The U.S. Economy Is Flying Blind With a Sputtering Engine

Federal data shortage makes it harder to assess shutdown’s current damage, let alone chart an informed path forward

By Justin Lahart

President Trump flew aboard Marine One on Monday. This week a White House economist estimated the shutdown’s dent to the GDP at about $6.7 billion a week. Photo: Andrew Harrer/Bloomberg News

The partial shutdown of the U.S. government is simultaneously hitting the economy and constricting the flow of data by which to gauge how big the hit actually is. Think of it as the forecasting equivalent of flying through a storm without instruments. Flying by sight will be tricky for both investors and Federal Reserve policy makers.

First, one has to assess how much government spending will be curtailed by the furloughing of about 380,000 federal workers and the direct effects of those curbed costs. Next, take a stab at how much consumer spending might cool as those furloughed workers along with about 420,000 workers on the job without pay strain to keep up with bills.

Then there are contractors who do work for the government and are at risk of running out of money to pay employees. That isn’t all. Fewer government workers and contractors are flying, for example, and other travelers might be forgoing trips rather than deal with checkpoint delays stemming from Transportation Security Administration staffing woes. The Small Business Administration has stopped approving routine small-business loans, choking off an important source of funding for many entrepreneurs.

All of these things are happening during a period when worries over the U.S. economy were already growing. How lower confidence might be affecting business is hard to know.

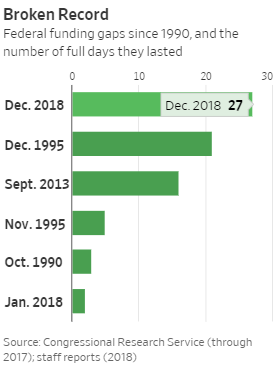

Still, economists have been trying to come up with estimates. White House Council of Economic Advisers Chairman Kevin Hassett initially said the shutdown was shaving 0.1 percentage points off gross domestic product every two weeks, but on Tuesday he doubled that estimate. The damage now amounts to about $6.7 billion a week—more than what President Trump is demanding for border-wall funding.

Unfortunately, the furloughing of Commerce Department employees means a lot of the reports that would help gauge the shutdown’s effects have been postponed. December retail sales figures, which include the first week of the shutdown, were supposed to come out this Tuesday, for example. Even when the government does reopen, it will take time for reports—including fourth-quarter gross domestic product—to be compiled.

So investors must rely on the government reports that are coming out (the Labor Department’s Bureau of Labor Statistics and the Fed are open for business) as well as privately produced reports. This less-complete picture is complicated by the fact that the economy already appeared be slowing as the shutdown began. Whatever faith investors had in their forecasting abilities should be lower now.

The same goes for Fed officials, who as a result of the shutdown have even more reason to delay further rate increases. Mr. Trump’s arguments that the central bank should hold off on monetary-policy tightening may have fallen on deaf ears. The shutdown threatening his economic legacy is another matter.

0 comments:

Publicar un comentario