Goldman Wakes Up to 1MDB Reckoning

Shareholders are realizing that the fallout from the 1MDB scandal could be severe for Goldman Sachs

By Aaron Back

Goldman Chief Executive David Solomon said he was “personally outraged” at the conduct of some Goldman employees. Photo: david gray/Reuters

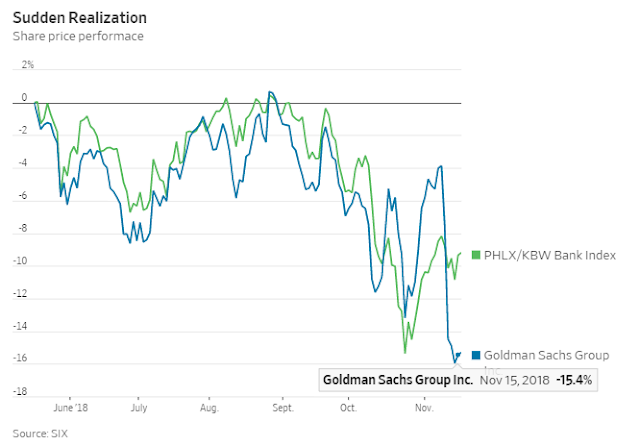

For the first time, investors are punishing Goldman Sachs GS -0.80%▲ for its role in one of the biggest financial scandals in history. They are right be concerned.

Goldman shares are down around 11% since news broke on Nov. 1 that a former partner pleaded guilty and another former Goldman employee was charged with helping steal money from a Malaysian government investment fund known as 1MDB and paying bribes to the country’s leader to help Goldman win more business. Another partner was cited in an indictment as an unnamed co-conspirator in the global scandal in which funds were looted from the fund through a network of dozens of banks and intermediaries in Asia, Europe and the Middle East. The employee charged couldn't be reached for comment.

In a letter to employees on Thursday, Goldman Chief Executive David Solomon said he was “personally outraged” at the conduct of the Goldman employees, and that they “violated the firm’s policies and procedures, and acted in conflict with all that we stand for.”

It is possible to make informed estimates of the ultimate cost to Goldman. Indeed, the firm’s shareholders have no choice but to start doing so.

The three implicated employees appear to have purposely misled the firm, but Goldman’s internal controls should have prevented that from happening. Goldman could face penalties for missing red flags and for the bribes paid by at least one of its employees.

In a note, Keefe, Bruyette & Woods analyst Brian Kleinhanzl cited four prior cases of big bank fines that he thinks are comparable.

HSBC was fined $1.9 billion by U.S. authorities in 2012 for failing to implement anti-money-laundering controls against drug cartels and sanctioned nations. The same year, Standard Chartered paid an initial fine to the U.S. of $667 million to settle allegations of sanctions breaches, including with Iranian companies. Both banks reached deferred prosecution agreements with the U.S. government.

By contrast BNP Paribasitself plead guilty to crimes for violating sanctions in 2014, and was fined a much higher $8.9 billion.

While every case is different, these precedents suggest a range of $1 billion to $2 billion is a reasonable expectation for Goldman’s potential penalties, according to Mr. Kleinhanzl. The firm already is under pressure from Malaysia’s new government to pay back the roughly $600 million of fees it earned from 1MDB.

Longer term, the reputational harm to Goldman may result in fewer mandates for business in Southeast Asia and from emerging-market sovereign and semi-sovereign issuers world-wide. Wells Fargo ’slong regulatory travails show how getting on U.S. regulators’ bad side can result in years of compliance headaches.

While none of this will be disastrous for Goldman, its share performance nonetheless is likely to lag peers until the ultimate costs become clear.

Goldman shares are still not cheap at around 1 times book value, compared to 1.09 times for rival Morgan Stanley. Investors should wait for further declines before going bargain hunting.

0 comments:

Publicar un comentario