China faces a tough fight to escape its debt trap

The country needs to rebalance its economy before opening up capital flows

by: Martin Wolf

.

If something cannot go on forever, it will stop.” This is “Stein’s law”, after its inventor Herbert Stein, chairman of the Council of Economic Advisers under Richard Nixon. Rüdiger Dornbusch, a US-based German economist, added: “The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought.”

These quotations help us think about the macroeconomics of China’s economy. Growth at rates targeted by the government requires a rapid rise in the ratio of debt to gross domestic product.

This cannot continue forever. So it will stop. Yet, since the Chinese government controls the financial system, it can continue for a long time. But the longer the ending is postponed, the greater the likelihood of a crisis, a big slowdown in growth, or both.

I have argued that it is in the interests of China and the rest of the world to keep their financial systems separate. The rapid growth of indebtedness and the size of its financial system represent a threat to global stability. China needs to rebalance its economy and stabilise its financial system before opening up capital flows. Western financiers will have a different view.

We should ignore this sectional interest.

Yet this raises a big question: will China achieve the needed rebalancing? As was true in the west before the financial crises of 2007-08 and the eurozone crisis that followed, the maintenance of stable growth in China has coincided with an explosive growth in indebtedness.

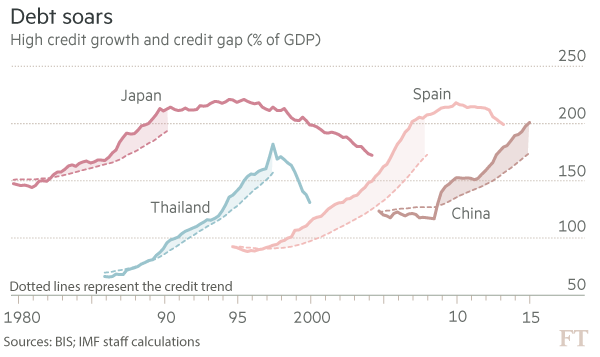

As a paper from the International Monetary Fund stresses: “Credit growth has been averaging around 20 per cent per year between 2009 and 2015, much higher than nominal GDP growth and the previous trend.” The picture is disturbingly similar to that of pre-crisis Japan, Thailand and Spain.

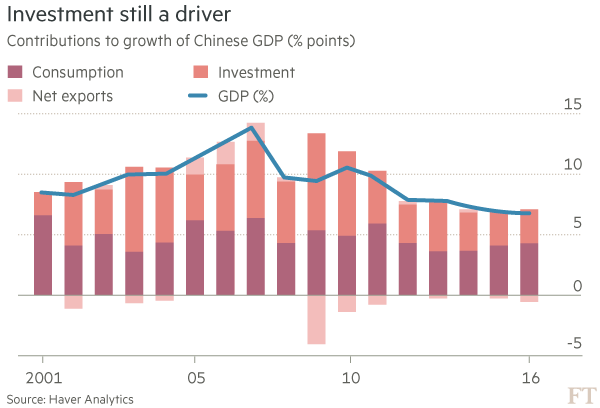

The turning point in these credit trends was 2008. That was no accident. Between 2000 and 2007, gross savings soared from 37 per cent to nearly 50 per cent of GDP. About half of this extraordinary rise financed additional domestic investment and half financed a rise in the trade surplus. Then came the western crisis. China decided (rightly) that its huge trade surplus was no longer sustainable. It raised investment, instead. That had already risen from 34 per cent of GDP in 2000 to 41 per cent in 2007. It then jumped to 48 per cent in 2010.

To achieve this outcome, the Chinese authorities promoted explosive credit growth. Before 2008, China had largely exported the credit surge attendant upon its massive rise in savings.

After the crisis, it re-imported it. A recent analysis by Credit Suisse concludes that credit needs to grow about twice as fast as nominal GDP if the government is to hit its target of real growth of 6.5 per cent.

The IMF adds that the credit growth coincides with declining returns on corporate assets, deteriorating corporate creditworthiness, falling efficiency of investment and rising financial complexity. We have seen this elsewhere. So will China be any different?

The answer is yes and no. Yes because, like Japan, China is a high-saving, creditor country.

The government controls the financial system and operates exchange controls. It may well avoid a crisis. Yet the answer is also no, because the authorities will need ever more credit expansion to achieve ever less growth. Chinese growth might then expire with a whimper, not a bang.

What are the possible escapes from the trap? One option would be for the authorities just to halt credit growth. If China’s growth depended on consumption alone, one might expect it to fall to 3-4 per cent a year. But China’s investment rate is still close to 45 per cent of GDP. Such a high rate of investment could not be justified if growth were so slow. Investment would then fall, creating a recession. The only escape would be for the government to take over the investment process, rendering market-oriented economic reform a nullity.

A second option would be to halt credit growth and let savings flow abroad, via a huge expansion in the current account surplus. Yet the trade discussions between Donald Trump and Xi Jinping in Florida show this would not be acceptable. Countries willing and able to run offsetting external deficits do not exist.

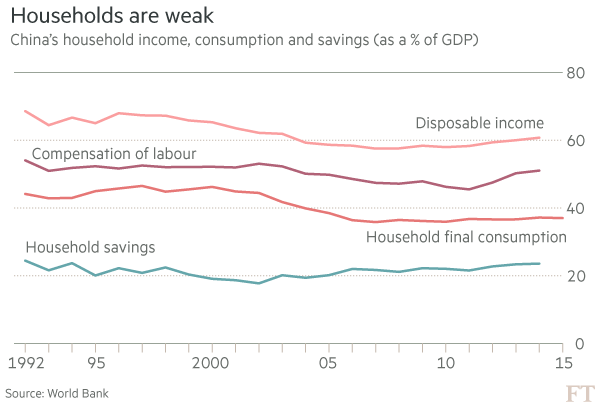

A third option would be to halt credit growth and raise consumption sharply, to offset a decline in investment. The problem here is that household disposable income is only a little above 60 per cent of GDP, while private consumption is about 40 per cent of GDP. Such savings rates are not so high by Asian standards. More than half of national savings consist of profits and government savings. If one wanted consumption to grow faster than now, the share of household incomes in GDP or of household wealth in total wealth needs to soar. The former would squeeze profits and investment. The latter would mean transferring public assets to households. Neither looks technically and politically workable. So consumption will not keep the economy from stalling.

A final (and perhaps best) option would be for the government to put much of the debt on its own balance sheet. It could restructure existing debt and be the principal borrower in future.

China would become a premature Japan. While government debt would rise, the borrower would be the country’s most solvent entity. Meanwhile, the private economy would be allowed to adjust to market signals.

Today, China can achieve growth of over 6 per cent only with rapid rises in indebtedness. All escapes from this trap are hard. The economy is now slowly rebalancing into consumption. But this will take well over a decade. Will the growth of debt be sustained until then? I doubt it.

0 comments:

Publicar un comentario