Fragile: Handle With Care

by: The Heisenberg

- Last night, I did two things I normally don't do and one of them involved watching Jim Cramer.

- I was surprisingly pleased with what I heard from Jim, but popular pundits need to do more of what he did on Friday.

- Now let's walk through some charts and have a few laughs (but unfortunately no drinks) along the way.

- I was surprisingly pleased with what I heard from Jim, but popular pundits need to do more of what he did on Friday.

- Now let's walk through some charts and have a few laughs (but unfortunately no drinks) along the way.

On Friday evening, I did two things I normally don't do: I took two hours away from working to watch a movie, and before that, I watched about 15 minutes of Jim Cramer.

To my complete surprise, neither of those two things was a waste of time. The movie was Guardians of the Galaxy Vol. 2 - it was great. And the 15 minutes of Mad Money turned up a pleasant surprise. Jim Cramer actually spent the last 15 minutes (give or take) of his Friday show explaining the "Goldilocks" narrative that's part and parcel of the dynamic driving the now ubiquitous "everything bull market."

I've spilled gallons of digital ink expounding on "Goldilocks" where that means decent and synchronized global growth but still subdued DM inflation. The former allows investors to assert the global economy is on sound footing while the latter helps make the case for cautious central banks who, by virtue of still below-target inflation, will be loath to normalize in a fashion that's aggressive enough to force a disorderly unwind of the bond trade.

That was notable because millions of retail investors effectively depend on popular pundits who have connections in the financial world to provide color as to what's actually driving asset prices. Cramer is the poster child, but even if you want to take a haughty attitude towards Jim, chances are you follow other pundits who are just like him. One thing that's particularly pernicious (and note that there is a distinction between something that's "pernicious" and something that's "nefarious" where the latter usually entails purposeful deception while the former doesn't necessarily have to) is the echo chamber of financial pundits and bloggers who spend a good portion of the work week parroting manifestly simplistic narratives about what's driving markets at the asset class level. I'm not going to name names because that's not constructive, but a lot of the commentary that emanates from these sources is ostensibly "educational" for the retail crowd but would not be taken any semblance of serious by Wall Street.

Here's an important note for any Heisenberg newcomers: regular readers know I don't talk much about individual stocks. So I am by no means suggesting that you should take a given bank's inherently conflicted calls on individual names in your portfolio seriously. Individual stock analysis is easy for regular investors to do on their own and platforms like this one are hugely valuable in helping retail investors come together and form their own consensus view on individual companies without having to worry so much about whether those views are biased due to investment banking relationships and myriad other conflicts of interest.

Rather, I write from the 30,000 foot perspective and I can say definitively, without equivocation, that it is profoundly unrealistic to think that retail investors have a better read on market structure and the dynamics that drive markets at the macro level than professional investors and analysts. For instance, it is (almost by definition) impossible for retail investors to know more about something like volatility than a Wall Street derivatives strategist. To give you another example, it isn't realistic to think that someone writing macro commentary without access to professional research or a direct line to Wall Street can have a better read on what would happen in the event central banks were forced to get more aggressive on normalization than a professional rates strategist.

In the absence of access, retail investors depend on pundits with connections to help them understand markets at the asset price level and pundits aren't doing a very good job of that lately, which is why I was glad to see Jim discussing "Goldilocks" on Friday evening - even if he only spent a few minutes on it.

Well, one thing that pundits have not done a good job of is helping to communicate why the ubiquitous "buy the dip" mentality continues to work (and again, I mean that broadly, not in the narrow context of this stock or that stock). Note that "buy the dip" in the volatility context translates roughly into "sell the spike."

There is a demonstrable tendency for popular pundits to try and explain this by way of earnings or the synchronous upturn in global growth. The problem with those simplistic explanations is that they do not explain what they purport to explain. And in employing those explanations, pundits fail to communicate the actual dynamic at play and thereby fail to convey what the risks are.

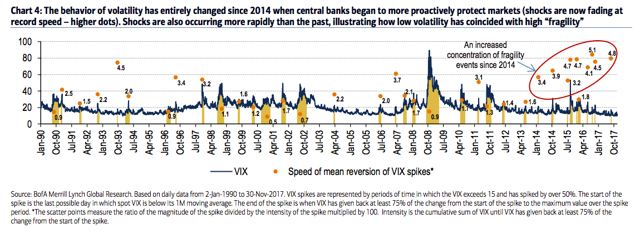

Obviously, robust earnings and synchronous global growth are good reasons to take a bullish view on risk assets like stocks (SPY). And indeed you can make an argument that those factors (combined with a few more fundamental drivers) can serve as the foundation for a bullish view over the near, medium, and long term. But what you cannot do is explain this chart with those arguments:

(BofAML)

You can read the literal fine print there, but the gist of it is captured in the description of the yellow dots which, as BofAML notes, represent "the speed of mean reversion of VIX spikes."

The rapidity with which fleeting volatility (VXX) spikes are collapsing is unprecedented.

Obviously, it makes little sense to attribute that entirely to optimism about earnings and global growth. You don't see a VIX spike and think "gosh, I better sell some vol. right now, this second, because I'm optimistic about earnings growth in 2018." Even more absurd is the idea that anyone sees a VIX spike and thinks "gosh, I better sell some vol. immediately because I really like the trajectory of the German economy and man, how about that November Chinese trade data?!"

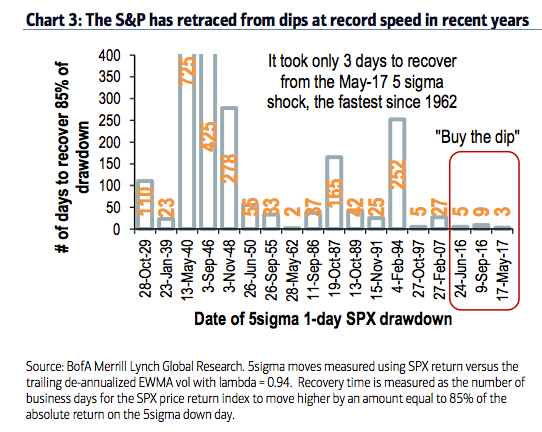

Here's another visualization of the same dynamic using the S&P:

(BofAML)

The reason that's happening is because the two-way communication loop between policymakers and markets makes taking a long-term view impossible. I'm going to excerpt a few passages from Heisenberg Report that regular readers will recognize. To wit:

Thanks to near-daily speeches and media appearances by Fed officials, this is quite literally a real-time information exchange between markets and policymakers. No one can see outside of this information exchange, and if you’re a trader, there’s really no utility in trying.

In this way, transparency introduces risk in a paradoxical way. As Deutsche Bank's Aleksandar Kocic wrote more than two months ago, “transparency as a way of stabilizing the markets has become a tool of suboptimal control, one that reinforces the future risk in order to diffuse it — it is a tactics of delaying, rather than reducing risk.”

Everything thus becomes short term. Taking a long-term view of the Fed (or of the ECB for that matter) is effectively impossible. You can try – you can “do the right thing”, as it were – but you will be drowned out. The status quo cannot change unless you are joined in your dissent by others. If you are alone in your rebellion, your efforts will almost invariably result in foregone carry and underperformance. Thus, change becomes for all intents and purposes imposible.

This is the controlling dynamic for volatility. This, as I put it a few weeks, is why things are the way they are.

This has become so deeply ingrained that the market "no longer fears shocks, but loves them, as it is an opportunity to predictably generate alpha" (to quote the BofAML note from which the charts above are taken).

This has become a self-fulfilling prophecy. Because no one believes that these vol. spikes will be sustained, vol. sellers immediately re-engage. Now think about what that means for the people who take the other side of those trades. Here's the above-mentioned Kocic again:

Dealers, who take the other side of that trade, through their hedging, reinforce local stability making resistance even more futile.

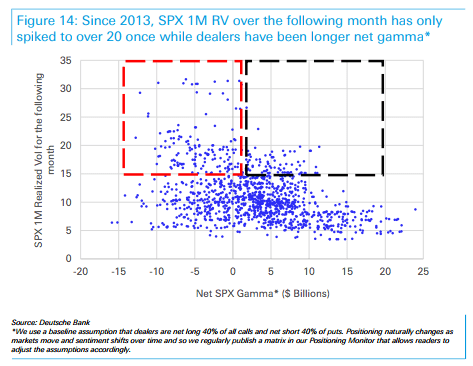

Have a look at this chart:

(Deutsche Bank)

See what I mean? This is a loop. But inherent in that loop is the idea that the market is becoming more fragile. The buildup of rebalance risk from levered and short VIX ETPs creates the conditions for a turbocharged vol. spike that could then spillover as it forces the hands of vol.-sensitive systematic strats. And on the dealer side, consider one more quote from Deutsche:

The short-dated, strike-dependent nature of the gamma profile means this phenomenon can disappear quickly. Slowing option selling following a large expiry or a spot move away from the current strikes could reduce net gamma significantly over just a few days.

That would mean the buffer that effectively works to contain outsized drawdowns could evaporate and in the event those vol. spikes stop mean reverting so rapidly, the chances of a systematic unwind occurring increase.

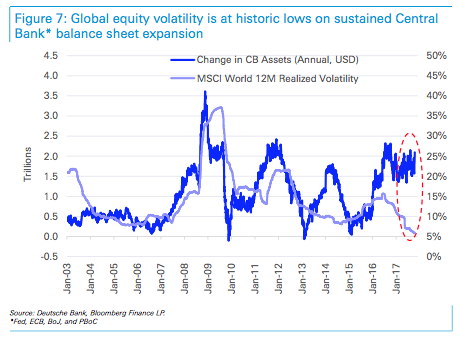

The other thing you need to keep in mind here is that in addition to the communication loop described above (i.e. forward guidance), central banks are still actively driving risk premia compression. The especially maddening thing about a lot of the commentary from popular pundits is that they demonstrate a truly remarkable (and quite disconcerting) propensity to say things about global QE that simply are not true. Central banks added $2 trillion to their balance sheets this year.

Have a look at one last chart which plots the 12-month change in central bank assets with 12-month realized vol. on the MSCI World:

(Deutsche Bank)

Coming full circle, it is incumbent upon popular pundits to convey all of this to retail investors.

Do note, by the way, that when I say "popular pundits" that is not a cheap shot at random commentators who, like me, just enjoy healthy debates about markets. I'm talking about pundits who have tens and hundreds of thousands of social media followers (in one specific case, nearly a million). I'm talking about the people you see writing Op-Eds for Bloomberg and the people who are fixtures on CNBC shows. People whose blogs are regularly listed by mainstream financial media outlets as being the go-to sources for free information. In other words, people who reach millions upon millions of retail investors each and every day of the work week. In short: I'm not talking to anyone writing for this platform, so if the shoe doesn't fit, don't try to wear it fellow contributors, because I'm not criticizing you.

Do note, by the way, that when I say "popular pundits" that is not a cheap shot at random commentators who, like me, just enjoy healthy debates about markets. I'm talking about pundits who have tens and hundreds of thousands of social media followers (in one specific case, nearly a million). I'm talking about the people you see writing Op-Eds for Bloomberg and the people who are fixtures on CNBC shows. People whose blogs are regularly listed by mainstream financial media outlets as being the go-to sources for free information. In other words, people who reach millions upon millions of retail investors each and every day of the work week. In short: I'm not talking to anyone writing for this platform, so if the shoe doesn't fit, don't try to wear it fellow contributors, because I'm not criticizing you.

Now you might very fairly say this: "ok Heisenberg, and how do you suggest someone convey everything you said in this article to retail investors in a way that's easily digestible?" The answer is: "dude, I have no idea or I'd be on CNBC wearing my sunglasses and my Heisenberg hat rather than writing blog posts."

All I can do is convey the message in the best way I know how, which is by mixing in humor and cynicism in an effort to keep readers engaged with challenging material. That was my goal with this post, and as usual, I sincerely hope it was useful.

Oh, and as a highly amusing side note, CNBC's Fast Money e-mailed me the other day asking to find out more about Heisenberg (true story). I said I'd be glad to talk to them, but it would have to be off the record. They never responded.

Yours truly on a disappointingly chilly weekend here on the island,

0 comments:

Publicar un comentario