A Reality Check for Retail

Slowing sales growth should make investors question the conventional wisdom that stores have figured out how to fend off Amazon

By Justin Lahart

Department store sales fell 1% in August after gaining 1.4% in July. Photo: Gabby Jones/Bloomberg News

About that retail revival. It might be less powerful than investors think.

Strong second-quarter results from many retailers bolstered the optimistic view that industry bulls have been spinning this year. Stores have finally started to figure out Amazon.com , AMZN -0.99%▲ developing clicks and mortar strategies that are helping them defend their turf against the online giant. It is part of why stocks of retailers have been among the year’s best performers.

But Friday’s retail sales report suggests that the third quarter might not be as rosy as the second. The Commerce Department reported that overall sales rose just 0.1% in August from a month earlier, after rising 0.7% in July. That was the slimmest gain since January, when sales declined.

The sales report hardly counts as a death knell for the American consumer, but it does suggest that the very strong retail sales figures from the three months ended in July, which coincides with the fiscal second quarter for most retailers, weren’t sustainable.

The details of the report reinforce this sense. Department store sales fell 1% in August after gaining 1.4% in July. Furniture and home-furnishing store sales fell 0.3% after a flat reading a month earlier. And apparel and accessory store sales slipped 1.7% after gaining 2.2%.

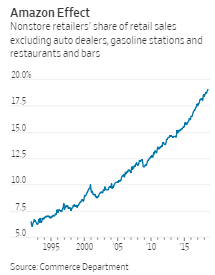

Online sales appear to have moderated as well. Nonstore retail sales—a category dominated by Amazon—increased by 0.7% in August, versus a July gain of 1.5%. Even so, nonstore retailers share of sales excluding auto dealers, gasoline stations and restaurants and bars climbed slightly to a record 19.1% from 19%. So Amazon is still making inroads.

And the competition among other retailers remains intense. Price surveys conducted by Wolfe Research analyst Scott Mushkin show that Walmarthas been aggressive on prices, holding them steady and in some cases reducing them. Thursday’s inflation report from the Labor Department showed that apparel prices slipped by 1.6% in August from a month earlier.

Anybody who thinks retailing suddenly became easy could be in for a big disappointment.

0 comments:

Publicar un comentario