IMF faces China debt dilemma as low income nations seek help

Many participants in Beijing’s Belt and Road Initiative are not financially secure

Delphine Strauss in London

© FT montage; AFP/Getty

The IMF has warned for more than a year of rising debt levels in low income countries. Now, bailout talks with Pakistan and requests for help from Angola, Zambia and others are forcing the fund to confront a pressing question: how far is debt distress in the developing world due to lending by China?

The trouble is, no one has the information needed to answer this question — and so ensure that Beijing plays its part in any writedowns of debt to official creditors.

In the past decade, China has stepped into the gap left by western donors, offering no-strings finance for political allies and for projects advancing its commercial and geopolitical interests.

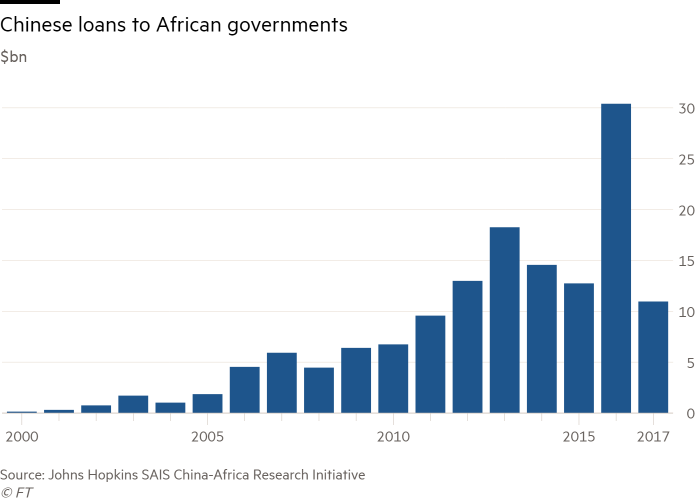

In the absence of official data, it is hard to assess even the scale of lending. Researchers at Johns Hopkins University — who say their task is “more akin . . . to detective work than accounting” — estimate that the Chinese government, banks and contractors loaned some $143bn to African governments and state-owned enterprises between 2000 and 2017. Information on the maturity, cost and terms of loans is next to non-existent.

This is a huge challenge for the IMF. “Assessing debt sustainability is at the heart of IMF competence. If you get it wrong or go about it without the information, it hurts your credibility,” said a former senior official at the fund.

The first big test of the IMF’s resolve to tackle the issue is Pakistan’s bailout request: talks will resume in January, after a staff visit this week ended without agreement .

The fund’s reputation is on the line: it must explain why a repeat customer whose last bailout programme ended only in 2016 is already in difficulties. But the opaque nature of Chinese lending makes it hard to judge whether the country’s debt is sustainable.

Pakistan’s sovereign debt is high for an emerging market, at around 70 per cent of GDP. As much as half of this could be owed to China, which has pledged to fund projects worth some $60bn and has made Pakistan a cornerstone of the Belt and Road Initiative, its scheme to fund and build infrastructure in more than 80 countries.

The former IMF official said Pakistan’s finances might be sustainable without debt relief — but only if there were no large hidden liabilities, such as guarantees on loans to state-owned enterprises. It would also be essential to establish the terms of Chinese loans, which analysts say are often extended at top-end commercial rates, not the concessionary rates usual for bilateral development aid.

When asked about Pakistan last month, Christine Lagarde, the fund’s managing director, insisted the IMF would demand “absolute transparency” on the nature, size and terms of its debt. This demand was one of the sticking points in the latest talks.

But the difference of approach between China and the fund reveals a larger mismatch between two competing visions for global development.

The IMF represents the Washington consensus, which stresses multilateral initiatives, open procurement and financial transparency. China’s approach in the BRI is largely bilateral, with project details withheld and contracts awarded mostly to Chinese state firms.

There is much at stake, given the likelihood that other countries will soon be queueing at the fund’s doors.

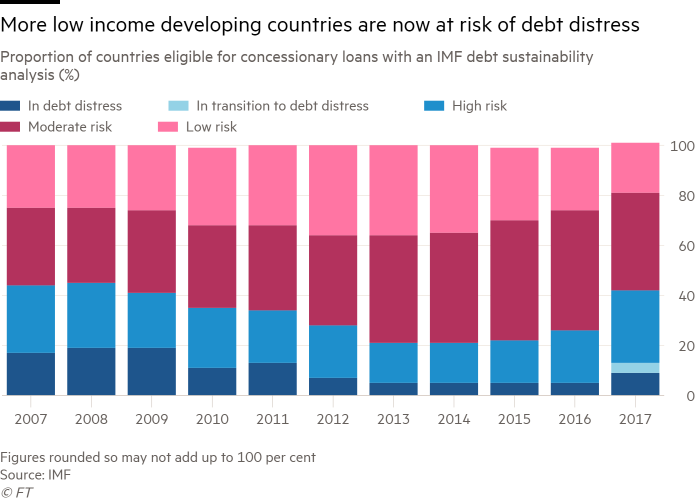

Last month, the IMF warned that more than 45 per cent of low income countries were at high risk of — or already in — debt distress, up from one-third in 2016 and one quarter in 2014.

Several sub-Saharan governments have asked the Fund for help: Chinese loans are among the obstacles to progress with Angola, which approached the IMF in August, and Zambia which has been locked in negotiations for months.

Many other countries China has chosen as participants in the BRI are financially insecure. According to Moody’s, the credit rating agency, 78 of them have a median rating of Ba2 — signifying a non-investment, or “junk”, level of risk.

Ted Truman, a fellow at the Peterson Institute for International Economics and a former IMF official, believes there could be bigger calls on the IMF within a few years. “Sooner or later, we all think that Venezuela [which has extensive debts to Beijing] will need an IMF programme to put the country back together again,” he said.

The US administration has already made it clear it will not back any IMF rescue that might serve simply to help its recipient pay off debts to Beijing.

Rescheduling debts to official creditors is usually a condition of an IMF bailout but China is not a member of the Paris Club, the group that coordinates debt relief.

The nature of Chinese lending is a further complication.

Gabriel Sterne, a former IMF official now at Oxford Economics, said it would not be easy to reschedule Chinese loans, often issued on commercial terms by state banks and other actors. “These chickens are going to come home to roost . . . it is completely unproven that China will behave cooperatively if things go bad,” he said.

Carmen Reinhart, a Harvard professor, has noted that China’s tendency to favour collateralised loans (such as oil backed loans extended to Angola and Ecuador) is a challenge, because their terms may affect the order of seniority among creditors.

China has at times proved willing to extend new loans or defer repayment when borrowers run into difficulties. It may now wish to be flexible — partly to avoid further conflict with the US, partly because it is worried that many loans may not be repaid.

Last month Wang Wen, the head of China’s export credit insure Sinosure, issued a rare public warning to Chinese developers of the need to step up risk management. He said Sinosure had already lost $1bn on a railway linking Addis Ababa to Djibouti — a project whose terms Ethiopia recently managed to renegotiate with Beijing.

But western governments will now want to see a formal commitment to burden sharing before they back an IMF bailout of any country heavily indebted to China. Pakistan’s crisis “is a test of the system,” Mr Truman said. “If they blink it’s a mess.”

0 comments:

Publicar un comentario