Here Is How Speculative Gold Traders Are Preparing For The Potentially Volatile Results Of French Elections

by: Hebba Investments

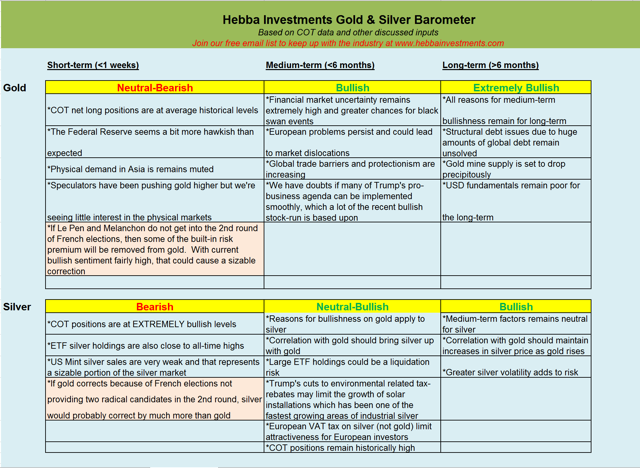

- Speculative gold traders pushed their net bullish position up for the fifth consecutive week.

- Speculative silver traders finally cut back on net bullish positions, but silver remains at extremely bullish levels.

- We believe that French presidential elections will result in an expected 2nd round run-off between the two top candidates.

- Based on French elections producing the expected result, it may be a catalyst for gold traders to cut bullish positions and result in a correction in precious metals.

- Speculative silver traders finally cut back on net bullish positions, but silver remains at extremely bullish levels.

- We believe that French presidential elections will result in an expected 2nd round run-off between the two top candidates.

- Based on French elections producing the expected result, it may be a catalyst for gold traders to cut bullish positions and result in a correction in precious metals.

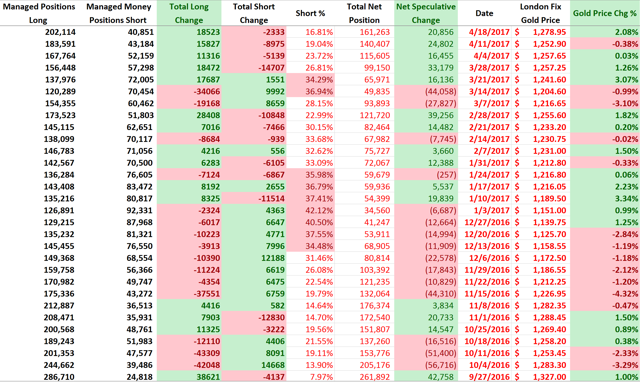

The latest Commitment of Traders (COT) report showed yet another increase in the net speculative long position for the fifth consecutive week. Silver positions also increased on the week, though based on the silver price declining after the COT close-date, we expect that they are a bit lower than shown in this report.

Of course, the big news this week are the French elections on Sunday. With no candidate expected to take the necessary 50% of the vote to win the election, it is widely expected to come to a run-off between the top two candidates: Emmanuel Macron and far-Right leader Marine Le Pen. The big wildcard is if communist candidate Jean-Luc Mélenchon, who is surging in the polls, can pull into the top two spots with Le Pen. If that happens, then a run-off between two anti-Euro candidates would ensue causing markets to significantly drop (and gold probably to rise).

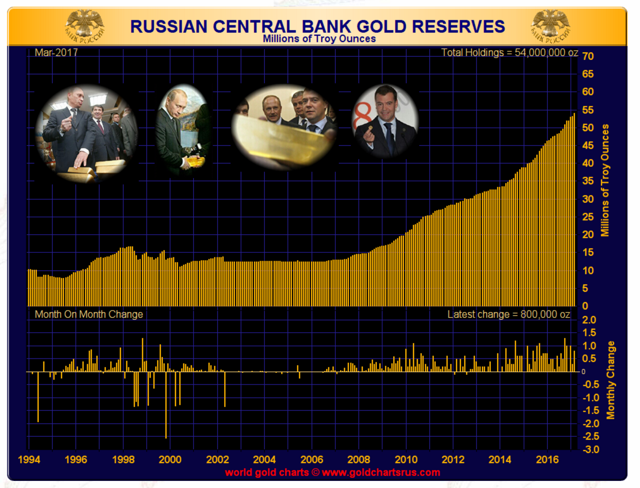

On another note, Russia released its monthly gold reserves and it turns out the country added a chunky 800,000 ounces during the month of March. While this wasn't stunning, it does show the Russian government is still confident enough in gold (or a lack of confidence in the system) to continue to add significant amounts to reserves.

We will get more into some of these details, but before that, let us give investors a quick overview into the COT report for those who are not familiar with it.

About the COT Report

The COT report is issued by the CFTC every Friday to provide market participants a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. In plain English, this is a report that shows what positions major traders are taking in a number of financial and commodity markets.

Though there is never one report or tool that can give you certainty about where prices are headed in the future, the COT report does allow the small investors a way to see what larger traders are doing and to possibly position their positions accordingly. For example, if there is a large managed money short interest in gold, that is often an indicator that a rally may be coming because the market is overly pessimistic and saturated with shorts - so you may want to take a long position.

The big disadvantage to the COT report is that it is issued on Friday but only contains Tuesday's data - so there is a three-day lag between the report and the actual positioning of traders. This is an eternity by short-term investing standards, and by the time the new report is issued, it has already missed a large amount of trading activity.

There are many ways to read the COT report, and there are many analysts that focus specifically on this report (we are not one of them), so we won't claim to be the experts on it.

What we focus on in this report is the "Managed Money" positions and total open interest as it gives us an idea of how much interest there is in the gold market and how the short-term players are positioned.

This Week's Gold COT Report

This week's report showed a fifth consecutive week of increases in speculative gold positions as longs added 18,523 contracts during the COT week while shorts decreased by 2,333 contracts.

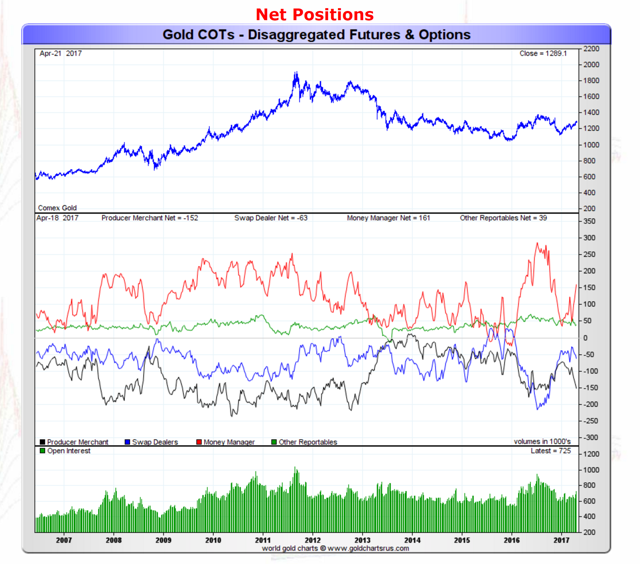

Moving on, the net position of all gold traders can be seen below:

Source: GoldChartsRUS

The red line represents the net speculative gold positions of money managers (the biggest category of speculative trader), and as investors can see, we saw the net position of speculative traders increase by 24,000 contracts to 140,000 net speculative long contracts.

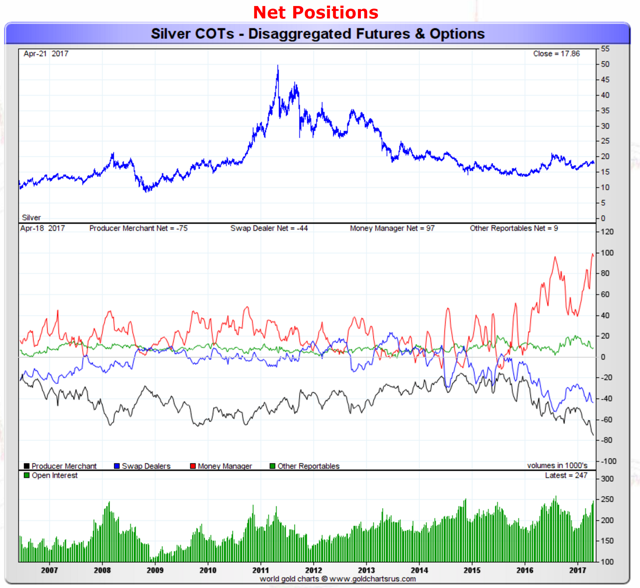

As for silver, the week's action looked like the following:

Source: GoldChartsRUS

The red line, which represents the net speculative positions of money managers, showed a decrease in bullish silver speculators as their total net position fell slightly by around 2,000 contracts to a net speculative long position of 97,000 contracts.

As we mentioned last week, the current speculative silver position is at extreme levels, so investors need to be extremely cautious at these price levels. Silver stood out last week with its 3% drop compared to gold essentially treading water for the week, which may mean that traders are cutting back on their speculative long positions. Based on these historically high silver positions, we could see this drop continue.

Russian Gold Purchases for March

During the week, we saw Russia release its gold purchases for the month of March:

Source: GoldChartsRUS

During March, Russia added 800,000 ounces (around 25 tonnes) to its gold reserves. While not as large as its eye-popping October purchase, it still was a large purchase and shows that the Russian government is still very interested in gold at these prices.

Additionally, investors tend to forget that 25 tonnes per month of gold purchases annualizes to around 10% of total world gold production. That is a big chunk of newly mined production that is going to one entity - something to keep in mind if gold production starts to drop as we believe it will in the upcoming years.

Our Take and What This Means for Investors

Without a doubt the big short-term event for markets are the upcoming French elections on Sunday, which will give markets (at least US ones) plenty of time to digest results. Despite tight polls and the surge for communist candidate Melanchon, it looks like the primary candidates who will face off in the second presidential round will be centrist Macron versus the more nationalist Le Pen. While we have now had two exceptionally wrong "polling instances" over the past year that have at least temporarily roiled markets, we think traders are a bit too optimistic of a similar black-swan type scenario of a second-round run-off consisting of Le Pen and Melanchon.

Based on currently elevated bullish speculative positioning in gold (and extremely bullish speculative position in silver), we think that any risk-on catalyst has the potential to spark a major correction in precious metals.

That is why we are maintaining our short-term bearish outlook on gold and silver as we think the French elections turning into a "non-event" could lead some traders to sell gold and silver positions.

That means for short-term speculators, the strategy would be to reduce precious metals exposure in the short term by either selling gold and silver positions (SPDR Gold Trust ETF (NYSEARCA:GLD), iShares Silver Trust ETF (NYSEARCA:SLV), and ETFS Physical Swiss Gold Trust ETF (NYSEARCA:SGOL), etc). Or reducing risk by trading for less risky positions (switching miners to ETFs or from silver to gold). Of course, this is only in the short term, the medium-term to longer-term position remains very bright (and bullish) for precious metals.

0 comments:

Publicar un comentario