GERMAN BANKS: CHRONICALLY SICK AND NO-ONE HAS A CURE / THE WALL STREET JOURNAL

German Banks: Chronically Sick and No-One Has a Cure

The structure of the German market leaves the odds stacked against major reform

By Paul J. Davies

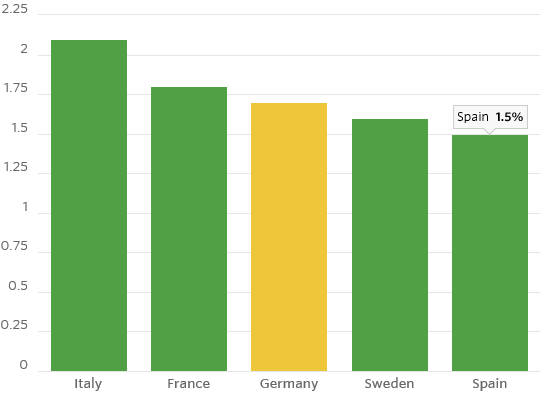

BACK OF THE PACK

Total asset share of five biggest banks combined by country

For all of Germany’s economic strength and discipline, its banking system remains a mess.

In all of the eurozone, German banking consistently produces some of the weakest returns and is most in need of consolidation. But investors hoping for better profitability shouldn’t hold their breath, even with an aggressive, value seeker like Cerberus Capital Management of the U.S. appearing as a big shareholder at both Commerzbank CRZBY 1.19%▲ and Deutsche Bank . DB 0.75%▲

The structure of the German market leaves the odds stacked against major reform.

Germany’s banking system is among the most fragmented, least efficient and poorly performing in the eurozone—and it is blighted with about €60 billion of bad loans mainly from the stricken shipping industry.

Bad loans make up a smaller portion of total loans at 2.2% in Germany than in Spain (5.4%) or Italy (12%), which is one reason investors don’t panic about German banks when regulators toughen bad-loan rules. The other reason is that more than half of the industry is state-backed or mutually owned anyway.

MARGINAL DIFFERENCE

Net interest margin on loans

But German banking is a wasteland of chronic problems: returns on equity have been worse over the long term than in other major European economies, including Italy.

Contrary to popular opinion, that isn’t because German banks are giving households and companies consistently cheaper credit than they would get in countries dominated by privately-owned banks. Net interest margins on German loans are greater than those in Spain and Sweden and not far behind those in France and the Netherlands, according to UBS.

The problem is that German banks don’t generate revenue from anything other than interest income. Fee income from customers is sparse—while costs are the highest in Europe.

CROWDED OUT

Share of lending in Germany

Fee income is weak because German savers invest little in equities—and that has been declining over time, too—so brokerage fees are low and falling. They also take out fewer unsecured personal loans, which would give banks more regular arranging fees than mortgages for instance.

Costs meanwhile are equivalent to more than 80% of revenue at German banks, according to Citigroup, which compares with 70% in France, 60% in Italy and 55% in Spain.

OVER SUPPLY

Number of credit institutions

A merger between Commerzbank and either Deutsche Bank or UniCredit ’s German arm, HVB, might help a little. And Deutsche Bank alone can still do a lot to improve Postbank, its retail arm: Morgan Stanley estimates it could close one-quarter of its branches.

But even if there were a big merger between shareholder-owned banks, this would do nothing to cut capacity from the savings, cooperative and state-backed commercial banks, or to make customers more financially adventurous and profitable.

The Commerzbank logo sits illuminated on the bank's headquarters in Frankfurt. Photo: Bloomberg News

Regional and political interests keep public-sector banks protected. With Germany’s political climate as uncertain as ever -- Chancellor Angela Merkel has been unable to form a governing coalition -- that seems unlikely to change. German financial reform will be a long time in coming.

0 comments:

Publicar un comentario