STEADY HIRING WITHOUT WAGE GAINS DEEPENS PUZZLE FOR FED / THE WALL STREET JOURNAL

Steady Hiring Without Wage Gains Deepens Puzzle for Fed

Nonfarm payrolls rose by 156,000 in August as the jobless rate edged up to 4.4% from 4.3%

By Eric Morath and Nick Timiraos

An extended run of modest labor market gains this year has produced little acceleration in wage growth or inflation, underscoring a puzzle that complicates Federal Reserve policy decisions looming in the months ahead.

Nonfarm payrolls rose a seasonally adjusted 156,000 in August, a modest slowdown from the prior two months, the Labor Department said Friday. When combined with June and July’s job growth, estimates of which were revised down, data show the economy still added jobs this summer at almost the exact pace that has prevailed since early 2016, a little more than 180,000 a month.

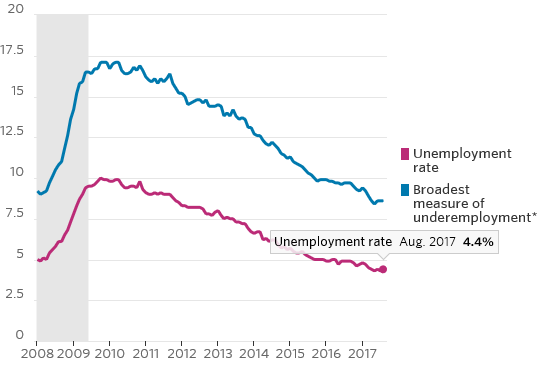

The unemployment rate ticked up from a 16-year low to 4.4% and wages failed to break out, rising 2.5% from a year earlier for the fifth straight month.

“The economy is doing well, but it’s not necessarily taking off,” said Laura Rosner, senior economist at Macro Policy Perspectives. “We’re on an even keel. The labor market continues to hum along.”

The U.S. economy expanded in the second quarter at a 3% annual rate, the Commerce Department said this week, but many economists and the Fed expect growth to come in just above 2% for the full year. Economic growth hasn’t topped 3% for a calendar year since 2005.

SUMMER STEADINESS

After falling rapidly at the beggining of the year, wildly watched measures of market health have flatenned

The steady trend in hiring comes as some other measures of economic vitality perk up.

Factory activity hit its highest level in six years last month, the Institute for Supply Management said Friday. That coincided with increased manufacturing and construction hiring last month and business investment accelerating this year. The University of Michigan’s gauge of consumer sentiment rose in August from July, and is trending near the highest levels since 2000.

Friday’s jobs report showed August hiring slowed in the services sector, which had been a source of strength for this year. The slowdown included restaurant work, health care and temporary-help services, while government employment declined for the second straight month.

Workers assemble power tools at Stanley Black & Decker Inc.’s plant in Charlotte, N.C., in August. Photo: Luke Sharrett/Bloomberg News

The August hiring report won’t change the Fed’s immediate plans. The central bank is widely expected to initiate the slow runoff of its $4.5 trillion portfolio of bonds and other assets at its Sept. 19-20 policy meeting.

But the report deepens a debate inside the Fed about how to respond to soft wage and inflation pressures. This dilemma could complicate the last big decision Fed Chairwoman Janet Yellen faces before her term expires early next year—how aggressively the Fed should proceed with interest-rate increases after it sets the balance sheet plan into motion.

At their June meeting, Fed officials penciled in one more interest-rate increase for this year, which markets expect would happen in December. But officials have been puzzled by a slowdown in price pressures that have moved annual inflation gauges farther away from the Fed’s 2% objective.

Ms. Yellen and other officials attributed the softness to one-off factors—price declines for wireless phone plans in March, for example, and prescription drugs in April. Inflation pressures have proved even more stubborn, with few signs of a rebound this summer. The Commerce Department on Thursday said the Fed’s preferred inflation gauge rose just 1.4% in July from a year earlier.

Fed officials have been willing to look past softer inflation pressures because they expect a tighter labor market will ultimately force employers to raise wages and prices and because the economy is growing in line with its projections, and might even be perking up. Employers are still adding far more jobs than Fed officials expect is needed to keep up with population growth.

Friday’s report doesn’t show a further decline in slack. Gauges of unemployment and underemployment have held steady after declining earlier this year, and the share of workers 25 to 54 years old who have jobs declined in August. This takes a little steam out of the argument of hawkish officials that the Fed should raise rates again. Instead, it gives weight to dovish officials to press their case that labor markets have more room to run before the economy overheats.

Average hourly earnings for private-sector workers increased 3 cents last month to $26.39 an hour. Wages have grown near a 2.5% year-to-year rate since early 2016. Many households are still better off, though. When adjusting for inflation, which has been low in recent years, wage gains have been slightly stronger than the 30-year average.

The wage gains are further puzzling because Fed officials keep seeing anecdotal evidence that labor markets are tightening in some industries and places.

One example: Olean, N.Y., knife manufacturer Cutco Corp. It is struggling to attract workers to its factory in the state’s rural southwest corner. About 100 employees, or about an eighth of its workforce, have retired in recent years. To respond, the company is stepping up efforts to train local workers. It is also funding scholarships for older people in community, not recent high-school graduates, who want to return to school to gain skills to work at the factory.

“We can still find and train people, but the population of this county is going down,” said Executive Chairman James E. Stitt. He is also responding by automating the plant. “We’ve got a lot of robots running right now,” he said.

If the incoming data don’t paint a dramatically different picture from the past few months—steady economic growth and hiring with low inflation and wage growth—and the Fed sticks to its plans to raise interest rates, Ms. Yellen will face a tricky balancing act. She will face pressure to explain how officials reconcile interest-rate increases with inflation that has moved away from their target.

Futures market traders put the probability of a Fed rate increase in December at 43% on Friday, up slightly from 39% on Wednesday, according to CME Group. That isn’t a substantial move and points to the uncertainty in the market about whether the Fed will proceed.

Inflation isn’t the Fed’s only concern. If bond yields fall and stocks rise because markets don’t expect the Fed to stay committed to raising rates, easier financial conditions could heighten officials’ anxieties over financial instability, giving greater reason to stick with their rate-increase plans.

The August hiring data do come with a caveat—for reasons that aren’t entirely clear to economists, the month’s result is typically revised higher.

Further complicating matters, future data could be murky.

0 comments:

Publicar un comentario