that gold and some other commodities are among the only things that are not in a bubble.

The problem with that assessment is that, based on most measures, gold is part of the everything bubble, rather than left out of it. It has already inflated to high price levels. As a financial asset, its price has outpaced the consumer price index. Its price growth has even outpaced the median home price growth over the past 25 years. Compared to the growth of money supply per capita, gold does not appear to be particularly undervalued or overvalued in terms of USD, but rather somewhere in the range of fairly-valued compared to its multi-decade historical average.

This is why I titled the article the way it is; many gold bulls argue that gold is woefully undervalued and suppressed in price, but I think the data show otherwise. I merely believe it to be appropriately-priced or mildly/moderately undervalued and, thus, am moderately bullish on it in a world full of things that are overvalued. Silver, platinum, and several other commodities, on the other hand, are historically very inexpensive and arguably quite undervalued.

Gold Appears Fairly Valued

According to the World Gold Council, less than 200,000 tonnes of gold have been mined in human history, with about 2,500-3,000 more tonnes being produced in a given year. Unlike most other commodities, almost all gold is thought to be maintained or recycled in perpetuity, with only trace percentages discarded in electronic waste.

With less than 200,000 tonnes of refined gold in existence and a 2,500-3,000 tonne/year global annual production rate, there is about one ounce of gold in the world for each human, and the amount of gold grows roughly as fast as the human population.

The U.S. broad money supply is growing quickly per capita, while the amount of gold per capita is relatively fixed. Thus, gold should gradually appreciate in price over time at a rate roughly equal to the growth of money supply per capita, which has averaged over 5% per year for nearly five decades now. Sometimes, gold gets ahead of this trend, and sometimes, it falls behind, but it logically and historically reverts to the mean.

Another way to put it is that dollars should gradually devalue such that it takes more of them to buy an ounce of gold, because the amount of dollars in existence per person is continually growing, while the amount of gold in existence per person is not.

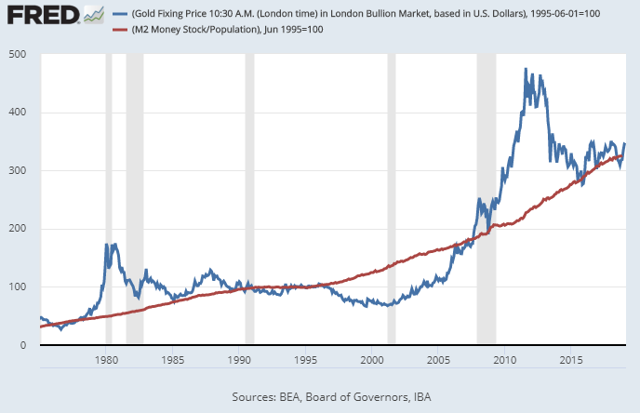

This following chart shows the growth of broad money supply per capita in the U.S. (red line) compared to gold prices (blue line), indexed to 100 in 1995:

Chart Source: St. Louis Federal Reserve

When gold hit major bubbles in 1980 and 2011, its price growth had majorly outpaced the growth of money supply per capita. Investors at those times feared the possibility of a dollar crisis due to major inflation (1980) or money-printing (2011), so the price of gold was bid up in preparation for a dollar crisis. When that dollar crisis never fully came, gold gradually fell back to normal levels over time to continue to track the growth of broad money supply per capita.

The only lengthy period where the price of gold trended below the growth of per capita money supply was in the late 1990s and early 2000s. At that time, the economy was booming, money supply growth was stable and low, and real interest rates were rather high, meaning it was more attractive to hold cash in a bank or buy U.S. treasuries than to buy gold. Thus, gold was very much out of favor. This eventually proved to be among the best times to buy gold in modern history.

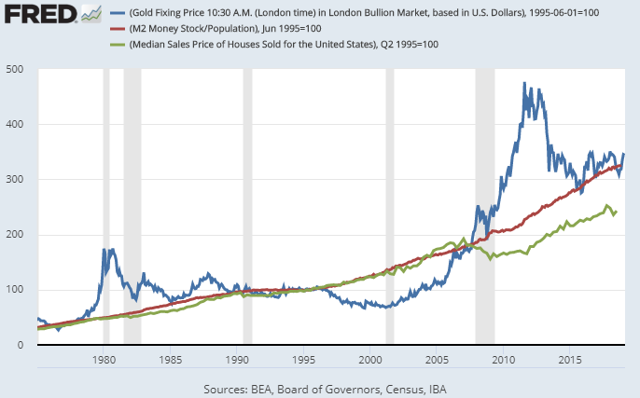

Right now, gold is fairly valued against the broad money supply per capita compared to how it was in 1995 or in the mid-1970s. Its current value has not dramatically outpaced money supply per capita like it did in 1980 and 2011, nor is it trending below the growth of money supply per capita like it did in the early 2000s. It has greatly outpaced consumer price inflation and has even outpaced the price growth of the median house.

This chart is the same as the one above but also adds the median house price over time, indexed to 100 in 1995 (green line):

As a second valuation check, it's also, of course, important to pay attention to the supply/demand balance of gold and the profitability of gold miners. A supply reduction or a demand increase can cause spikes or troughs in the gold price.

I like to look at the AISC and free cash flows of the biggest miners in the gold stock ETF (GDX). If they are insanely profitable, that's a red flag that the price of gold may have gotten ahead of itself. If they are closing down and going bankrupt, then gold may be undervalued, and that higher prices would be needed to keep production online. If they are struggling somewhat but doing okay, gold is most likely in the ballpark of being appropriately-valued, which is what I see when I look at a variety of gold miners today.

More specifically, many of the gold majors I follow are profitable but have dwindling reserves, since recent gold prices have been enough to keep good miners profitable but have not been enough to justify major spending on exploration and development. As a result, there has been an increase in M&A activity within the industry as the companies try to consolidate their reserves. That's a case for at least mild undervaluation in gold.

A Note On Silver And Platinum

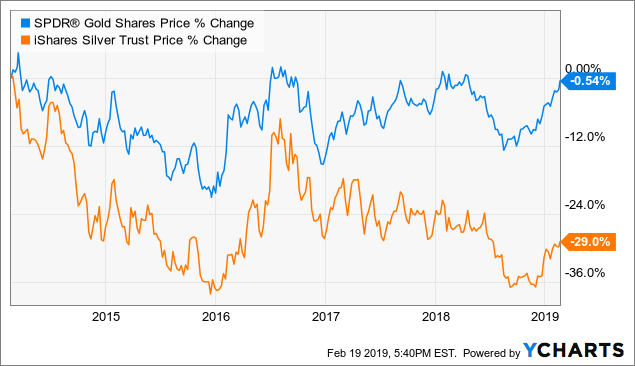

Silver (SLV), on the other hand, is trending well below average valuation. The gold-to-silver ratio is historically quite high at over 80, which when combined with the idea that gold is approximately fairly valued or mildly undervalued implies that silver is significantly undervalued.

Historically, when gold price spikes higher, the gold-to-silver ratio shrinks, meaning there's a tendency for silver to spike even higher.

Indeed, the long-term expected demand growth for silver from electric vehicles, solar panels, and electronics in general, is bullish, for silver prices, but anything goes in the short term.

Data by YCharts

Data by YCharts

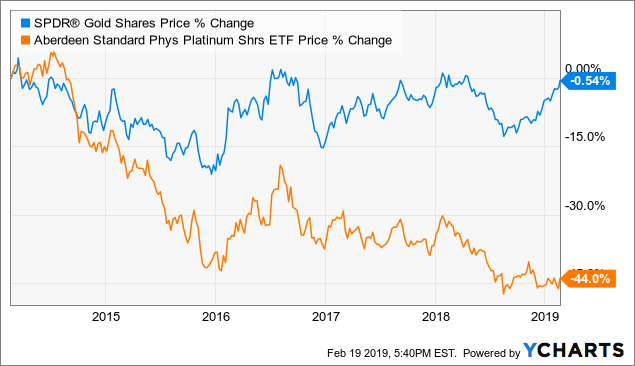

Platinum in the past several years has also become deeply undervalued in respect to its historical relationship with gold. The caveat with platinum and palladium is that their principal industrial use is in combustion vehicles which may face long-term gradual demand destruction by electric vehicles which don't need catalytic converters. In the meantime, it is unusual for platinum to be priced so much below gold and Palladium.

Data by YCharts

Data by YCharts

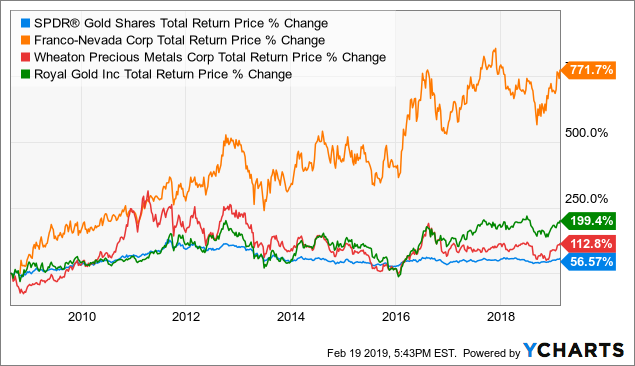

Gold stocks, additionally, are trading at historically low valuations compared to gold based on the XAU-to-gold ratio. In other words, gold miners are the second cheapest they've ever been relative to the price of gold, with the only cheaper period being a few years ago at the gold bottom in 2015/2016.

It's important to be picky with gold stocks, however, because, as a group, they've been historically bad managers of capital and have underperformed the metals they mine:

Data by YCharts

Data by YCharts

The Role Of Gold In A Portfolio

Rather than merely being an inflation hedge, gold serves a variety of purposes in a portfolio. Gold is insurance against a currency crisis, a nice hedge during recessions, and a play on perpetually low interest rates and quantitative easing going forward.

Unlike real estate, gold tends to appreciate in price during recessions due to investor fear.

However, on a fundamental basis, it's not currently any cheaper than median residential real estate relative to the growth of the U.S. money supply. Silver is a deeper-value play.

Some people point out that precious metals don't keep up with stocks over the long term, but it really depends on when you buy and how long you define "long" to be. Gold has outpaced the S&P 500 (SPY) and the Nasdaq 100 (QQQ) over the past 20 years due to how highly-valued stocks were at that time and how undervalued gold was. But if you measure from gold price peaks in 1980 or 2011, gold's returns have been bad. Gold historically gives good risk-adjusted returns when bought at cheap or moderate prices during times when equities are highly valued.

Moreover, I view gold mostly as competing for a spot in a portfolio against cash and bonds, rather than necessarily competing against stocks. And, on that front, it has done quite well:

Data by YCharts

Data by YCharts

I sold my gold and silver coins that I collected as a youngster to a local shop in 2011 when they became overvalued, went on to ignore the space for a few years, and started buying back in the past two years up to a 5-7% allocation when gold fell back to its trend against the broad money supply per capita comparable to its 1995 valuation, and as stocks became highly-valued based on a number of metrics.

I believe gold is a healthy part of a diversified portfolio, but I want to caution investors against the idea that it's the one magical asset class that can save them from economic calamity. Other hard assets like real estate outside of high-priced cities and infrastructure assets are desirable as well.

Good solid companies with in-demand products and services that produce strong free cash flows and have fortress balance sheets are also solid choices to hold through market turmoil.

Over the very long run, I expect gold to continue to appreciate in price in terms of dollars at about the same rate as the growth of per capita money supply (which has averaged over 5% per year), with occasional spikes over it due to fear, which are hard to predict. In comparison, Vanguard recently reported that they expect about 5% annual returns from U.S. stocks over the next decade.

When real interest rates are low like they are now, it would make sense for gold to err on the side of trending a bit above the growth of the money supply per capita since there is less opportunity cost for holding it compared to cash or sovereign bonds.

In contrast, during periods of high real interest rates and stable economic growth, it wouldn't be unusual to see the price of gold trend below the growth of the money supply per capita since the opportunity cost of holding it is significant.

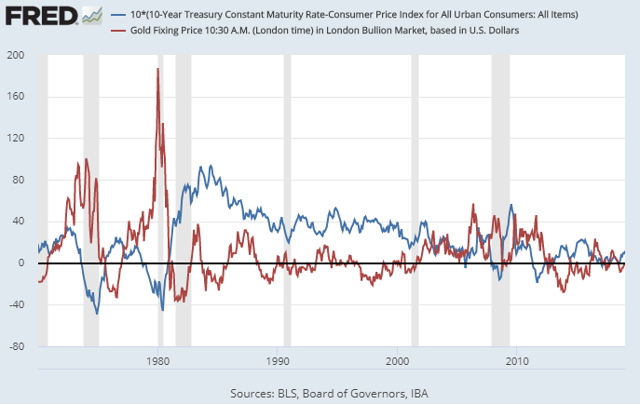

Historically, gold price movements as a percent-change-per-year (red line) are inversely correlated with real treasury yields (blue line, scaled by a factor of 10 for clarity):

During periods of inflation in the 1970s, gold spiked higher when real treasury yields were negative.

Then, during the 1980s, 1990s and early 2000s, the U.S. enjoyed a sustained economic boom with consistently high real interest rates, which kept the price of gold stable and low. During the global financial crisis and its aftermath, real interest rates became practically zero. In response to this, as well as global debt crises and quantitative easing, gold spiked high once again before gradually falling back to its trend as things stabilized against resumed economic growth.

Given that we seem to be perpetually in a low real interest rate environment for much of the developed world going forward (the existing high debt levels can't support higher interest rates at this point), and gold is at a balanced price relative to money supply per capita, gold appears to be a reasonably good investment that should continue to appreciate in the long term, even if it, of course, has various dips along the way.

I personally like to hold a little bit of physical gold, and then a broad array of gold streaming and royalty companies like Franco Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Sandstorm (SAND), and Osisko Gold Royalties (OR). As a group, gold royalty and streaming companies have outperformed the price of gold and gold miners over the past decade because their diversified business model of financing gold mines is more stable than doing the dirty work of actually mining gold. They have less explosive upside potential but are better at riding out the downturns, which suits the purpose of my investment in them. Some of them became rather expensive years ago but have drifted down to better valuations in recent years.

Data by YCharts

Data by YCharts

In addition, I am holding a select number of historically well-managed gold/silver miners.

Currently, I have small positions in the new Barrick (GOLD), Agnico Eagle (AEM), B2Gold (BTG), Fortuna Silver Mines (FSM), and First Majestic Silver (AG).

Summary Thoughts

Growth of the gold price logically and historically tracks the growth of per-capita money supply over time, which has averaged over 5% per year during the past several decades.

Compared to estimated stock, cash, and bond returns over the next decade, gold is a favorable risk/reward asset class currently to include within a portfolio.

Gold tends to deviate from the trend to the upside during times of currency uncertainty and low real interest rates. Inversely, gold has more rarely deviated from the trend to the downside during periods of high real interest rates and strong economic growth.

Shrinking in-ground reserves among gold majors, increased gold buying from central banks, perpetually low real interest rates, and the observation that we're likely relatively late in the U.S. business cycle are all bullish for gold.

There's a good case to hold some precious metals at this price point, and they're best thought of as competing against a portion of cash and bonds when deciding whether they fit within a portfolio. Gold stocks can be thought of as competing against traditional equities, but generally with just a small allocation at best.

0 comments:

Publicar un comentario