Chris Vermeulen

Technical Traders Ltd.

PART I

Recent news of the US enacting $60 billion in economic tariffs on China as well as reactionary tactics from China have everyone spooked. The US stock markets and global markets tanked last week as this news hit the wires. At www.TheTechnicalTraders.com, we have been warning of a massive upside move in precious metals as well as global market concerns for the past 12+ months. Our recent research shows just how fragile the global markets are to external factors as well as strengths in the US and other established economies.

This multi-part special report will delve into the immediate and future risks that are associated with the fundamental and economic likelihoods of credit market contractions and economic rotations within the China, India, South East Asia markets in relation to recent news events.

We hope to clearly illustrate the opportunities and risks that will likely play out over the next 12 to 48+ months for investors and traders. Let’s start by trying to keep it simple with some very clear examples of what has transpired over the past 4 to 5 years and how we believe things will change in the near future.

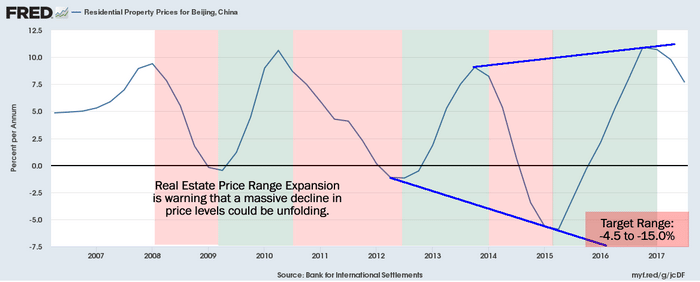

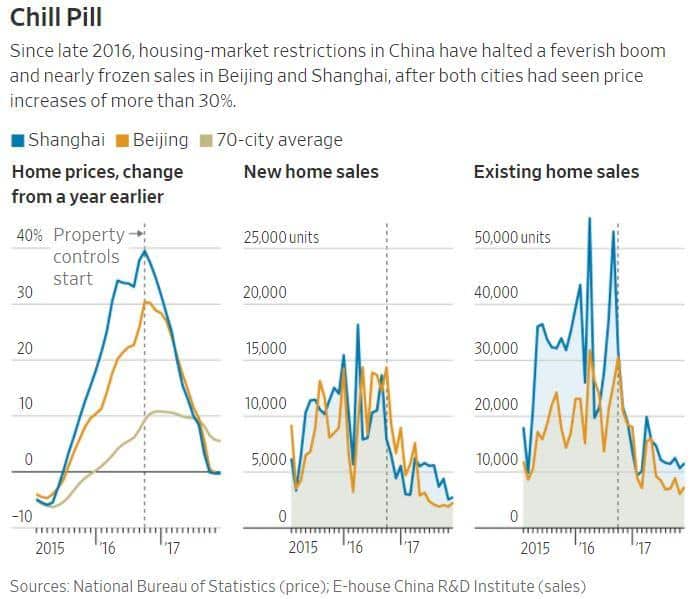

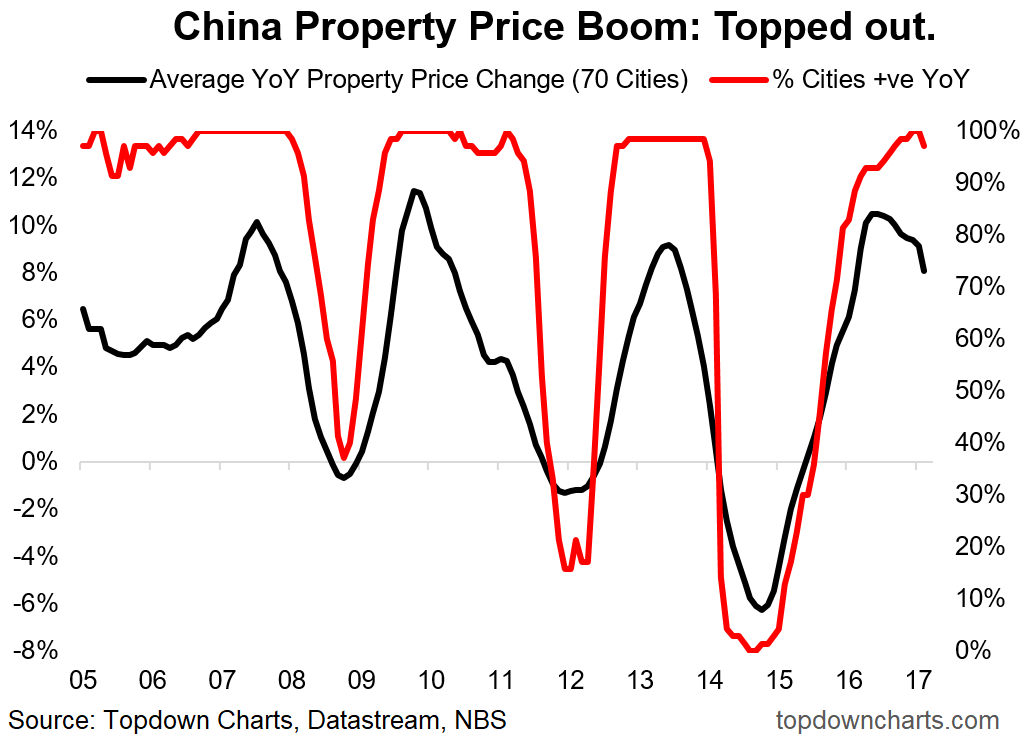

This chart of property price cycles (advancing price cycles vs. declining price cycles; highlighted for your convenience) in Beijing, China, clearly illustrates the expansion and contraction cycles experienced in the capital city/region of China. One can clearly see the expansion of the peaks vs. troughs as these price cycles have played out over the past 10 years.

What we find interesting about this chart is that the upper boundary appears to reside within the +8.5% or slightly greater expansion range, while the price contraction cycles continue to explore deeper and broader downside boundaries over this same range.

This leads one to consider the possibility that Real Estate prices and cycles in China may be much more speculative in nature than we may have considered in the past. It also points to the concept that the Global Credit Crisis (2008 through 2010) may have created a consumer mentality that wealth can be created by speculating on real property throughout these cycles.

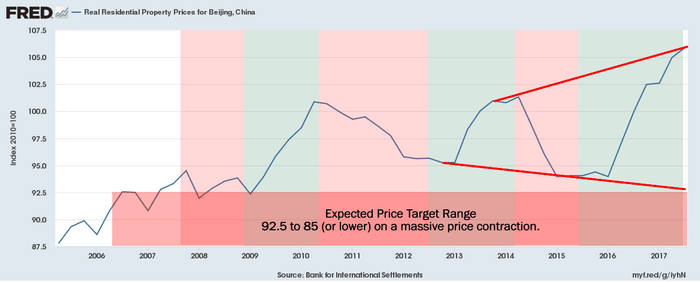

Additionally, we see some correlation to the real price valuations of Beijing property in the following chart. Any analyst can clearly see that prior to 2008, the rotational price levels were much narrower than after 2008 (roughly 2~3% in range vs. 7 to 15% in range). This volatility in pricing is one key factor that is leading us to our conclusion that the current downward price cycle (see the above chart) may lead to a substantially lower downside price target range in Beijing (and other areas of the world). Our analysis leads us to believe this early stage price rotation is an excellent opportunity for investors and traders to prepare for and begin to execute trades to attempt to profit from these events.

Recently, we posted an article regarding the massive increase in pre-foreclosures in most US metros.

Our intent was to illustrate just how dynamically this price cycle is changing and to highlight the potential for investors to be prepared for a move. Our current research into the potential for a China/Asia market implosion is based on the assumption that the past years of easy money, quantitative easing, support for property markets across the globe and massive support for an expansion cycle are nearing an end event. If our analysis is correct, this end event cycle will present incredible opportunities for smart investors by attempting to capitalize on early and middle stage market events.

PART TWO

In our previous article regarding the potential China/Asia Economic Implosion, we illustrated how the property market cycles in China (Beijing) are in the early stages of a potentially topping and a massive drop in value.

Today, we are going to try to expand on this analysis a bit further by illustrating how the US and other global established economies may have inadvertently setup certain emerging markets for another global crisis event. Our research team at Technical Traders Ltd. has developed a unique set of skills in sourcing and evaluating current market events and predictive price modeling systems that allow us to attempt to determine future events with relative certainty. Within this post, we will attempt to provide further evidence and supporting data as it relates to our belief that we are in a very late stage economic expansion cycle and about to enter a very early stage economic contraction cycle. As we continue to disclose our research and findings within this multi-part article, we will close this research out by explaining how and why we believe smart investors will be able to create massive opportunities over the next 12 to 48 months from our research.

Please review our previous research post (Part I) of this detailed research report before you continue reading if you have not already read it. It is important that you continue reading this post with the context of the previous research post. Thank you.

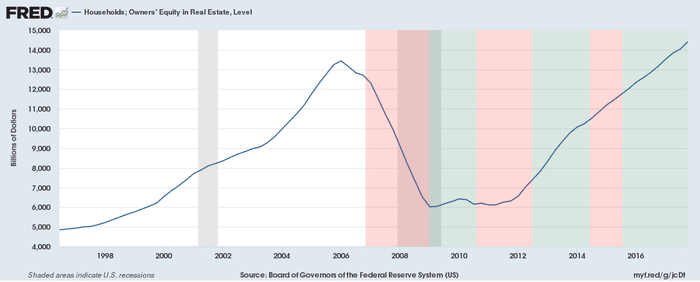

You should recall from our first post that we illustrated the expanding real estate cycle events in Beijing and how they related to a downside price cycle that appears to be in the very early stages of rotation. Today, we want to illustrate how the US market has been driving much of this expansion and speculation in China. Below, we have highlighted the same Beijing pricing cycles over a US Real Estate Equity chart. The point of this analysis is to clearly show that real price/equity expansion in the US market did not begin to occur until late 2012 and into early 2013. This was the time that real estate values in the US began an upward trajectory and real equity was being earned again. Prior to this, from roughly 2006 to the end of 2011, real estate price equity was declining or basing – with no real attrition or increase.

Now, if you open up Part I of this article in a separate window, you’ll see that the real price expansion in the Beijing real estate market also began in mid to late 2012 and peaked in 2014.

Our analysis and belief is that many Chinese investors were jumping into the US and global real estate markets at this time and that the increase in prices in Beijing assist them in diversifying assets across the globe by buying foreign assets. We believe this assumption is supported by the price decline in Beijing between mid-2014 through early 2016. We believe the previous price advance allowed Chinese investors to leverage their gains into outside/foreign assets while chasing the easy credit allowed by many foreign central banks.

It was also evident that many Chinese were moving capital outside China in an attempt to source new revenue growth. We believe this transition to outside assets was in full swing by 2013 to 2016 – when China finally started clamping down on capital flowing outside it boarders.

For your reference, here are a few resources to support our findings:

NYTimes : February 13, 2016: Chinese Start to Lose Confidence in Their Currency

The Strait Times: February 15, 2016: China’s rich move money our of country, joining capital exodus

The Wall Street Journal: December 2, 2016: China Clamps Down on Exodus of Cash

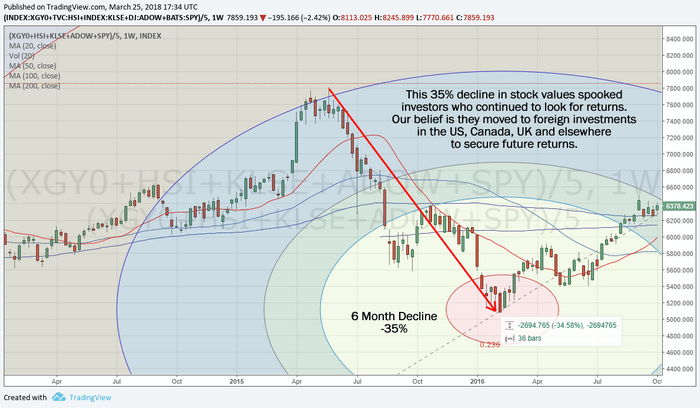

It is obvious from the data that Chinese investors and wealthy individuals were hungry for returns in an environment where their stock markets had recently declined more than 30% while their real estate markets were experiencing a multi-year price decline of well over 10%.

What were these people to do but find outside sources for returns and move their money into foreign investments that could allow for continued revenue growth. And what better place to move their money than the US and Canada – which were experiencing massive real estate price advances.

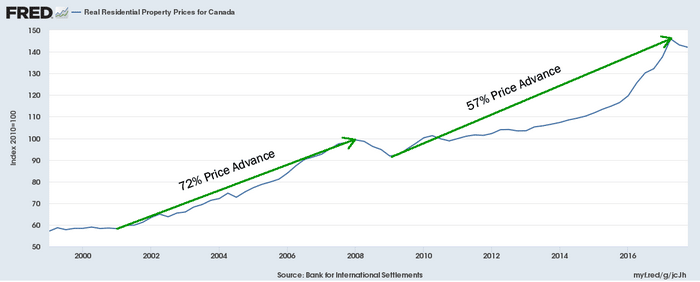

Take a look at this chart of the Canadian real estate price advances over the past 15 years.

Incredible.

But, think about this for a minute, now that many of the Chinese were investing in Chinese and foreign assets and property while at the same time investing in China ‘s shadow government, corporate and derivative investment schemes, what are they to do with all this capital tied up in markets that are nearing or entering a contraction phase? What is their exit plan and how can they move to the sidelines fast enough to avoid the risks associated with collapse?

This multi-part special report will delve into the immediate and future risks that are associated with the fundamental and economic likelihoods of credit market contractions and economic rotations within the China, India, South East Asia markets in relation to recent news events.

We hope to clearly illustrate the opportunities and risks that will likely play out over the next 12 to 48+ months for investors and traders. Let’s start by trying to keep it simple with some very clear examples of what has transpired over the past 4 to 5 years and how we believe things will change in the near future.

This chart of property price cycles (advancing price cycles vs. declining price cycles; highlighted for your convenience) in Beijing, China, clearly illustrates the expansion and contraction cycles experienced in the capital city/region of China. One can clearly see the expansion of the peaks vs. troughs as these price cycles have played out over the past 10 years.

What we find interesting about this chart is that the upper boundary appears to reside within the +8.5% or slightly greater expansion range, while the price contraction cycles continue to explore deeper and broader downside boundaries over this same range.

This leads one to consider the possibility that Real Estate prices and cycles in China may be much more speculative in nature than we may have considered in the past. It also points to the concept that the Global Credit Crisis (2008 through 2010) may have created a consumer mentality that wealth can be created by speculating on real property throughout these cycles.

Additionally, we see some correlation to the real price valuations of Beijing property in the following chart. Any analyst can clearly see that prior to 2008, the rotational price levels were much narrower than after 2008 (roughly 2~3% in range vs. 7 to 15% in range). This volatility in pricing is one key factor that is leading us to our conclusion that the current downward price cycle (see the above chart) may lead to a substantially lower downside price target range in Beijing (and other areas of the world). Our analysis leads us to believe this early stage price rotation is an excellent opportunity for investors and traders to prepare for and begin to execute trades to attempt to profit from these events.

Recently, we posted an article regarding the massive increase in pre-foreclosures in most US metros.

Our intent was to illustrate just how dynamically this price cycle is changing and to highlight the potential for investors to be prepared for a move. Our current research into the potential for a China/Asia market implosion is based on the assumption that the past years of easy money, quantitative easing, support for property markets across the globe and massive support for an expansion cycle are nearing an end event. If our analysis is correct, this end event cycle will present incredible opportunities for smart investors by attempting to capitalize on early and middle stage market events.

PART TWO

In our previous article regarding the potential China/Asia Economic Implosion, we illustrated how the property market cycles in China (Beijing) are in the early stages of a potentially topping and a massive drop in value.

Today, we are going to try to expand on this analysis a bit further by illustrating how the US and other global established economies may have inadvertently setup certain emerging markets for another global crisis event. Our research team at Technical Traders Ltd. has developed a unique set of skills in sourcing and evaluating current market events and predictive price modeling systems that allow us to attempt to determine future events with relative certainty. Within this post, we will attempt to provide further evidence and supporting data as it relates to our belief that we are in a very late stage economic expansion cycle and about to enter a very early stage economic contraction cycle. As we continue to disclose our research and findings within this multi-part article, we will close this research out by explaining how and why we believe smart investors will be able to create massive opportunities over the next 12 to 48 months from our research.

Please review our previous research post (Part I) of this detailed research report before you continue reading if you have not already read it. It is important that you continue reading this post with the context of the previous research post. Thank you.

You should recall from our first post that we illustrated the expanding real estate cycle events in Beijing and how they related to a downside price cycle that appears to be in the very early stages of rotation. Today, we want to illustrate how the US market has been driving much of this expansion and speculation in China. Below, we have highlighted the same Beijing pricing cycles over a US Real Estate Equity chart. The point of this analysis is to clearly show that real price/equity expansion in the US market did not begin to occur until late 2012 and into early 2013. This was the time that real estate values in the US began an upward trajectory and real equity was being earned again. Prior to this, from roughly 2006 to the end of 2011, real estate price equity was declining or basing – with no real attrition or increase.

Now, if you open up Part I of this article in a separate window, you’ll see that the real price expansion in the Beijing real estate market also began in mid to late 2012 and peaked in 2014.

Our analysis and belief is that many Chinese investors were jumping into the US and global real estate markets at this time and that the increase in prices in Beijing assist them in diversifying assets across the globe by buying foreign assets. We believe this assumption is supported by the price decline in Beijing between mid-2014 through early 2016. We believe the previous price advance allowed Chinese investors to leverage their gains into outside/foreign assets while chasing the easy credit allowed by many foreign central banks.

It was also evident that many Chinese were moving capital outside China in an attempt to source new revenue growth. We believe this transition to outside assets was in full swing by 2013 to 2016 – when China finally started clamping down on capital flowing outside it boarders.

For your reference, here are a few resources to support our findings:

NYTimes : February 13, 2016: Chinese Start to Lose Confidence in Their Currency

The Strait Times: February 15, 2016: China’s rich move money our of country, joining capital exodus

The Wall Street Journal: December 2, 2016: China Clamps Down on Exodus of Cash

It is obvious from the data that Chinese investors and wealthy individuals were hungry for returns in an environment where their stock markets had recently declined more than 30% while their real estate markets were experiencing a multi-year price decline of well over 10%.

What were these people to do but find outside sources for returns and move their money into foreign investments that could allow for continued revenue growth. And what better place to move their money than the US and Canada – which were experiencing massive real estate price advances.

Take a look at this chart of the Canadian real estate price advances over the past 15 years.

Incredible.

But, think about this for a minute, now that many of the Chinese were investing in Chinese and foreign assets and property while at the same time investing in China ‘s shadow government, corporate and derivative investment schemes, what are they to do with all this capital tied up in markets that are nearing or entering a contraction phase? What is their exit plan and how can they move to the sidelines fast enough to avoid the risks associated with collapse?

Thank you for following our multi-part research (Part I, Part II) into the possibility of a China/Asia market collapse and our hypothetical analysis of what that event might consist of and how it may play out. So far, we have discussed the Chinese housing market rotation as well as the recent trends within the past 7+ years, expansion and foreign investments made by many Chinese and successful Asian investors. All of this research raises some interesting questions for us to consider.

- Just how much risk exposure have these Asian/Chinese investors set themselves up with?

- How tightly are the assets in China/Asia associated with equity/debt that was used to explore foreign investments and additional debt?How varied and deep do these “debt rabbit holes” go in terms of derivative assets, layered debt and more?

- How has the expansion of credit/debt in China expanded out into other foreign markets?

- How has the US and other central bank easing policies fostered a risk-taking role in Asia over the past 7+ years?

What would it take for China/Asia to move from an investments/risk-taker mode to a protectionist/crisis mode?

One of the first things we need to consider is the expansion of credit that originated after the global market credit crisis (2008 to 2010) was still evident in China and Asia – although not quite as deep in form and structure as it was in the US, Canada, Europe and others. Our previous research reports show that China’s property market and equities markets were not subject to the types of deep declines the US and other established economies experienced. This was likely because China, at the time, was still experiencing a middle stage economic expansion period where China could continue to fund and export enough raw and finished materials to keep their economy running at 6%+ without much issue. Of course, after 2015~2016, China was able to accomplish this by devaluing their currency, expending billions in reserves to build and product excess cities and finished material as well as foster and finance hundreds of large-scale projects throughout the globe (Africa, Europe, Asia, Mexico and South America).

In other words, the growth that China is experiencing is almost a shadow of the real growth because it has been enacted by shadow banking, shadow debt and leveraged expenses based on reserves while decreasing the Yuan valuation in order to maintain this economic shell game. As long as their markets don’t contract more than a certain amount and investors are able to continue rolling their capital into this shadow banking system without any fear – nothing will likely change. But when it does change, it should be very dramatic and quick.

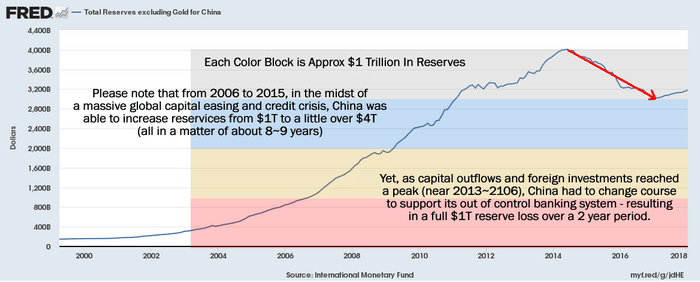

Recent Chinese economic expansion has been partly a result of renewed global economic activity as well as the capacity of the Chinese government to use capital reserves to support their economic transition process – as evident by the $1 trillion in capital reserves that vanished between 2015 and 2017.

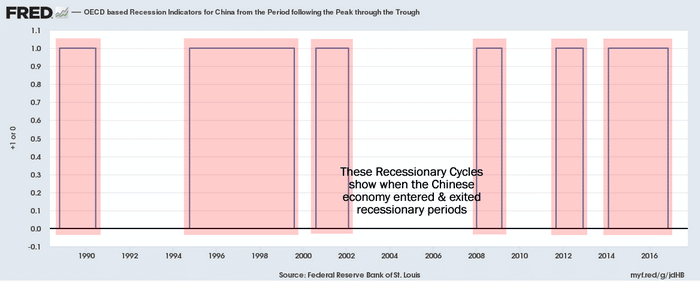

When one considers the recessionary economic cycles chart, above, as well as the US Presidential election cycle, one could explain this contraction as a general global contraction in relation to the uncertainty of a US election. Yet, the size and scope of the capital reserve decline (over $1 trillion) within the scope of an expanding global economy, as well as expanded investment projects within China, means only one outcome could result in this reserve decline – reserves were used to support banking and finance facilities in an effort to avoid a collapse of credit/debt mechanisms.

These are tell-tale signs that the Chinese, and likely other Asian/Indian countries, are trapped in an expansive credit/debt environment that is likely very similar to what happened in the US/UK to set off the 2008~2010 global credit crisis. The only difference this time is that it appears to be the Chinese have run themselves into this debt trap and the fragility of their economic footing is showing signs of cracking.

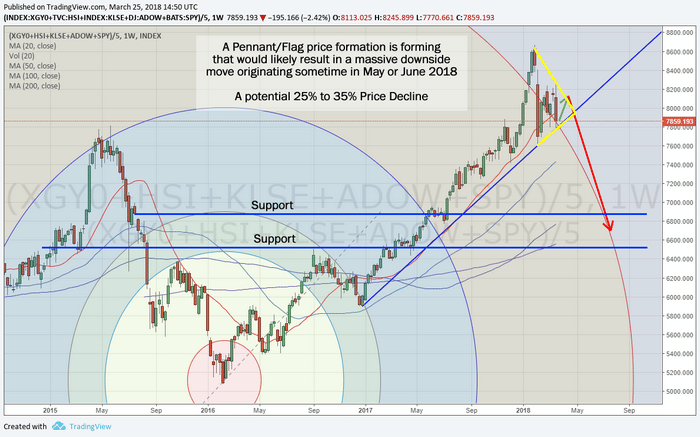

What would it take to cause the floor to crumble under the Chinese/Asian economies?

A deep (-32%) price correction occurred between 2015 and early 2016 that coincides with the reserve decrease as well as the property market price decline. As our research shows, this also coincides with a mass exodus of capital from within China to outside sources (USA, Canada, UK and elsewhere). If a decline of this nature in equities that was also associated with a property price decline resulted in a $1 trillion decline in China’s reserves, think about the potential chaos that could be associated with a new property price decline associated with an equity market decline.

PART FOUR

Our previous three segments of this research report detailed not only the history of the Chinese economic activity but also detailed some of the capital flow issues that have been active in presenting this unique instance in time as it relates to a potential implosion of economic activity in China and most of Asia. We, the research team at Technical Traders Ltd., have attempted to clearly illustrate all of the components and facets that have existed to make up a very unique scenario where traders may be able to experience a once or twice in a lifetime trade that could result in massive returns.

Within our previous posts, we attempted to disclose what we believe to be one of the most critical and potentially damaging economic events in our future. We urge all readers to review (Part I, Part II, Part III) of this multi-part research report to bring everyone up to speed with our thinking. Please take a moment to our earlier posts before continuing.

In this section, we are going to explore the ongoing relationship between debt levels, shadow economic functions, global equity price levels and global economic activity all coincide at this very unique time to present a potentially massive and unprecedented event in human history – a massive economic collapse across dozens of nations and resulting in a potentially cataclysmic economic outcome. We are certain you might be asking, “how could this happen again?”.

Well, in some ways the recovery process in the US, Europe and other areas could have prompted a very unique and dangerous setup in China, India and the general Asian region.

Why are these areas uniquely at risk?

The reason is because China has become a major economic driving force in the region and has become responsible for much of the areas economic advancement. This has been the case since the late 1990s.

In the previous section, we hinted that a downturn in the Chinese property market between 2015 till 2016 in combination with an equity price decline in excess of -15% to -20% and an outflow of capital from the Chinese economy resulting in a massive, $1 trillion, decrease in the Chinese capital reserves. How could something like this result in a total of $1 trillion in reserves to be depleted? The answer is that pressures on the economy at that time resulted in a number of general and corporate debt failures that, if left alone, would have pressured the entire Chinese financial/banking system into a possible crisis. Therefore, the Chinese had to make the problem go away and they did this by diving into their reserves to wash away the debt issues while continuing to prop up their economies and banking institutes. This $1 trillion reserve decrease was the “patch” that was needed to make sure the economic collapse was averted.

We have been watching the news and related investment research for years attempting to stay on top of these moves and keep our members aware of the potential for a market correction/reversal. Part of our research is now warning us that we need to begin to prepare for the eventual crumbling of the economic footing of the global markets and we believe China/Asia will play a massive role in the next big move.

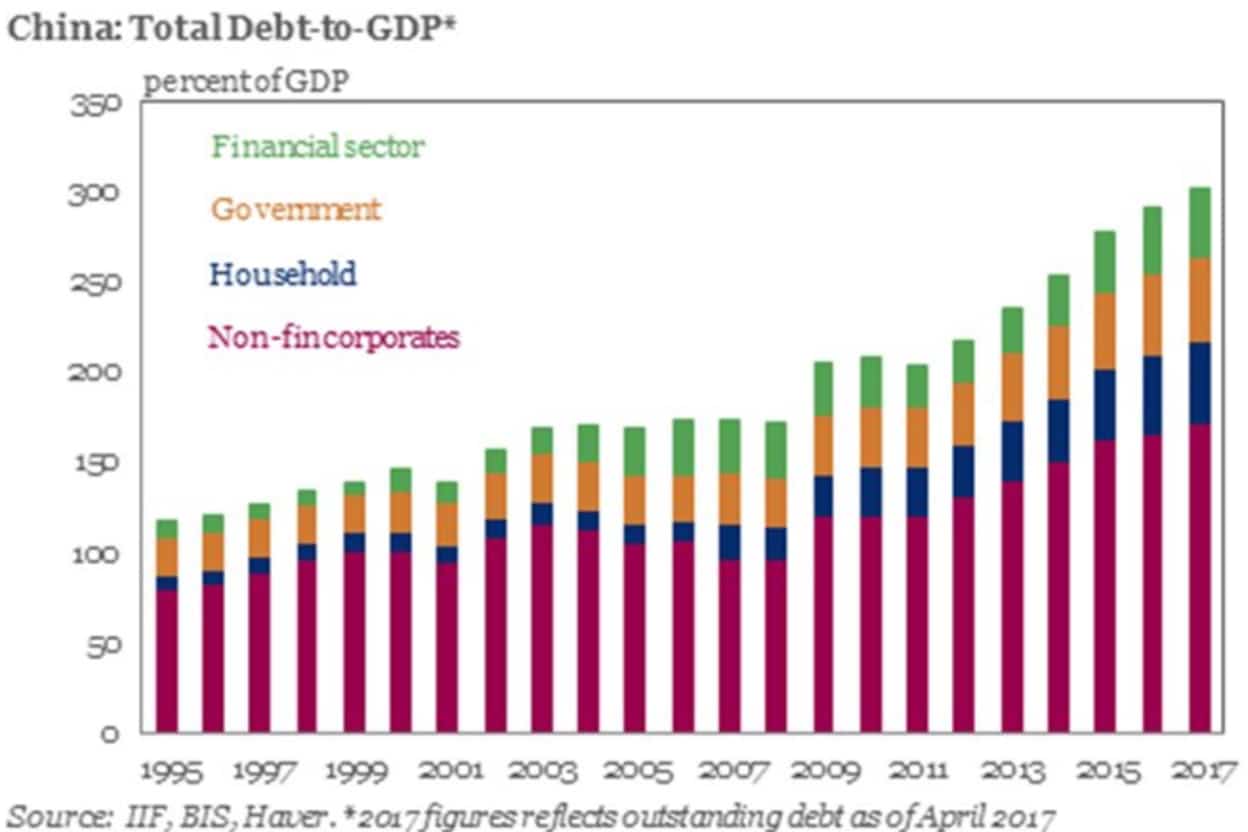

Chinese debt to GDP is massive compared to the US or other developed nations.

And China’s debt just keeps rising…

By our estimates, the current Chinese debt to GDP levels have increased by nearly 100% (to somewhere above 350% of total annual GDP. Additionally, current levels are well in excess of 200% to 300% of levels found near 2005 to 2007. If we consider 2014 levels alone, the time just before the massive $1 trillion reserve decrease, debt levels today are nearly 45% larger than debt levels in 2014. Therefore, the fragility of the Chinese economy in terms of debt constrictions related to any proposed property market price rotation and/or any capital/equity market price correction, particularly if they happen at the same time (like before), could present a very unique collapse event. It is our opinion that the current debt levels make the fragility of the Chinese economy even more sensitive to property market and/or equity market disruptions.

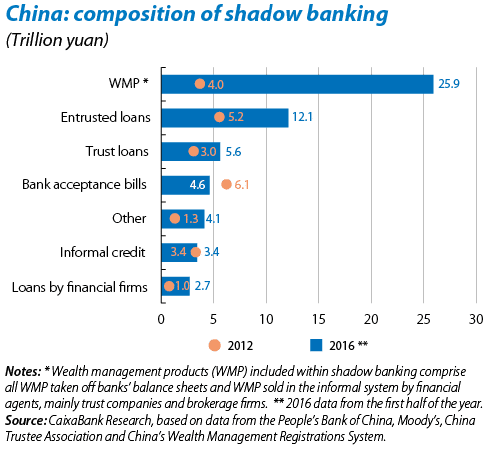

China’s shadow banking, particularly WMP (Wealth Management Products), Entrusted, Trust and loans by Financial Firms present a huge issue in regards to stability of the Chinese credit markets. Over 4~5 short years, over $30 Trillion Yuan in these types of loans have been originated – a massive 400% increase on average. The individual component levels range from a 100% increase to well over 650% increase.

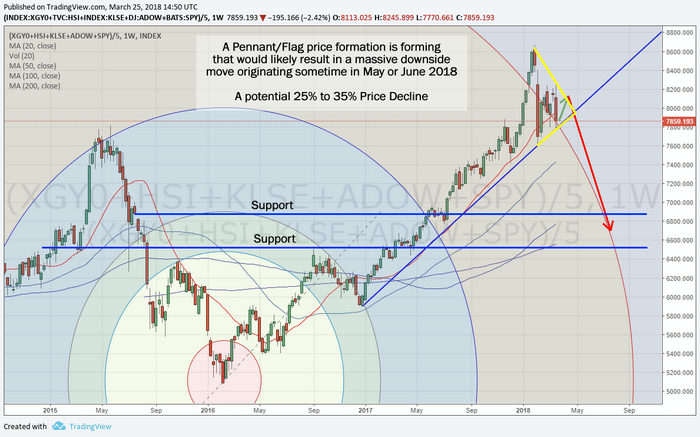

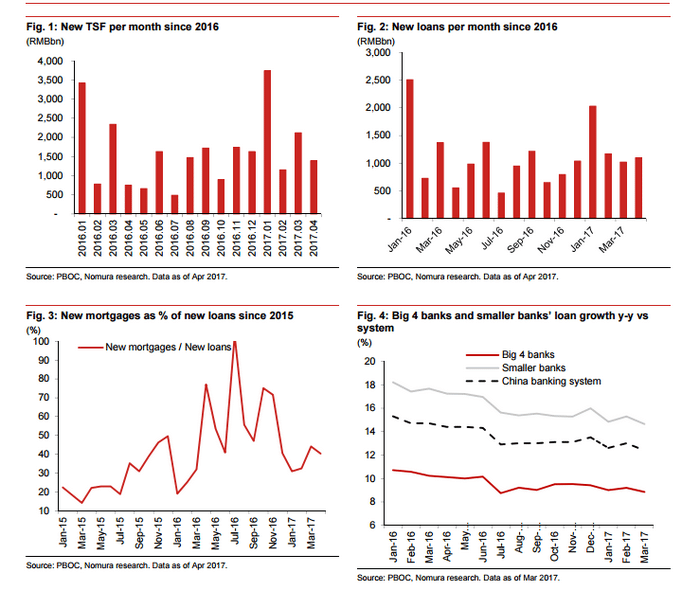

Remember, these financial (credit) instruments are rooted in the projections that borrowers have the ability and capability to repay these loans, or that the projects they back will result in substantial real value at some point. The loan origination data, below, shows a decent increase just after the US Presidential elections and we are certain this recent rally in the US and global markets has eased some pressure away from the Chinese and other Asian markets. Yet, the recent price rotation (February and March 2018) could be “just enough” to crush the floor in the Chinese/Asian markets waiting for that last pin drop to start the crumbling process.

It is our belief that any contraction in any single market, Chinese property, Chinese equities or Chinese debt could likely be contained as long as the contraction range is less than 15~25% from the most recent highest valuation points. Our range of 15~25% is just that, a range that should be considered extremely dangerous for the Chinese and Asian markets. Should two or more of these market react in a similar manner, decreasing by 15~25% over an extended 12~24 month period, we believe the pressures of this type of move could be catastrophic for China and parts of Asia. The simple fact that two, or more, capital markets that experience this type of valuation decline would likely put an additional $1 to $2.5 trillion (or more) in reserve pressure on the Chinese and local markets.

Additionally, this type of valuation pressure would likely result in liquidations of foreign assets at near fire-sale prices to move these asset into cash as quickly as possible. This type of market action is called a “death spiral” for a reason. As panicked sellers dump assets to get into cash, they are driving the property and equity valuations even lower in the process – causing others to become panicked sellers and perpetuating the cycle. A death spiral event is one that sparks up overnight, causes runs on banks as people try to get as much cash as possible and causes wildly unreasonable price valuations simply because people are desperate to unload assets that could destroy their balance sheets. It is better to sell it for X than to hold onto it and watch it destroy any existing capital I may currently have.

Now that we’ve gone through quite a bit of detail in describing what could happen, allow us to go into just a bit more detail with our next article showing the current equity markets and the current property markets in these regions in addition to more of our predictions.

PART FIVE

As we, the research team at www.TheTechnicalTraders.com, continue to deliver sections of this multiple part global market research report centered around China and Asia as a catalyst for an impending global market/debt collapse, we want to make sure our readers understand this process will likely play out over many months into the future. This is not something that we should concern ourselves with right away. This is not a warning that “the sky is falling and we need to run to our bunkers”. This is forward-looking research that indicates a strong possibility that China and Asia, along with many other nations in this region, may experience a credit/debt market contraction that could lead to another global credit crisis and we need to be aware of it and plan to profit from it. (Part I, Part II, Part III, Part IV)

So far, we have covered the history of Chinese property and equity market growth from before the 2008-2010 global credit crisis till now and have clearly shown that the Chinese property market is rolling over (downward) after the 2016 regulations were put into place to curtail the mass exodus of capital from within China. We have also gone over many of the correlative economic items that point to the fact that a 15~25% correction in any one market segment, property, equity, credit/debt or global markets that result in capital risks for China, could drive a contagion effect for the Chinese investors/government. In other words, a simple 10~20% price decline in two or more of these markets could put enough pressure on the Chinese that capital reserves could diminish dramatically as well as some level of investor panic could set in to drive a “death spiral” type of event.

Even today, our researchers visited the National Bureau of Statistics in China to continue our research and found the following :

Whereas growth rate of purchases (land), commercial sales and floor space sales and growth rate of fund for development have decreased dramatically just over the past 3+ months. When you look at this data on a year over year context, it shows mild contraction up until December 2017. After December 2017, the contraction in Residential and Commercial real estate activity is dramatic – almost frightening.

Throughout all of 2017, the Growth Rate of Investment in Real Estate Development averaged near 8.1%. Beginning in early 2018, this level shot up to 9.9% – the highest level in over 13 months.

Growth of Land Area Purchased over the same period showed signs of increase over 2017 – averaging near 11.2% or so throughout 2017. The values of this indicator near the end of 2017 were above 15%.. Whereas the 2018 levels show a -1.2% growth rate. In one month span, the level of this indicator fell -17%?

The Growth Rate of Floor Space and Sales of Commercial Buildings continued to decline throughout most of 2017. Starting near 25~26% and ending the year near 10% – a -15% decrease. What we found very interesting is that Sales of Commercial Buildings increased 1.6% in early 2018 while Floor Space sold decreased 3.6%. It would appear the Chinese central bank is willing to lend to property buyers while floor space buyers are falling off the map.

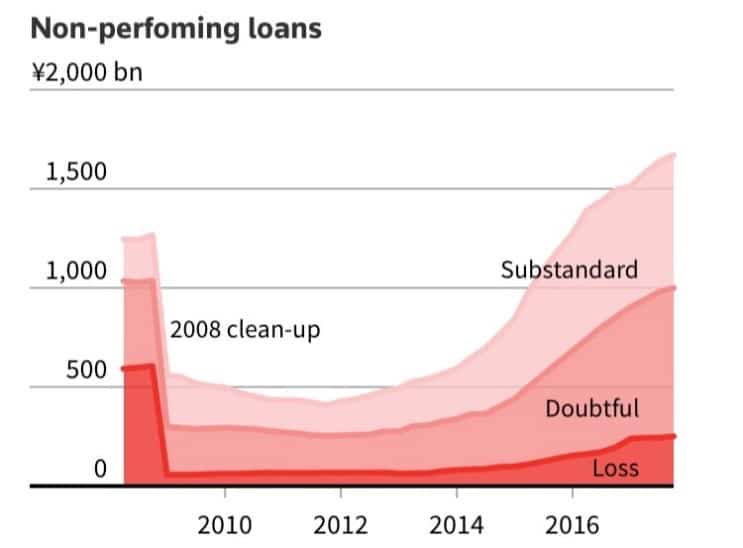

Our primary concern with regards to any type of Chinese or Asian credit market collapse is that the recent 5 to 7+ years of outward capital expansion, expanding investments outside of China/Asia in support of lofty objectives and fuzzy real/return values, may have prompted a massive sub-standard debt issue that could become very dangerous for the world. We’ve all been reading of the issues of Non-performing assets and loans in China recently. These types of credit/debt are the same types of instruments that led to the 2008~2010 global credit crisis.

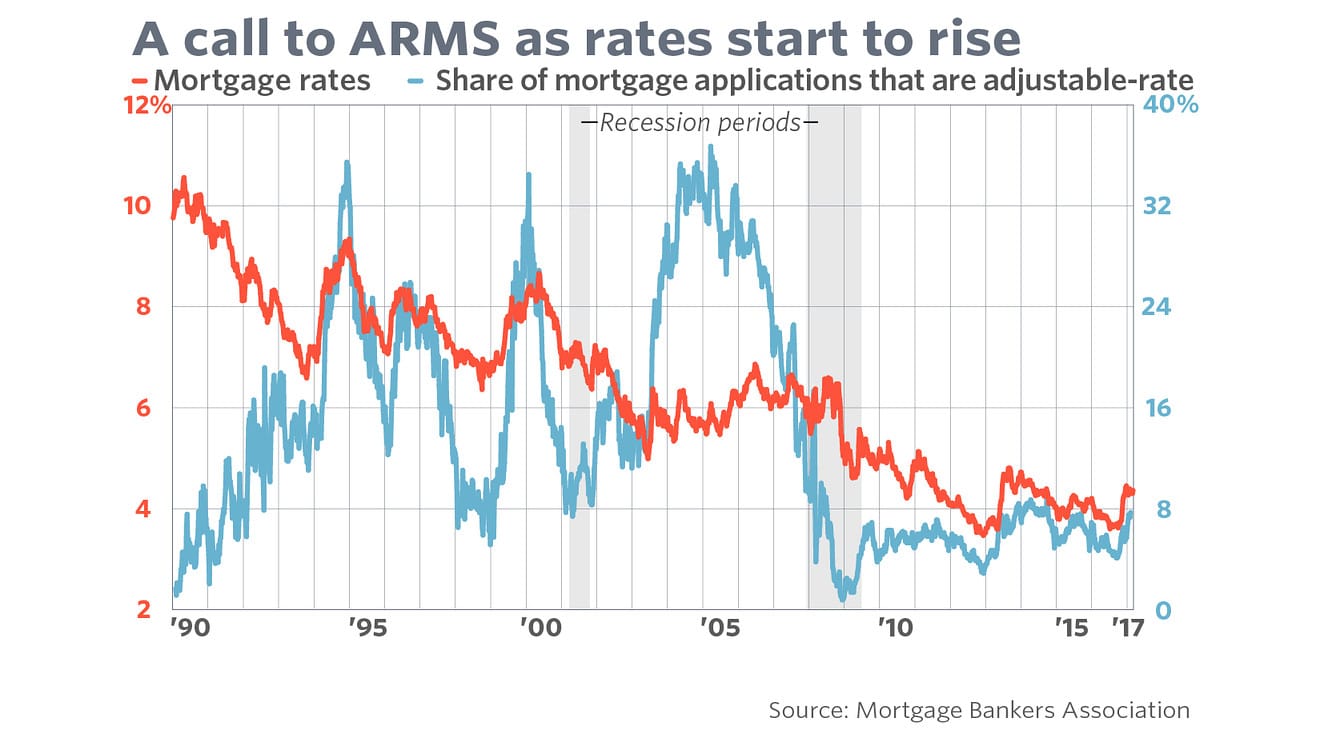

Imagine the Chinese economy as both a local organism (contained to only the China/Asia general region), but also as an international organism (depending on external sources for essential life sustaining components – like the US and UK for purchases and the other emerging markets for growth projects). Now, imagine these external sources experience an extended 10~35% general asset decrease over a period of 3~5+ years while the US Federal Reserve, and other central banks, tighten the credit markets and push up borrowing costs. If China is dependent on these outside sources for essential economic sustaining components, then the economic balance they depend upon could become threatened – if not even more fragile than we have already examined.

Yet, consider one additional component of this hypothetical exercise. Consider that the Chinese property and equity markets experience a moderate contraction event (say 10~20+% lower over 2~3 years) while the US and other established economies continue to push up the borrowing costs with rising interest rates. We have long believed that capital migrates into the most healthy and opportunistic environments, with ease, and as capital migrates to new sources of returns, it leaves deteriorating economies in a “death spiral” for a period of time. Capital that is unable to quickly move to new opportunistic sources may become trapped in these contracting economies for many years or decades.

The signs of this hypothetical economic exercise are already starting to become evident. Recent China housing market data shows an incredible decline in activity and pricing – about to fall into negative territory.

China’s property market cycles have topped out as well, indicating a strong potential for further contraction in the real value of property assets.

Combine this with a global central bank tightening and recently announced US/China tariffs and economic positioning and we have the making of another Global Crisis event – this time originating in China/Asia as the Chinese Dragon economy bursts.

As US mortgage rates continue to climb above 5%, the inevitable economic tightening across the US and globe will continue. The attempt to move China away from a US Dollar based economy and become more focused on the Chinese Yuan will, in our opinion, be a difficult transition over many decades. We believe the Chinese/Asian markets are on the cusp of a potentially dramatic collapse and the recent news of US and Chinese tariffs do nothing more than exasperate the current issues. Pay very close attention to the surrounding Asian markets as we continue to watch for breakdown events.

As US mortgage rates continue to climb above 5%, the inevitable economic tightening across the US and globe will continue. The attempt to move China away from a US Dollar based economy and become more focused on the Chinese Yuan will, in our opinion, be a difficult transition over many decades. We believe the Chinese/Asian markets are on the cusp of a potentially dramatic collapse and the recent news of US and Chinese tariffs do nothing more than exasperate the current issues. Pay very close attention to the surrounding Asian markets as we continue to watch for breakdown events.

In the next, and last, portion of this series, we will attempt to present our final conclusions and expectations for traders and investors. We have attempted to clearly illustrate our detailed China/Asia market research and the potential for a dramatic price decline in the immediate future. We’ve outlined how this incredible opportunity for investors was setup, almost perfectly, by the global recovery efforts after the 2008-09 credit crisis. At this point, it would appear the Chinese Dragon economy is on its last leg and we are well positioned to take advantage of the next big move.

0 comments:

Publicar un comentario