Only 2 Things Matter Now

by: The Heisenberg

- Now that the VIX ETP train wreck is the rearview, let's remind ourselves of what started us on the road to the selloff in the first place.

- And let's look at what happened midday on Wednesday that brought the bond selloff fears back to the fore.

- Finally, let's talk about everyone's favorite boogeymen: CTAs, risk parity, and vol. control.

- And let's look at what happened midday on Wednesday that brought the bond selloff fears back to the fore.

- Finally, let's talk about everyone's favorite boogeymen: CTAs, risk parity, and vol. control.

Ok, so I don't know if you noticed or not, but it was right back to worrying about the bond selloff on Wednesday.

And you know what? That's as it should be, because after all, that's what started us down the road to the selloff in the first place. Two Mondays ago, I gently suggested that if yields didn't stop rising, equities were going to get hit. I even slapped a fun title on the article so as not to sound too alarmist: "Hey Guys, The Bond Selloff Needs To Stop, Like Right Now".

Well, it didn't stop. And for all the reasons I laid out last weekend, that's a real problem.

You're undoubtedly tired of hearing this narrative by now, but unfortunately I need to rehash it in order to discuss what happened on Wednesday so humor me and I promise to keep the retelling short.

You're undoubtedly tired of hearing this narrative by now, but unfortunately I need to rehash it in order to discuss what happened on Wednesday so humor me and I promise to keep the retelling short.

Up to a certain point, rising yields are seen by the market as a barometer of the robustness of the recovery; evidence (if you will) that deflation has been banished to whatever netherworld it hides in until the next disinflationary shock. So for a time, bonds can selloff and stocks can digest that selloff on the excuse that rising yields are saying something positive about the outlook for the economy.

But if yields rise too far, too fast and that is catalyzed by a sudden upturn in inflation, well then it sets up a policy conundrum. In the U.S., that conundrum is as follows.

If the Fed withdraws transparency (i.e. decides to stop allowing the market to have a say in how policy develops) on the way to leaning aggressively hawkish, they risk hiking too fast, bear flattening the curve, and pushing the economy into recession.

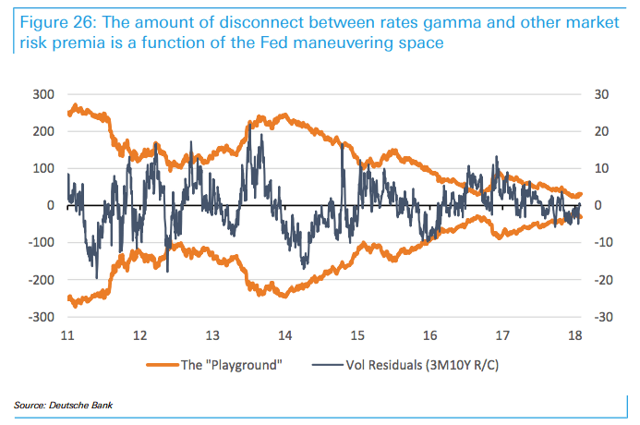

If, on the other hand, they stick to a gradualistic pace and allow the market to fully price each hike, they risk falling behind which, if inflation pressures keep building, would mean sitting idly by as the curve aggressively bear steepens. That risks a disorderly unwind of the bond trade and it also increases the size of the "playground" as Deutsche Bank's Aleksandar Kocic calls the spread between the long rate and the shadow rate. Have a look at this chart:

That dark grey line represents the residuals of rates gamma on other measures of risk premia, in this case FX vol., IG spreads, rates levels and curve risk premium. If that "playground" widens out, it's likely that markets would start differentiating between different assets again on the basis of something other than the carry those assets provide. If that happens, cross-asset vol. would rise, the carry trades could unwind, and on and on.

So, that's why the market is worried about the bond selloff. The Fed will be forced to choose between potentially hiking too fast and the second scenario outlined above.

Ok, so one of the things I've been keen on pointing out in the wake of the blowup in the short vol. ETPs, is that it won't be long before everyone stops being fascinated with that story and begins to think about what the problem was in the first place. That is, market participants will remember why stocks were selling off last week. In short, everyone would get back to focusing on the bond rout.

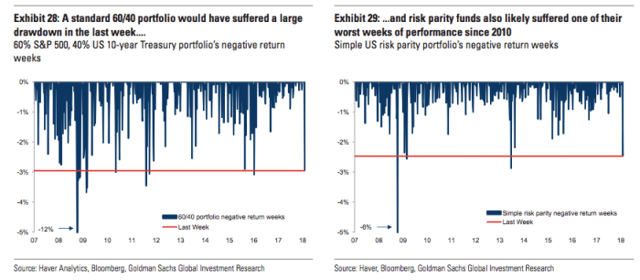

You might recall that over the weekend, I tried to drive the point home about what the concurrent selloff in equities and bonds meant for balanced portfolios which have enjoyed the longest run without a 10% pullback in 100 years. That run is in part attributable to the simultaneous rally in stocks and bonds, but the "genius" (if you want to call it that) of a 60/40 portfolio is of course the diversification benefit or, technically speaking, the negative stock-bond return correlation. When stocks are falling, bonds are rallying and vice versa.

Over the past twenty years (give or take) that correlation has been negative even as both assets have generally rallied which represents the best possible scenario for obvious reasons. As most readers are likely aware, the concept behind the 60/40 portfolio also underpins risk parity funds. Well guess what? Last week, as the market tried to assess how bad the bond rout would ultimately be, the simultaneous selloff in equities and bonds culminated in an abysmal stretch for 60/40 portfolios and for risk parity. In fact, as Goldman wrote on Wednesday morning, “only five times since 1990 have simple risk parity and 60/40 balanced portfolios had weeks where they simultaneously sold off as much as they did last week – the last two times being during the global financial crisis.” Here are the charts on that:

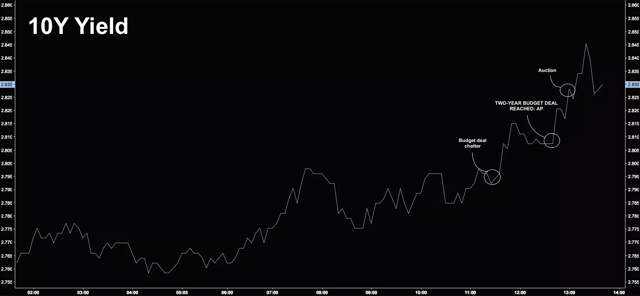

Well now that the VIX ETP debacle is in the rearview, traders have begun to focus on bonds again and on Wednesday, there were two catalysts for higher yields: a lackluster 10Y auction and a bipartisan budget deal that tipped more spending and a suspension of the debt limit.

Clearly, both of those things are bearish for bonds and it showed. Here's the annotated 10Y yield chart from Wednesday:

Well, that rise in yields threw stocks for a loop and ultimately undercut what looked, early on, like a positive sesión:

I don't even know why I feel the need to show you these screengrabs, but I guess I've learned over the past year that readers sometimes need to be reminded that I'm not just making this stuff up, so here's Bloomberg:

And here's CNBC:

So yes, we're back to the original problem that spooked markets last week: the bond selloff and that problem is rooted in considerations about what rapidly rising yields mean for Fed policy as outlined above.

Ok, so that's the first of the two things that matter. The second thing that matters is what I alluded to in my "Black Monday" recap. Namely, what the future holds for the systematic/programmatic strats that I and plenty of other folks have warned could be forced to deleverage into a falling market in the event things get bad enough. Obviously, you have to differentiate between these strategies. CTA does not equal risk parity does not equal... etc. etc.

But the fact remains that as a group, they have probably increased their exposure to equities as volatility continued to trend lower. Here's what I said on Monday evening in the post linked above:

So what's the outlook? Well, I'm not sure. For one thing, it's as yet unclear what exactly is going on with those short vol. products and I for one wonder if there's more programmatic selling in the cards if volatility remains elevated. We may have leap-frogged concerns about the bond rout and gone straight to the part of the show where some of the celebrated "miracles" of modern market structure break down.

And here are the passages I excerpted from JPMorgan's Marko Kolanovic (affectionately known as "Gandalf" and the recognized authority on systematic unwinds):

Outflows resulted from index option gamma hedging, covering of short volatility trades, and volatility targeting strategies. These technical flows, in the absence of fundamental buyers, resulted in a flash crash at ~3:10pm today. At one point, the Dow was down more than 6%, and later partially recovered. After-hours, the VIX reached 38 and futures more than doubled—it is not clear at this point how this will reflect on various short volatility products (e.g., some volatility ETPs traded down over 50% after hours).

Today’s large increase of market volatility will clearly contribute to further outflows from systematic strategies in the days ahead (volatility targeting, risk parity, CTAs, short volatility). The total amount of these outflows may add to ~$100bn, as things stand.

Over the past 24 hours, I've spoken with a couple of quants and they of course dispute the notion that there is any real systemic risk associated with the funds that Marko Kolanovic helped thrust into the public eye in the wake of the August 24, 2015, meltdown.

I am not a quant, so I do not pretend to know with any degree of certainty what the risk here is, but what I am virtually certain of is that the risk of these strategies exacerbating a drawdown is higher than their proponents suggest. Some readers have asked for more details on this, so I wanted to excerpt two short passages and the accompanying charts from a new Goldman note out in the wake of Monday's selloff:

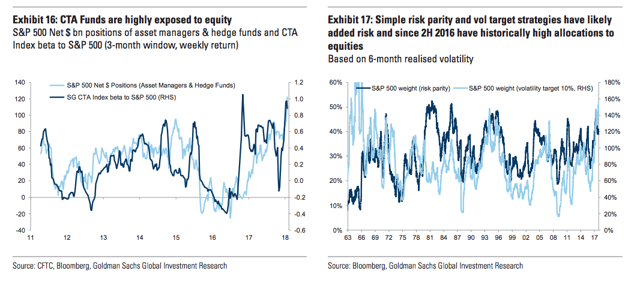

We think the bullish equity positioning has in part been supported by systematic investors, such as CTAs, vol target and risk parity funds, that have been attracted to equities by their low volatility, especially in recent months. As trend followers, CTAs (c.US $350 bn, Source: BarclayHedge) would in simple terms buy assets with positive momentum - and the recent negative short-term trend reversal in equities triggers selling. As Exhibit 16 shows, the net dollar CFTC long positioning in the S&P 500 has been correlated with the CTA beta to the S&P 500.

Risk parity and vol target funds, which have combined AuM close to US$1 tn, have also likely increased their exposure to equities due to their low volatility - they use both realised and implied measures of volatility (and often also correlation). Based on a simple risk parity and vol target strategy, they are currently running very high equity allocations (Exhibit 17). Risk parity funds usually focus on longer-term measures (6m realised) while vol target strategies often use a shorter window, which suggests they are more likely to de-risk as a result of shorter periods of high volatility. Depending on where realised volatility settles in the coming weeks, selling from those funds might continue. For risk parity and procyclical multi-asset funds, the combined equity/bond sell-off can further increase pressure to reduce risk.

Again, I am not going to profess to know what the likelihood of the worst case scenario there is, but what I can tell you is that's the second set of dominos in the "doom loop" scenario. The VIX ETP rebalance pushes vol. higher, and then the systematic crowd is forced to deleverage. That is a deliberately simplistic assessment and I've reached out to another quant who I hope will be able to provide me with a more benign take. I will certainly be happy to elaborate further once I feel like I have the proper first-hand information.

Coming full circle, there are two things to watch going forward. First and foremost are yields.

The bond selloff is what pushed us over the edge last week and set the stage for Monday and it will be what pushes over the edge again if 10Y yields rise sustainably above 3%. Second, in the event we do get more chaos and/or vol. remains elevated, you'll want to watch for signs of systematic deleveraging.

So there's what to look out for in the days and weeks ahead. As usual, I hope it was informative.

0 comments:

Publicar un comentario