The Davos Warnings

by: Lance Roberts

The Melt-up Continues

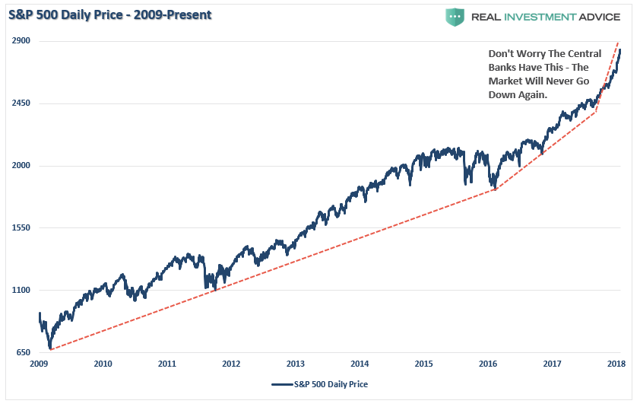

Since the beginning of the year, the acceleration in the markets has continued unabated. As I showed yesterday, the acceleration in the S&P 500 has now gone parabolic.

Of course, market melt-ups are symbolic of the final phases of "capitulation" as investors who feel like they "missed the boat," finally jump back on board.

Such can be confirmed by the numerous emails from individuals asking me is "now the time to get back in?"

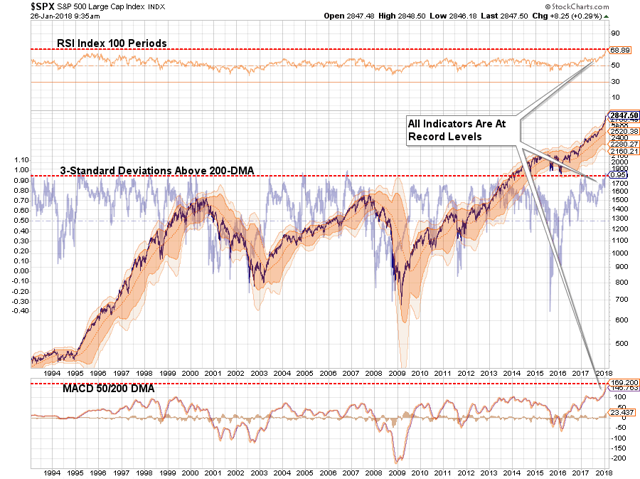

As shown in the chart below, such is the epitome of the "buy high, sell low" syndrome. Never before in recent history has the market been this overbought and extended from longer-term averages which suggests that a correction that reduces such conditions is highly likely in the near-term.

This doesn't necessarily mean a "full blown" market crash, but even a correction back to the 200-dma, which is certainly within the scope of normal corrective actions, would currently entail a drawdown of almost -13%.

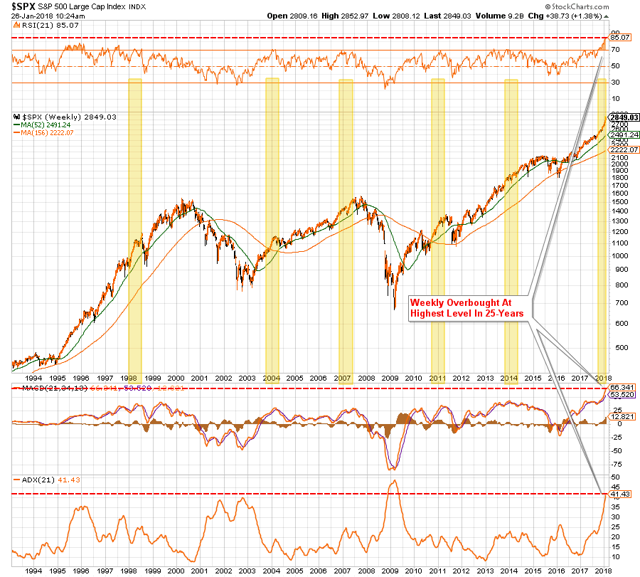

But let's step back to a weekly chart and look at previous periods where historically high overbought conditions have existed previously.

On a weekly basis, a correction back to the 52-week moving average would require a bit more than a -14% decline while a correction back to the long-term trending average would be roughly -28% from current levels.

As I have said before, given we are now in the longest stretch in market history without even a 3% correction, 13% to 14% is going to "feel" worse than it is, and 28% will be equivalent to a full-fledged crash.

But just to keep that in perspective, a 28% decline from current levels only sets investors back to 2015. But, given that most investors are driven largely by emotion, those that have jumped in just recently, will be looking to "bail out" with that kind of a drop.

Buy high. Sell low.

Wash. Rinse. Repeat.

However, there's nothing to worry about currently as long as the markets keep ratcheting up to new highs. As I penned last week in "The Honey Badger Market":

"For now, it is hoped that historically high levels of stock valuations will be reduced by an explosion in underlying earnings growth due to the impact of tax reform.

While exuberance is currently 'off the charts' bullish, and our portfolios remain inherently long in the meantime, we are extremely cognizant of the risk of something 'breaking.'

It is what always happens.

Yes, currently, everything is absolutely, positively, optimistic. Economic growth has picked up over the last couple of quarters due to an unprecedented level of natural disasters, oil prices have risen boosting production and corporate earnings, and employment is at historically high levels if you don't count those out of the labor force.

The positive backdrop for stocks could not be currently better."

Such is certainly the case for now.

The Davos Warnings

Meanwhile, in Davos, the confab of billionaires, world leaders, and the media have gathered for the annual confab in which the fate of the world is determined.

We were fortunate enough to obtain a clip from one of the speeches.

However, not all the views from Davos were of global tranquility and peace.

Barclays CEO Jes Staley warned that financial markets remind him somewhat of what was seen before the 2008 crash.

"This feels a little bit like 2006. There are lots of reasons to be optimistic.

Global economic growth across the board is doing great at roughly 4%, unemployment rates in the U.K. and the U.S. are at almost record lows. All that is great. But all that comes amid 'incredibly accommodating' monetary policy, with interest rates that almost assume we're still in recession.

If interest rates move too quickly and volatility whips around, things could get 'interesting' for markets over the next two years. It's 'concerning' that people are selling short volatility even as it's historically low, asset values are at all-time highs, and every major industry around the world last year grew by more than 20%."

Axel Weber, chairman of the board of UBS AG, the Swiss bank, warned:

"Complacency in the markets is a key risk: Valuations are at unprecedented levels. The probability that we'll encounter an unforeseen crisis on the next part of our journey is high."

André Bourbonnais, chief executive of PSP Investments, which manages close to 112 billion USD of Canadian pension-fund assets, said:

"Everyone feels, despite the exuberance in the market, that we need to dial down on the risk."

Michael O'Sullivan, chief investment officer for international wealth management at Credit Suisse, stated:

"The markets are being driven by a synchronized economic recovery in the U.S., Asia and Europe. Markets are focused on the business cycle rather than politics. Most asset markets are therefore ignoring politics-with the exception of the foreign-exchange market. One possible reason for the lack of market focus on politics may be the growth of automated trading as robots are much less interested in politics than humans."

Carlyle's David Rubenstein, who co-founded the private-equity firm more than 30 years ago, warned:

"The biggest concern I have is that most people think there's no problem of a likely recession this year or early next year. Generally, when people are happy and confident, something wrong happens."

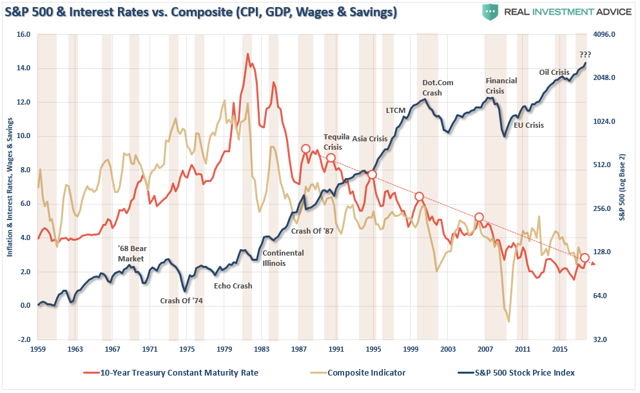

Kenneth Rogoff, who co-wrote the definitive history of the financial crisis, expressed the most concern:

"If interest rates go up even modestly, halfway to their normal level, you will see a collapse in the stock market. I don't know how everything from art and bitcoin to stock prices will react as interest rates go up."

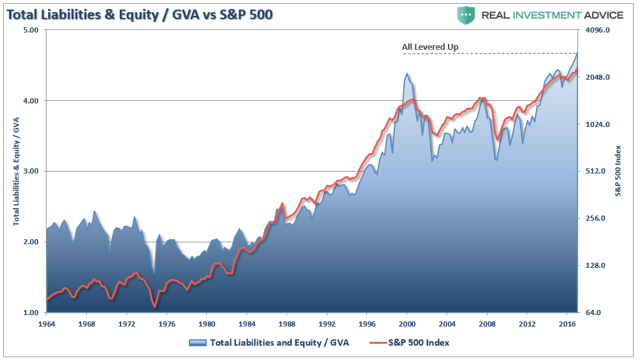

Of course, with interest rates around the globe at historic lows, companies have binged on cheap borrowing, easy credit terms and "sellers' market" as investors chase yield.

You will notice that each major market peak in history was accompanied by high leverage ratios.

The biggest risk, as noted last week, is a significant rise in interest rates the "pricks" the debt bubble.

Reviewing Our Job As Investors

Let me reiterate that while I am currently monitoring the risk in the market, such DOES NOT mean I am "bearish" and sitting in cash on the sidelines. However, given the current extensions, we have rebalanced portfolios a little bit to bring in some of the gains in larger equity-based holdings and added some hedges to reduce volatility risk.

I want to reprint something I have posted previously, but given the current environment, felt it was worth repeating.

Our job as investors is actually quite simple, but investors consistently repeat the same mistakes.

From exuberance to fear, buying high to selling low, chasing returns, and always believing this time is different, only to once again be reminded it's not.

As the old saying goes:

"The more things change, the more they remain the same."

The current environment of daily price gains certainly makes it easy to rationalize why prices can only go higher, why this time is different than the last, and why only the "bullish views" matter.

But therein lies an important point.

As investors, our job is NOT making the case for why markets will go up.

Read that again.

Making the case for why markets will rise is a pointless endeavor because we are already invested.

If the markets rise, terrific. We all make money, and we are the better for it.

However, that is not our job.

Our job is to analyze, understand, measure, and prepare for what will negatively impact the value of our invested capital.

Period.

If we are to accumulate capital over the time span that we have available, from today until we reach retirement, the most important thing we can do to ensure our success is not suffering a large loss of it.

Therefore, our job as investors is actually quite simple:

Capital preservation:

- A rate of return sufficient to keep pace with the rate of inflation.

- Expectations based on realistic objectives. (The market does not compound at 8%, 6% or 4%).

- Higher rates of return require an exponential increase in the underlying risk profile. This tends to not work out well.

- You can replace lost capital - but you can't replace lost time. Time is a precious commodity that you cannot afford to waste.

- Portfolios are time-frame specific. If you have a five years to retirement but build a portfolio with a 20-year time horizon (taking on more risk), the results will likely be disastrous.

With forward returns likely to be lower and more volatile than what was witnessed over the past decade, the need for a more conservative approach is rising. Controlling risk, reducing emotional investment mistakes and limiting the destruction of investment capital will likely be the real formula for investment success in the decade ahead.

This brings up some very important investment guidelines that I have learned over the last 30 years.

- Investing is not a competition. There are no prizes for winning but there are severe penalties for losing.

- Emotions have no place in investing. You are generally better off doing the opposite of what you "feel" you should be doing.

- The ONLY investments that you can "buy and hold" are those that provide an income stream with a return of principal function.

- Market valuations (except at extremes) are very poor market timing devices.

- Fundamentals and Economics drive long-term investment decisions - "Greed and Fear" drive short-term trading. Knowing what type of investor you are determines the basis of your strategy.

- "Market timing" is impossible - Managing exposure to risk is both logical and posible.

- Investment is about discipline and patience. Lacking either one can be destructive to your investment goals.

- There is no value in daily media commentary - Turn off the television and save yourself the mental capital.

- Investing is no different than gambling - Both are "guesses" about future outcomes based on probabilities. The winner is the one who knows when to "fold" and when to go "all in".

- No investment strategy works all the time. The trick is knowing the difference between a bad investment strategy and one that is temporarily out of favor.

As I have stated before, as a portfolio manager, I am neither bullish nor bearish. I simply view the world through the lens of statistics and probabilities. My job is to manage the inherent risk to investment capital. If I protect the investment capital in the short term - the long-term capital appreciation will take of itself.

Right now that job is easy.

Just remain long.

It just won't always be the case.

See you next week.

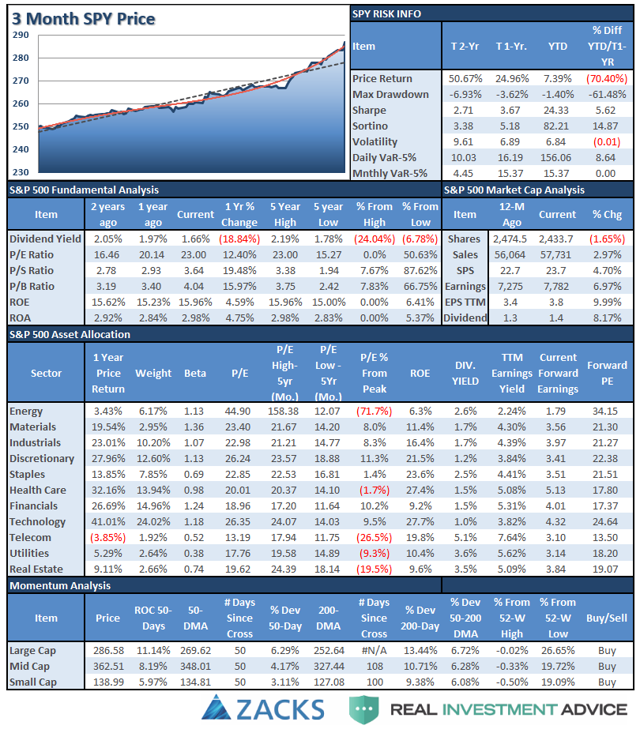

Market & Sector Analysis

Data Analysis Of The Market & Sectors For Traders

S&P 500 Tear Sheet

Performance Analysis

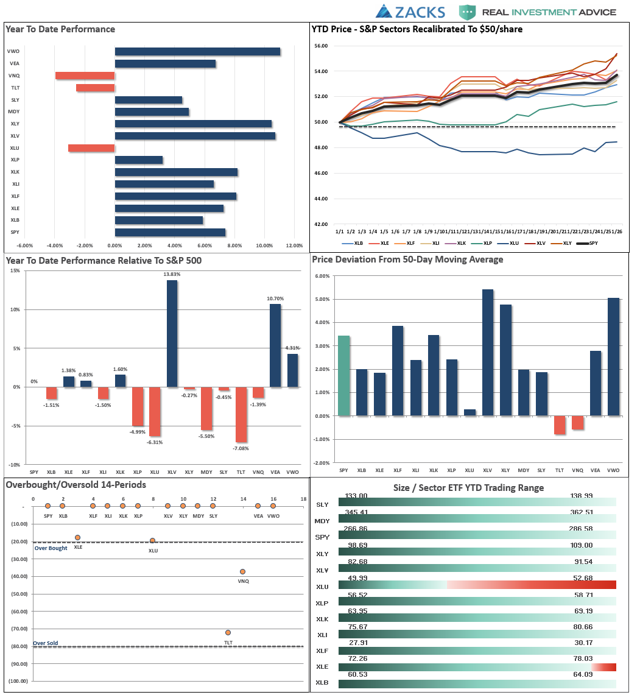

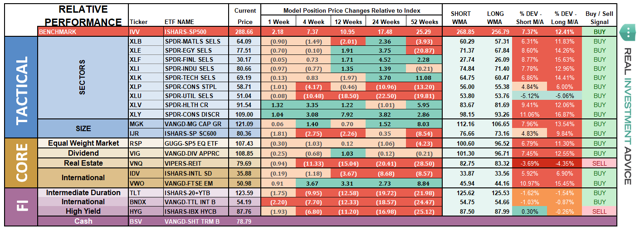

ETF Model Relative Performance Analysis

Sector & Market Analysis

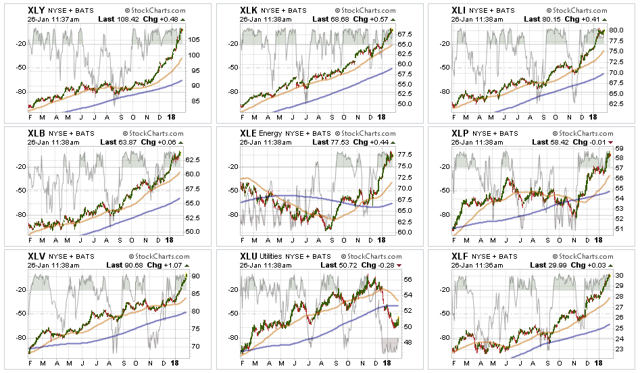

This is just getting a bit TOO extreme. Take a look at the sectors below. Every sector is pushing 2- and 3-standard deviations of longer-term moving averages.

This isn't normal.

Every Sector Except Utilities remain in full-fledged party mode again this last week with Staples catching up to the party as the chase higher continues. The massive overbought conditions in every sector, again except Utilities, needs to be reduced before a better entry opportunity will present itself.

We are still long our positions but continue to hedge risk and rebalance opportunistically.

Energy - As I noted in December, the positive backdrop developed in the energy sector on a technical basis. We added one-half of a tactical trading position to portfolios last month which has paid off well. However, that trade has gotten way over-extended so look to take profits on any weakness. We are moving up our stop-loss levels as well.

Utilities - We remain long the sector for now and added some weight to the sector as a hedge against a risk-off rotation. With the sector very oversold, we did begin to see that start of an upswing this last week. We continue to look for a risk-off rotation soon to see a further pick-up in the sector.

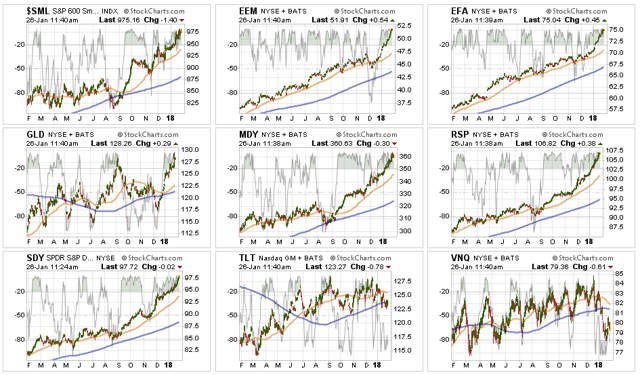

Small and Mid-Cap Index trends are positive, which keeps allocations in the markets, but the extreme overbought conditions make adding exposure here riskier. Look for weakness to take profits and rebalance weights in portfolios.

Emerging Markets and International Stocks - As noted below, we added some international exposure on the breakout following the recent pullback. The markets are extremely overbought on every front, so, as with virtually every other position, rebalancing portfolio weights and reducing some risk is prudent.

Gold - We are now fully on the lookout to add gold into portfolios on any pullback that somewhat reduces the current overbought conditions without violating important support levels. A rally in the dollar from currently extremely oversold levels will likely provide that opportunity.

S&P Equal Weight & Dividend Stocks - As noted previously, both of these positions have simply gone parabolic as money is chasing yield currently. We have moved up stops and are looking to take profits and rebalance accordingly.

Bonds and REITs - We remain long these sectors and did add to them recently on weakness as a hedge against a "risk off" rotation. Our conviction on these positions continues to rise, but we are still honoring our longer-term stop-loss levels.

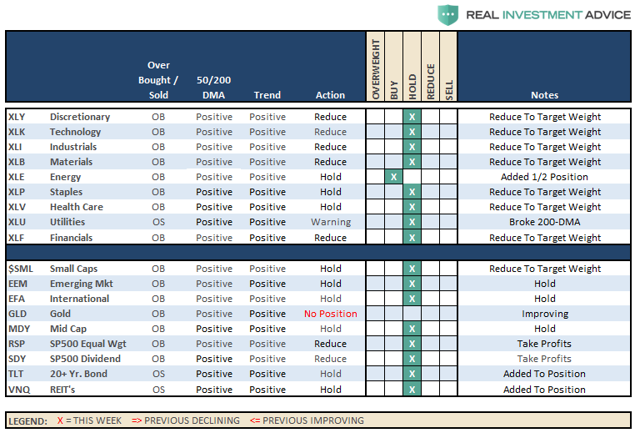

Sector Recommendations

The table below shows thoughts on specific actions related to the current market environment.

(These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril).

Portfolio Update

Also, as noted four weeks ago, hedges were added to our portfolios. Given the parabolic rise in the markets, which has created massive extensions in price, we continue to maintain those hedges for now. We will add to them once a correction begins to ensue.

As far as portfolios go, we continue to maintain our current positions. As noted over the last few weeks, our most recent additions were Energy in mid-December and the Russell 2000 and Japan on recent breakouts three weeks ago.

While our hedges are under pressure currently, they are small relative to the long-side of our portfolio. As always, we remain fully invested but are becoming highly concerned about the underlying risk. Our main goal remains capital preservation which is why we are de-risking portfolios where and when we can.

The Real 401(k) Plan Manager

The Real 401(k) Plan Manager - A Conservative Strategy For Long-Term Investors

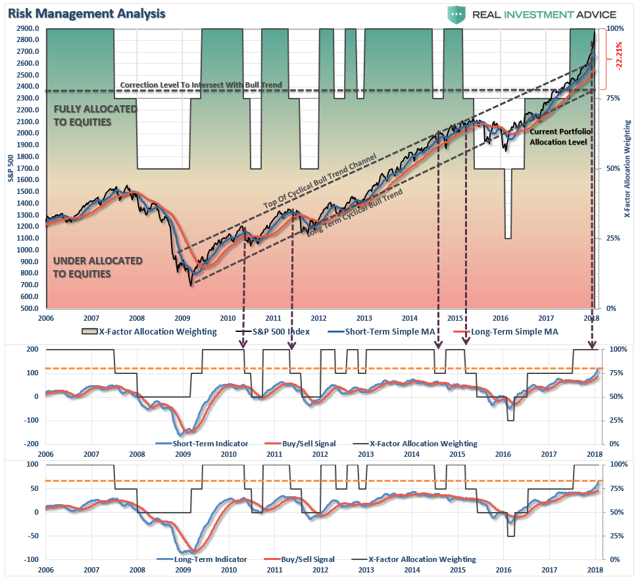

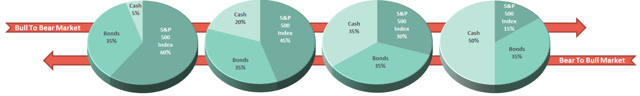

There are four steps to allocation changes based on 25% reduction increments. As noted in the chart above, a 100% allocation level is equal to 60% stocks. I never advocate being 100% out of the market as it is far too difficult to reverse course when the market changes from a negative to a positive trend. Emotions keep us from taking the correct action.

It Just Keeps Getting Nuttier…

Over the last several weeks, I have noted how the current advance just keeps getting "nuttier."

The acceleration of the advance is not only unsustainable, but it is also dangerous, as eventually it will lead to a very sharp reversion that few investors are ready for.

But I know. It hasn't happened yet.

However, just because it hasn't happened yet does not mean it won't. As with everything in life, "timing" is everything.

While portfolio allocations remain at target levels, for now, the time for complacency is now gone.

I have added a couple of notations to the 401(k) plan manager graph above. The markets have now MASSIVELY pierced the top of the long-term bullish trend channel, which only happens either at the peaks or troughs of a market trend. Secondly, as noted by the arrows, with the markets extremely overbought and extended, the risk outweighs reward at this juncture.

As I stated last week:

"Importantly, note the orange horizontal lines I have added in the two bottom buy/sell signal indicators. The market has never been this overbought since I began tracking our model in 2006. (Just for the record, it hasn't been this overbought since the turn of the century when I began running this model in the newsletter.)"

Given the inability to hedge 401(k) plans, I continue to recommended rebalancing risks in portfolios by trimming overweight equity exposure and adding to fixed income exposure.

All NEW contributions to plans should currently be adjusted to cash or cash equivalents like a stable value fund, short-duration bond fund or retirement reserves. We will use these funds opportunistically to add to weightings when corrections occur.

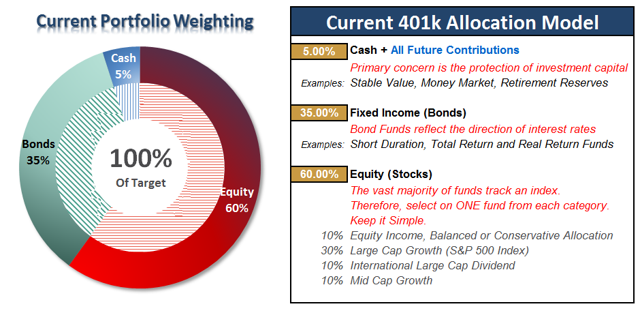

Current 401(k) Allocation Model

The 401(k) plan allocation plan below follows the K.I.S.S. principle. By keeping the allocation extremely simplified, it allows for better control of the allocation and a closer tracking to the benchmark objective over time. (If you want to make it more complicated you can, however, statistics show that simply adding more funds does not increase performance to any great degree).

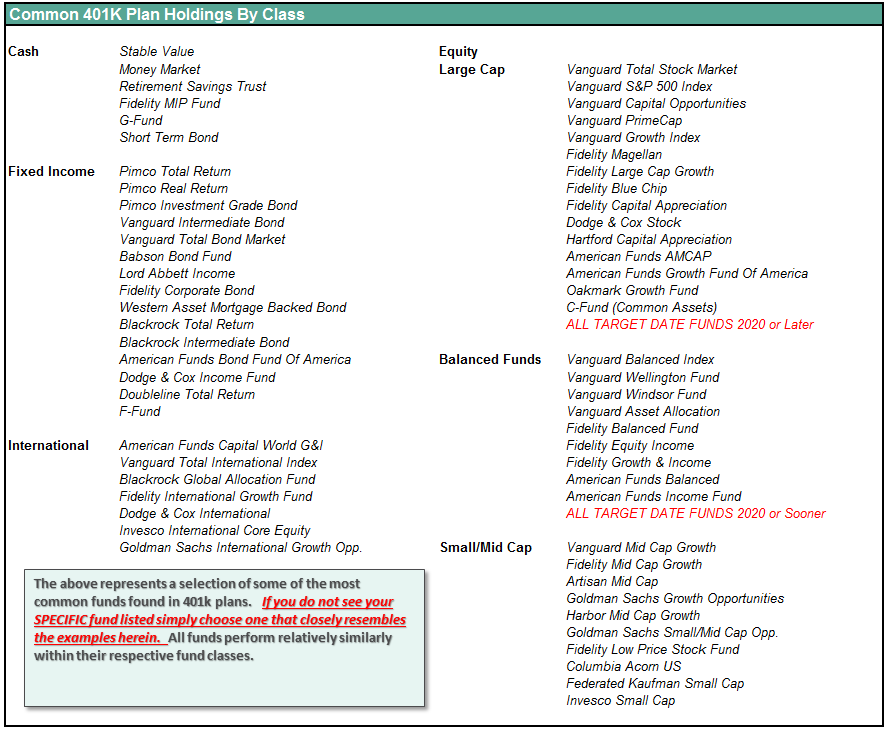

401(k) Choice Matching List

The list below shows sample 401(k) plan funds for each major category. In reality, the majority of funds all track their indices fairly closely. Therefore, if you don't see your exact fund listed, look for a fund that is similar in nature.

0 comments:

Publicar un comentario