Turning Point?

by: The Heisenberg

- The "divergence" narrative has gone mainstream, with even the Wall Street Journal running a feature piece documenting the historic disparity between U.S. stocks and the rest of the world.

- There are signs that September marked a turning point beyond which ex-U.S. assets, and EM particularly, should be due for a tactical bounce.

- Here's an in-depth breakdown of the arguments for and against the "convergence" trade complete with a table documenting the history of U.S.-EM divergences.

- There are signs that September marked a turning point beyond which ex-U.S. assets, and EM particularly, should be due for a tactical bounce.

- Here's an in-depth breakdown of the arguments for and against the "convergence" trade complete with a table documenting the history of U.S.-EM divergences.

You'd be forgiven for pondering whether now is an opportune time to buy the dip in emerging market assets and ex-U.S. assets more generally.

Even the Wall Street Journal has picked up on the "divergence" narrative. On Monday, the paper ran a feature story called "U.S. Stocks Widen Lead Over Rest of the World" the point of which is to highlight what I've been documenting for going on two months in these pages and elsewhere.

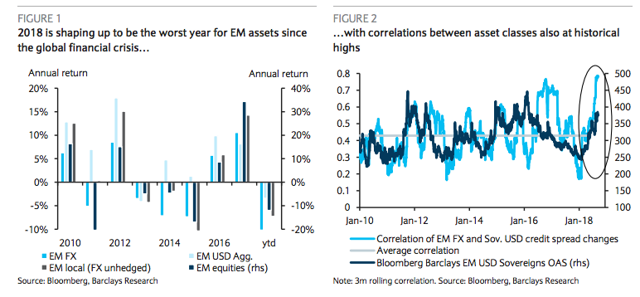

It's been a horrendous year for emerging markets (hereafter "EM"). Have a look:

While it was initially possible to argue that weakness in developing economy assets was primarily down to the effect idiosyncratic flareups (e.g., Turkey and Argentina) had on sentiment, it's become abundantly clear over the past six or so months that the proximate cause for the malaise is the Fed's tightening cycle.

Sure, country-specific risk is at play, but even if you want to suggest that sentiment wouldn't have turned so sour so quickly were it not for the collapse of the Argentine peso and Turkish lira, you run into a chicken-egg problem pretty quickly.

That is, was the combination of December's poorly communicated decision to up the inflation target and a couple of equally ill-advised policy rate cuts (in January) just too much for investors when it came to Argentina? And did market participants finally decide that enough is enough when it comes to Turkish President Recep Tayyip Erdogan's autocratic tendencies and unorthodox economic views?

Or were Argentina and Turkey simply the wobbliest dominos in an environment where the post-crisis dynamics that drove investors out of the risk curve in search of yield are reversing thanks to Fed tightening? Again, it's a bit of a chicken-egg dilemma.

Whatever the case, what's clear is that Jerome Powell was mistaken when he said the following at an IMF/SNB event back in May:

Monetary stimulus by the Fed and other advanced economies played a relatively limited role in the surge of capital flows to (emerging market economies) in recent years.

There is good reason to think that the normalization of monetary policy in advanced economies should continue to prove manageable for EMEs. Markets should not be surprised by our actions if the economy evolves in line with expectations.

Days after those comments were delivered, I wrote something for this platform called "Jerome Powell May Live To Regret These Statements." Here are some excerpts from that post:

The bottom line is that while there are signs that the EM pain may be short-lived, the problems in Turkey and Argentina aren't going to be resolved any time soon and it seems just as likely as not that the dollar will continue to be underpinned by higher rates in the U.S. and expectations of a more aggressive Fed.

My contention is that Jerome Powell will live to regret the statements excerpted here at the outset.

That was on May 13. Since then, the Turkish lira and the Argentine peso have collapsed and EM equities (EEM) as a group have fallen 11% and nearly 15% at the lows on September 11.

In the three months from the publication date on that article and the August highs, the broad dollar (UUP) was up more than 4%.

Fast forward to late September and the market was abuzz with talk of the "convergence" trade, something I've detailed both here and on my site at great length. The week before last, that trade worked exceptionally well, depending on how one wanted to express it.

At the heart of the convergence narrative is the idea that EM assets will play catch up to their U.S. counterparts through year-end. There are a number of arguments you can make in favor of that view, not the least of which is that the space is just plain old oversold. One might also argue that the scope of the dollar rally and commodities selloff simply isn't comparable to the 2014-2016 episode. That's one argument JPMorgan's Marko Kolanovic makes in his latest note.

Here's an excerpt:

Our view in favor of a rotation towards the RoW and EM is based on the premise that the global growth cycle is not over and that stresses in EM are much less severe than those leading into the 2015 crisis. Why is the current situation different? One can look at the scale of two important drivers of EM stress: USD and commodities.

In 2014-16, the USD rallied ~25%, which should be compared with a ~5% rally in the current episode. Being already near the top of the ~5-year range, there is a low probability the USD can go another 10% or 20% higher (e.g., Trump or the Fed would likely not allow it). Also if one looks at commodity prices, in 2014-16 they declined by ~45% vs. a more modest ~7% decline this year. So by these measures the current stress is five times smaller than what was experienced in the 2014-16 time period. However, we do acknowledge that interest rates are higher in the recent period. We agree that current EM fundamentals are worse than those of DM, but given the recent price action, EM could be the best-performing assets from now to the end of the year, and still be the worst-performing assets for the year.

I'll show you what Marko means. Here's a comparison of the 2014-2016 dollar rally versus the greenback gains since April:

And here's a visualization of Marko's point about weakness in commodities:

That comparison suggests the pain in EM is perhaps overdone.

On top of that, EM central bankers have done a fairly admirable job of trying to stay ahead of the game. A series of rate hikes from Turkey, Russia, Indonesia and Argentina suggest policymakers are acutely aware of the risks, but it’s by no means clear they’ll be able to stay out ahead of the storm with a December Fed hike baked in.

Consider, for instance, the following chart which shows the Indonesian rupiah plotted with Bank Indonesia's policy rate:

That's not a great sign. Indonesia has hiked five times since May to no avail when it comes to shielding the currency.

Meanwhile, there's trouble in India. If you aren't up to speed on recent turmoil in the previously buoyant Indian equity market, there's a quick primer here, but suffice to say it's yet another example of a "Fed-induced Tightening Tantrum" (to quote Nomura's Charlie McElligott). Have a look at this:

Still, September wasn't horrible for EM. In fact, following a truly harrowing first couple of days, developing nation currencies managed to recover and by the end of the month, logged their first monthly gain in six on MSCI's gauge:

Also, have a look at the following visual which plots the ratio of EM FX volatility to G7 FX volatility against the dollar:

That's an important chart. Simply put, it illustrates how critical it is for EM stability that the dollar take a breather for a while.

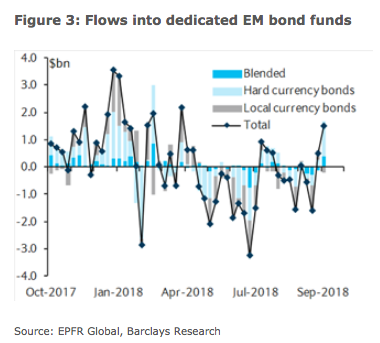

As far as flows go, it's worth noting that last week, EM-dedicated bond funds enjoyed their largest inflow since April:

(Barclays, EPFR)

(Barclays, EPFR)

In short, EM has a bit of an "it's always darkest before the dawn" feel to it right now.

But before you go "bargain" hunting, do note that nothing has really changed in terms of the factors that are weighing on the space. That is, the bull thesis seems very tactical rather than fundamental.

The Fed's tightening cycle isn't over yet, although it likely will be sometime next year. In the week through Tuesday, the net spec dollar long didn't budge ahead of the FOMC meeting and is still very stretched, suggesting some folks don't see a good reason to bet against the greenback just yet:

As long as the dollar and USD short rates are rising, there will be pressure on risk assets, including and especially EM.

So if you're planning on playing the "convergence" trade, you do want to exercise caution and understand the risks.

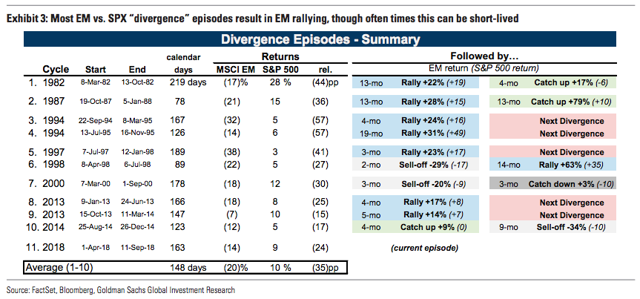

With that, I'll leave you with a brief excerpt and a great visual from a Goldman note out Sunday that documents the history of U.S.-EM divergences and details how those episodes ultimately played out:

A concrete take-away from the historical playbook is that divergence tends to result in EM rallying (8 of the 10 episodes). Half of these rallies are substantial in length (12 months or longer) and half are relatively short-lived (~4 months). The remaining 2 episodes of divergence resulted in both the S&P 500 and MSCI EM selling-off; in other words, there is no divergence episode that was resolved by S&P 500 immediately catching down to MSCI EM.

0 comments:

Publicar un comentario