THE FED GETS IT RIGHT, FOR NOW / THE WALL STREET JOURNAL

The Fed Gets It Right, for Now

The central bank raised rates as much as promised in 2017; the risk is it needs to raise them more than expected in 2018

By Justin Lahart

Federal Reserve Chairwoman Janet Yellen at a news conference following a Federal Open Market Committee meeting on Wednesday. Photo: Andrew Harrer/Bloomberg News

The biggest shock about the Federal Reserve this year is it got its prediction of interest-rate increases right. The danger for investors in 2018 is the Fed will get it wrong and rates will end up higher than expected.

Fed policy makers on Wednesday raised their target range for overnight rates for a third time this year. This was the first year it met its promise on rates since it started to plan for increases in 2015.

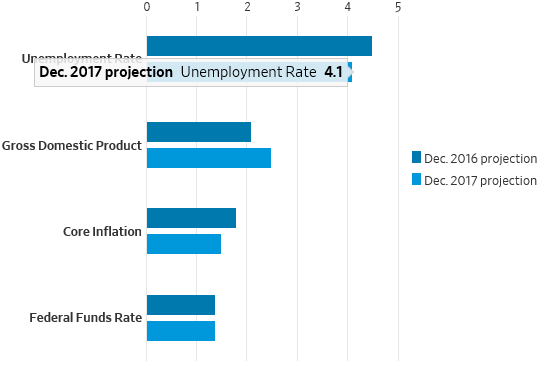

Another thing that stood out is that policy makers met their promise even though the economy didn’t perform the way they thought it would. They thought that the unemployment rate would fall less than it has, and that the economy would be weaker, but that inflation would be stronger. Put it another way: They thought they would be raising rates because inflation was moving toward their 2% target, but they raised them because of a stronger economy and job market.

MISSES AND HITS

Federal Reserve economic projections for 2017

Next year the Fed is reckoning on another three rate increases and the market is expecting two.

But both are hard to square with the bank’s economic projections. They show gross domestic product up 2.5% on the year in the fourth quarter of 2018, matching 2017’s pace. In September, the projections called for 2.1% growth in the last quarter of 2018. That probably reflects an expectation that the Republican tax plan will give the economy a boost. Policy makers also foresee a lower unemployment rate, now projecting it will slide to 3.9% versus the 4.1% they had penciled in in September.

Yet the inflation forecast didn’t change, with the projection for the Fed’s preferred measure of core prices, which excludes food and energy items, pegged to increase 1.9% next year from 1.5% this year. Given how poorly economists’ inflation forecasts have done lately, the unchanged projection makes some sense. But it is hard to imagine that an economy that grows faster and an unemployment rate that sinks lower wouldn’t throw off more heat.

Moreover, the projection for unemployment sliding to 3.9% from the current 4.1% would represent a much slimmer drop than the 0.6 percentage point decline that the unemployment rate registered through November this year. The further it goes below 4%, the more likely Fed policy makers will raise rates further.

The Fed didn’t offer up any real surprises this year. Next year will be another matter.

0 comments:

Publicar un comentario