Cheer for the blues

Blue-collar wages are surging. Can it last?

A weaker dollar and an energy boom are pushing up pay

IF THERE was a defining economic problem for America as it recovered from the financial crisis, it was stagnant wages. In the five years following the end of the recession in June 2009, wages and salaries rose by only 8.7%, while prices increased 9.5%. In 2014 the median worker’s inflation-adjusted earnings, by one measure, were no higher than they were in 2000. It is commonly said that wage stagnation contributed to an economic anxiety in middle America that carried Donald Trump into the White House.

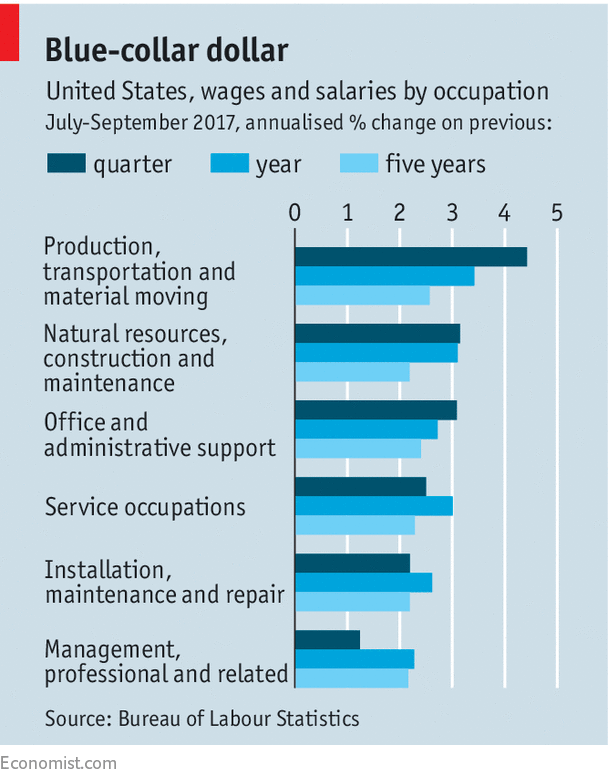

Yet Mr Trump’s rise seems to have coincided with a turnaround in fortunes for the middle-class. In 2015 median household income, adjusted for inflation, rose 5.2%; in 2016 it was up another 3.2%. During those two years, poorer households gained more, on average, than richer ones. The latest development—one that will be of particular interest to Mr Trump—is that blue-collar wages have begun to rocket. In the year to the third quarter, wage and salary growth for the likes of factory workers, builders and drivers easily outstripped that for professionals and managers. In some cases, blue-collar pay growth now tops 4% (see chart).

Has Mr Trump delivered on his promise to revive American manufacturing, mining and the like? A more probable explanation is that he came to office just as America began to run out of willing workers to fill all of its job vacancies. As unemployment has fallen from over 6% in mid-2014 to just 4.1% today, wage growth has gradually picked up.

At first it seemed like the biggest beneficiaries of a tight labour market would be those in service occupations, such as waiting and cleaning. A year ago service workers were enjoying the biggest pay rises in the economy—3.4%, on average. (Higher minimum wages also helped; 25 states and localities raised minimum pay in 2016.) Over the last year, however, growth in service wages has decelerated slightly. At the same time, blue-collar wage growth has surged ahead.

In some industries the labour shortage seems acute. Now is not a good time for Americans to remodel their bathrooms: tile and terrazzo contractors earn 11% more per hour than a year ago (and fully one-third more than in 2014). Having a bath might get pricier, too: workers who make soap have also enjoyed 11% wage gains over the past year.

Strong demand, rather than a productivity boom, is driving the scramble for workers. In the manufacturing sector, for example, output per hour worked is just 0.1% higher than a year ago, and has not grown at all in the past five years. Production and wages have picked up anyway. One reason is a cheapening dollar. On a trade-weighted basis, the greenback fell by almost 9% between the start of the year and mid-September (it has since recovered a little). A weaker dollar and a strengthening world economy have spurred demand for American goods. In the first three quarters of the year, goods exports were up nearly 4% on 2016.

At the same time, a rebound in oil prices from their trough in early 2016 has set off another cycle of investment in the shale industry. There are currently 907 active oil rigs in America, up from 568 a year ago, according to Baker Hughes, an oil services firm. Economists at UBS, a bank, estimate that energy investment has driven nearly three-fifths of all economic growth in 2017, once the effect of fluctuating inventories has been stripped out of the figures.

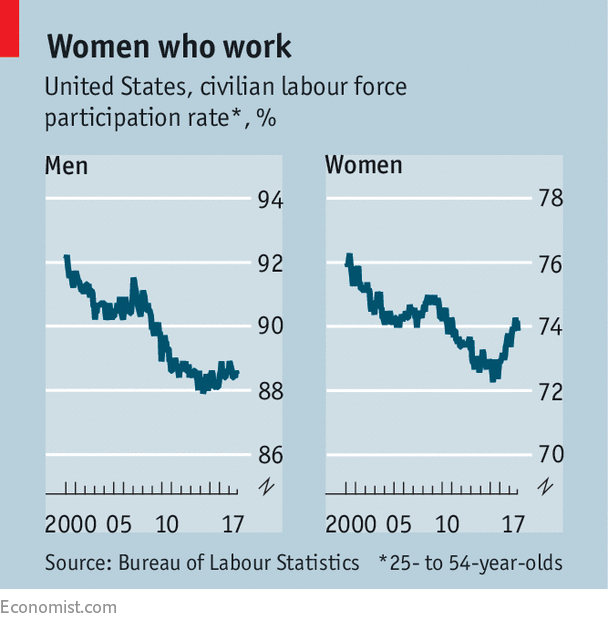

If these trends continue, higher wages might begin to tempt more men, who dominate blue-collar occupations, to look for jobs (those who do not seek work do not count as unemployed).

For the past two years, the strengthening labour market has encouraged more jobseeking by so-called prime-aged workers, ie, those aged between 25 and 54. But the increase in workforce participation has been almost entirely concentrated among women (see chart). At 89%, male prime-age participation remains close to a record low.

Whether male participation improves may depend on whether men are prepared to up sticks and move to where the labour market is booming. UBS’s economists note that Texas and neighbouring oil states such as Oklahoma account for almost all of the acceleration in manufacturing employment this year. Industries and places where blue-collar employment has been in a decades-long decline are unlikely to stage a recovery. Jed Kolko, chief economist for indeed, a jobs website, says that even some of the recent wage gains are misleading, because they have occurred in industries, such as textile manufacturing, in which employment continues to fall.

Rising incomes for lower- and middle-earners may help reduce inequality, especially if wage growth for higher-earners remains subdued. A recent analysis by the Economic Policy Institute, a left-leaning think-tank, found that real wages for the top 1% of earners fell by 3.1% in 2016, and were lower that year than they were in 2007. As workers’ wages grow, firms’ profit margins may also come under pressure, reducing, somewhat, the capital income of the rich. Texas Roadhouse, a chain of steak restaurants, recently warned investors that it expects its wage bill to grow by 7-8% in 2017.

After years of imbalance, a shift in economic power towards workers is to be welcomed, so long as inflation remains low. Yet wage growth also helps to determine the fate of politicians, whether or not they deserve it. Mr Trump’s election led to soaring small-business confidence, which is yet to abate. His promise to deregulate the energy sector may have spurred some investment. Yet his apparent economic success to date mostly reflects fortunate timing.

That will not stop him from taking the credit should a tight labour market lift America’s spirits as the 2020 presidential election approaches. Rightly or wrongly, the biggest beneficiary of a sustained wage boom for workers may be a suited man sitting in the Oval Office.

0 comments:

Publicar un comentario