Based On The Recent Jobs And COT Reports, We Are (Slightly) Changing Our Position On Gold

by: Hebba Investment

- The recent COT data show that speculative gold traders once again cut their long positions.

- Despite the drop in speculative gold long positions, shorts did not feel confident enough to match with a commensurate amount of shorting.

- While the jobs report was weak, it was not weak enough to stop the Fed from potentially raising rates in September.

- Despite our belief that the Fed is likely to raise interest rates in September, there are too many gold-positive catalysts to not buy back some of our gold positions.

- Despite the drop in speculative gold long positions, shorts did not feel confident enough to match with a commensurate amount of shorting.

- While the jobs report was weak, it was not weak enough to stop the Fed from potentially raising rates in September.

- Despite our belief that the Fed is likely to raise interest rates in September, there are too many gold-positive catalysts to not buy back some of our gold positions.

The latest COT report showed a much-needed pullback in speculative bullish positioning, with gold also following the speculative traders by falling about 2% for the week ending in Tuesday's COT close. Silver bullish speculative positioning also fell for the week, but not by as much as gold, as speculative traders cut their long silver bets. Both of these COT reports closed before Friday's US non-farm payrolls, which as investors now know, was a relatively weak number, and that caused gold and silver to close the week with a bang.

We will give our view and will get a little more into some of these details, but before that, let us give investors a quick overview into the COT report for those who are not familiar with it.

About the COT Report

The COT report is issued by the CFTC every Friday to provide market participants a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. In plain English, this is a report that shows what positions major traders are taking in a number of financial and commodity markets.

Though there is never one report or tool that can give you certainty about where prices are headed in the future, the COT report does allow the small investors a way to see what larger traders are doing and to possibly position their positions accordingly. For example, if there is a large managed money short interest in gold, that is often an indicator that a rally may be coming because the market is overly pessimistic and saturated with shorts - so you may want to take a long position.

The big disadvantage to the COT report is that it is issued on Friday, but only contains Tuesday's data - so there is a three-day lag between the report and the actual positioning of traders. This is an eternity by short-term investing standards, and by the time the new report is issued, it has already missed a large amount of trading activity.

There are many different ways to read the COT report, and there are many analysts that focus specifically on this report - we are not one of them, so we won't claim to be the experts on it. What we focus on in this report is the "Managed Money" positions and total open interest as it gives us an idea of how much interest there is in the gold market and how the short-term players are positioned.

This Week's Gold COT Report

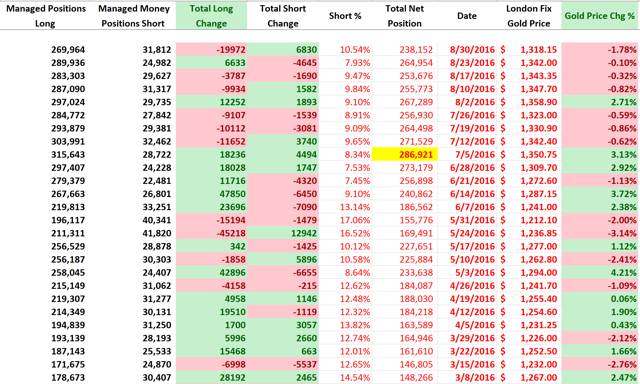

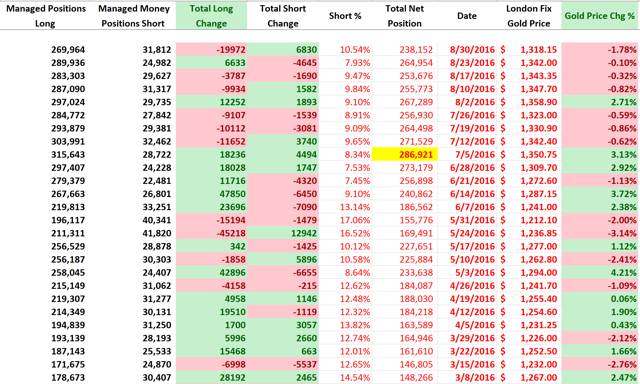

For the fourth week in a row (and the seventh out of the past eight weeks), gold closed down during the COT reporting week (Tuesday to Tuesday). This week's report showed a big decrease in speculative gold longs by 19,972 contracts and a decent increase in speculative shorts, as they opened 6,830 contracts on the week. This was the biggest decline in speculative longs in three months and the second largest decline in speculative longs in 2016, but interestingly enough, shorts didn't jump in by significant amounts - not much courage is being shown by the bears.

Since this report closed before Friday's jobs report, it seems that gold's decline for the week was mainly related to over-extended longs lightening up their bullish bets in anticipation of the report, as short activity was less than we expected. This also may explain why Friday's move in gold was only 1% despite the poor jobs report - not many shorts to cover and give us one of those parabolic up days.

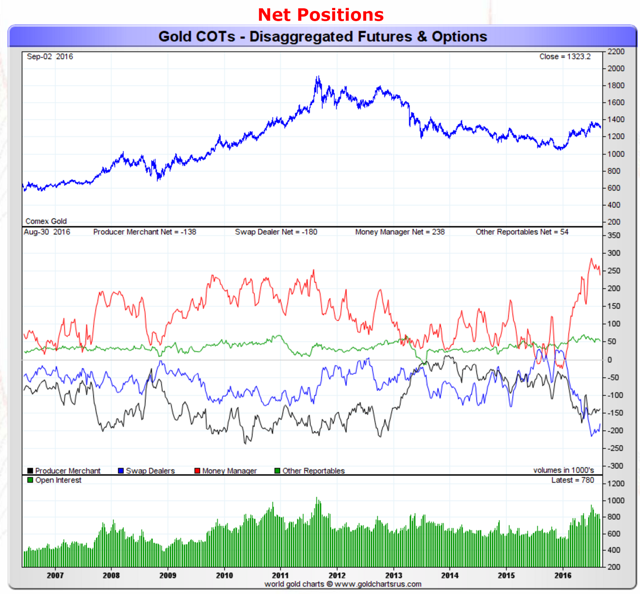

Moving on, the net position of all gold traders can be seen below:

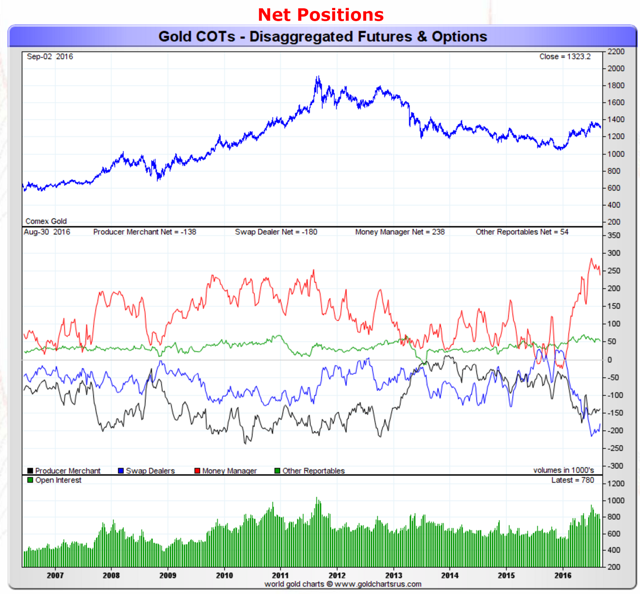

Source: Sharelynx Gold Charts

Source: Sharelynx Gold Charts

The red line represents the net speculative gold positions of money managers (the biggest category of speculative trader), and as investors can see, speculative traders have continued their recent pullback from all-time high positions and are now net long by around 238,000 contracts. As long-term gold bulls, this is what we want to see to eliminate some of the frothy players in the market, but we would still be more comfortable seeing it lower as speculative traders remain extremely bullish.

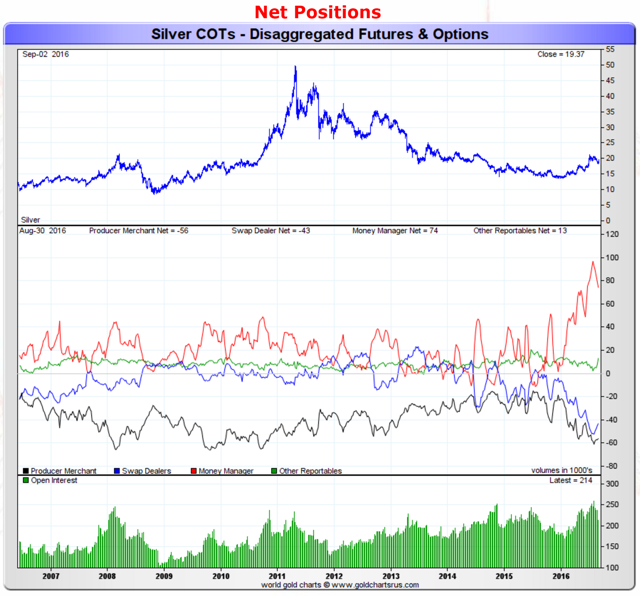

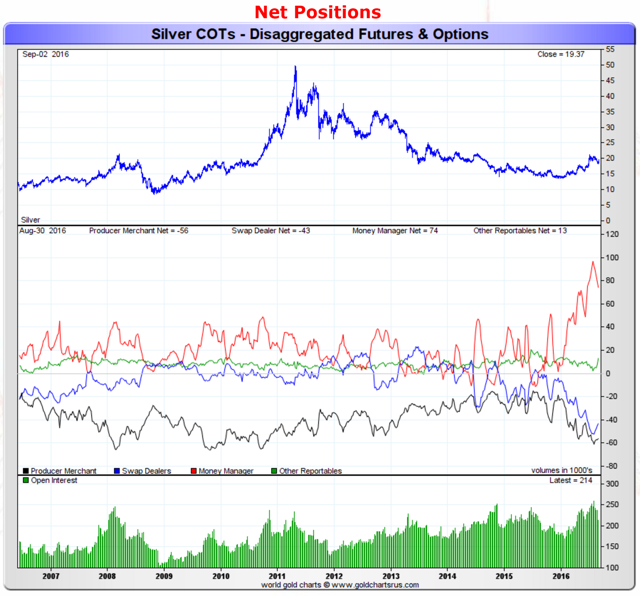

As for silver, the week's action looked like the following:

Source: Sharelynx Gold Charts

Source: Sharelynx Gold Charts

The red line which represents the net speculative positions of money managers continued its pullback as speculative silver traders again cut their long positions and increased their short positions. Last week, we published a piece that showed extremely poor silver demand from bullion investors as US Mint sales of silver eagles have been very weak, which highlights the importance that speculative silver bulls are playing in the market as they are a big reason why the price remains where it is and hasn't fallen further. In our opinion, silver needs to continue to see these speculative bullish traders playing a large part in the market as silver bullion demand remains weak and these retail bullion sales make up a larger proportion of the silver market than in the gold market.

The Jobs Report, Our Take, and What Should Investors Do Here

The latest COT report clearly showed long traders gearing up for Friday's job report as they cut back on their long positions, while shorts fell short of matching this drop in longs. That tells us that the recent pullback in gold was more longs taking profits off the table rather than braver shorts entering the market.

Depending on the reason why longs closed out their positions, Friday's weak job report may either cause them to re-enter the market (if they sold to eliminate event risk) or to stay out until they get a better price (if they sold to take profits). Since we didn't see a larger rise in the gold price on Friday, this suggests that we didn't have a lot of "event risk" sellers as they would have bought back on the weak report. Instead, we are leaning towards traders locking in profits, and thus would be looking for lower levels in the gold price to re-enter.

So what should investors do here with gold?

Unfortunately, the jobs report doesn't give us too much clarity, as despite its weakness, it wasn't so weak that the Fed absolutely couldn't raise rates at the next meeting. However, it was weak enough to put back uncertainty into the meeting, as previous to the report, we thought it very likely the Fed was going to raise rates - that was pretty much what they were saying.

Mohamed El-Erian, chief economic adviser at Pimco parent Allianz said the data further complicate this month's decision for policy makers. Mr. El-Erian said in an interview on Bloomberg Television:

Our thoughts are the rate hike is still on the table in September and so we are still cautious in gold and silver, but this week's report took out a major catalyst for a big pullback in the metals as it certainly wasn't great. We want to buy gold and re-establish our speculative bullish gold positions as we think governments (especially the US) are about to embark on significant spending measures following the upcoming US elections.

Thus, we aren't as bearish as we were early last week as another short-term potential negative catalyst has been removed, COT speculative bullish gold positions fell further, and the only major upcoming potentially negative catalyst we see is September's Fed meeting. We feel now is a time to re-establish a few of our previously sold speculative gold positions in the ETFs such as the SPDR Gold Trust ETF (NYSEARCA:GLD), ETFS Physical Swiss Gold Trust ETF (NYSEARCA:SGOL), iShares Silver Trust (NYSEARCA:SLV) - not all of these positions though, as we still feel the Fed is more likely to hike in September than stay put on interest rates. But we also do not want to be picking up nickels in front of a bulldozer here, as we feel that we're getting much closer to the stage when governments attempt to employ more fiscal stimulus measures (very gold positive) versus only monetary policy measures (i.e. fooling around with interest rates) - we wouldn't want to be underweight in gold when we reach this stage.

In summary, it is time to buy back SOME of our previously sold gold positions with the understanding that short term we are still bearish on gold and looking for further pullbacks.

We aren't there yet on most of the mid-tier and larger gold miners as we still feel they are a bit pricey here, and the risk-reward isn't there just yet.

We will give our view and will get a little more into some of these details, but before that, let us give investors a quick overview into the COT report for those who are not familiar with it.

About the COT Report

The COT report is issued by the CFTC every Friday to provide market participants a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. In plain English, this is a report that shows what positions major traders are taking in a number of financial and commodity markets.

Though there is never one report or tool that can give you certainty about where prices are headed in the future, the COT report does allow the small investors a way to see what larger traders are doing and to possibly position their positions accordingly. For example, if there is a large managed money short interest in gold, that is often an indicator that a rally may be coming because the market is overly pessimistic and saturated with shorts - so you may want to take a long position.

The big disadvantage to the COT report is that it is issued on Friday, but only contains Tuesday's data - so there is a three-day lag between the report and the actual positioning of traders. This is an eternity by short-term investing standards, and by the time the new report is issued, it has already missed a large amount of trading activity.

There are many different ways to read the COT report, and there are many analysts that focus specifically on this report - we are not one of them, so we won't claim to be the experts on it. What we focus on in this report is the "Managed Money" positions and total open interest as it gives us an idea of how much interest there is in the gold market and how the short-term players are positioned.

This Week's Gold COT Report

For the fourth week in a row (and the seventh out of the past eight weeks), gold closed down during the COT reporting week (Tuesday to Tuesday). This week's report showed a big decrease in speculative gold longs by 19,972 contracts and a decent increase in speculative shorts, as they opened 6,830 contracts on the week. This was the biggest decline in speculative longs in three months and the second largest decline in speculative longs in 2016, but interestingly enough, shorts didn't jump in by significant amounts - not much courage is being shown by the bears.

Since this report closed before Friday's jobs report, it seems that gold's decline for the week was mainly related to over-extended longs lightening up their bullish bets in anticipation of the report, as short activity was less than we expected. This also may explain why Friday's move in gold was only 1% despite the poor jobs report - not many shorts to cover and give us one of those parabolic up days.

Moving on, the net position of all gold traders can be seen below:

Source: Sharelynx Gold Charts

Source: Sharelynx Gold ChartsThe red line represents the net speculative gold positions of money managers (the biggest category of speculative trader), and as investors can see, speculative traders have continued their recent pullback from all-time high positions and are now net long by around 238,000 contracts. As long-term gold bulls, this is what we want to see to eliminate some of the frothy players in the market, but we would still be more comfortable seeing it lower as speculative traders remain extremely bullish.

As for silver, the week's action looked like the following:

Source: Sharelynx Gold Charts

Source: Sharelynx Gold ChartsThe red line which represents the net speculative positions of money managers continued its pullback as speculative silver traders again cut their long positions and increased their short positions. Last week, we published a piece that showed extremely poor silver demand from bullion investors as US Mint sales of silver eagles have been very weak, which highlights the importance that speculative silver bulls are playing in the market as they are a big reason why the price remains where it is and hasn't fallen further. In our opinion, silver needs to continue to see these speculative bullish traders playing a large part in the market as silver bullion demand remains weak and these retail bullion sales make up a larger proportion of the silver market than in the gold market.

The Jobs Report, Our Take, and What Should Investors Do Here

The latest COT report clearly showed long traders gearing up for Friday's job report as they cut back on their long positions, while shorts fell short of matching this drop in longs. That tells us that the recent pullback in gold was more longs taking profits off the table rather than braver shorts entering the market.

Depending on the reason why longs closed out their positions, Friday's weak job report may either cause them to re-enter the market (if they sold to eliminate event risk) or to stay out until they get a better price (if they sold to take profits). Since we didn't see a larger rise in the gold price on Friday, this suggests that we didn't have a lot of "event risk" sellers as they would have bought back on the weak report. Instead, we are leaning towards traders locking in profits, and thus would be looking for lower levels in the gold price to re-enter.

So what should investors do here with gold?

Unfortunately, the jobs report doesn't give us too much clarity, as despite its weakness, it wasn't so weak that the Fed absolutely couldn't raise rates at the next meeting. However, it was weak enough to put back uncertainty into the meeting, as previous to the report, we thought it very likely the Fed was going to raise rates - that was pretty much what they were saying.

Mohamed El-Erian, chief economic adviser at Pimco parent Allianz said the data further complicate this month's decision for policy makers. Mr. El-Erian said in an interview on Bloomberg Television:

"This is going to put the Fed in a really tricky position when they next meet in September. This is going to ultimately come down to one fundamental issue: how worried are Fed officials about the collateral damage and the unintended consequences of a protracted period of low interest rates? If they are as worried as I am, then this report is a green light to hike. If they're not worried, then they'll wait."Clear as mud…

Our thoughts are the rate hike is still on the table in September and so we are still cautious in gold and silver, but this week's report took out a major catalyst for a big pullback in the metals as it certainly wasn't great. We want to buy gold and re-establish our speculative bullish gold positions as we think governments (especially the US) are about to embark on significant spending measures following the upcoming US elections.

Thus, we aren't as bearish as we were early last week as another short-term potential negative catalyst has been removed, COT speculative bullish gold positions fell further, and the only major upcoming potentially negative catalyst we see is September's Fed meeting. We feel now is a time to re-establish a few of our previously sold speculative gold positions in the ETFs such as the SPDR Gold Trust ETF (NYSEARCA:GLD), ETFS Physical Swiss Gold Trust ETF (NYSEARCA:SGOL), iShares Silver Trust (NYSEARCA:SLV) - not all of these positions though, as we still feel the Fed is more likely to hike in September than stay put on interest rates. But we also do not want to be picking up nickels in front of a bulldozer here, as we feel that we're getting much closer to the stage when governments attempt to employ more fiscal stimulus measures (very gold positive) versus only monetary policy measures (i.e. fooling around with interest rates) - we wouldn't want to be underweight in gold when we reach this stage.

In summary, it is time to buy back SOME of our previously sold gold positions with the understanding that short term we are still bearish on gold and looking for further pullbacks.

We aren't there yet on most of the mid-tier and larger gold miners as we still feel they are a bit pricey here, and the risk-reward isn't there just yet.

0 comments:

Publicar un comentario