Reports Of My Demise Were Greatly Exaggerated

by: The Heisenberg

- And so we close the book on yet another extraordinary week for markets.

- This was the best week for U.S. stocks since 2013 and it comes one week after a veritable train wreck.

- What to make of it all? Well, I've got some thoughts.

- Here's a sweeping trip across markets complete with everything you'd expect from a Heisenberg Friday evening missive.

- This was the best week for U.S. stocks since 2013 and it comes one week after a veritable train wreck.

- What to make of it all? Well, I've got some thoughts.

- Here's a sweeping trip across markets complete with everything you'd expect from a Heisenberg Friday evening missive.

I don't think I have ever enjoyed commenting on markets as much as I have over the last two weeks.

This has been one of those most amusing and entertaining stretches I can remember, and I've been commenting on markets for a long - long - time (Heisenberg newcomers should note that the "Heisenberg" moniker is a fairly recent phenomenon; I've been doing this under my real name in one capacity or another for the entirety of my adult life).

The implosion of the short vol. trade prompted a swift reappraisal of things by investors and traders of all stripes which was highly amusing to observe for two reasons: 1) everyone who had studied those short vol. ETPs knew they were going to blow up one day and in the process cause a supercharged spike in the VIX, but more importantly 2) the proximate cause of the entire unfortunate episode that swiftly triggered a correction in global equities was the bond selloff catalyzed by signs of inflation pressure and the worsening fiscal outlook in the U.S. The point: exactly none of what happened was really "news".

In fact, "inflation surprise" and "bond crash" had been at the top of everyone's "biggest worries" list for months headed into 2018 and the tax cuts and fiscal stimulus were quite literally a campaign trail promise of Donald Trump's, so the deteriorating fiscal outlook was telegraphed a full 14 months in advance.

If you were bullish headed into 2018, you shouldn't have been surprised by the rapid rise in yields; I mean maybe the pace of it was a bit alarming, but not if you'd been paying attention to how things were developing over the preceding six months. Neither should you have been all that alarmed by the short vol. ETP blow-up because if you understood the mechanics of it, you would have known that while it would surely be painful in the short-term (you can't really "contain" a sudden 100% spike in the VIX), it was technical in nature (the reason the implosion of XIV was preordained was precisely because the risk and hence the fallout were to a large extent quantifiable ahead of time). So too was the domino effect from the VIX spike preordained and technical in nature. I've written so much about that over the last year I couldn't catalogue all of the articles if I tried, which is why last summer I simply dedicated an entire archive to it on my site just to make sure I had a convenient link to point people to when what I dubbed "the doom loop" was finally triggered.

You'll also note that one of the reasons why what happened earlier this month was so easy to call was because once it became apparent in late January that the rapid rise in yields was on the verge of flipping the stock-bond return correlation positive, you could see the systematic unwind coming. That was going to happen either way and indeed, risk parity had a terrible 5-day stretch the week prior to the short vol. implosion. So with the bond/equity correlation rising and momentum already reversing, it was going to be a rough stretch for some of the systematic crowd anyway.

Well, if you knew that and you also understood how pervasive the short vol. trade in all its various forms really was, it didn't take a leap of logic to understand that if something pushed up vol. enough to trigger the rebalance risk in the levered and short VIX ETPs, what was already a precarious situation for risk parity, CTAs, and the vol. targeting crowd would suddenly get worse in a hurry, likely leading to a cascade where that means deleveraging into a falling market. And that's exactly what happened.

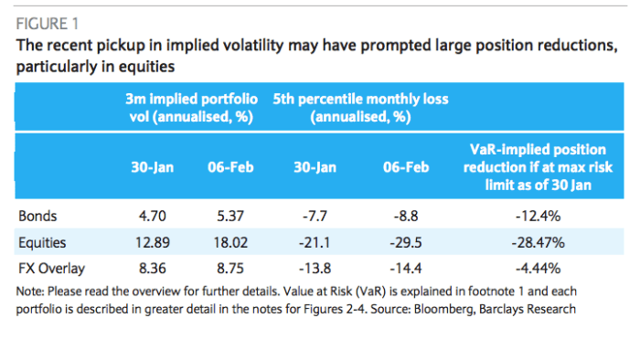

CTAs and risk parity were forced to offload some $200 billion in equity exposure (on BofAML's estimates). More generally, think about what the implications were for global portfolio managers with positions already close to pre-defined risk limits measured with a VaR metric. Consider this from a Barclays note out last week:

For example, assume a risk manager is comfortable with an equity portfolio manager losing USD1mn in one month 5% of the time. Prior to the recent pickup in volatility, Figure 1 shows the 5th percentile equity portfolio return was -21.1%, suggesting a maximum position size of approximately USD4.7mn to stay within the defined VaR limit of USD1mn. With the recent pickup in implied volatility, however, the 5th percentile move has become more negative as the distribution of returns has become wider and is now -29.5%, implying a new VaR of almost USD1.4mn for the same portfolio – well above the USD1mn risk limit. To return to the VaR limit, the portfolio manager needs to reduce the position by about 28% to approximately USD3.4mn.

See this just underscores the notion that if you care at all about seeing these kind of unwinds coming, you really need to try and understand the underlying issues. People will tell you that wrapping your head around all of this isn't necessary for most investors and those people are absolutely right. But if that's the position you want to take, well then don't act surprised when you can't figure out how it's possible that we can have a week like February 5 through February 9, where the Dow has two 1,000+ point drops just two days apart and the VIX spikes 100% in a single afternoon.

And look, I don't want you to get the impression that it was just retail investors who were blindsided here. For instance, Shahraab Ahmad apparently took a 25% hit during the turmoil.

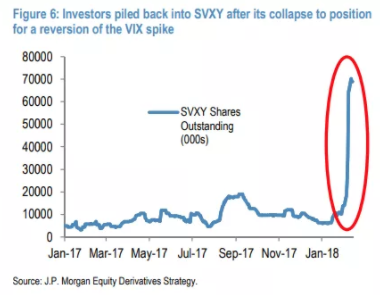

But there are indeed signs that retail still doesn't get it. Take a look at this chart:

(JPMorgan)

(JPMorgan)As JPMorgan's Marko Kolanovic writes in a new note out Friday, it's not clear that people really understand how this works. To wit:

We note the drawdown in these products represents a permanent impairment to the strategy, and investors shouldn’t look for a return to previous trading levels even as volatility continues to fall. For example, SVXY peaked ~$138 in mid January and is currently trading ~$13—if the one-month weighted VIX future were to fall ~35% from the current level (~17.5) back to the same level as it was trading in mid January (~11.5), SVXY would only rally to ~$17.503 (i.e., 13 x 1.35) and would still trade ~87% below its recent peak.See what I mean? Also, some of the smart money did indeed see this coming. Take Peter Thiel who, assuming he was still holding onto positions he had in December, very well might have made an obscene amount of money betting on a vol. spike. You can bet he understood what was going on here.

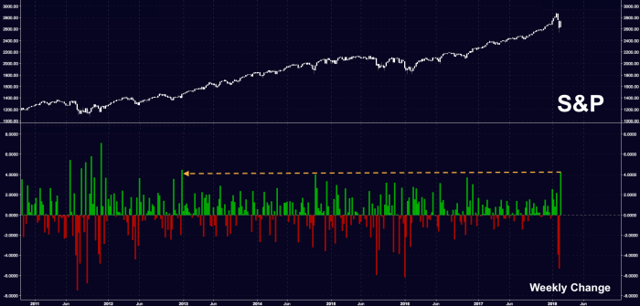

All of that said, you might very fairly point out that reports of the rally's demise were greatly exaggerated (hence the title of this post). After all, we just witnessed the best week for the S&P since 2013:

(Heisenberg)

A couple of things to note here. First of all, history was on the bulls' side and there was no shortage of commentary to that effect last weekend. Goldman, for instance, wrote the following in a note dated February 9:

Most equity market corrections recover without developing into bear markets or presaging recessions. There have been 16 drawdowns of 10%+ since 1976. Of the 16 corrections, only five occurred around a recession. Of the remaining 11 non-recession episodes, 1987 was the only one that turned into a bear market.Of course on the same day, the bank's co-head of global equities trading Brian Levine sent a letter to clients that, if you're inclined to being extremely cynical, seemed to contradict the more sanguine take that's evident in the excerpted passage above. Here's what Levine said about the outlook (full letter here):

Bottom line, we haven’t reached the short-term bottom, but you’ll know it when you see it (or at least 5 minutes later!). But longer-term, I do believe this is a genuine regime change, one where you sell-the-rallies rather than buy-the-dips.Again, that sounds foreboding, but he didn't say "there will be no rallies." He just said the mindset might be shifting in terms of how people respond to rallies.

The point is, I'm not entirely sure the rally's demise was "greatly exaggerated." I mean sure, I talked a lot about what the pitfalls were and you can always find the doomsayers if you're looking for them, but the ostensibly "serious" folks were pretty measured if not outright bullish in their assessments following the pullback.

For instance, you might remember that one of the reasons cited for last Friday's late afternoon rally (so, the now infamous late-day surge that unfolded on February 9) was a note from JPMorgan's Nikolaos Panigirtzoglou. I wrote about that earlier this week. This is the headline that was blasted out on the Terminal at 3:30 ET that afternoon:

- CTA/RISK PARITY FUND UNWINDING MOSTLY BEHIND US, JPMORGAN SAYS

At least one commenter thought my article on that was silly (of course if you actually read my article as opposed to just skimming it, what you'll find is that I myself was very skeptical about whether the note in question was actually behind the surge, but you know, who reads the whole article, right?).

But as it turns out, that JPMorgan note proved to be pretty prescient. Because it basically suggested that if the overhang from systematic deleveraging was what was spooking people, that overhang was largely cleared. Sure enough, that was borne out this week and Marko Kolanovic himself was out on Friday reiterating the point. Here's what he said in the same note from which the bit about SVXY excerpted above is taken:

With nearly all of the required de-leveraging by systematic investors behind us, we believe markets should continue to recover. Further, systematic investors could begin to re-lever equity positions as momentum is positive at all but short-term horizons (allowing CTAs who were stopped out on the sharp sell-off last week to reenter longs) and realized volatility begins to decline (causing Volatility Targeting funds to gradually re-lever).As I put it on Friday afternoon, last week’s forced systematic unwind is next week’s tailwind as the deleveraging offer turns into a re-leveraging bid.

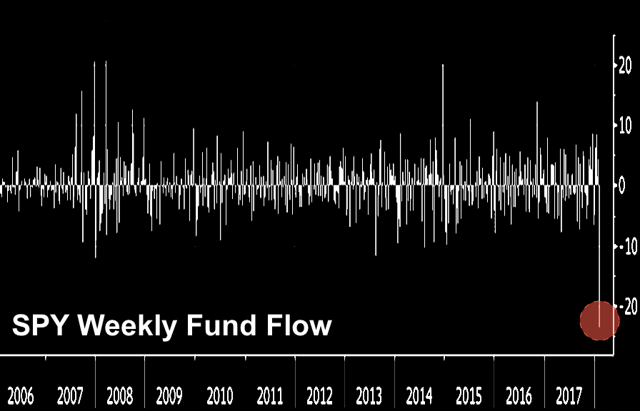

Again, it's not clear that the rally's demise was "greatly exaggerated" and if it was, it was likely to the Johnny-come-lately retail crowd that was doing the exaggerating because as I showed you earlier this week, SPDR S&P 500 Trust ETF (SPY) saw a $23.6 billion outflow during the selloff.

(Bloomberg, Heisenberg)

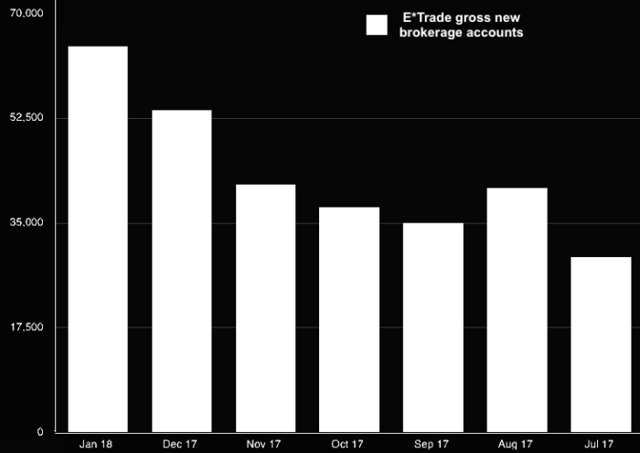

That came hot on the heels of a record monthly inflow into U.S. equity ETFs in January, and January was also a month that saw E*Trade add 64,581 gross new brokerage accounts, the most for a single month since September of 2016:

(E*Trade data, Heisenberg)

(E*Trade data, Heisenberg)So I guess when I hear people saying that the rally's demise was "greatly exaggerated", I wonder who that refers to. You can plausibly say it refers to me, but it certainly doesn't refer to some of the bigger names on the Street and when it comes to anecdotal evidence, it seems to me like the people who were panicking the most were the people who might not have had a firm grasp on things in the first place.

Anyway, the most interesting thing about this week (well, besides the fact that it was the second-best week for U.S. equities since December of 2011) was the extent to which equity traders' perception of rising inflation changed. There was myriad new evidence to support the notion that price pressures are rising in the U.S. and that foretells an end-of-cycle dynamic and presages a more aggressive Fed.

In other words, if you were worried about that average hourly earnings number that led directly to the selloff, well then you had even more reason to worry this week, courtesy of the CPI beat on Wednesday and then from Fed surveys and PPI data on Thursday, all of which supported the inflation narrative.

But stocks ignored it. And I have yet to hear a good explanation for why. I would just chalk it up to dip buying and the fact that the systematic deleveraging boogeyman is back in the closet for a while, if it weren't for the violent reaction in futures on Wednesday morning. Of course some of that was algos reading the headlines but still, there was exactly no evidence on Thursday and Friday that anyone was still worried about inflation pressures.

Ultimately, I think that's a mistake. Treasurys rallied on Friday helping yields retrace some of the post-CPI move higher, but we're still uncomfortably close to 3% on 10s. Beyond 3% is "where the wild things are" - so to speak.

This week, as fun as it was, raised more questions than it answered. At some point, equities are going to have to come to grips with rising inflation pressures and what that might mean for central bank forward guidance. Meanwhile, it is close to a foregone conclusion that the fiscal stimulus being piled atop the overheating U.S. economy is going to pull forward the end of cycle.

My guess would be that the disparity between how the market reacted to evidence of inflation this week and how the market reacted to evidence of inflation earlier this month will be reconciled sooner rather than later. Make sure you have a view on that. I'm not going to tell you what your view should be, but you need to have one. Either stocks were right in their interpretation this week or they were right earlier this month, but it can't possibly be both.

So there's my Friday night missive. It's close to 9:00 p.m. here on the island as I wrap it up.

Now it's time for a steak. Or a cigar. Or more likely both.

0 comments:

Publicar un comentario