A PILLAR OF CHINESE GROWTH STARTS TO SHOW CRACKS / THE WALL STREET JOURNAL

A Pillar of Chinese Growth Starts to Show Cracks

As prices in the all-important interior lose momentum, the market looks close to an inflection point

By Nathaniel Taplin

HEAT STROKE

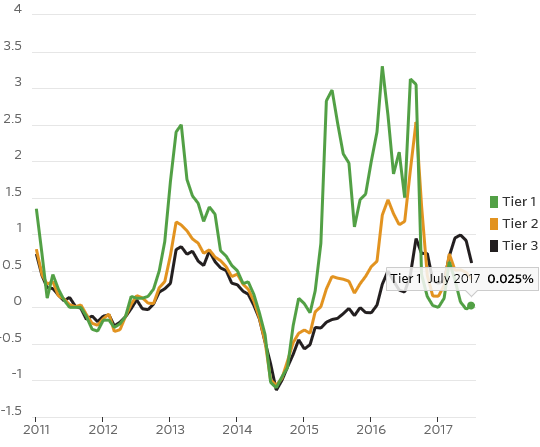

Chinese Housing prices, change from a month earlier

Summer in the city is tough—especially if you’re a construction worker in China’s furnace-like interior.

In July, as temperatures in China were breaking records, the economy showed distinct signs of slowing following a strong run in the first half. The heat itself may have been a factor. But July housing prices, out Friday, are another sign that momentum is faltering: Prices in the multitude of medium-size cities in China’s vast interior, which account for as much as 70% of the country’s housing market by floor space, rose at a slower pace for the second month in a row. That Is troubling news for all the investment and commodities demand they drive.

A construction site in Dalian, China. July housing prices in China’s medium-sized cities rose at a slower pace for the second month in a row. Photo: china daily/Reuters

The deceleration in growth, from a rise of 0.9% on the month in June to just 0.6% in July, is relatively minor. But consumer-loan growth and tightening mortgage restrictions have already put the lid on rallies in top-tier coastal markets like Beijing and Shanghai. If prices in the interior begin falling outright, or if housing investment weakens again in August, it may be time to start hedging bets on China growth plays. Some vulnerable stocks include mining firms and U.S. construction-equipment maker Caterpillar , which has been testing new highs this year as global growth rebounded.

NO VACANCY

Vacant, unsold commecial housing(square meters)

Some slowdown in the interior is to be expected. Credit has been gradually tightening in China for months. Steel prices are up, buoyed by mill-capacity cuts. That is fantastic for steel producers but bad for downstream industries like construction, which buy steel. Steel sector growth accelerated in July, while most other sectors decelerated.

The biggest bullish factor for Chinese construction remains intact: Massive housing inventories, which depressed construction growth for years, are still falling. Vacant, unsold housing floor space in China fell 10 million square meters in July to the lowest level since February 2014, according to data released earlier in the month. Vacant floor space is down 20% on the year.

China’s housing market looks close to an inflection point. If August data shows sales and investment weakening again, or the fall in inventories leveling off, sentiment on China is likely to deteriorate rapidly—a chilly end to the dog days of summer.

0 comments:

Publicar un comentario