Copper Outlook 2019: Supply And Demand

by: Dan Victor, CFA

Summary

- Chile's Copper Commission 'Cochilco' just released its 2019 copper forecast a $3.05/lbs representing 14% upside from current levels amid an expected market supply deficit.

- While demand is seen rising 2.4% globally in 2019, half of which is from China, global production may only increase 1.6%.

- Estimated supply deficit for 2019 and 2020 is revised higher from forecast last year due to to lower than expected production from Grasberg mine in Indonesia, the world's second largest.

- Deceleration of global growth, ongoing trade tensions between U.S. and China, and financial market volatility highlighted as main negative factors slowing recovery of metal prices.

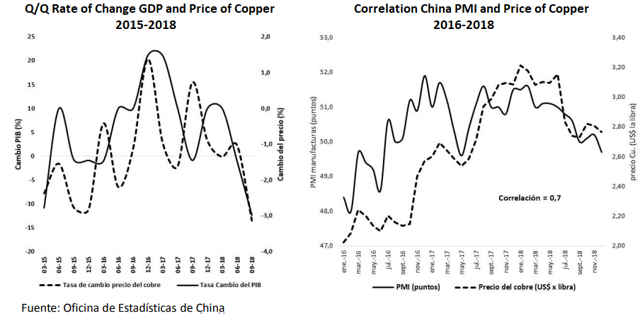

- Price of copper has been increasingly linked to Chinese activity data with rising correlation observed with China PMI since 2016.

- While demand is seen rising 2.4% globally in 2019, half of which is from China, global production may only increase 1.6%.

- Estimated supply deficit for 2019 and 2020 is revised higher from forecast last year due to to lower than expected production from Grasberg mine in Indonesia, the world's second largest.

- Deceleration of global growth, ongoing trade tensions between U.S. and China, and financial market volatility highlighted as main negative factors slowing recovery of metal prices.

- Price of copper has been increasingly linked to Chinese activity data with rising correlation observed with China PMI since 2016.

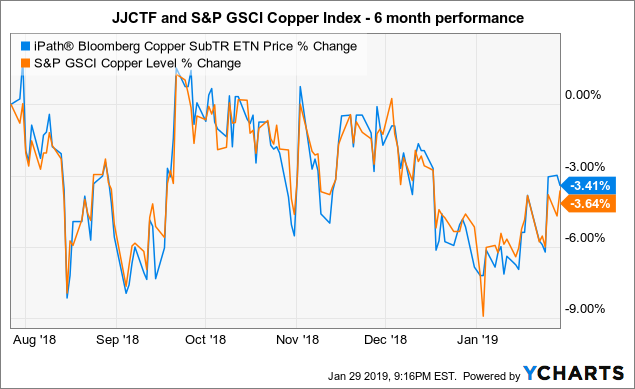

iPath DJ-UBS Copper Total Return Sub-Index ETN (OTCPK:OTCPK:JJCTF) tracks an index that reflects the performance of an investment in one futures contract on copper. For stock traders JJCTF, exchange-traded-note provides exposure to market price movements of Copper High Grade futures contract traded on the COMEX. The ETN has an expense ratio of 0.75%. This article highlights 2019 and 2020 global supply and demand forecasts published by the Chilean Commission on Copper (Cochilco) and my view on where the price of copper is headed next.

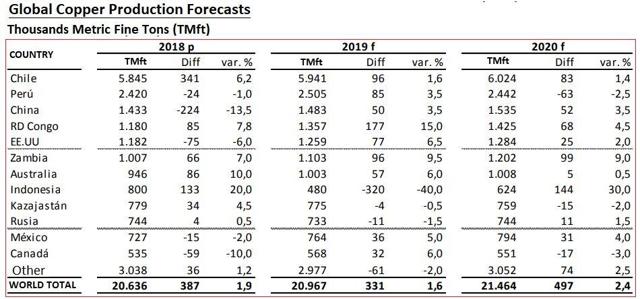

Global Copper Production Forecast

Copper Production Forecast. source: Cochilco/author translation

Preliminary data shows global copper production in 2018 reached 20,636 thousand metric fine tons 'TMFT' up 1.9% from 2017. Chile, with production of 5,845 TMFT represented 28.3% of world total. The 6.2% growth in output from Chile is skewed considering a major mining labor strike going back to 2017 as the comparison period. The world's second-largest copper mine, the Grasberg field in Indonesia also observed work stoppages in 2017 leading to the apparent 20% bump in 2018 production from Indonesia. Supply disruptions have been a theme in recent years.

For 2019 the forecasts consider the combination of the timetable for known mining developments and expected brownfield projects. The Grasberg mine production is forecast to drop nearly 40% as the operation is retooled from open-pit to underground. This represents nearly 1.6% of global 2019 production. In 2018 the mine was officially sold from the Freeport-McMoran (NYSE:FCX) and Rio Tinto PLC (NYSE:RIO) joint venture to the Indonesian government, while Freeport continues as the operator. Grasberg production is expected to only normalize by 2022. This will remain an important monitoring point as any further revision lower to production estimates or extending the timetable to get it operating at capacity will be bullish for copper prices. Copper output growth from Australia is decelerating as new mines came on-line in recent years and no major new mine is expected in 2020.

Separately, higher production from Congo Republic expected to increase 15% in 2019 and its' Tenke copper mine has made the country one of the fastest growing copper mining regions in the world.

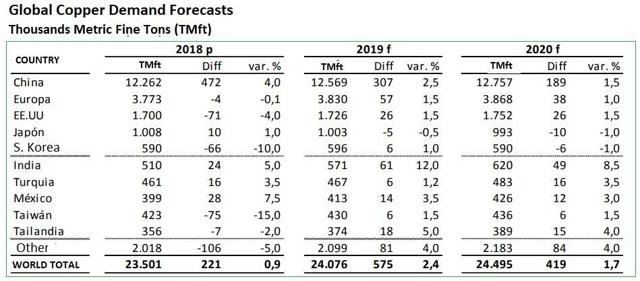

Global Copper Demand Forecast

Copper Demand Forecast. source: Cochilco/author translation

In terms of demand, China in 2018 consumed 12,262 TMFT of copper up 4% from 2017 and now representing 52% of world supplies. Global demand increased 0.9% in 2018. Excluding China, global demand would have actually been down about 1%. India is the other rapidly growing copper consumer with demand forecast to grow 12% in 2019 and expected to double by 2026, to a still relatively modest 5% of global demand. Other important countries and regions for copper demand including Europe, U.S., Japan, and South Korea are expected to have relatively flat growth in the coming years.

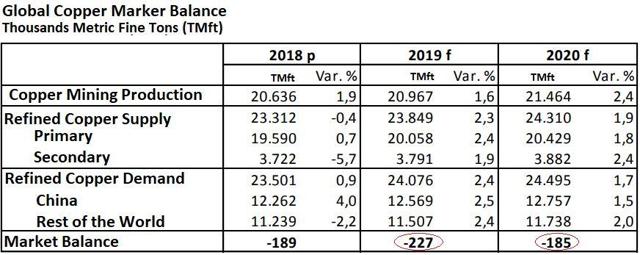

Global Copper Market Balance Forecast

Copper Market Balance Forecast. source: Cochilco/author translation

Considering new refined-primary copper supply and secondary supplies like inventories and scrap, the table above demonstrates the market balance with demand forecast for 2019 and 2020. The 227 TMFT deficit estimated for 2019 and again 185 TMFT in 2020 represent 3.6 and 3.0 days of consumption globally. In terms of China's demand forecast, the deficit for 2019 gives about a 1% margin of error to the downside that would maintain the market in equilibrium. Demand in China could end up being 1% lower and all else equal the market would still have a marginal deficit.

China

Cochilco highlights its observation that the price of copper since 2016 has been increasingly driven by changes in Chinese activity, displaying a an increasing correlation with China Manufacturing PMI which its notes as 0.7. If there is any doubt whether Dr. Copper still has a read on the economy, my take is that he must be Chinese.

China Impact on Copper Price. source: Cochilco/author translation

If the Chinese economy begins to materially deteriorate or the slowdown is deeper than expected, I'd expect this scenario to have implications for broader global slowdown. In that case demand would be lower for all countries and Copper could test down to its 2016 low near $2.00/lbs. I am more constructive on China after viewing that their fiscal and monetary stimulus capacity has the firepower necessary to "manage" growth. Chinese GDP is still expected above 5% per year for the medium term which is beyond its copper demand forecasts 2.5% in 2019 and a relatively anemic 1.5% in 2020. I see upside to the demand forecasts which would be supportive to copper prices.

Conclusión

Copper Futures Daily Price History. source: Finviz.com

Copper has traded in a relatively tight trading range for the past half year between approximately $2.85 to the upside and $2.60 as support. I think its going to need a major catalyst to break down or trend higher possibly with a resolution to the U.S. China trade dispute. Risks are balanced at this time with concerns over Chinese demand balanced against tighter supplies.

0 comments:

Publicar un comentario