Italian election results expose eurozone inadequacy

Until prosperity is better distributed, Europe will remain vulnerable to upheaval

Martin Wolf

The election results in Italy are a lesson to Europe. Italians were once among the most enthusiastic supporters of the European project. This is true no longer. The combination of economic malaise with political impotence has discredited not only Italy’s political and policymaking elite, but even the country’s engagement with the EU.

This does not mean Italy will leave; the costs would be too great. It means instead that the threat of both friction between Italy and the European establishment and further financial and economic disruption is now far greater.

The election results are quite as shocking as the Brexit referendum and the election of Donald Trump in the US: 55 per cent of the voters chose Eurosceptic and anti-establishment parties.

The Five Star Movement — an amorphous party of protest — gained 32 per cent of the vote and the League — a rightwing nationalist party — gained 18 per cent. The share of the centre-left Democratic party, in which the European establishment had put its trust, tumbled from 41 per cent four years ago to 19 per cent. The share of Silvio Berlusconi’s Forza Italia fell to 14 per cent. The populist revolution devours its parent.

Why are Italian voters so disenchanted? The obvious answers are that economic performance has been so dismal, while established Italian policymakers appear so ineffective. This is certainly not only — probably not even mainly — due to Italy’s participation in the euro. But the eurozone has made things worse. Not least, it offers an external scapegoat, which unscrupulous politicians are happy to exploit. Blaming foreigners is always an attractive strategy. In a failing country with a frustrated population, it is irresistible.

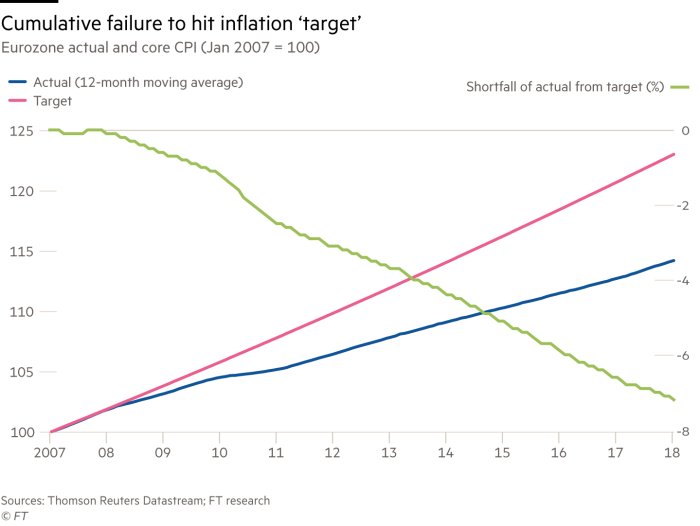

One aspect of the eurozone has been the inadequacy of its overall macroeconomic policy. In January 2018, the consumer price index of the eurozone (excluding erratic items) was 7.2 per cent lower than it would have been had it risen at an annual rate of 1.9 per cent since January 2007 — a rate of inflation that is a reasonable interpretation of the European Central Bank’s objective of “inflation rates below, but close to, 2 per cent over the medium term”.

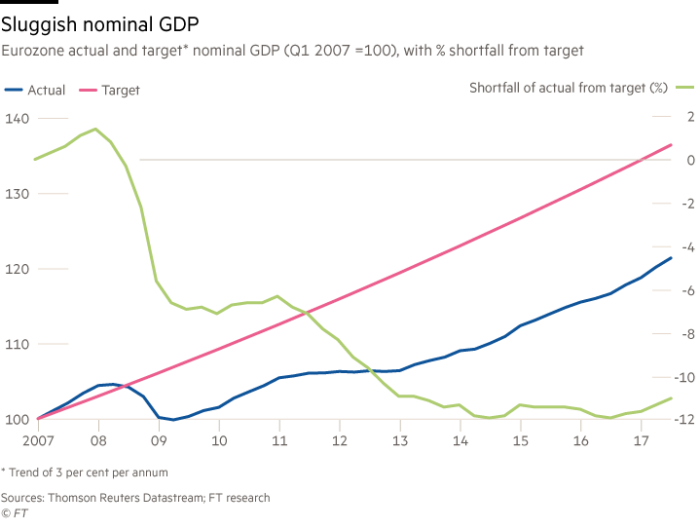

An alternative assessment of macroeconomic policy is in terms of the growth of nominal gross domestic product. By the third quarter of 2017, eurozone nominal GDP was 11 per cent lower than it would have been had it grown at an annual rate of 3 per cent since early 2007 — a rate that would have been consistent with annual real growth of around 1 per cent and inflation of 2 per cent. Under Mario Draghi, the ECB did act successfully in the end. Yet overall macroeconomic policy has clearly been inadequate. It failed to deliver adequate growth in overall aggregate demand (see charts).

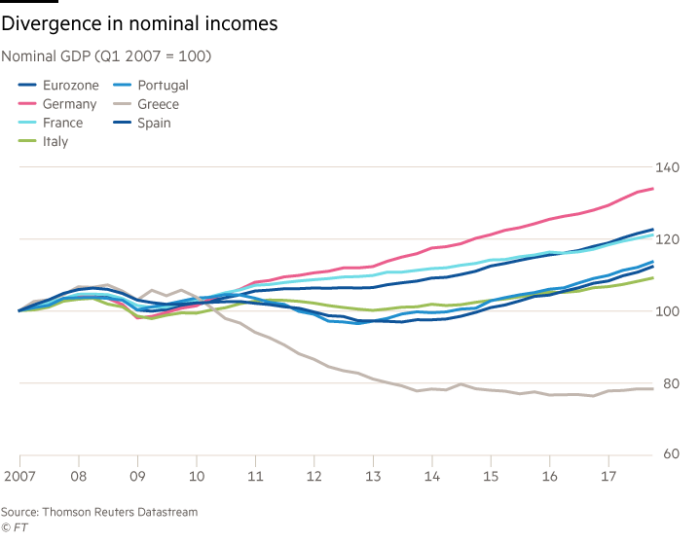

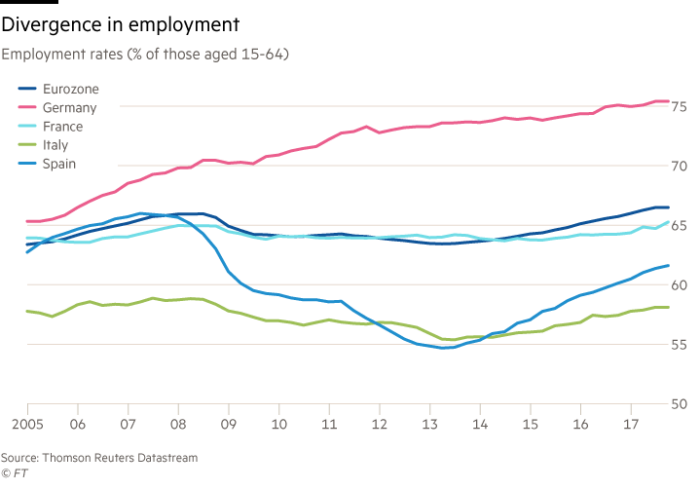

Within this weak macroeconomic environment, huge divergences also opened up among individual member countries. Germany’s nominal GDP rose by 34 per cent between the first quarter of 2007 and the last quarter of 2017 (a compound average annual rate of 2.7 per cent).

Italy’s rose by a mere 9 per cent over the same period (a compound average annual rate of 0.8 per cent).

Not surprisingly, given modest overall growth of nominal GDP, even Germany’s core annual inflation averaged a little over 1 per cent. Such low inflation in the core creditor country made adjustments in competitiveness within the eurozone far more difficult.

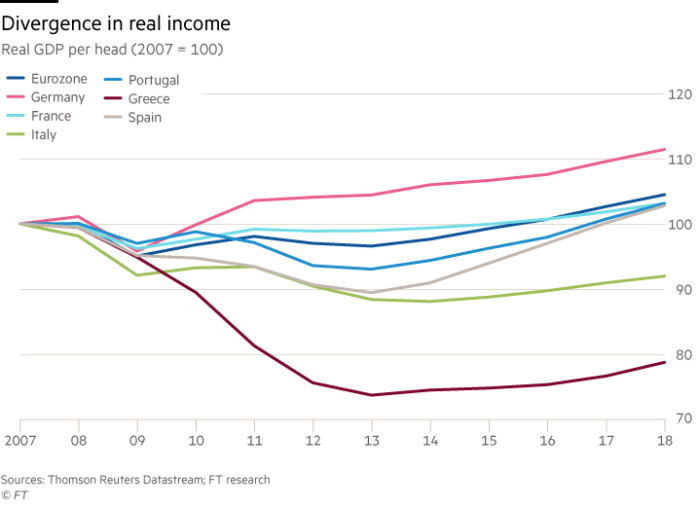

If the Italian government had been able to pursue its traditional policy of devaluation and inflation, it could have generated a far stronger rise in nominal GDP. That would surely also have delivered higher levels of real output. Italy’s real GDP in the last quarter of 2017 was, instead, 5 per cent below its level in the first quarter of 2007, while its real GDP per head was still some 9 per cent below the 2007 level a full decade later. No wonder Italians are disillusioned.

No doubt, Italy has huge structural economic problems, which tightly constrain growth, but potential output cannot have fallen this much since 2007. Italy also suffers from chronically deficient demand, a failing that the eurozone, as it is now run, is simply unable to remedy. This is partly because overall demand has been too weak and partly because, within the rules, demand cannot be directed to where it is weakest.

A prolonged recession, with high unemployment and low employment has inescapable political consequences. But the biggest frustration may be that the people Italians vote for have next to no room for manoeuvre. The question has rather been whom to elect (or sometimes not even elect) to carry out the policies decided in Brussels and Berlin. Why not vote for a clown or a party created by a clown? It might not make much difference to what happens in Italy, but it might at least be more amusing. Some Italian economists now argue that the country could obtain a degree of macroeconomic policy freedom by issuing what is known as “fiscal money” — a parallel currency that could be used to pay Italian taxes.

This is technically possible. It would surely create hysteria in northern Europe, since it would eliminate the monetary policy monopoly of the ECB. But the very fact that such a radical idea is being discussed demonstrates the scale of the disenchantment in so large and important a country.

Unless and until the eurozone is able to generate widely-shared prosperity, it remains vulnerable to political upheaval. Weaknesses of the system, plus the impotence of democratic politics at the only level that really counts (the national one) remains a recipe for populism and fragility.

Italy, as many remark, is too big to fail and too big to bail. But its voters have moved from europhilia to scepticism. Like it or not, the risks of further upheaval are big.

0 comments:

Publicar un comentario