Why The Next Bear Will Be Bad

by: Eric Parnell, CFA

- Thought the month of October was bad? It may be only the very beginning of the beginning.

- The long-term rhythm of the U.S. economy has been badly disrupted for many years.

- An economic and stock market heart attack has been building for nearly three decades now with several close calls along the way.

- The cleansing process is not pleasant, but it is necessary in fostering long-term growth.

- Even if U.S. stocks fall into a prolonged bear market, capital markets are always filled with attractive return opportunities. Investors may just have to work at it going forward.

- The long-term rhythm of the U.S. economy has been badly disrupted for many years.

- An economic and stock market heart attack has been building for nearly three decades now with several close calls along the way.

- The cleansing process is not pleasant, but it is necessary in fostering long-term growth.

- Even if U.S. stocks fall into a prolonged bear market, capital markets are always filled with attractive return opportunities. Investors may just have to work at it going forward.

“No way you can fight it every day

No matter what you say

You know it, the rhythm is gonna get you”

- Rhythm Is Gonna Get You, Gloria Estefan & Miami Sound Machine, 1987

Thought the month of October was bad? If so, you ain’t seen nothing yet. Why? Because the United States has been battling an increasingly challenging case of economic arrhythmia in recent years. And while potentially rather harmless and manageable at one time, policy makers have repeatedly refused to learn from the past, letting the problem fester and grow. Eventually, the rhythm is gonna get this market in a big time way.

The U.S. economy has historically moved with rhythm. Every three years on average, the economy would expand. And then for just over a year on average, the economy would fall into recession. This historical rhythm is important in maintaining balance in the U.S. economy. For by periodically entering into recession, the economy is given the opportunity to cleanse the excesses built up during the last expansion and build a stronger base for the next phase of growth. And while policy maker hubris has led us to try and cheat this historical cycle by trying to take the good while avoiding the bad, history tells us that the practice of trying to cheat recessions can bring far greater consequences down the road.

The rhythm of the U.S. economy has been disrupted in recent years. According to the National Bureau of Economic Research (NBER), the historical relationship described above remained consistently intact barring rare exception for 128 years from 1854 to 1982. But then something dramatically changed about three decades ago right around the time that Alan Greenspan took the reins as Federal Reserve Chair. The idea was fully embraced that the U.S. economy could effectively cheat death and enjoy continued growth without recessions through the active implementation of fiscal and monetary policy. But as the old Chiffon Margarine ads taught us way back when, it’s not nice to fool Mother Nature.

The first instance of cheating economic death came in 1986. Under normal economic rhythms, the timing was right for the economy to slow that year. And so it was in 1986 that economy growth began to fade. But instead of falling into recession, the fiscal and monetary policy makers managed to ease the economy into a “soft landing”. U.S. stocks celebrated and ramped higher into 1987. And we all know what happened by October of that year. Unfortunately, the ability of policy makers to “save the day” only emboldened them to up the ante going forward.

The next rhythmic disruption came in 1994. After lowering interest rates aggressively to reduce the depth of the 1990 recession, the Fed acted to ease inflationary pressures by tightening policy. But they were able to tighten slowly enough to avoid a recession. Unfortunately, what followed was the start of an epic market bubble where the S&P 500 posted back-to-back-to-back-to-back returns of +38% in 1995, +24% in 1996, +39% in 1997 and +42% in 1998.

The economy cheated death once again in 1998. A year following the outbreak of the Asian financial crisis, the recession threat was lapping up against U.S. shores following the Russian ruble crisis and the collapse of Long Term Capital Management. (Remember how a single hedge fundrequired a $3.6 billionbailout orchestrated by the Federal Reserve in order to save the global financial system? Quaint, right?). But once again policy makers intervened by lowering interest rates. And instead of the economy falling into recession, it stabilized. And what followed in the coming months was the full blown inflation of the technology bubble in into its final and most infamous stages.

A stock market heart attack finally ensues. By the turn of the millennium, the U.S. economy had skipped three of the past four recessions. And the excesses that built up and never cleansed out of the economy along the way started to boil over. The markets finally buckled, with stocks falling into their worst decline in a quarter century. And the economy soon followed into recession in 2001 with spillover effects lingering well into 2002.

Get on your feet and buy a house! But even after two decades with only one shallow recession leading up to this point, the magnitude of the economic contraction in 2001 was still relatively modest. This once again was thanks to exceptionally aggressive fiscal and monetary policy including interest rates that were locked near 1% for roughly three years from 2001 to 2004. Of course, what followed was a massive housing bubble with catastrophic consequences for the global economy.

Not so sudden near cardiac arrest. The Fed, after tightening policy for two years from the summer of 2004 to the summer of 2006, declared it was ceasing to raise rates further citing a pending slowdown in growth that would help diffuse mounting inflation pressures. The intent of policy was to try to achieve yet another economic soft landing. But by this point, the consequence of trying to prevent recessions and the economic excesses being cleansed from the system was on the brink of exploding. And so it did in now historic fashion starting in 2007 and culminating in the financial crisis of late 2008.

Paddles! Clear! Now on you go. Despite the economic pain so many have endured over the last few years, the outcome could have been vastly worse had it not been for unprecedentedly aggressive fiscal and monetary policy response. Indeed, the recession was severe, but it could have been worse. Unfortunately, by taking such decisive policy action yet again and not being able to resist keeping the economy on a heavy policy adrenaline rush in the years since, we set ourselves up for potentially an even bigger cardiac episode going forward.

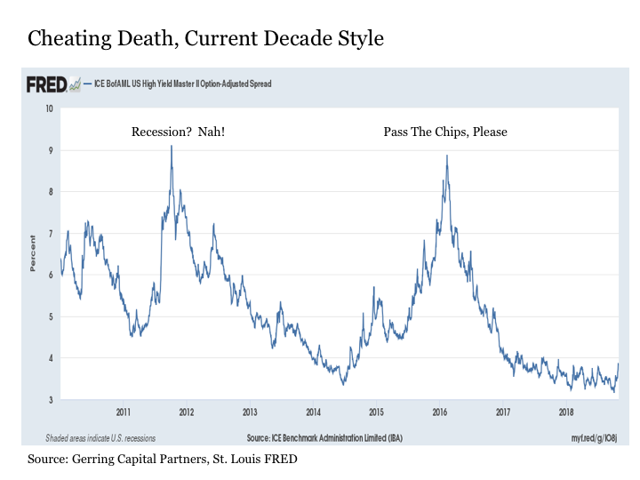

Missed treatment in 2012. According to the rhythm of the economy, after three years of economic expansion, we reached the point where it is time for another recession. And the stage was clearly set for such an outcome as we moved toward the summer of 2012. U.S. economic data was increasingly fading, Asian economies were slowing and Europe was descending into its own crisis. One of many indicators suggesting accumulating underlying economic stress was the sharp rise in high yield bond spreads into late 2011.

But policy makers once again simply could not help themselves, as they operation twisted and quantitative eased for the third time no less with a declaration of unlimited medicine in order to keep this economy afloat. Recession avoided (for the time being), further excesses accumulated.

Another missed treatment in 2016. Next up after skipping 2012 was 2016. And like clockwork, we were heading in that direction starting as early as the summer of 2014. Over the next 18 months into early 2016, oil prices fell by more than -75% and corporate earnings were falling by double digits. And see if you can find the signs of accumulating economic stress in the high yield bond market over this same time period in the chart from 2012 above. But did policy makers allow the economy to fall into recession? Sakes alive no! Instead, the Federal Reserve along with their global monetary policy compadres busted out the economic crash cart once again, postponing interest rate increases, and injecting another $6 trillion in monetary adrenaline into the global economy. Get up and keep running, U.S. economy, you’re OK!

So here we find ourselves in late 2018. After the global financial system almost died nearly a decade ago thanks in large part to policy makers thinking they could cheat economic death for nearly two decades prior, they wasted no time in getting right back to their old bad habits, having disrupted the rhythm of the last two economic recessions since. Awesome! I’m certain this will all end really well. Thanks Alan. Thanks Ben. Thanks Janet.

The stakes are rising for financial markets. With each successive effort by policy makers to try to smooth over recessions if not bypass them altogether, they have prevented the economy from cleansing itself. As a result, they are creating consequences that are becoming increasingly complex and more severe for the next time around once a recession finally arrives.

The economy will eventually cleanse itself whether policy makers like it or not. It would have been best to let the U.S. economy get on with it in 2012 and 2016 and let the economy recede, as it would have gone a long way in preventing unintended consequences and a more severe outcome down the road. But just as the heart attack victim should have cleaned up their diet and exercise habits many years before, we now find ourselves in that notorious spot of “coulda, shoulda, woulda”. Except that for many economic and market participants, the cries keep going out for “more, more, more”. When will we ever learn?

Stock market shortness of breath and chest discomfort. What we have been seeing first in January 2018 and now in October 2018 is not the end. Instead, it is the beginning of the beginning of what could turn out to be a very long road for stocks over the next decade. Historically high stock valuations with generally tepid underlying economic growth outside of a fleeting tax cut sugar high coupled with a growth dampening historically high debt-to-GDP ratio along with corporations also leveraged to the gills having spent the last many years gorging on the repurchases of their own stock. What is not to love about the stock market outlook heading into the 2020s?

Don’t be complacent. Stay calm, invest passively, and hold your stocks through whatever lies ahead? Stocks always rise in value over the long-term, right? Maybe. But ask stock investors from just about any other part of the world outside of the U.S. how that has worked out for them since. Let’s put it this way – most are still waiting more than one, two, three decades to get their money back, and this is despite the extraordinary measures by global central banks. What happens the next time around when this support has gone away?

Stock investing is not as easy as it has seemed in recent years. It is also important to remember the following almost always overlooked reality that underlies the U.S. stock market. Remove 21 years from stock market history – the 16-year period from 1950 to 1965 when the U.S. was the unrivaled economic superpower of the free world as the rest of the planet rebuilt itself from World War II, and the 5-year period from 1995 to 1999 during the manic rise of the tech bubble, and the U.S. stock market has provided investors with a real annualized rate of return of less than 2%.

You still have time. Now is the time to check the vital signs of your portfolio. The current correction will run its course and the stock market will eventually bounce. How high from here remains to be seen. Nonetheless, stick with passive investing only if you think that the Federal Reserve is both committed AND able to keep making the stock market rise after doing so for so many years with so little to show for it other than two (three?) epic financially destabilizing asset bubbles. Instead, consider where attractive long-term investment opportunities actually exist today and slowly shift your allocations accordingly. Just because the U.S. stock market as measured by the S&P 500 Index may fall into a bear market does not mean that opportunities are not abundant in capital markets. It may not be a great experience for the sleepy passive investor, but bear markets are often regarded as the best times for active management.

It’s not a matter of if at this point. Instead, it’s a matter of where. It’s not about standing on the sidelines and waiting for the next bear market to arrive. Nor is it about putting your S&P 500 Index fund into a drawer and forgetting about it (how do those Nikkei 225 Index circa 1989 or Shanghai Composite Index circa 2006 products look today?). Instead, its about positioning today for what may lie ahead in the immediate-term, short-term, intermediate-term, and long-term. And it’s also about having the patience to see today’s attractively valued opportunities through to fruition over time.

The next bear may be bad. But you can be better if you are ready.

0 comments:

Publicar un comentario