Among major U.S. banks, JPMorgan Chase has done the best at hitting its profitability target and ensuring it won’t slip too much in a downturn

By Aaron Back

Despite economic uncertainty, JPMorgan Chase is operating at an enviable level of profitability. Photo: timothy a. clary/Agence France-Presse/Getty Images

Much like everyone else at the moment, JPMorgan Chase JPM -0.99%▲ & Co. is confused about where the economy is headed. It has less to worry about than most, though.

At JPMorgan’s annual investor day on Tuesday, Chief Financial Officer Marianne Lake gave a cautious outlook. Downside risks to the economy are higher now than they have been for some time, she said. Indications of a coming recession “are not flashing red, but they are off the floor.” Uncertainty over global trade tensions and Brexit further cloud the outlook.

Meanwhile, the future direction of interest rates, so crucial to bank earnings, is unclear. Ms. Lake noted that in the last tightening cycle of the mid-2000s, deposit rates kept rising even after the Fed had finished raising rates so JPMorgan’s deposit costs may keep rising even if the Fed pauses.

At the same time, JPMorgan’s core loan growth is clearly slowing, from an average pace of 11% over the past five years to 7% in 2018 and just 6% in the fourth quarter. As a result of all this, the bank sees only modest growth in net interest income going forward.

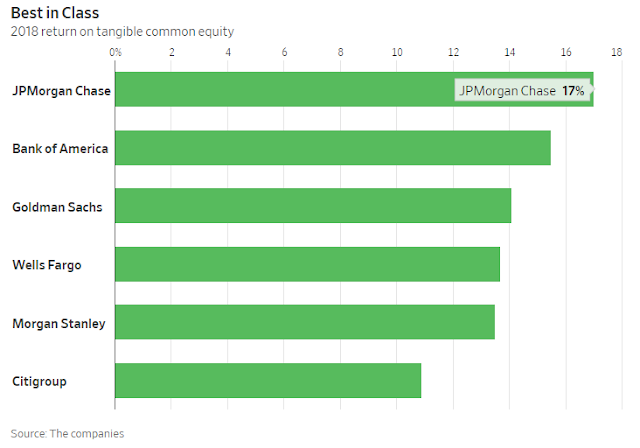

Still, investors can find reassurance in the fact that JPMorgan is humming along at an enviable level of profitability. Its 2018 return on tangible common equity, a key measure of bank performance, was a robust 17%—not only in line with its medium-term target, but also easily the highest among its peers.

Wells Fargo ’sROTCE was 13.7% last year, below its 2018-2019 target of 14% to 17%. Citigroup ,with a 10.9% return last year, has a long way to go to meet its target of 13.5% by 2020. If these banks are shy of their targets when rates are rising and the economy is expanding, they will fall well short in a downturn.

JPMorgan, on the other hand, could easily “overearn” on its target for the next year or two if market conditions are positive, Ms. Lake said, and still achieve a medium-term 17% rate through the length of the cycle. Bank of Americadoesn’t have an explicit target but had a respectable 15.5% ROTCE in 2018. That could easily go higher if the economy keeps cooperating. Because of Bank of America’s strong sensitivity to interest-rate movements, though, it also could fall a bit more than JPMorgan if things head south.

Finally, JPMorgan has levers it can pull to keep returns high. Its investment-banking and markets businesses have strong records of gaining market share over the past few years, allowing them to potentially prosper in a downturn. On Tuesday, Ms. Lake also hinted at plans to allocate the bank’s portfolio more toward securities holdings as loan and deposit growth slow.

When the outlook is so uncertain, investors are best off with an all-weather performer.

0 comments:

Publicar un comentario